gm 10/02

Summary

gm, Ethereum (ETH) saw a significant drop of over 5%, trading below $2,600, influenced by increasing circulating supply and regulatory delays. Meanwhile, several U.S. states, including Kentucky, proposed Bitcoin reserve bills, potentially initiating a global competition to accumulate Bitcoin as a reserve asset. In the altcoin space, Canary Capital's decision not to launch a Dogecoin ETF, citing concerns over its utility and unlimited supply, contrasted with their plans for XRP and Solana ETFs. Additionally, Brazil's main stock exchange, B3, announced plans to introduce Bitcoin options and futures contracts for Ethereum and Solana, further expanding cryptocurrency offerings in traditional finance markets.

News Headlines

📉 Crypto VC Suggests Market May Be "Near the Bottom"

- Felix Hartmann, founder of Hartmann Capital, suggests the crypto market may be nearing a local bottom due to persistently negative funding rates and bearish sentiment.

- Quality altcoins have retraced significantly, with Ether pulling back to $2,639 from above $4,000.

🏭 Trump Announces 25% Steel and Aluminum Tariffs, Impacting Crypto Markets

- US President Donald Trump announced a 25% tariff on imported aluminum and steel, causing a brief dip in cryptocurrency values.

- Bitcoin dropped to $94,000 before recovering to over $97,000, while Ether declined to $2,537 before rebounding to $2,645.

🏦 Brazilian Stock Exchange B3 to Launch BTC Options, ETH and SOL Futures

- B3, Brazil's main stock exchange, is expanding its cryptocurrency offerings with bitcoin options and futures contracts for ether and solana.

- This move follows B3's successful introduction of bitcoin futures in April 2024, which achieved R$5 billion (approx. $860 million) in monthly trading volume.

💰 Gold-Backed Crypto Set to Benefit as Wall Street Raises Price Estimates to $3,000

- Major financial institutions like Citi and UBS have raised their gold price targets to $3,000 per ounce due to heightened trade war fears and central bank accumulation.

- Gold-backed cryptocurrencies like PAXG and XAUT have benefited from this trend, outperforming the broader digital asset market.

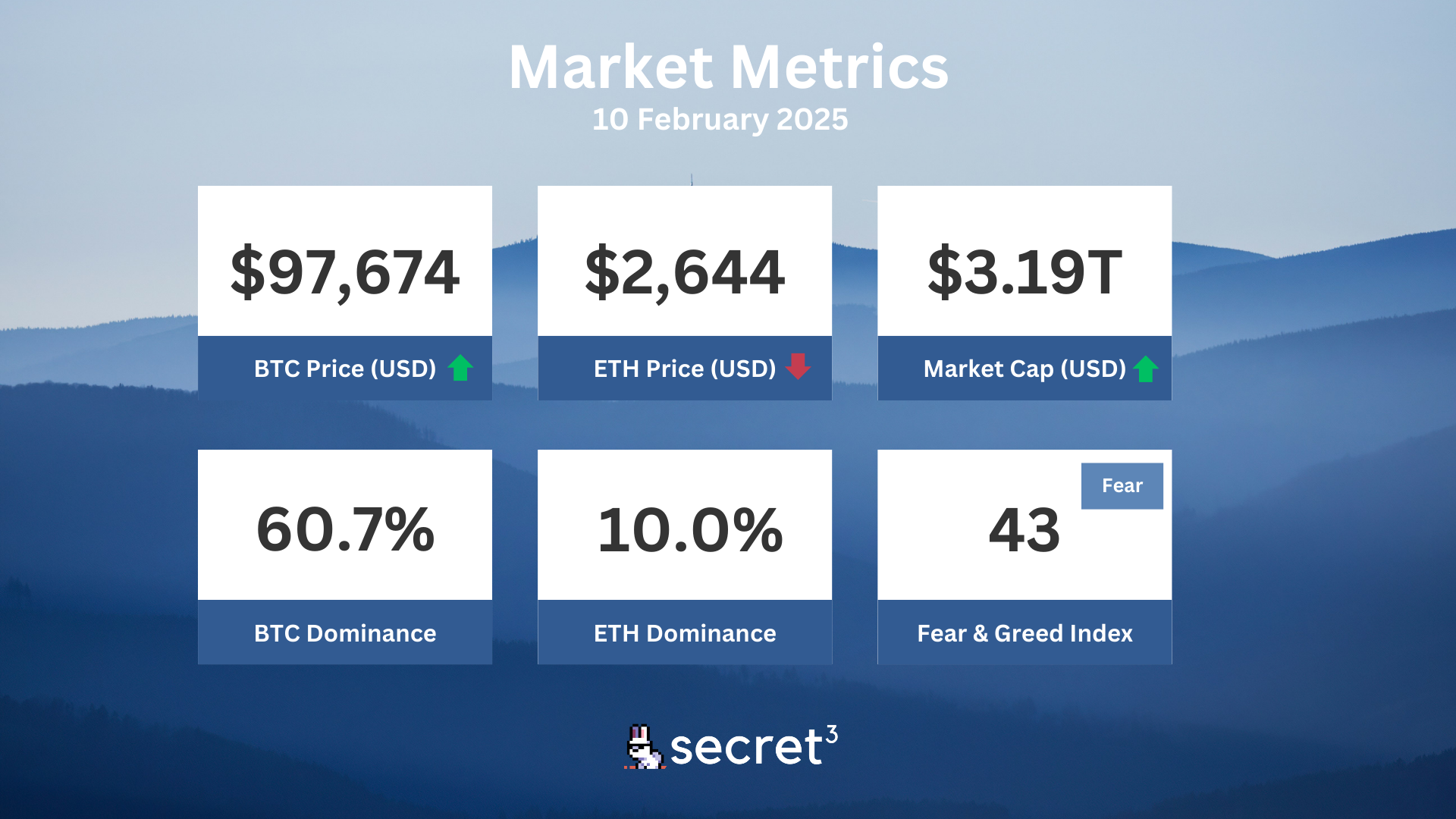

Market Metrics

Fundraising & VC

No fundraising data today.

Regulatory

🏛️ US States Consider Bitcoin Reserves in Landmark Shift

- Nine US states are proposing legislation to establish strategic Bitcoin reserves, including Texas, Pennsylvania, and Ohio.

- These proposals reflect a growing trend of governmental interest in cryptocurrency as a means of financial diversification and modernization.

🔍 SEC Delays Decision on Ethereum ETF Options

- The SEC is seeking more time to deliberate on Ethereum ETF options, extending their decision period until April 2025.

- This delay impacts the potential launch of Ethereum-based ETFs and reflects ongoing regulatory caution in the crypto space.

🏦 Operation Chokepoint 2.0 Hearings Reveal Regulatory Tensions

- Congressional hearings on Operation Chokepoint 2.0 exposed sharp political divisions regarding alleged efforts to de-bank crypto firms.

- Witnesses like Coinbase's Paul Grewal alleged strong regulatory pressures on banks to deny services to crypto companies.

🌐 Blockchain-Based US Treasury Proposed by Coinbase CEO

- Coinbase CEO Brian Armstrong advocates for a blockchain-based US treasury system to increase transparency in government spending.

- The proposal aims to simplify audits and improve fiscal accountability through on-chain records of government expenditures.

🌍 Central African Republic's Memecoin Launch Raises Suspicions

- A video of CAR's President announcing a new memecoin has been flagged as potentially fake by AI detection tools.

- The memecoin reached a market cap of $530 million shortly after launch, raising concerns about its legitimacy.

Technical Analysis

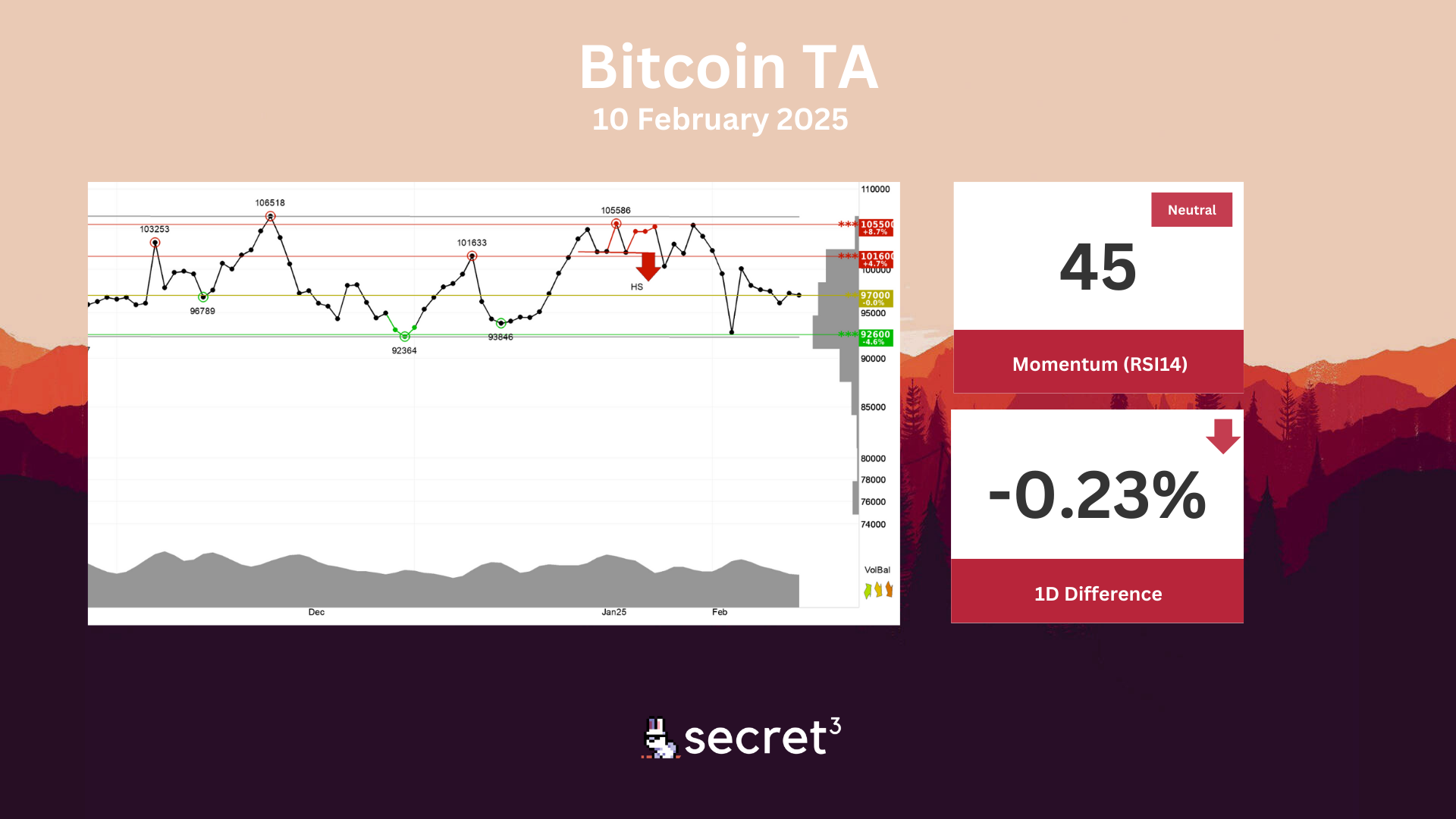

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. The currency is testing support at points 97000. This could give a positive reaction, but a downward breakthrough of points 97000 means a negative signal. Volume has previously been low at price tops and high at price bottoms. This weakens the currency and indicates increased chance of a break down. The currency is overall assessed as technically neutral for the short term.

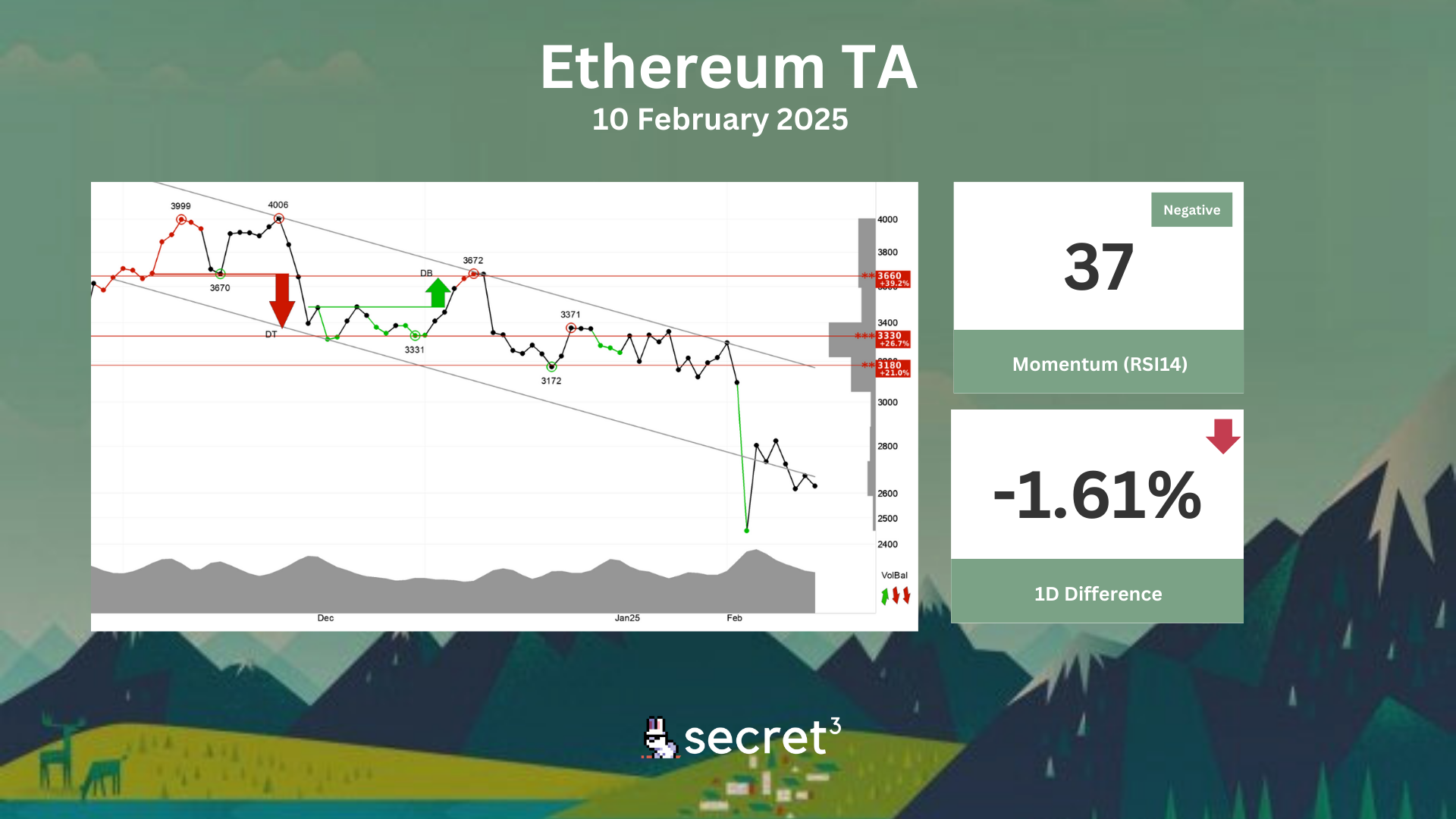

Ethereum - Ethereum has broken the falling trend channel down in the short term. This signals an even stronger falling rate, but the negative development may result in corrections up in the short term. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 3180 points. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.