gm 31/05

Summary

gm, The SEC dropped its lawsuit against Binance and its founder Changpeng Zhao, while also issuing clarification that certain staking activities are not subject to securities laws. The Digital Asset Market Clarity Act (CLARITY Act) was introduced in Congress with bipartisan support, aiming to establish a comprehensive regulatory framework that defines the roles of the SEC and CFTC in overseeing digital assets. On the institutional front, Telegram successfully raised $1.7 billion through a convertible bond offering, while Bitcoin experienced a price correction of approximately 5%, triggering over $800 million in liquidations across the market as altcoins faced steeper declines amidst concerns over Trump's trade tariffs and macroeconomic uncertainties.

News Headlines

💸 Stablecoin Payment Volume Reaches $94B

- Stablecoin payment volume has reached $94.2 billion between January 2023 and February 2025, with business-to-business transactions constituting the majority at an annual rate of $36 billion.

- The total stablecoin market cap has grown 54.5% over the past year to $247.3 billion, highlighting the increasing adoption of stablecoins for cross-border payments and commerce.

💰 BlackRock Bitcoin ETF Inflows Have Already Hit a Record High

- The iShares Bitcoin Trust (IBIT) has achieved unprecedented inflows exceeding $6.22 billion in May 2025, positioning it among the top five ETFs by total inflows this year.

- IBIT has accounted for approximately 90% of all spot Bitcoin ETF inflows, with institutional and retail traders increasingly gravitating towards crypto ETFs in the more supportive regulatory environment.

🏠 Mogul puts real estate investments on Avalanche

- Mogul is leveraging blockchain technology for fractionalized real estate investments through its Mogul Clubs on the Avalanche network, allowing investors to pool resources in user-created investment groups.

- With a minimum investment of just $250, the platform offers access to single-family rentals in the U.S. sunbelt region, claiming cash-on-cash returns of 10-12% and an average internal rate of return of 18.8%.

⛓️ Tokenized equities will be 'bigger than stablecoins': Backed CEO

- Kraken is listing Solana-based tokenized equities called 'xStocks' in collaboration with startup Backed, with Backed's co-founder predicting tokenized equities could surpass stablecoins in volume.

- These tokenized equities offer easier access to American securities for non-US residents and appeal to younger investors who find trading tokens more intuitive, with plans to launch on additional exchanges and blockchains.

📈 Most-Hated L1: Arthur Hayes Thinks Ethereum Could Double in Price This Year

- BitMEX founder Arthur Hayes predicts Ethereum could reach $5,000 by the end of 2025, nearly doubling its current price, noting that it's currently the most disliked layer-1 asset.

- Hayes cites Ethereum's recent 45% price increase over the past month due to stablecoin demand and potential growth from layer-2 networks, with Ethereum holding 51% of the total stablecoin supply.

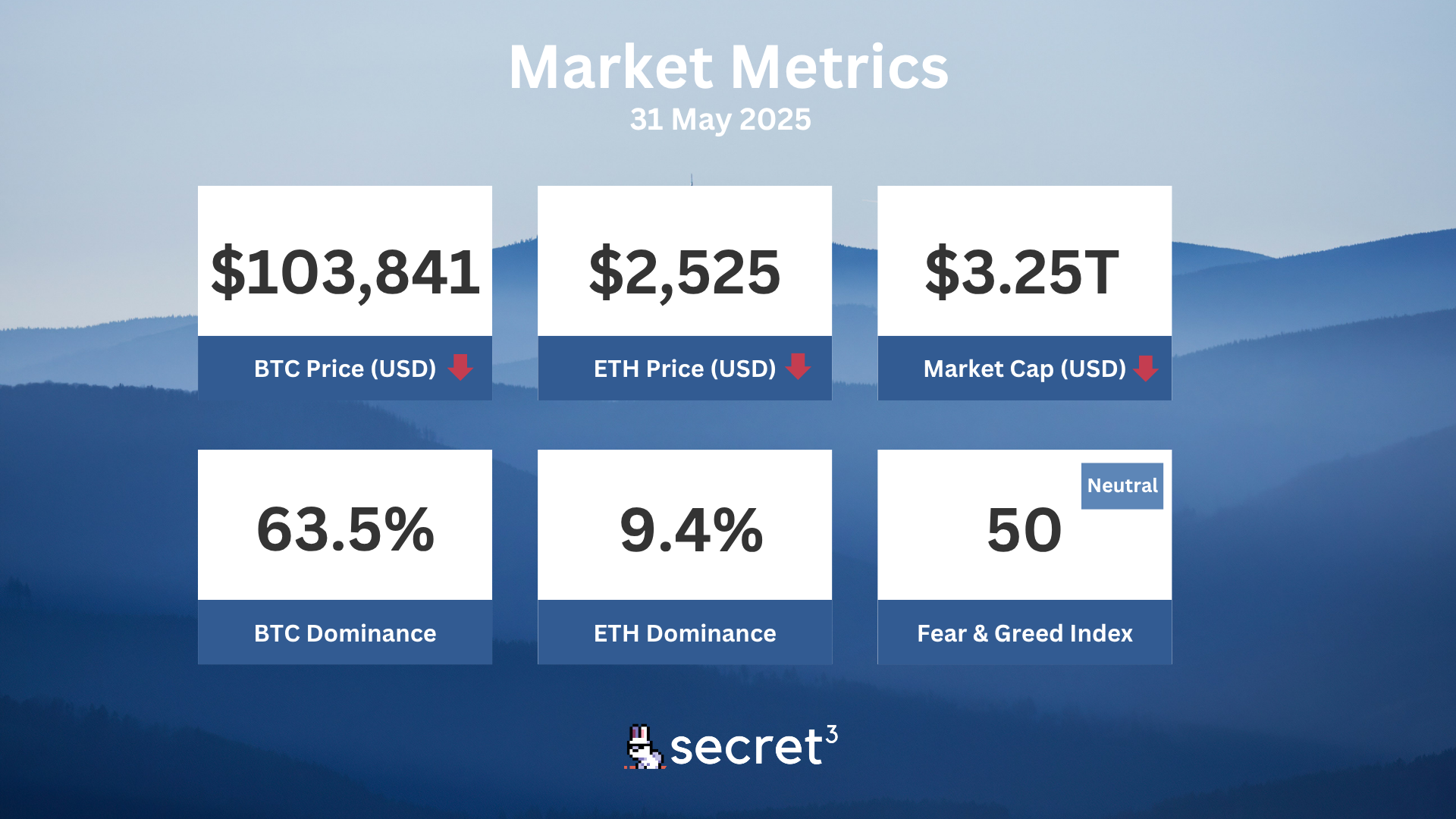

Market Metrics

Fundraising & VC

1. Twenty One (Undisclosed, $100M) - Bitcoin-native public company

2. Cooking City (Undisclosed, $7M) - Fair launch platform on Solana

3. Assisterr AI (Undisclosed, $2.8M) - Network of specialized AI models & agents

Regulatory

🔒 Privacy Concerns: KYC Data Risks in Crypto

- Recent incidents, including the doxxing of Solana co-founder Raj Gokal and the Coinbase data breach, have sparked debate about the security risks of KYC processes in crypto.

- Industry leaders are increasingly criticizing KYC requirements as significant risk factors, suggesting that zero-knowledge proofs could enhance privacy while maintaining compliance.

🚫 Thailand to Block Unlicensed Crypto Exchanges

- Thailand's SEC will block five cryptocurrency exchanges, including Bybit and OKX, from operating within the country starting June 28 due to unlicensed operations.

- The decision follows legislation allowing authorities to block unauthorized platforms, with the SEC warning users to take necessary actions regarding their assets before the shutdown.

🧮 Stripe: Banks "Very Interested" in Stablecoin Use

- Stripe's president John Collison revealed that banks are showing serious interest in integrating stablecoins into their services, attracted by potential reductions in transaction costs and processing times.

- Collison emphasized that clearer regulatory frameworks are necessary for stablecoins to gain more traction, with countries lacking robust regulations risking industry migration.

💼 Nigel Farage Pledges Pro-Crypto Agenda for UK

- UK politician Nigel Farage announced the Reform UK party will accept Bitcoin donations and proposed the Crypto Assets and Digital Finance Bill if elected.

- The bill would reduce capital gains taxes on cryptocurrency from 24% to 10% and require the Bank of England to establish a Bitcoin reserve, positioning the Reform Party as aligned with crypto values.

🏦 Santander Exploring Stablecoin Launch

- Banking giant Santander is exploring the possibility of launching a stablecoin and providing expanded crypto services to retail clients.

- The bank may introduce fiat tokens pegged to the dollar and euro, joining other large institutions like JPMorgan and Bank of America considering similar offerings to enhance financial services and inclusion.

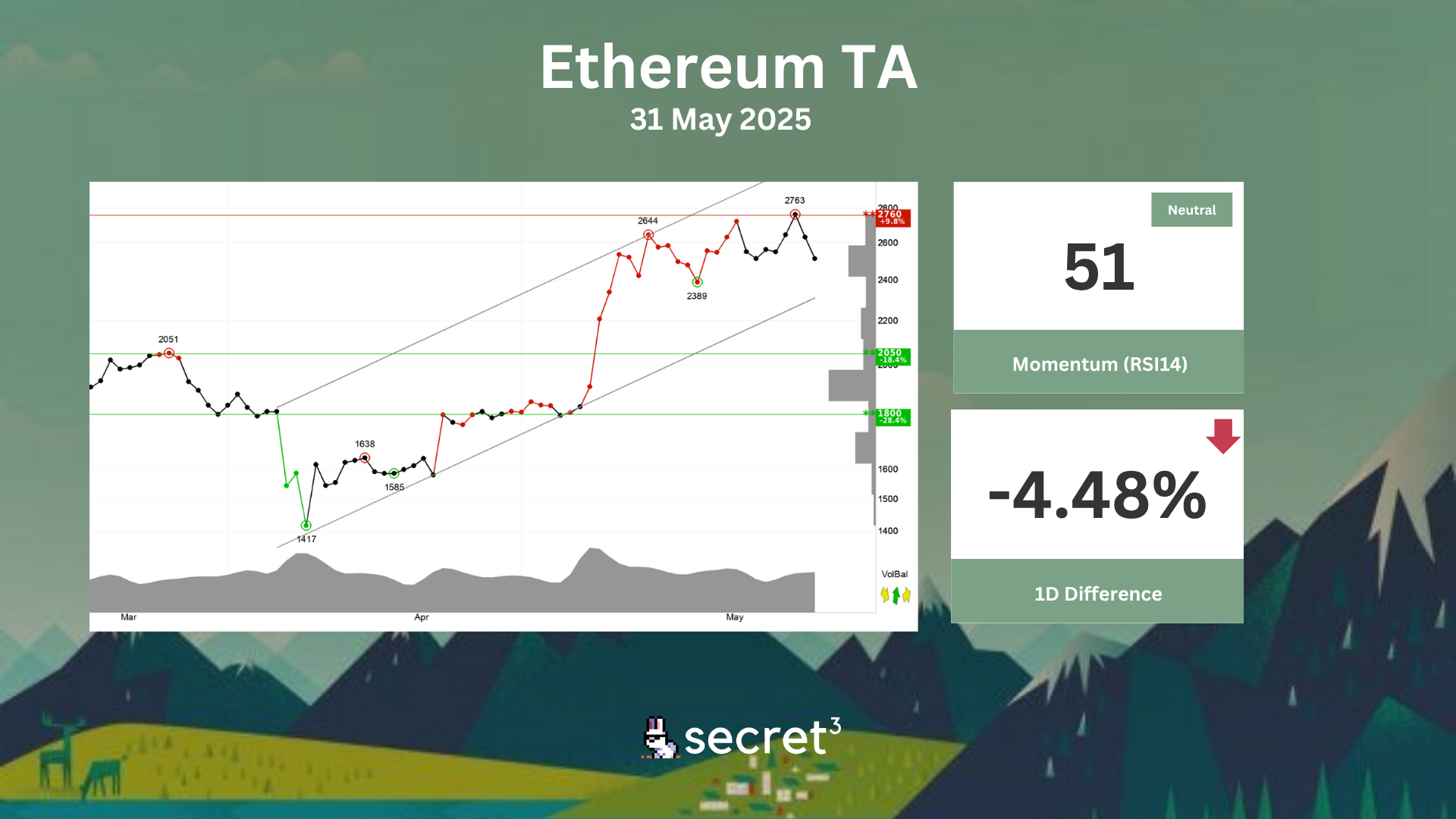

Technical Analysis

Bitcoin - Bitcoin has broken the floor of the rising trend channel in the short term, which indicates a weaker initial rising rate. The currency is testing support at points 103400. This could give a positive reaction, but a downward breakthrough of points 103400 means a negative signal. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically slightly positive for the short term.

Ethereum - Investors have paid higher prices over time to buy Ethereum and the currency is in a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. The currency has support at points 2050 and resistance at points 2760. Volume tops and volume bottoms correspond well with tops and bottoms in the price. Volume balance is also positive, which strengthens the trend. The currency is overall assessed as technically positive for the short term.