gm 31/03

Summary

gm, Bitcoin miner MARA initiated a massive $2 billion at-the-market stock sale plan to acquire more BTC, signaling strong institutional interest in the leading cryptocurrency. Meanwhile, Terraform Labs announced the opening of a claims portal for investors affected by the Terra/LUNA collapse, scheduled for March 31. On the regulatory front, industry experts emphasized the need for clear U.S. regulations on banking and stablecoins before addressing tax reforms. Amidst these developments, Bitcoin experienced a notable decline, dropping to around $82,100, with analysts attributing the sell-off to rising trade tensions and inflation concerns, particularly in light of new tariffs announced by the U.S. government.

News Headlines

💼 25% of S&P 500 Companies May Hold Bitcoin by 2030, Analyst Predicts

- Elliot Chun from Architect Partners forecasts that one in four S&P 500 firms will invest in Bitcoin by 2030 due to pressure on treasury managers to experiment with crypto.

- Currently, only a handful of companies hold Bitcoin, and another 123 would need to adopt it for this prediction to come true.

🔒 New Android Malware 'Crocodilus' Targets Crypto Wallets

- A new Android malware called 'Crocodilus' is targeting cryptocurrency and banking applications, tricking users into sharing their crypto seed phrases.

- The malware can take full control of digital wallets, allowing attackers to drain them completely.

💰 Crypto Trader Turns $2K PEPE Investment into $43M

- A cryptocurrency trader transformed a $2,000 investment in the memecoin PEPE into over $43 million during its peak valuation.

- The trader realized a profit exceeding $10 million after selling 1.02 trillion PEPE coins for $6.66 million, retaining 493 billion coins worth roughly $3.64 million.

🕵️ Iranian Officials Accused of $21M Crypto Theft During Corruption Investigation

- Top interrogators from Iran's Islamic Revolutionary Guard Corps (IRGC) are accused of orchestrating a crypto theft of over $21 million while investigating the defunct exchange Cryptoland.

- Key figures in the scheme allegedly transferred tokens from the exchange's assets into wallets they controlled and sold them for personal gain.

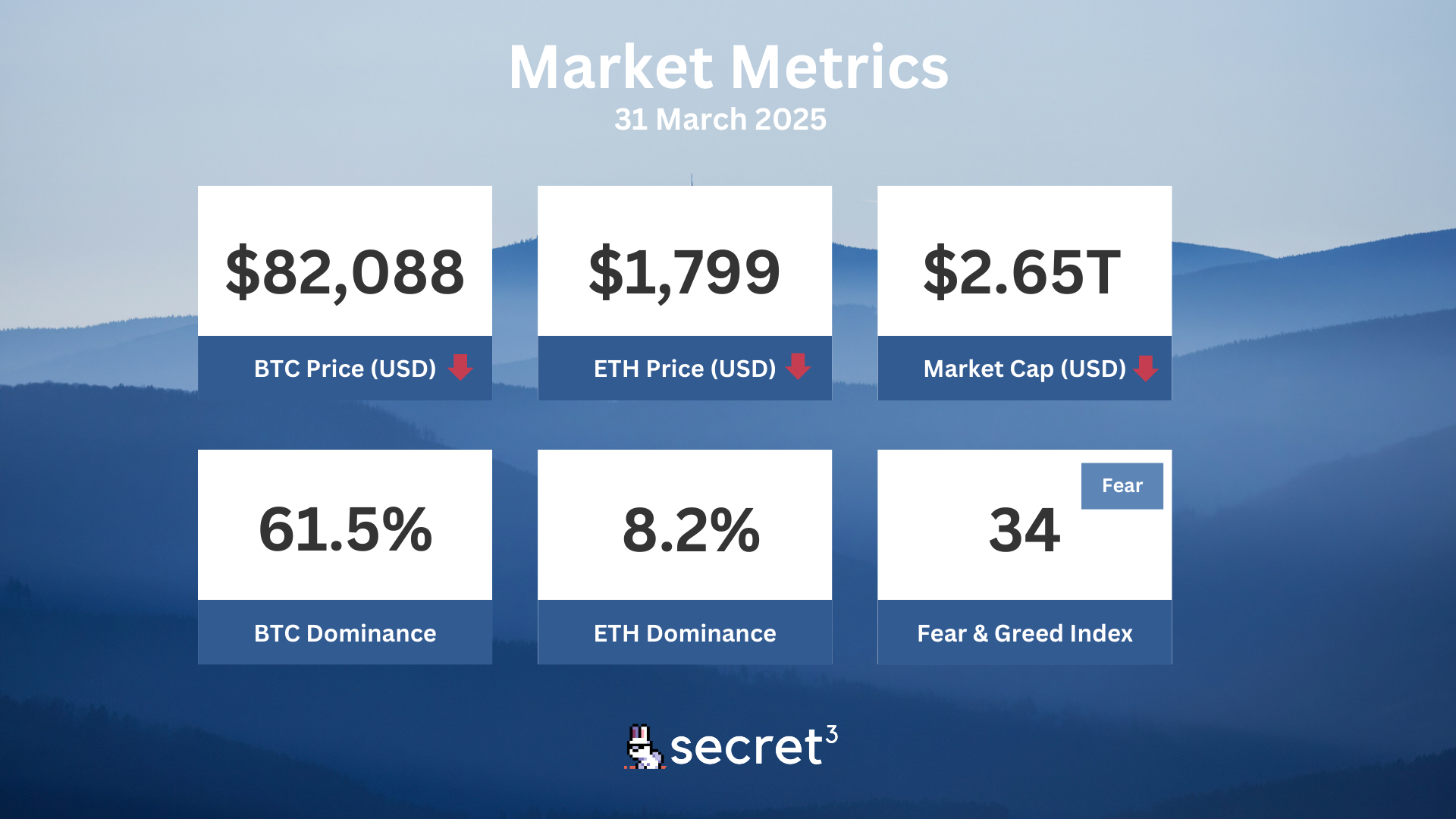

Market Metrics

Fundraising & VC

No fundraising data today.

Regulatory

🏛️ California Introduces Bitcoin Rights Bill

- California proposes legislation to guarantee residents' rights to self-custody digital assets and use cryptocurrencies for private transactions.

- The bill prohibits public entities from restricting or taxing digital assets based solely on their use as payment.

💰 Japan Considers Reclassifying Crypto as Financial Products

- Japan plans to reclassify cryptocurrencies as financial products, potentially implementing insider trading restrictions.

- The Financial Services Agency aims to submit legislation by 2026, which could encourage more institutional investments in crypto.

🎮 Crypto Gaming Updates: Immutable Cleared, GameStop Embraces Bitcoin

- The SEC closes its investigation into Ethereum gaming platform Immutable without enforcement actions.

- GameStop amends its investment policy to include Bitcoin, planning to raise $1.3 billion through convertible senior notes.

🏦 Institutions Hesitant About DeFi Adoption

- Privacy issues, inconsistent compliance regulations, and legal accountability concerns deter institutions from adopting DeFi solutions.

- Regulatory uncertainty remains a major barrier, with varying legal frameworks across jurisdictions complicating adoption.

💼 Stablecoin Regulations Prioritized Over Crypto Tax Reform

- Industry leaders emphasize the need for clear stablecoin and banking relationship guidelines before addressing crypto tax reform.

- The anticipated GENIUS Act aims to set collateralization guidelines for stablecoin issuers and ensure compliance with anti-money laundering laws.

Technical Analysis

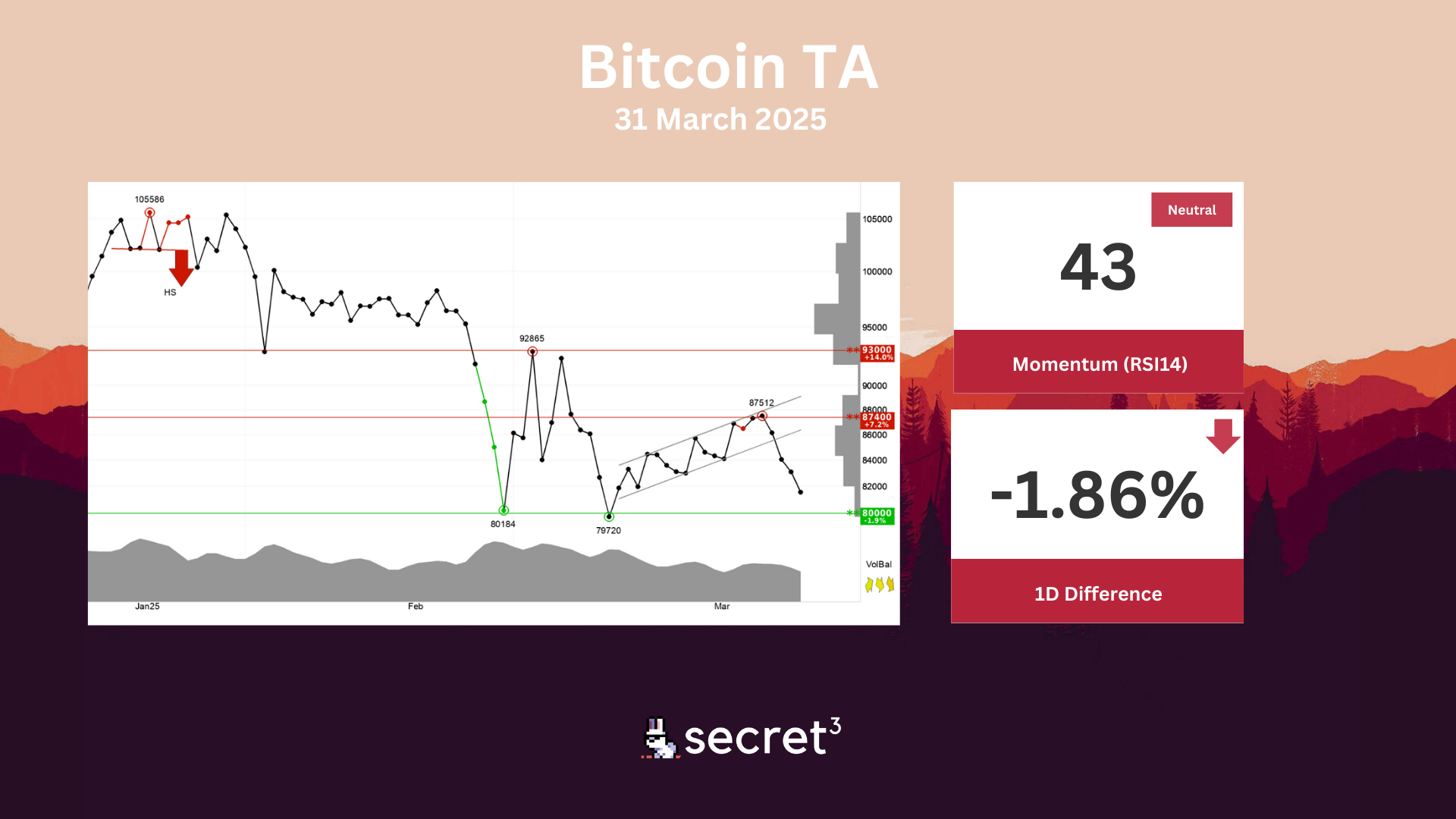

Bitcoin - Bitcoin has broken the floor of the rising trend channel in the short term, which indicates a weaker initial rising rate. The currency is approaching support at 80000 points, which may give a positive reaction. However, a break downwards through 80000 points will be a negative signal. The currency is assessed as technically positive for the short term.

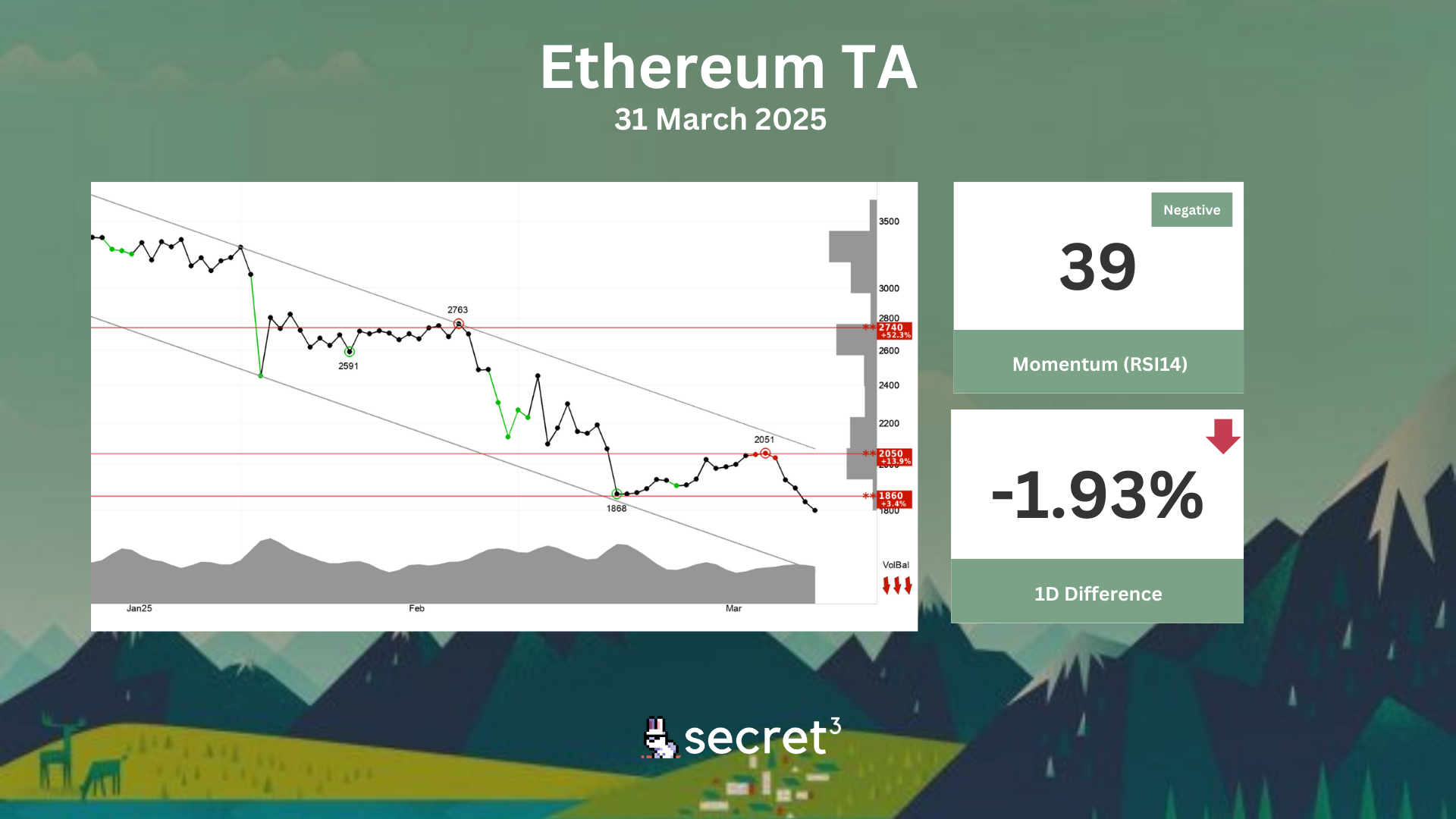

Ethereum - Ethereum is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. The currency has broken down through support at points 1860. This predicts a further decline. Negative volume balance weakens the currency in the short term. The currency is overall assessed as technically negative for the short term.