gm 30/05

Summary

gm, Cork Protocol suffered a $12 million smart contract hack and Coinbase revealed a major data breach affecting nearly 70,000 accounts due to compromised customer service agents. Meanwhile, institutional interest in crypto continued to strengthen as BlackRock announced plans to purchase approximately 10% of Circle's upcoming $624 million IPO, while IMA Financial and Chainproof expanded crypto insurance offerings to include minimum annual yield guarantees for Ethereum stakers, potentially opening new financial products to institutional investors. The regulatory landscape showed signs of evolution with the introduction of the "Digital Asset Market Clarity Act of 2025" in Congress, aiming to define the roles of the SEC and CFTC in crypto oversight, while the US Labor Department retracted Biden-era guidance that had discouraged crypto investments in retirement plans.

News Headlines

💼 Polygon Launches Katana, a DeFi-Focused Chain Using AggLayer

- Polygon Labs is launching Katana, a new blockchain specifically optimized for DeFi that aims to concentrate liquidity and provide high yields by focusing exclusively on core financial protocols.

- The platform will generate yield from multiple streams while utilizing zero-knowledge finality from the start, with the public mainnet scheduled for June 23, intended to demonstrate the capabilities of Polygon's AggLayer framework.

🧠 Self-Spreading Malware Found Mining Privacy Crypto Dero

- A new Linux malware campaign is exploiting unsecured Docker infrastructure globally, converting exposed servers into a decentralized cryptojacking network that mines the privacy coin Dero.

- The attack begins by exploiting publicly exposed Docker APIs, infecting containers to mine cryptocurrency and scan for additional targets without a central command server, with over 520 Docker APIs exposed and vulnerable.

💲 Conduit Raises $36M to Expand Cross-Border Stablecoin System

- Boston-based cross-border payments company Conduit has raised $36 million in a Series A funding round led by Dragonfly and Altos Ventures to scale their payment system and expand their currency offerings.

- The company aims to provide a modern alternative to the SWIFT network by integrating stablecoins with local fiat currencies, enabling near real-time settlements and reportedly saving clients over 60,000 hours in settlement times and more than $55 million in fees since 2021.

📈 Toncoin Soars Amid Telegram's $1.5 Billion Bond Sale and xAI Deal

- Toncoin (TON) surged nearly 12% following reports of Telegram's plans to raise $1.5 billion through a corporate bond sale and a $300 million deal with Elon Musk's xAI.

- Telegram reported $540 million in profits on $1.4 billion in revenue for 2024 and has reached one billion users as of March 2025, contributing to the positive sentiment around its associated blockchain token despite founder Pavel Durov's legal challenges in France.

🏢 New Jersey County to Tokenize $240B in Property Deeds

- Bergen County, New Jersey has partnered with blockchain land record management firm Balcony to tokenize 370,000 property deeds valued at approximately $240 billion, making it the largest blockchain-based deed tokenization initiative in U.S. history.

- This five-year project aims to create a tamper-proof and searchable chain of title for all 70 municipalities in the county, significantly reducing fraud, title disputes, and administrative errors in property records.

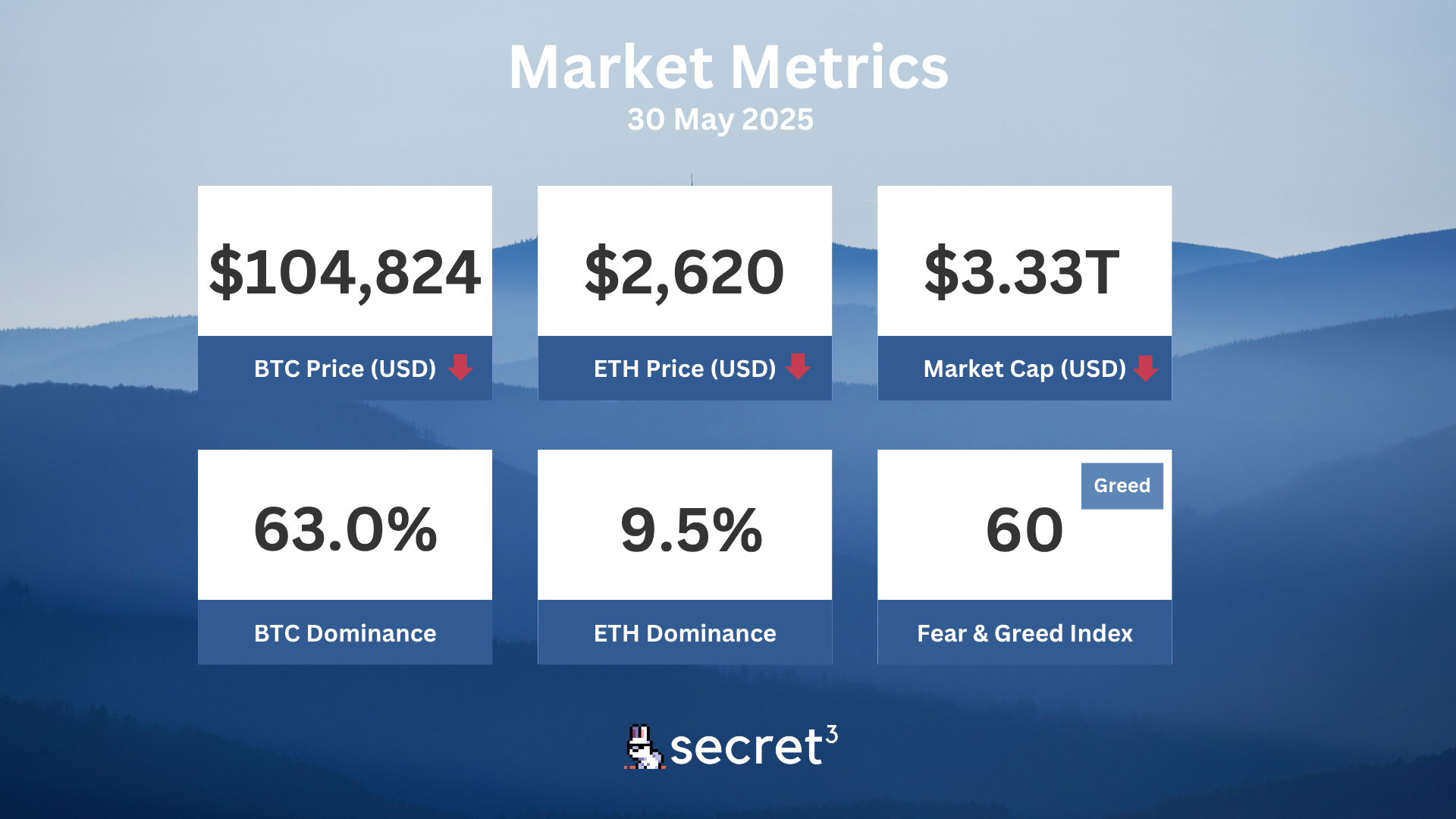

Market Metrics

Fundraising & VC

1. Donut (Pre-seed, $7M) - Agentic crypto browser built on Solana

2. Naoris Protocol (Strategic, $3M) - Decentralized post-quantum infrastructure

3. EGO.tech (Pre-seed, $800K) - Protocol to launch and trade any profile on the internet

Regulatory

⚖️ SEC Dismisses Lawsuit Against Binance and CZ

- The Securities and Exchange Commission (SEC) has filed to dismiss its ongoing lawsuit against Binance and founder Changpeng Zhao (CZ).

- The lawsuit had alleged that Binance engaged in the sale of unregistered securities, failed to restrict U.S. users from accessing the main exchange, and deceptively commingled customer funds.

📱 Kazakhstan to Pilot "CryptoCity" for Crypto Payments

- Kazakhstan has announced plans to create a pilot zone named "CryptoCity," aimed at integrating cryptocurrencies for purchasing goods and services in a regulated environment.

- The initiative will explore cryptocurrency adoption across various sectors and aims to attract IT professionals while fostering local economic growth.

🔐 SEC Clarifies Crypto Staking Not Subject to Securities Laws

- The SEC has clarified that certain staking activities in cryptocurrency, including self-staking and custodial staking where asset ownership is retained, are not considered securities transactions.

- The guidance covers three types of staking: self-staking, self-custodial staking, and custodial staking, though practices such as liquid staking and restaking may still be subject to regulations.

🕵️ US Sanctions Filipino Tech Company for Aiding Crypto Scams

- The U.S. Treasury Department has sanctioned Funnull Technology Inc. and its administrator for facilitating cryptocurrency scams that defrauded Americans of over $200 million.

- Funnull provided infrastructure for "pig butchering" scams by hosting fraudulent websites and reselling IP addresses to cybercriminals.

🏙️ NYC Mayor Eric Adams Calls for End to BitLicense

- New York Mayor Eric Adams urged the repeal of the BitLicense, a regulation requiring crypto businesses in the state to obtain a license to operate.

- Adams emphasized New York's potential to become a leader in the crypto industry and announced plans to launch a Bitcoin bond in the city to attract investment.

Technical Analysis

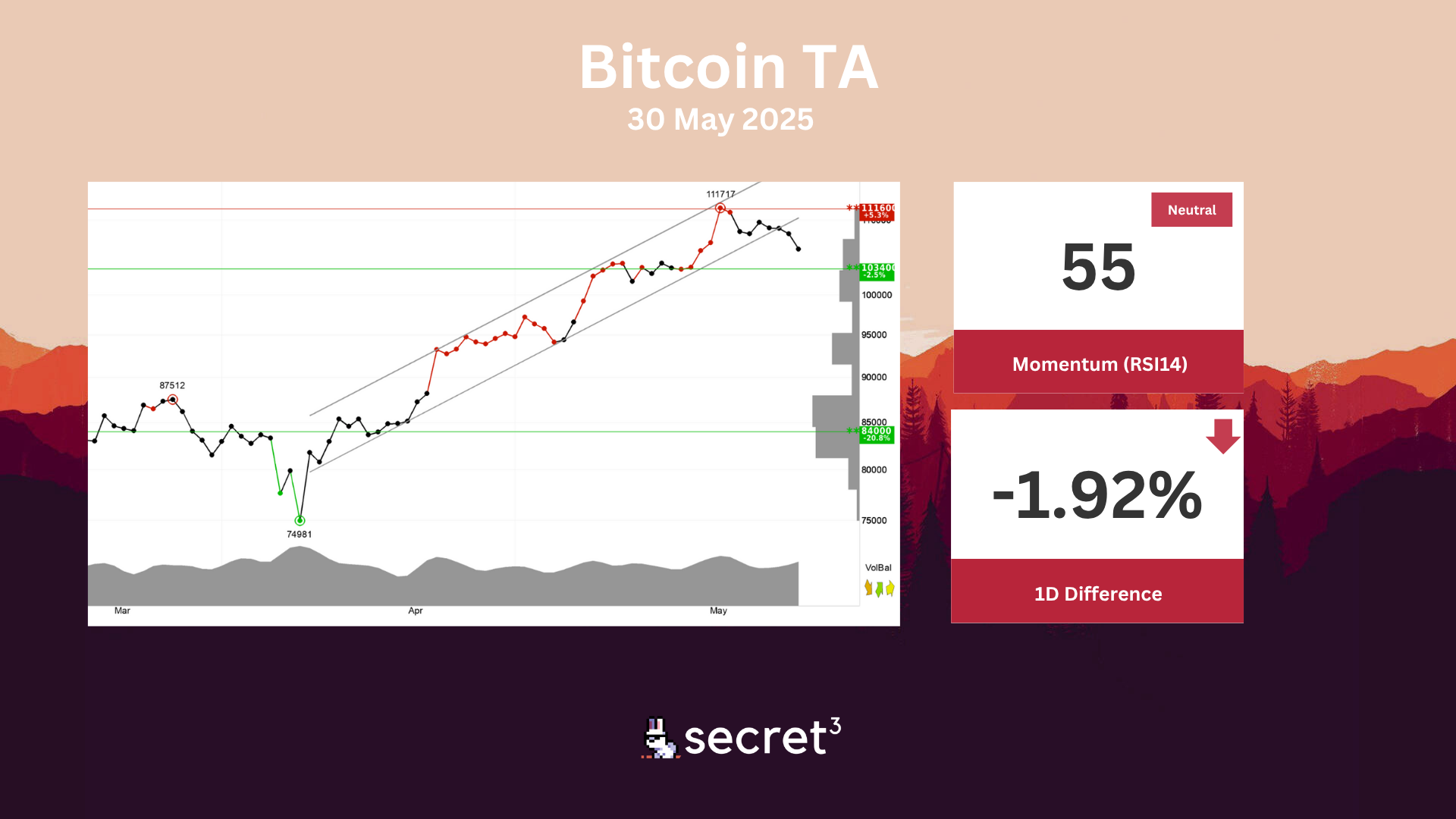

Bitcoin - Bitcoin has broken the floor of the rising trend channel in the short term, which indicates a weaker initial rising rate. The currency is approaching support at 103400 points, which may give a positive reaction. However, a break downwards through 103400 points will be a negative signal. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically positive for the short term.

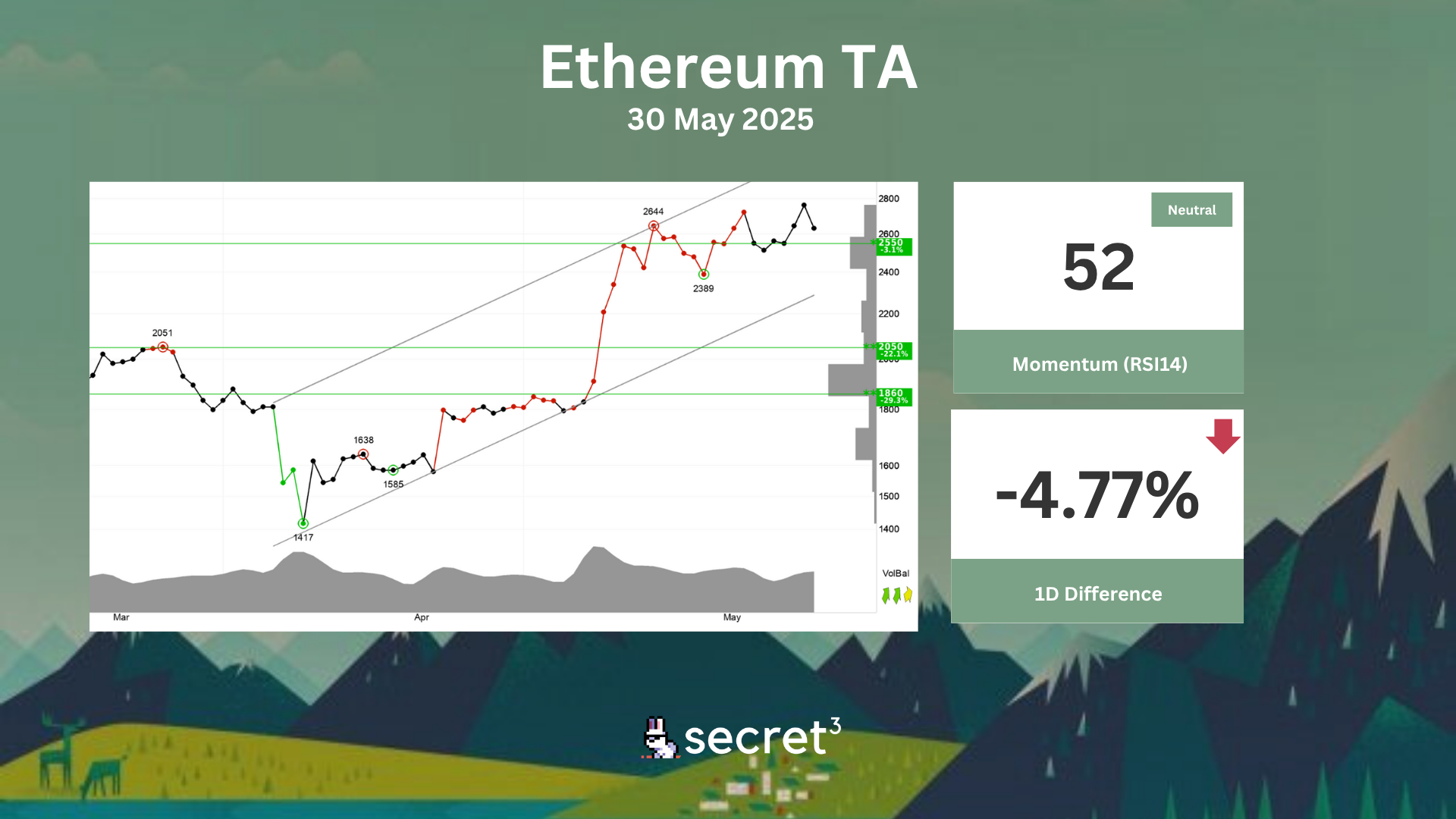

Ethereum - Ethereum is in a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. The currency is approaching support at 2550 points, which may give a positive reaction. However, a break downwards through 2550 points will be a negative signal. Volume has previously been high at price tops and low at price bottoms. This strengthens the trend. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically positive for the short term.