gm 30/04

Summary

gm, Mastercard announced a major initiative to enable stablecoin payments for merchants within its network, partnering with Circle and Paxos to facilitate this integration. This move could significantly boost the adoption and utility of stablecoins in everyday transactions. Bitcoin continued its upward trend, approaching the $95,000 mark, driven by strong inflows into Bitcoin ETFs, particularly BlackRock's iShares Bitcoin Trust which saw its second-largest daily inflow of $970 million. The broader market showed resilience, with AI-related tokens experiencing a notable surge. Regulatory developments also made headlines, with the UK government unveiling draft legislation for crypto regulation and the US Senate majority leader expecting a vote on stablecoin regulation before May 26. Meanwhile, Trump Media plans to launch a crypto token and wallet for its Truth+ platform, starting with subscription payments, raising questions about political influence in the crypto space.

News Headlines

📉 Bitcoin Miner Q1 Results May Disappoint as Hashprice Fell, Tariffs Hit

- CoinShares reports Bitcoin miners' first-quarter results could be disappointing due to declining hashprice and impact of trade tariffs.

- Miners relying on older or less efficient equipment face greater exposure to tariffs ranging from 24% to 54% for imported mining rigs.

🏆 Tether Gold Backed by 7.7 Tons of Gold in Swiss Vault

- Tether Gold (XAUT) has achieved a market capitalization of $770 million, supported by 7.7 tons of gold stored in a Swiss vault.

- Each XAUT token corresponds to one troy ounce of LBMA-certified gold, with rigorous controls including bar verification and regular audits.

💼 Kraken's Former Legal Chief Marco Santori Joins Pantera Capital

- Marco Santori, former chief legal officer at Kraken, has joined Pantera Capital as a general partner on its investment team.

- Santori will focus on expanding the firm's cryptocurrency portfolio and serve as an advisor on regulatory compliance and strategic growth.

🎮 Sky Mavis Accuses Ronin Game of Making Secret Deal

- Sky Mavis has accused the game Ragnarok: Monster World (RMW) of secretly entering into a deal with another blockchain, allegedly breaching prior agreements.

- Co-founder Aleksander Larsen cited RMW's inability to compete effectively since the Ronin blockchain became permissionless in February.

🏦 Circle Gets Abu Dhabi Regulatory Nod to Expand in Middle East

- Circle has received in-principle approval from the Financial Services Regulatory Authority of the Abu Dhabi Global Market.

- This approval will enable Circle to apply for a full Financial Services Permission license to operate as a regulated money services provider.

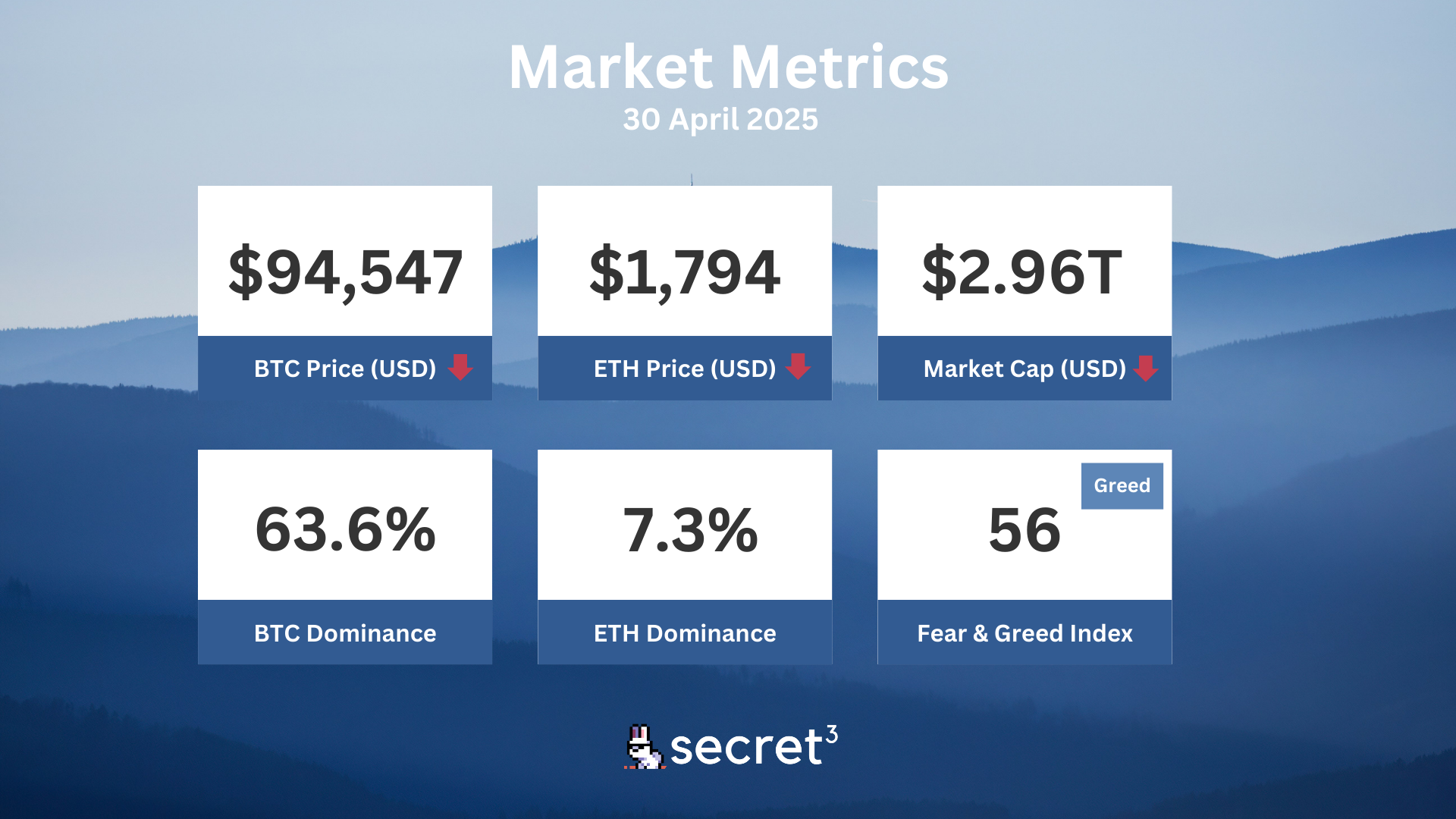

Market Metrics

Fundraising & VC

1. Camp Network (Series A, $25M) - Autonomous IP L1 blockchain

2. Miden (Seed, $25M) - ZK-enabled edge blockchain

Regulatory

🌪️ Court Bars OFAC From Reinstating Tornado Cash Sanctions

- A federal court permanently barred the U.S. Treasury from reimposing sanctions on Tornado Cash.

- The ruling affirms that immutable smart contracts cannot be classified as sanctionable property under existing law.

💼 DOJ May Drop Case Against Samourai Wallet Founders

- The U.S. Department of Justice is considering dropping charges against Samourai Wallet founders.

- This follows a recent DOJ policy shift on not pursuing criminal charges against crypto mixers unless involved in serious misconduct.

🏦 Bank of Italy Warns of Crypto Systemic Risks

- The Bank of Italy raised concerns about systemic risks from growing ties between crypto and traditional finance.

- It highlighted potential vulnerabilities from increased crypto market integration and stablecoin risks.

💳 PayPal's Stablecoin Cleared by SEC

- The SEC concluded its investigation into PayPal's stablecoin (PYUSD) without pursuing enforcement actions.

- PayPal's stablecoin has seen a 75% increase in circulating supply since early 2025.

⚖️ Australia Cracks Down on Dormant Crypto Exchanges

- Australia's AUSTRAC is targeting inactive registered crypto exchanges to prevent scams.

- Exchanges must resume trading or face registration cancellation.

Technical Analysis

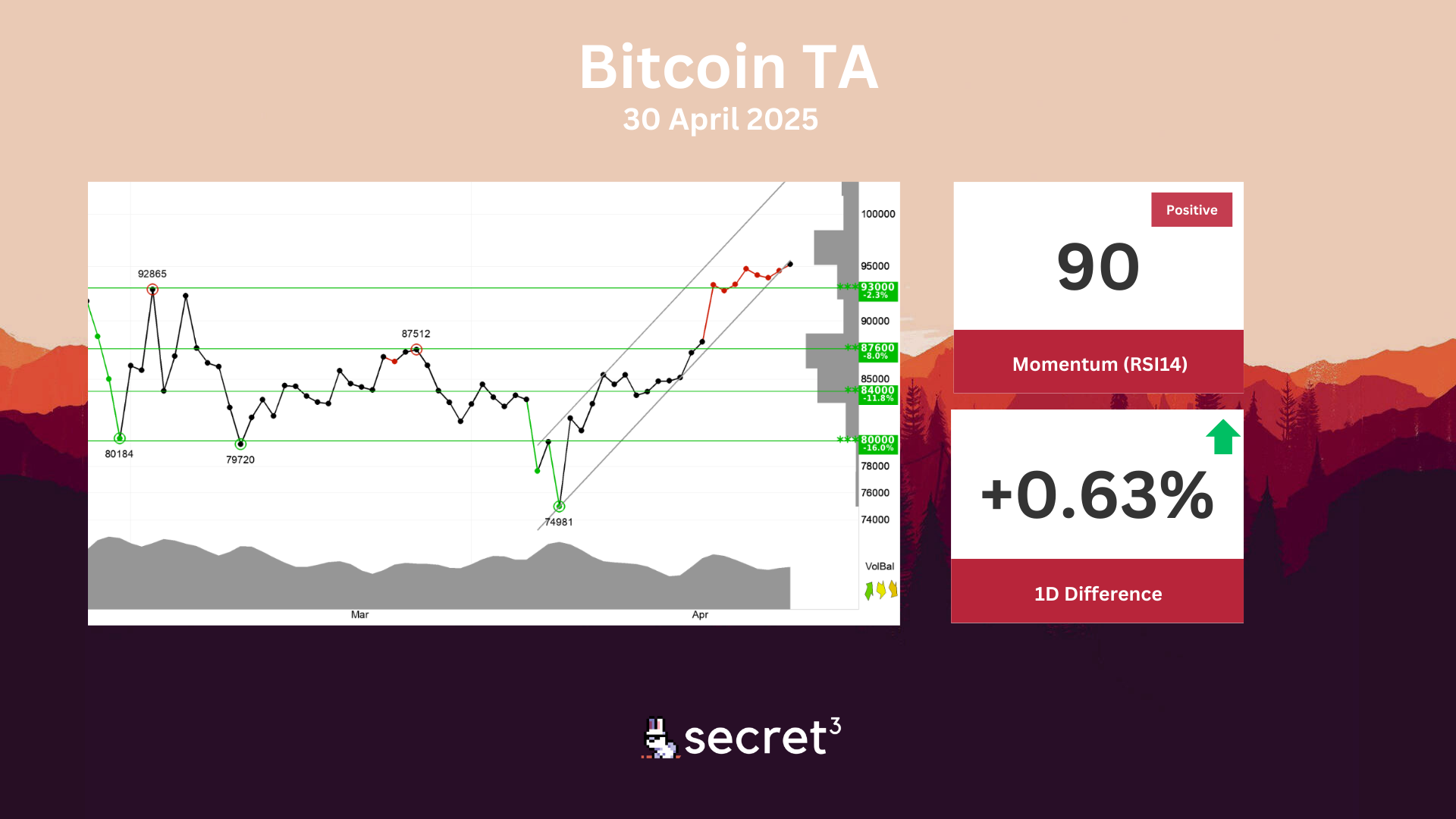

Bitcoin - Bitcoin has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. The currency has broken up through resistance at points 93000. This predicts a further rise. RSI is above 70 after a good price increase the past weeks. The currency has strong positive momentum and further increase is indicated. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.

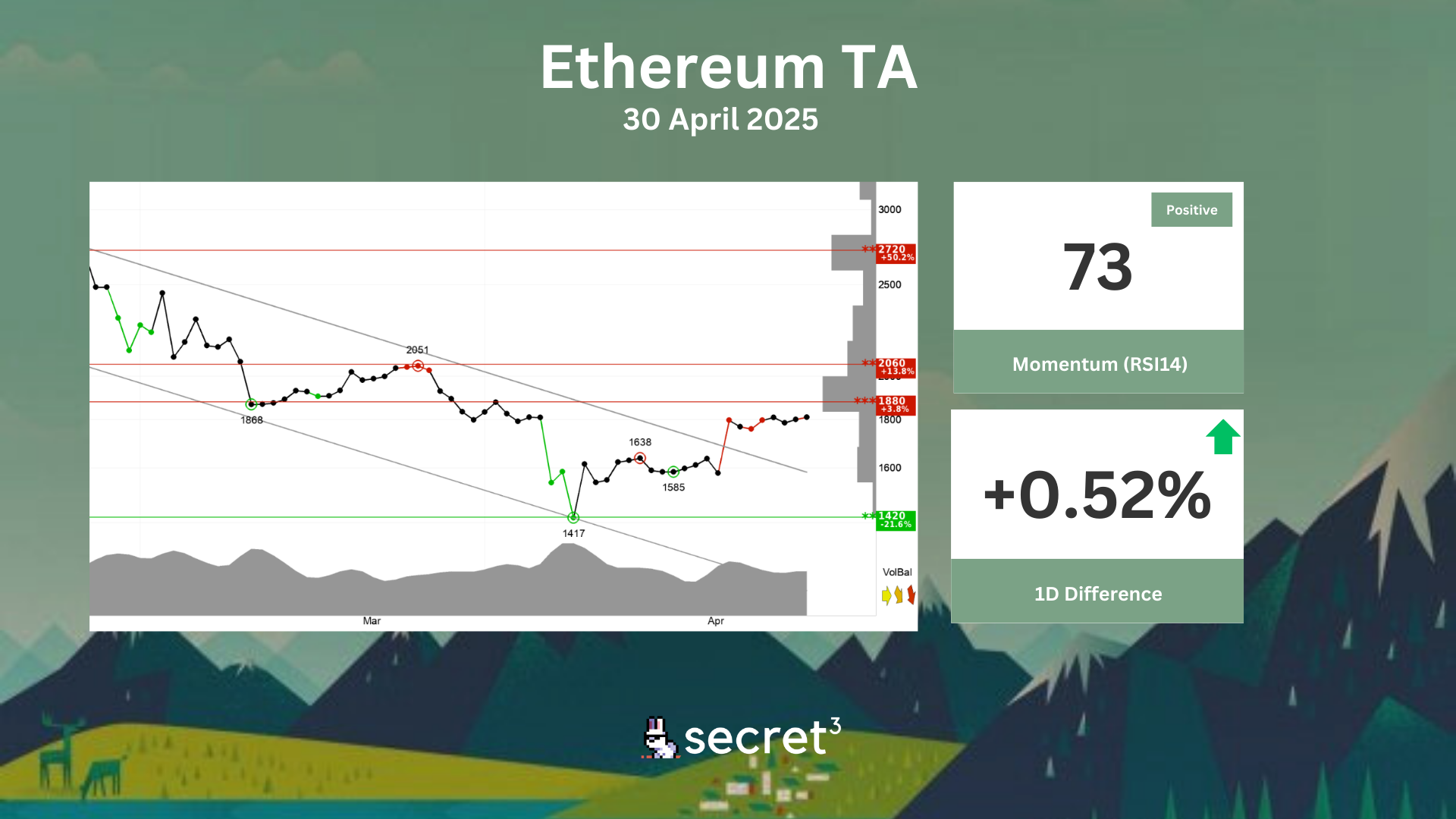

Ethereum - Ethereum has broken the ceiling of the falling trend in the short term, which indicates a slower initial falling rate. The currency is approaching resistance at 1880 points, which may give a negative reaction. However, a break upwards through 1880 points will be a positive signal. RSI is above 70 after a good price increase the past weeks. The currency has strong positive momentum and further increase is indicated. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically negative for the short term.