gm 30/01

Summary

gm, Bitcoin surged past $105,000 following the Federal Reserve's decision to hold interest rates steady. Institutional interest in crypto continues to grow, evidenced by Tesla reporting a $600 million gain on its Bitcoin holdings and Coinbase appointing key figures to its advisory board, including a former Trump campaign manager. Meanwhile, regulatory scrutiny persists as French prosecutors expand their investigation into Binance for alleged money laundering and tax fraud. The market also saw increased activity in memecoins, particularly those associated with Donald Trump, highlighting the ongoing influence of political factors on crypto markets.

News Headlines

🚀 Czech Central Bank to Consider $7 Billion Bitcoin Reserve

- The Czech National Bank Governor will propose allocating up to $7 billion into Bitcoin as a foreign exchange reserve.

- This could make the Czech Republic the first Western central bank to hold crypto assets, aiming to diversify its investment portfolio.

💰 Tesla Reports $600M Bitcoin Gain in Q4 Using New Accounting Rule

- Tesla reported a $600 million gain on its Bitcoin holdings in Q4 2024 due to new accounting rules.

- The company's Bitcoin holdings increased to approximately $1 billion from $184 million in prior quarters.

🏛️ Trump Media Launches Fintech Brand With Bitcoin and Crypto Focus

- Trump Media and Technology Group announced the launch of Truth.Fi, a new financial services arm focused on Bitcoin and cryptocurrencies.

- The firm plans to utilize $250 million in cash, managed by Charles Schwab, to make these investments.

🔄 Robinhood Hints at Bitcoin Futures Launch

- Robinhood is set to launch futures trading for Bitcoin and other assets, expanding beyond traditional stock trading.

- The move positions Robinhood against established players like CME Group and Coinbase Derivatives Exchange.

🏗️ Movement Labs Unveils Developer Mainnet Ahead of Public Launch

- Movement Labs launched a developer mainnet aimed at integrating Facebook's Move Virtual Machine with Ethereum.

- This initiative marks a significant step towards deploying the company's core infrastructure for DeFi protocols.

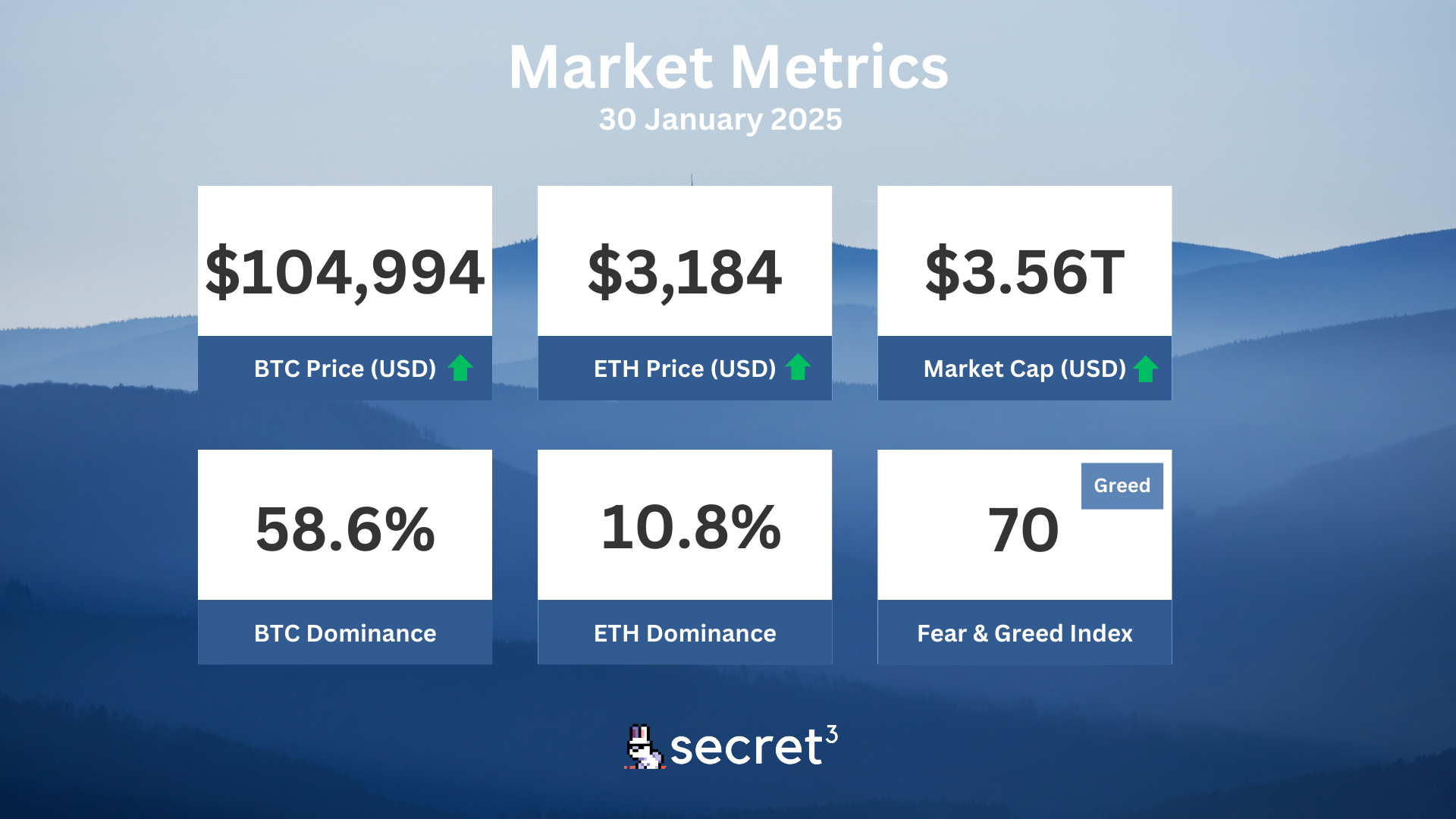

Market Metrics

Fundraising & VC

1. D3 (Series A, $25M) - DomainFi

2. Sign (Undisclosed, $16M) - on-chain infrastructure for token distribution and credential verification

3. Cryptio (Extended Series A, $15M) - Back-Office OS for regulated enterprises

4. Bluwhale (Series A, $10M) - Web3’s intelligence layer (L3)

On-chain Data

1. NAVI (NAVX) token unlocked today ($405.88K, 1.05%)

2. Portal (PORTAL) token unlock in 1 day ($6.10M, 18.33%)

3. Biconomy (BICO) token unlock in 1 day ($1.80M, 0.81%)

4. Celo (CELO) token unlock in 1 day ($1.09M, 0.36%)

Regulatory

🏛️ Senator Calls for Clear Crypto Regulation Standards

- Wyoming Senator Cynthia Lummis submitted an amicus brief supporting Coinbase's appeal against the SEC.

- Lummis argues the SEC has exceeded its authority in crypto enforcement actions and adheres to outdated securities laws.

⚖️ Fed Chair Calls for Congressional Action on Crypto Regulation

- Federal Reserve Chair Jerome Powell emphasized the need for a regulatory framework around cryptocurrencies.

- Powell indicated banks can service crypto customers if risks are managed properly.

🏦 Crypto.com to Delist USDT and 9 Other Tokens in Europe

- Crypto.com will delist Tether's USDT and nine other cryptocurrencies in Europe starting January 31, 2025.

- The move is to comply with the Markets in Crypto-Assets Regulation (MiCA).

🌎 El Salvador Amends Bitcoin Law to Comply with IMF Deal

- El Salvador's Congress quickly approved legislation to amend its Bitcoin laws, aligning with an IMF agreement.

- The reform makes Bitcoin acceptance optional for private sector merchants instead of mandatory.

🌊 Ondo Finance's Tokenized US Treasury to Join XRP Ledger

- Ondo Finance plans to launch its tokenized US Treasury fund on the XRP Ledger within the next six months.

- This move is part of a growing market for tokenized Treasury assets, currently valued at $3.43 billion.

Technical Analysis

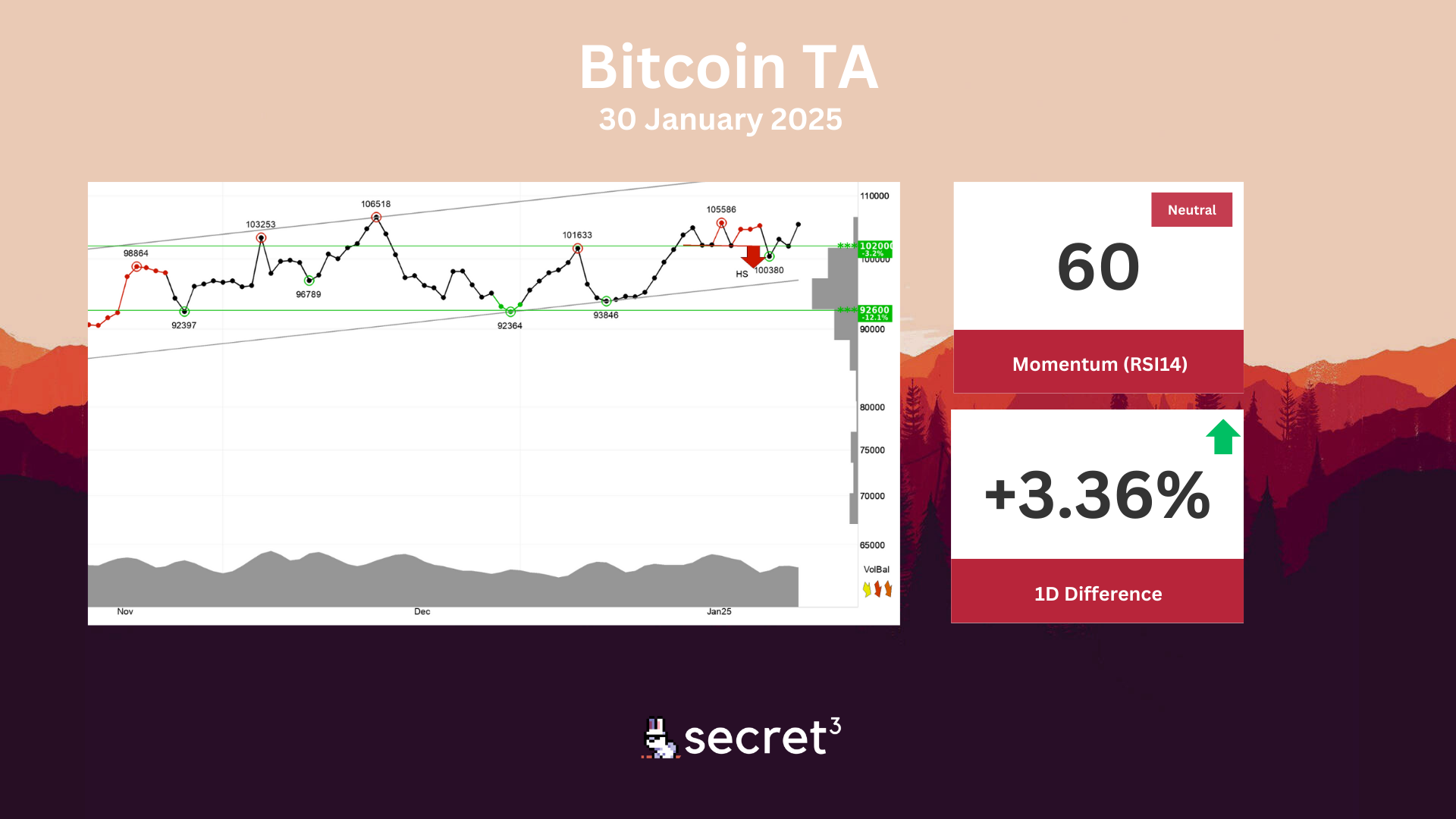

Bitcoin - Investors have paid higher prices over time to buy Bitcoin and the currency is in a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 102000 points. The RSI curve shows a falling trend, which is an early signal of a possible trend reversal downwards for the price as well. The currency is overall assessed as technically positive for the short term.

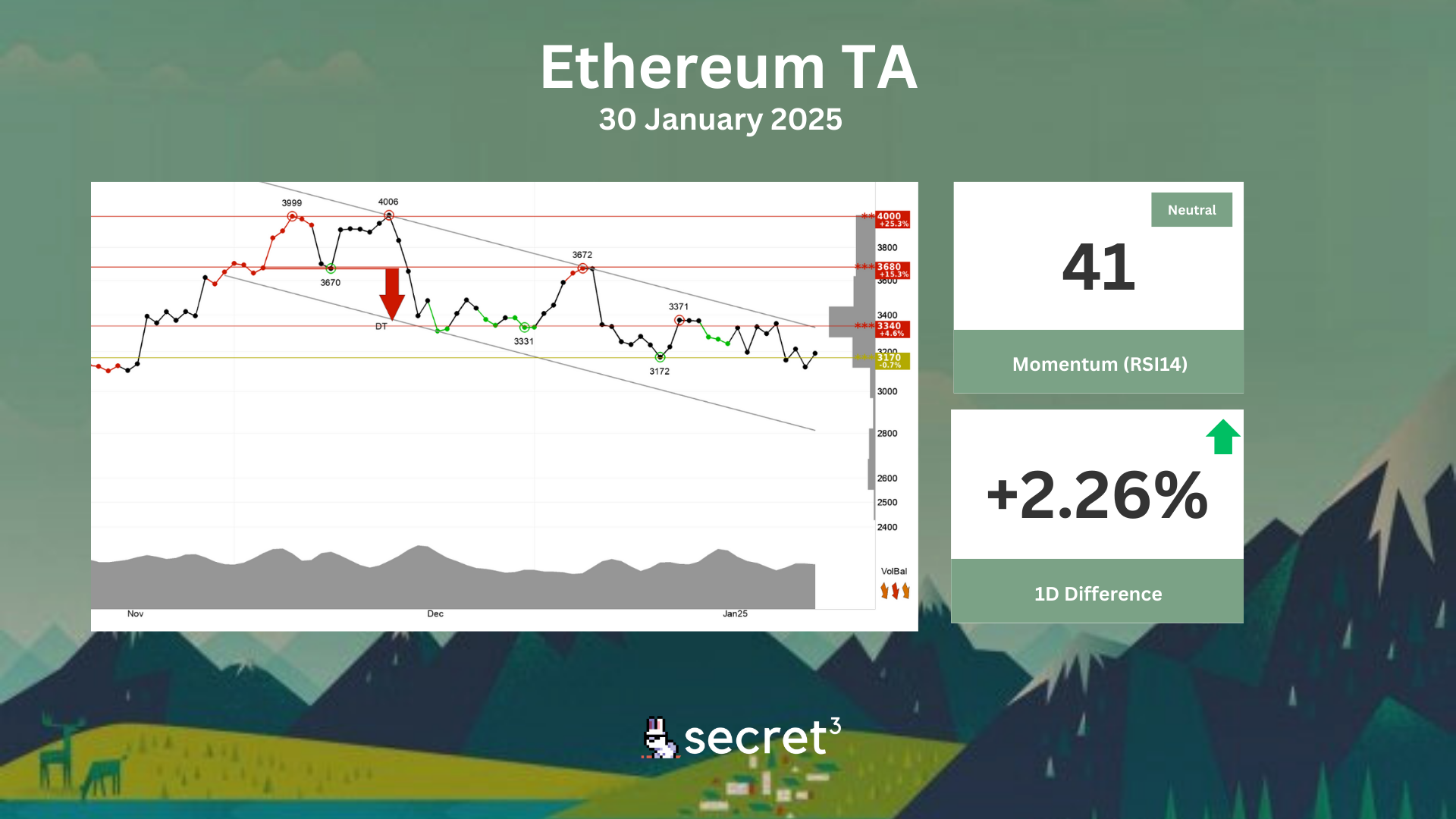

Ethereum - Investors have accepted lower prices over time to get out of Ethereum and the currency is in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Ethereum. The currency is testing support at points 3170. This could give a positive reaction, but a downward breakthrough of points 3170 means a negative signal. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

🔮 Osmosis DAO | Recover IBC Client for Kopi Chain (897) (Active Vote)

- This proposal seeks to recover the IBC client used by the Kopi chain.

💢 Across DAO | Reduce ACX Emissions to ACX LPs (Active Vote)

- This proposal aims to decrease ACX emissions across ACX LPs in the ETH, USDC, USDT, and DAI pools from 15,000 ACX per day to 7,500 ACX per day.

👻 Aave DAO | Add USDe and sUSDe to Base Aave V3 (Preliminary Discussion)

- This proposal aims to onboard USDe and sUSDe as a collateral asset on Aave v3 Base.