gm 29/05

Summary

gm, BlackRock reportedly seeks a 10% stake in Circle's upcoming IPO alongside Cantor Fitzgerald's launch of a $2 billion Bitcoin lending business that completed its first transactions with FalconX and Maple Finance. Corporate Bitcoin adoption accelerated with GameStop purchasing 4,710 BTC ($512M), Strive Asset Management raising $750M for Bitcoin strategies, and SharpLink Gaming raising $425M to create the first Nasdaq-listed Ethereum treasury. Meanwhile, the U.S. Labor Department reversed Biden-era guidance against crypto in retirement plans, while at the Bitcoin 2025 conference in Las Vegas, Pakistan announced plans for a strategic Bitcoin reserve, and Vice President JD Vance emphasized Bitcoin's importance as a "strategically important asset" for the United States.

News Headlines

💰 BlackRock Boosts IBIT Bitcoin ETF Exposure by 25% in Strategic Portfolio

- BlackRock's Strategic Income Opportunities Portfolio has increased its holdings in the iShares Bitcoin Trust (IBIT) to 2,123,592 shares valued at $99.4 million, up from 1,691,143 shares at the end of 2024.

- IBIT has established itself as the largest Bitcoin ETF with over $72 billion in net assets, with May 2025 achieving record inflows exceeding $1.5 billion in just two days.

💸 Vivek Ramaswamy's Strive Raises $750M for Bitcoin Strategy

- Strive Asset Management, co-founded by Vivek Ramaswamy, has raised $750 million through a PIPE financing structure that could reach $1.5 billion with warrant exercises, all dedicated to Bitcoin acquisitions.

- Unlike traditional Bitcoin treasury companies, Strive plans innovative acquisition strategies including buying distressed Bitcoin claims, unlocking cash through acquisitions, and purchasing lower tranches of structured Bitcoin credit vehicles.

🚨 Sui Details $220M Cetus Protocol Exploit, Pledges $10M for Security

- Sui revealed that the recent $220M exploit of Cetus Protocol was caused by a bug in its math library that allowed an attacker to misconfigure liquidity pools and drain substantial value.

- In response, Sui has committed $10 million to enhance security measures, including funding audits for projects on its blockchain, acknowledging it had grown complacent after previous successful audits.

💡 Vice President JD Vance: Bitcoin Will Be "Strategically Important Asset" for US

- Vice President JD Vance emphasized at Bitcoin 2025 that Bitcoin is not just a viable investment but a strategically important asset for the United States over the next decade.

- Vance criticized the Biden administration's regulatory approach and pledged to create a supportive environment for digital assets, eliminating regulatory hurdles while establishing favorable frameworks for stablecoins.

📱 Telegram Secures $300M Deal with Elon Musk's xAI for Grok Integration

- Telegram has partnered with Elon Musk's xAI to integrate the Grok AI chatbot into its messaging platform, reaching one billion users with enhanced features like threaded chats and document digests.

- The deal includes a $300 million investment from xAI and a 50% revenue share from Grok subscriptions sold via Telegram, causing Toncoin to rise over 20% following the announcement.

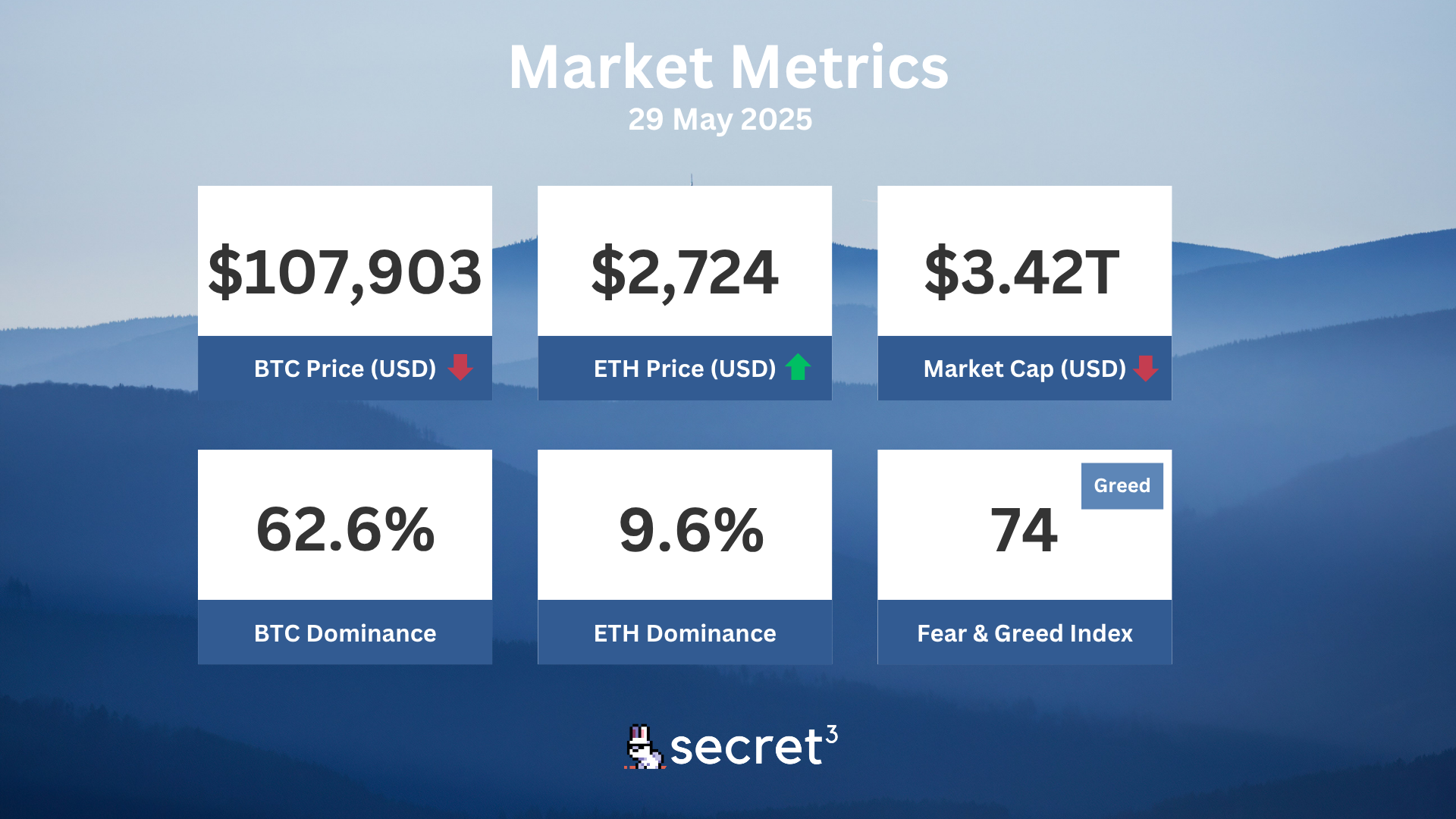

Market Metrics

Fundraising & VC

1. Conduit (Series A, $36M) - cross-border payments platform

2. Oncade (Undisclosed, $4M) - Web3-native game distribution platform

3. Asigna (Seed, $3M) - Smart custody layer for Bitcoin

4. BlockSpaces (Strategic, $2M) - Bitcoin-native financial infrastructure platform

Regulatory

🌐 U.K. FCA Opens Consultation on Stablecoin Regulations

- The U.K.'s Financial Conduct Authority has initiated a public consultation on proposed regulations for stablecoin issuers and cryptocurrency custody providers.

- The rules would require stablecoin issuers to maintain token value and provide clear information on backing asset management, with independent third-party custodians securing reserve assets.

💰 Pakistan Announces Strategic Bitcoin Reserve

- Pakistan's crypto minister Bilal Bin Saqib announced plans to establish a strategic Bitcoin reserve during the Bitcoin 2025 conference in Las Vegas.

- The initiative marks a significant policy shift from the Pakistani government's previous rejection of cryptocurrencies, citing U.S. inspiration for the pro-crypto regulatory approach.

🔄 Nasdaq Files for 21Shares Sui ETF, Initiating SEC Review

- Nasdaq has filed with the SEC for 21Shares to list a spot Sui exchange-traded fund (ETF) in the U.S., beginning the regulatory review process which could take up to 240 days.

- The filing indicates the SUI token supports various functions within the Sui ecosystem, including staking, serving as a liquid asset, and governance.

🚨 Australian Regulator Sues Former Crypto Exchange Director

- The Australian Securities and Investments Commission (ASIC) has initiated civil proceedings against Allan Guo, former director of the collapsed crypto exchange ACX.io, for allegedly misusing $20 million in customer funds.

- ASIC's investigation revealed that customer and company funds were co-mingled, with the company owing users at least $22.7 million after it suspended withdrawals in 2019.

🛑 Federal Court Freezes $57M USDC in Libra Memecoin Case

- A Manhattan federal court has temporarily frozen approximately $57 million in USDC connected to the controversial Libra memecoin as part of a class action lawsuit.

- The lawsuit alleges that Libra's creators—Gideon, Thomas, and Hayden Davis—misled investors regarding liquidity pools, with defendants including blockchain companies KIP Protocol and Meteora.

Technical Analysis

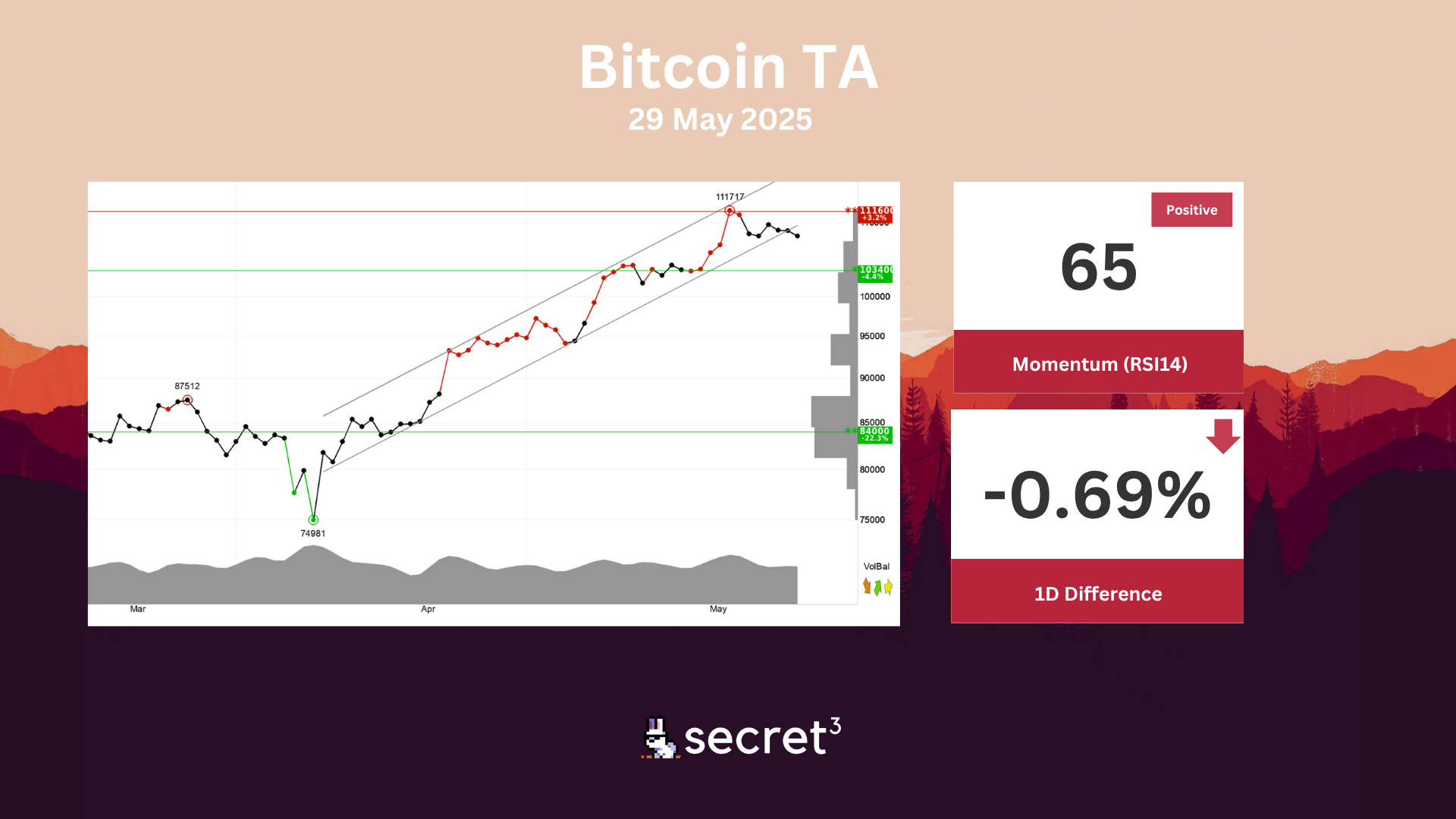

Bitcoin - Bitcoin has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. The currency has support at points 103400 and resistance at points 111600. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically slightly positive for the short term.

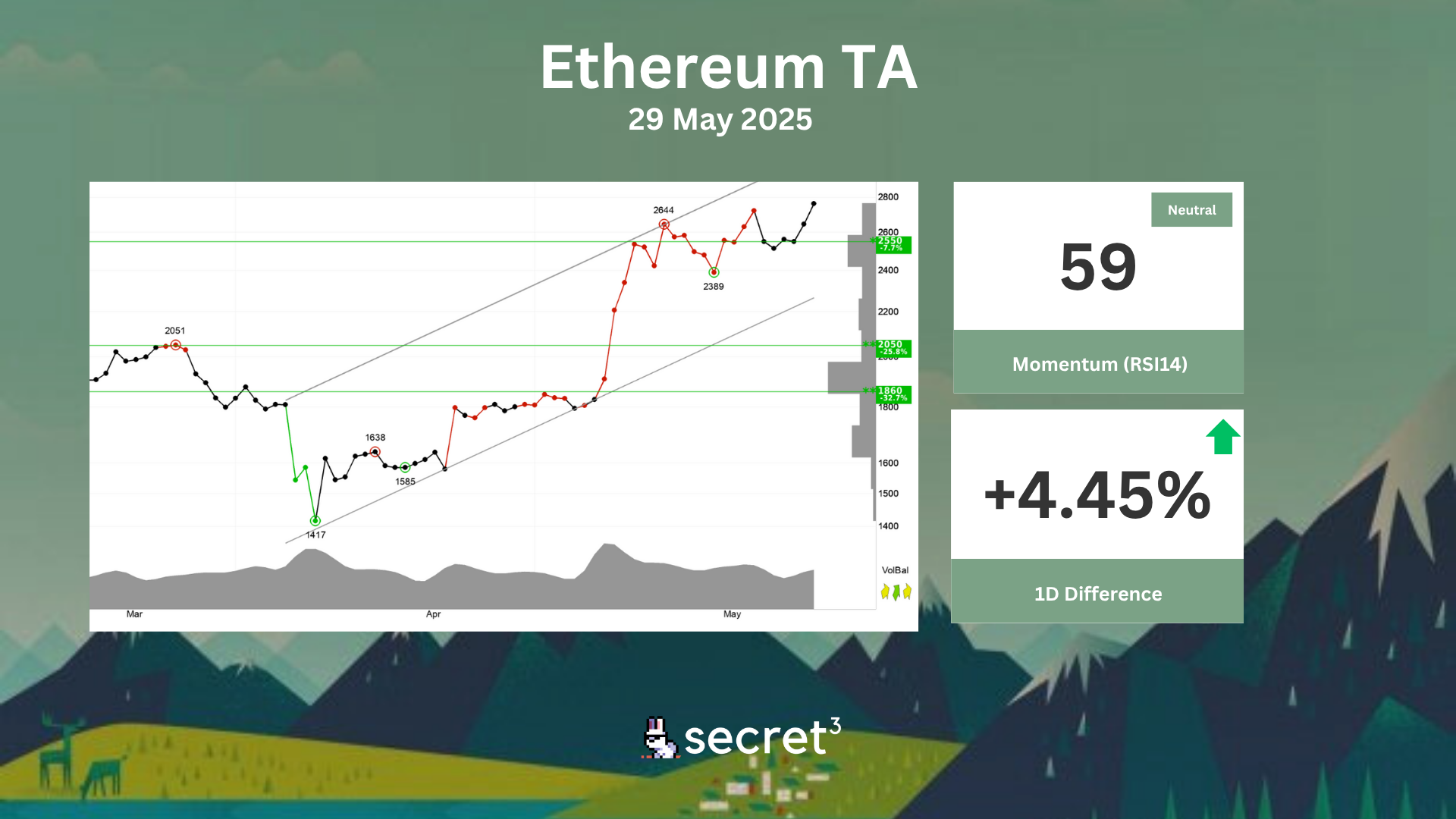

Ethereum - Investors have paid higher prices over time to buy Ethereum and the currency is in a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 2550 points. Volume has previously been high at price tops and low at price bottoms. This strengthens the trend. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically positive for the short term.