gm 29/04

Summary

gm, Bitcoin continued its upward trajectory, trading around $95,000, with analysts from Standard Chartered predicting it could reach $120,000 this quarter and potentially $200,000 by year-end. Institutional interest remains strong, with crypto ETPs experiencing their third-largest inflows on record at $3.4 billion. Meanwhile, Mastercard announced partnerships with Circle and Paxos to enable stablecoin payments for merchants, signaling growing mainstream adoption of digital assets. Additionally, the Arizona House of Representatives passed two bills proposing the establishment of a state cryptocurrency reserve, potentially setting a precedent for other states to follow.

News Headlines

🏦 Coinbase to Launch Yield-Bearing Bitcoin Fund for Institutions

- Coinbase announces the launch of its Bitcoin Yield Fund on May 1, targeting institutional investors outside the US.

- The fund aims to offer a net return of 4% to 8% on Bitcoin holdings, addressing the rising demand for Bitcoin yield products.

🐋 Strategy Acquires 15,355 Bitcoin for $1.42B as Price Surges Above $90K

- Michael Saylor's Strategy significantly expands its Bitcoin holdings, acquiring 15,355 BTC at an average price of $92,737 per Bitcoin.

- The total Bitcoin holdings of Strategy now amount to 553,555 BTC, valued over $50 billion.

🔄 Ethereum Foundation Restructures Leadership

- The Ethereum Foundation separates its board of directors and management roles to enhance governance and strategic focus.

- Hsiao-Wei Wang and Tomasz K. Stańczak appointed as co-executive directors to execute the foundation's vision.

💱 Tether Maintains Stablecoin Dominance Despite Rising Competition

- Tether (USDT) holds a 66% market share in the stablecoin sector, compared to USDC's 28%, according to a report by Nansen.

- USDC has experienced increased adoption since November 2024, driven by improved regulatory clarity for crypto.

🔒 MetaMask to Launch Self-Custody Crypto Card with Mastercard

- MetaMask introduces a crypto payments card enabling users to spend self-custodied funds, backed by Mastercard.

- The card will utilize smart contracts for real-life transactions, boasting a processing speed under five seconds on the Linea network.

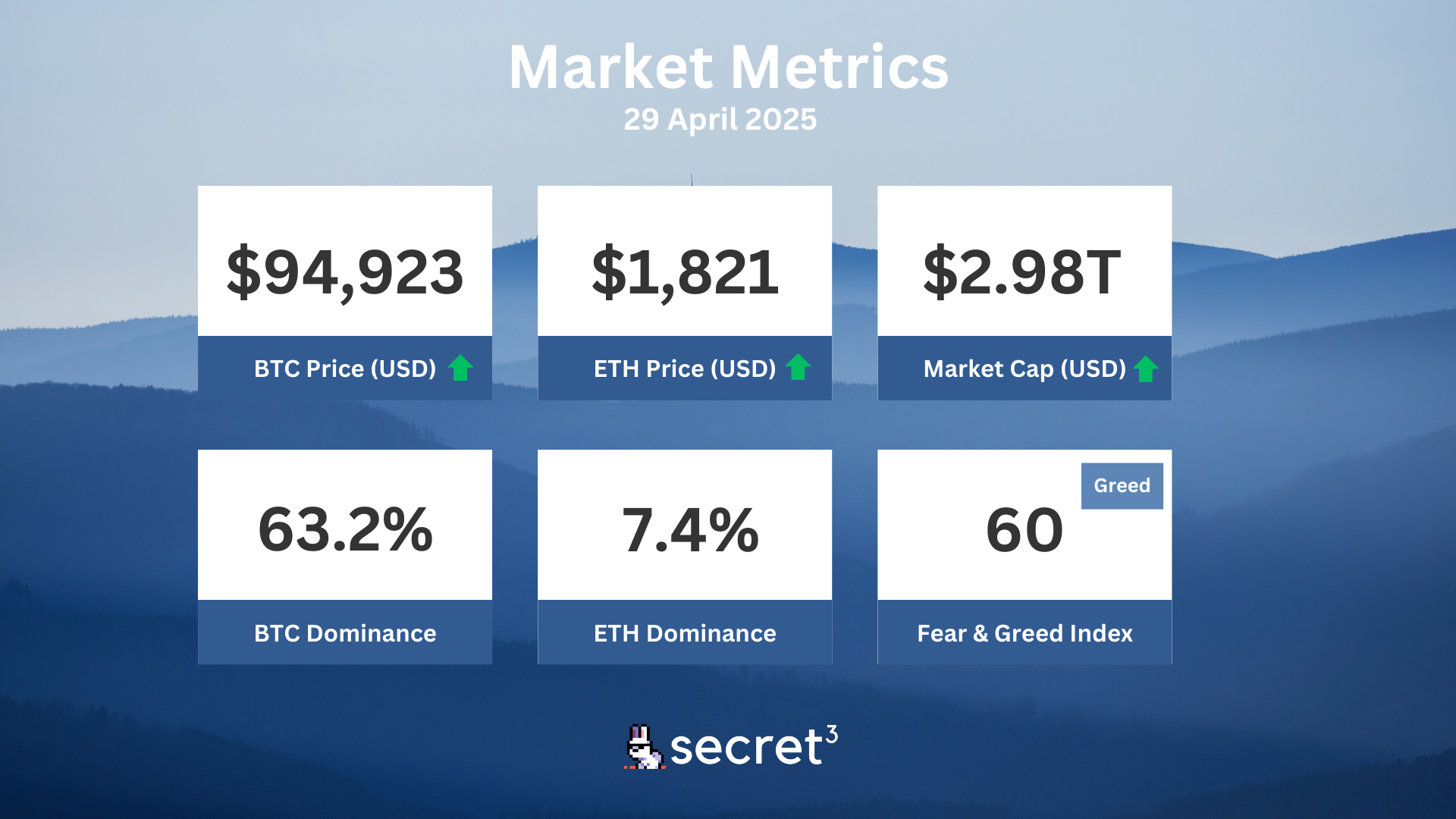

Market Metrics

Fundraising & VC

1. Next Generation (Seed, $5M) - Blockchain payments solutions

2. WineFi (Undisclosed, $2M) - Wine investment platform

3. YOAKE (Private Token Sale, $1.25M) - Japan-based Web3 entertainment company

Regulatory

🚨 Senators Demand Ethics Probe Over Trump Meme Coin Dinner

- Democratic Senators Elizabeth Warren and Adam Schiff called for an ethics investigation into President Trump's invitation to top holders of his meme coin for an exclusive dinner.

- The senators raised concerns about potential "pay to play" corruption risks and foreign influence through anonymous crypto investments.

⚖️ Crypto Group Urges Trump to End Prosecution of Crypto Devs

- The DeFi Education Fund asked the Trump administration to halt the prosecution of Tornado Cash co-founder Roman Storm.

- The group argued that the DOJ's actions threaten to criminalize software development in the U.S. and could deter innovation.

🛒 Swiss Supermarket Chain Spar to Accept Bitcoin Payments

- Spar supermarkets in Switzerland are set to roll out Bitcoin payments nationwide after a successful pilot in two locations.

- This move marks one of the first major retail integrations of Bitcoin payments in Switzerland, potentially expanding throughout the country.

🚨 FTX Sues NFT Marketplace and AI Gaming Platform Over Token Agreements

- FTX files lawsuits against NFT Stars and Delysium for failing to deliver tokens owed under investment agreements with Alameda Ventures.

- The lawsuits seek recovery of over 83 million SIDUS, 831,000 SENATE, and 75 million AGI tokens, plus damages.

🏦 Nexo Returns to U.S. Market Citing Crypto-Friendly Trump Policies

- Crypto lender Nexo announced its return to the U.S. market after previously withdrawing due to regulatory challenges.

- The company attributed this comeback to the more favorable environment established by the Trump administration for innovation in the crypto space.

Technical Analysis

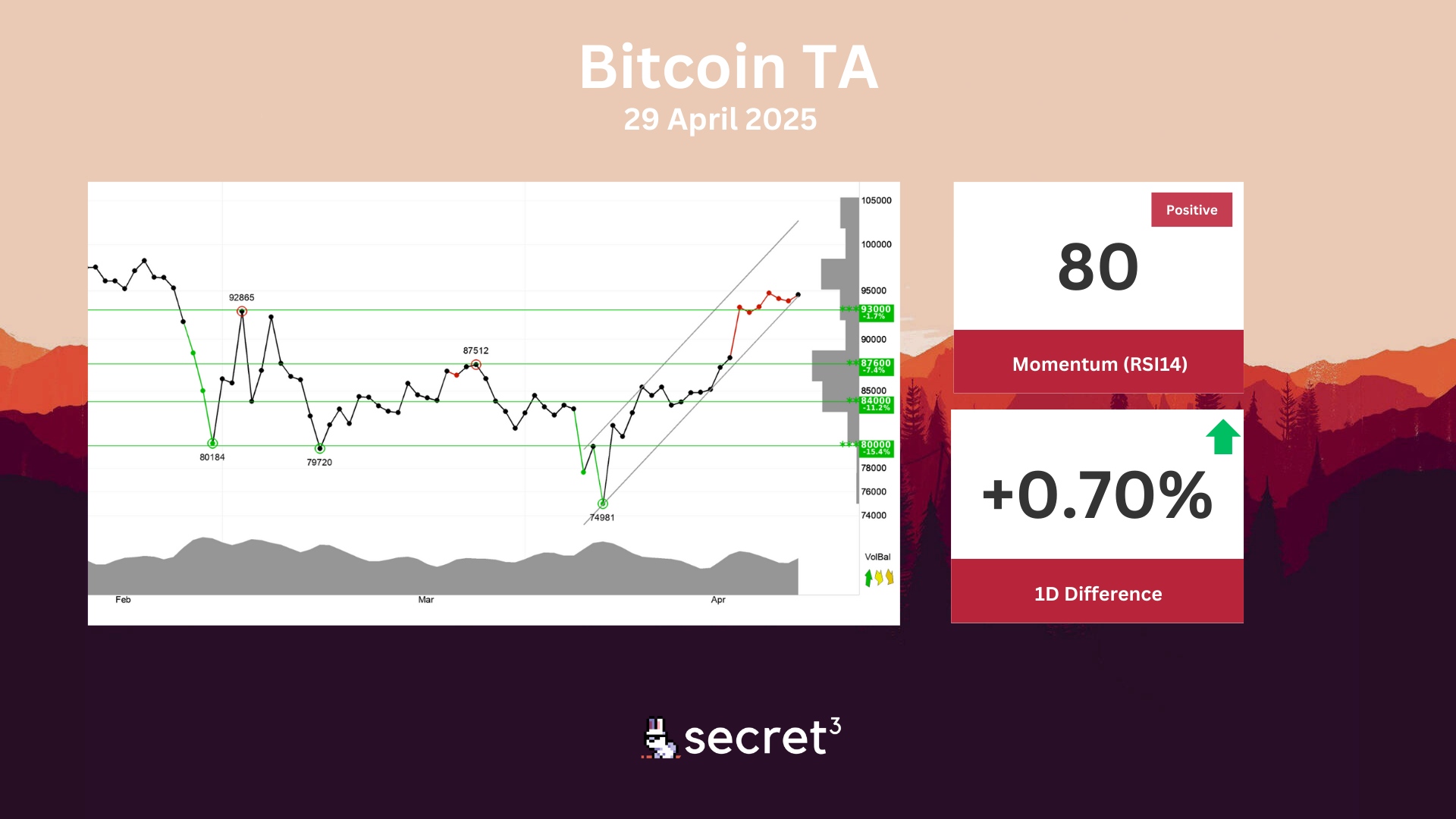

Bitcoin - Bitcoin shows strong development within a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. The currency has broken up through resistance at points 93000. This predicts a further rise. RSI is above 70 after a good price increase the past weeks. The currency has strong positive momentum and further increase is indicated. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.

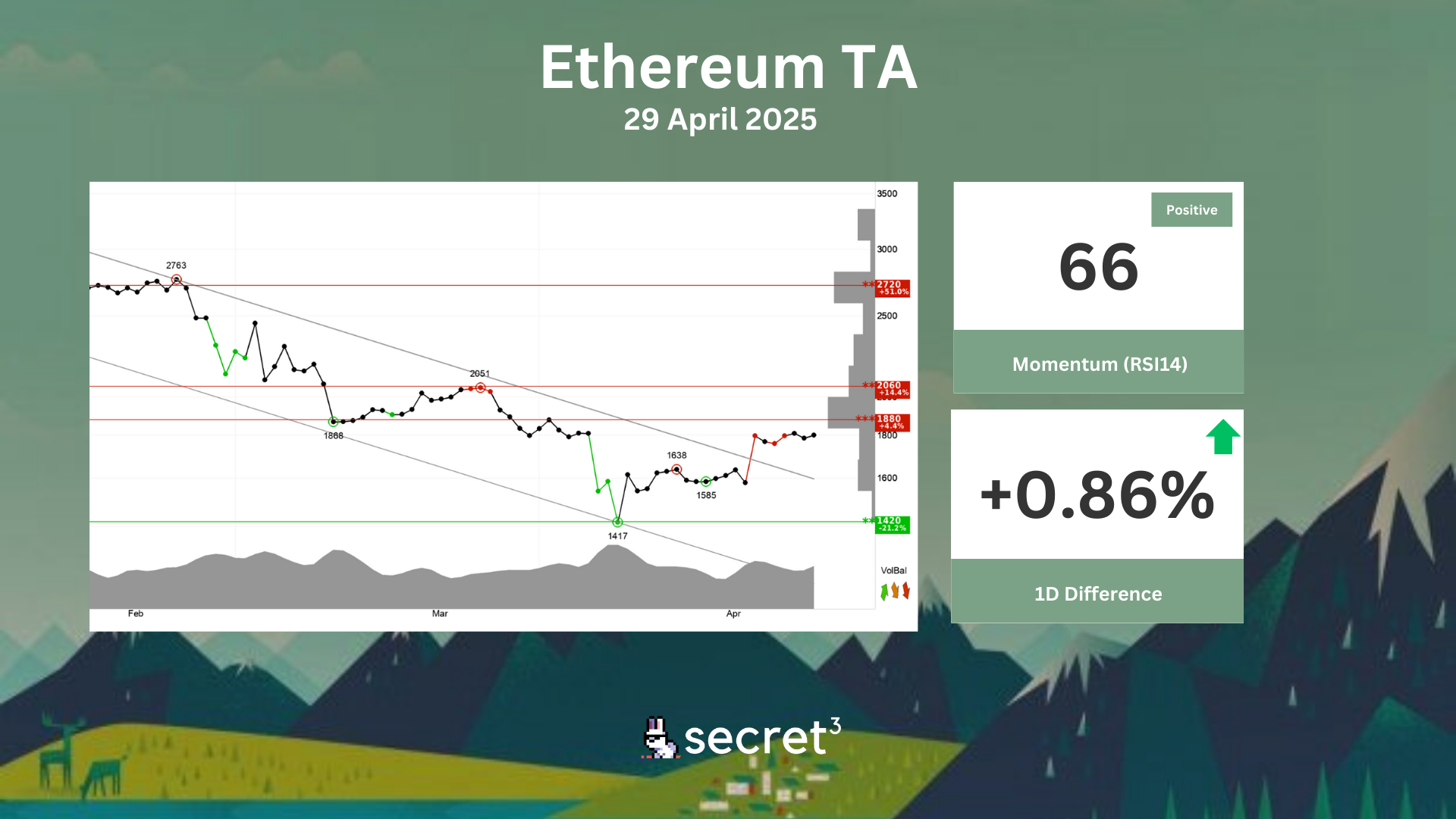

Ethereum - Ethereum has broken through the ceiling of a falling trend channel in the short term. This indicates a slower falling rate initially, or the start of a more horizontal development. The currency is approaching resistance at 1880 points, which may give a negative reaction. However, a break upwards through 1880 points will be a positive signal. The currency is assessed as technically negative for the short term.