gm 29/01

Summary

gm, Bitcoin briefly dipped below $98,000 before rebounding to around $102,000. This fluctuation was partly attributed to concerns surrounding the Chinese AI startup DeepSeek, which reportedly developed a competitive AI model at a fraction of the cost of established players. The news caused a ripple effect in tech stocks, particularly impacting Nvidia, which saw a substantial market cap loss. Despite the initial sell-off, many analysts view this as a potential buying opportunity, with some expecting Bitcoin to target higher levels in the coming months. Meanwhile, regulatory developments continue to shape the crypto landscape, with Arizona lawmakers advancing a Bitcoin strategic reserve bill and Ripple obtaining money transmitter licenses in key U.S. states. The market also saw notable movements in altcoins, with XRP leading gains among major cryptocurrencies, rising over 11% in the past day.

News Headlines

🌐 Metaplanet Announces $745M Raise to Buy Bitcoin

- Tokyo-listed Metaplanet executed the largest capital raise focused on Bitcoin in the Asian equity market, amassing approximately $745 million.

- The company aims to boost its Bitcoin treasury using 0% discount moving strike warrants.

🐕 Bitwise Files for Dogecoin ETF Amid Shifting US Regulations

- Bitwise has filed for a Dogecoin exchange-traded fund (ETF) as U.S. policymakers show increasing openness to cryptocurrencies.

- This development follows the SEC's earlier approvals of Bitcoin and Ethereum-based ETFs.

🏦 Binance Faces Money Laundering Investigation in France

- French authorities are investigating Binance for money laundering, tax fraud, and other serious charges.

- The investigations were referred to the French judiciary by JUNALCO, a division of the French Public Prosecutor's Office.

🌐 Ripple Acquires Money Transmitter Licenses in Texas and New York

- Ripple has obtained money transmitter licenses in Texas and New York, bringing its total to over 50 licenses across various jurisdictions.

- This licensing will enable Ripple to provide a cross-border payment solution in the U.S.

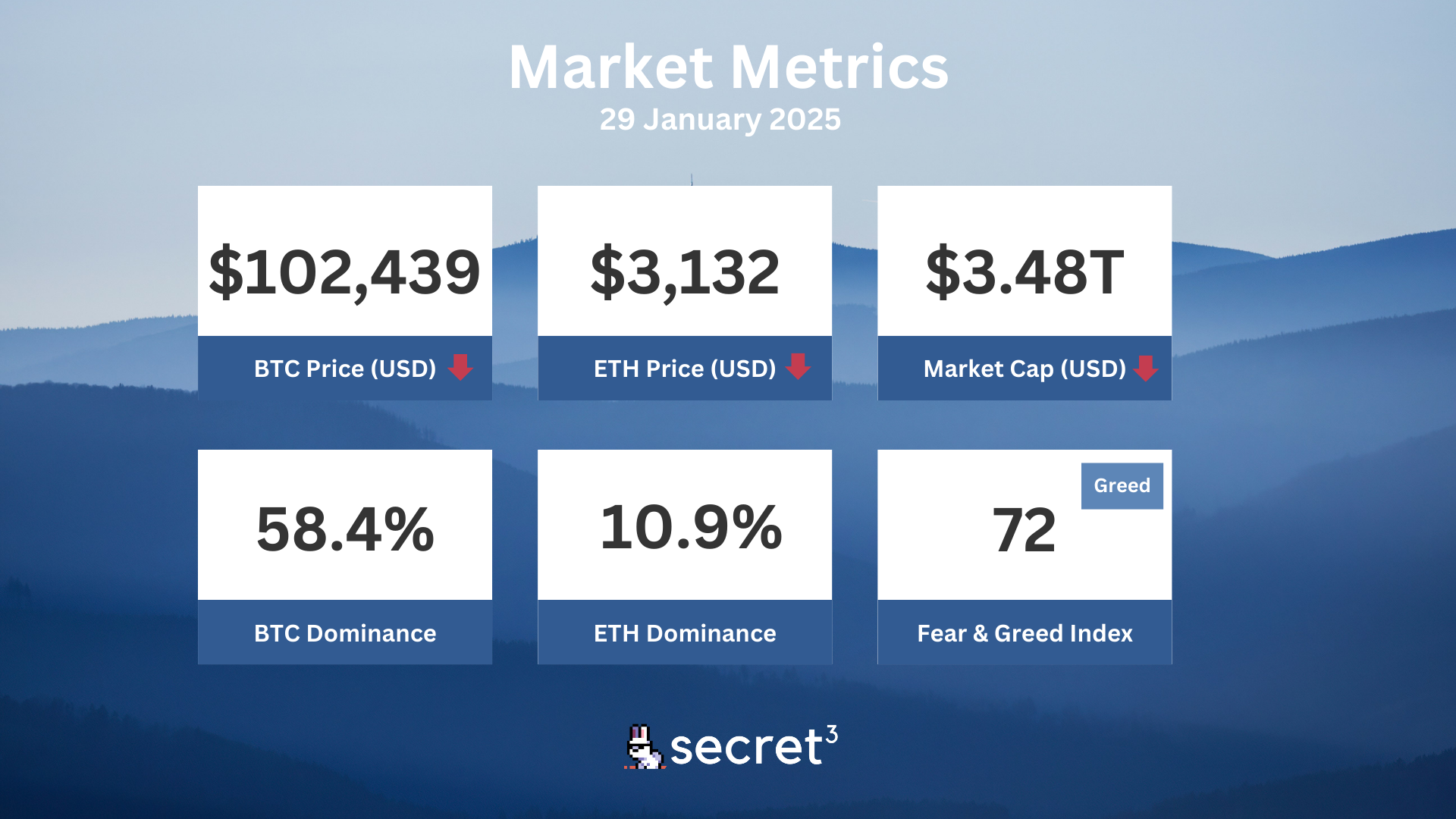

Market Metrics

Fundraising & VC

1. Pod (Seed, $10M) - stake-based programmable layer one blockchain

2. Pixion Games (Strategic, $4.9M) - UK-based game development company

3. Maalexi (Post IPO Debt, $3M) - Agri-trade fintech company

4. MCQ Markets (Strategic, $1.16M) - Iconic automobiles investing platform

On-chain Data

1. NAVI (NAVX) token unlock in 1 day ($372.78K, 1.05%)

2. Portal (PORTAL) token unlock in 2 days ($6.04M, 18.33%)

3. Celo (CELO) token unlock in 2 days ($1.08M, 0.36%)

Regulatory

🌐 Coinbase Expands Services in Argentina

- Coinbase has received approval from Argentina's National Securities Commission to expand its services in the country.

- The registration as a Virtual Asset Service Provider allows Coinbase to introduce new services, including local payment methods in Argentine pesos.

🏛️ Arizona Advances Bitcoin Strategic Reserve Bill

- Arizona lawmakers have passed a bill in the State Senate Finance Committee to create a Bitcoin strategic reserve.

- The bill would allow government and public funds to invest up to 10% of their capital in Bitcoin and other digital assets.

⚖️ Utah House Committee Approves Crypto Investment Bill

- The Utah House Economic Development Committee has approved a bill allowing the state to invest up to 5% of certain public funds in cryptocurrencies.

- The bill includes regulations for secure custody and allows staking and lending of crypto assets.

🛡️ EFF Calls for Dismissal in Tornado Cash Case

- The Electronic Frontier Foundation has filed an amicus brief advocating for the dismissal of Roman Storm's case related to Tornado Cash.

- The EFF argues that the prosecution stretches criminal laws beyond their limits, potentially stifling innovation in privacy-enhancing technologies.

📊 Cboe BZX Refiles for Solana ETFs

- Cboe BZX Exchange has refiled applications for four Solana-based ETFs on behalf of various investment firms.

- If approved, these ETFs would provide traditional investors access to Solana without holding the cryptocurrency directly.

Technical Analysis

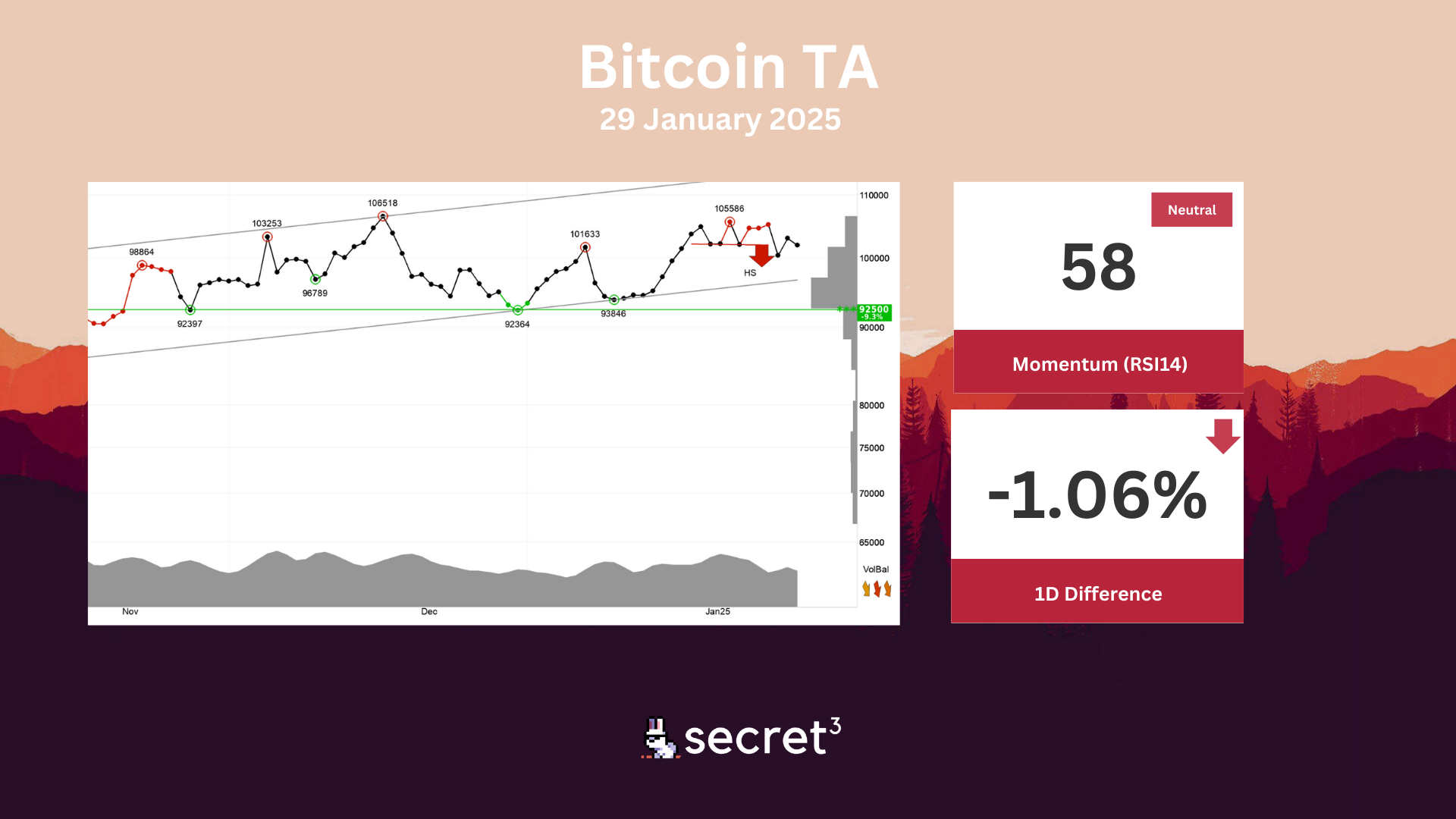

Bitcoin - Investors have paid higher prices over time to buy Bitcoin and the currency is in a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. It, however, gave a negative signal from the head and shoulders formation at the break down through the support at 101977. Further fall to 98576 or lower is signaled. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 92500 points. The RSI curve shows a falling trend, which is an early signal of a possible trend reversal downwards for the price as well. The currency is overall assessed as technically positive for the short term.

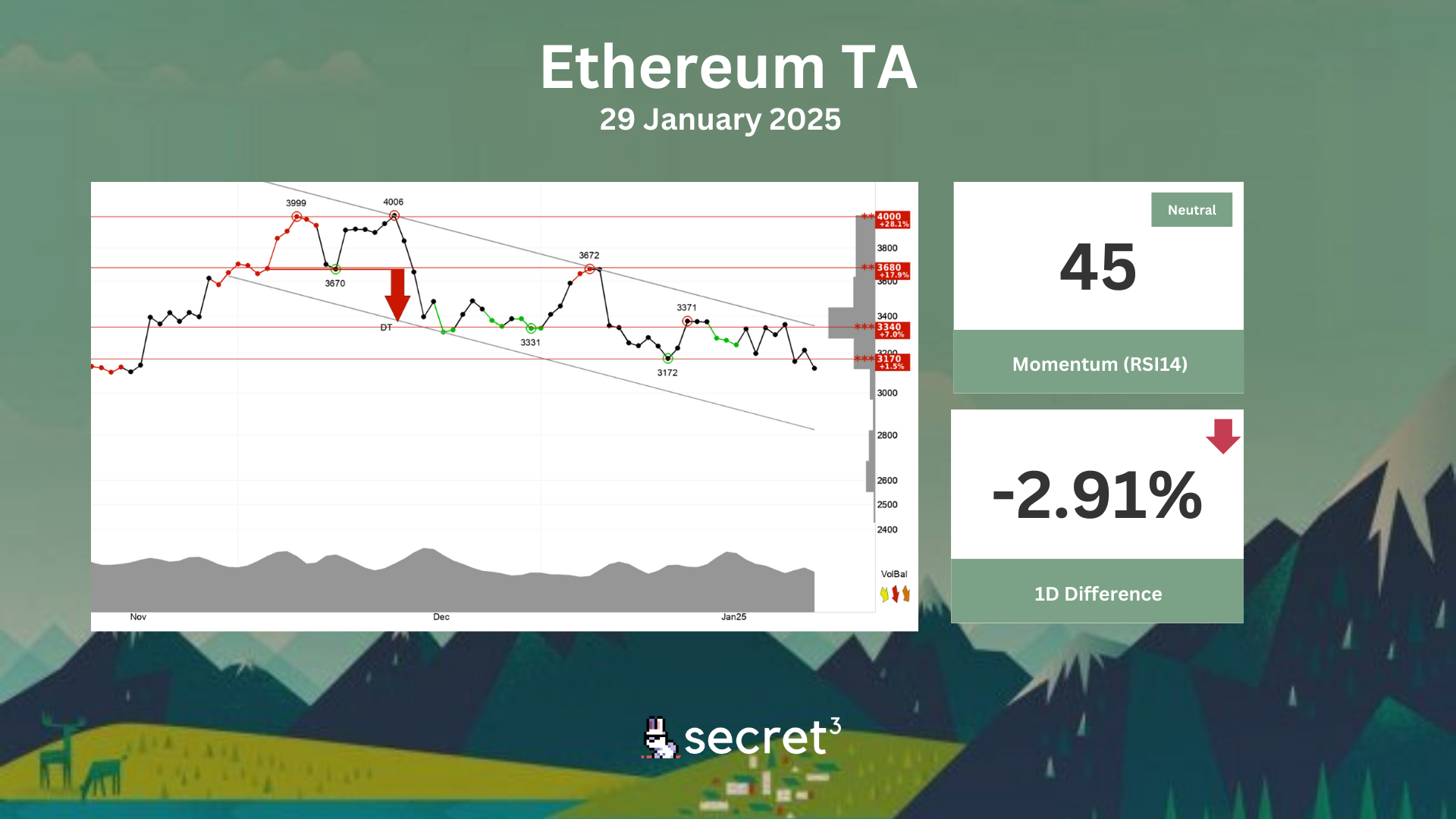

Ethereum - Investors have accepted lower prices over time to get out of Ethereum and the currency is in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Ethereum. The currency has broken down through support at points 3170. This predicts a further decline. In case of positive reactions, there will now be resistance at points 3170. Volume has previously been low at price tops and high at price bottoms. Volume balance is also negative, which confirms the trend. RSI diverges positively against the price, which indicates a possibility for a reaction up. The currency is overall assessed as technically negative for the short term.

Governance & Code

⚡ dYdX DAO | Launch Incentives - Season 8 Distribution (206) (Active Vote)

- This proposal aims to distribute $1.5 million in DYDX tokens from the dYdX Chain Community Treasury to qualifying users in trading season 8 of the dYdX Chain Launch Incentives Program.

⚖️ Balancer DAO | Enable Boosted GHO/PYUSD on Balancer v3

- This proposal seeks to enable a Balancer gauge for the boosted GHO/PYUSD pool on Ethereum.