gm 28/03

Summary

gm, GameStop's announcement of a $1.3 billion Bitcoin purchase plan causes significant volatility. The company's stock price initially surged but later dropped 25%, raising concerns about its strategic direction. Meanwhile, regulatory scrutiny intensified as SEC nominee Paul Atkins faced questioning about his crypto industry ties during a Senate confirmation hearing. In the stablecoin arena, Circle and Intercontinental Exchange announced plans to explore integrating USDC into traditional financial operations, signaling growing institutional interest. Amidst these developments, Bitcoin struggled to maintain momentum above $90,000, with analysts citing factors such as short-term holder sell pressure and liquidity contraction as potential barriers to further growth.

News Headlines

💼 BlackRock Expands Digital Asset Team with Four New High-Level Roles

- BlackRock is adding four new high-level positions to its digital asset team, reflecting ongoing commitment to the cryptocurrency sector.

- The expansion aims to enhance BlackRock's capabilities in the rapidly evolving digital asset market.

📊 Bitcoin Options Worth $12 Billion Set to Expire

- $12 billion worth of Bitcoin options contracts are set to expire, marking one of the largest quarterly expiries on the Deribit exchange.

- The expiry affects 45% of open options, with $85,000 identified as a key max pain point for options traders.

🚨 Darkweb Actors Claim to Have Over 100K Gemini and Binance User Records

- Darkweb actors claim to possess over 100,000 records of user information from Gemini and Binance, offering these for sale online.

- The data allegedly includes names, emails, phone numbers, and location details primarily from U.S. users.

💰 France's Public Investment Bank to Invest $27 Million in Crypto

- Bpifrance announced a $27 million investment to support early-stage crypto tokens and enhance the local blockchain ecosystem.

- The investment will prioritize smaller, newly-issued tokens from French projects not yet available on exchanges.

🏦 Circle and Intercontinental Exchange to Explore Stablecoin Integration

- Circle and ICE are investigating the integration of USDC and US Yield Coin into ICE's operations, including derivatives exchanges and clearinghouses.

- The partnership highlights growing belief that stablecoins can play a significant role in capital markets.

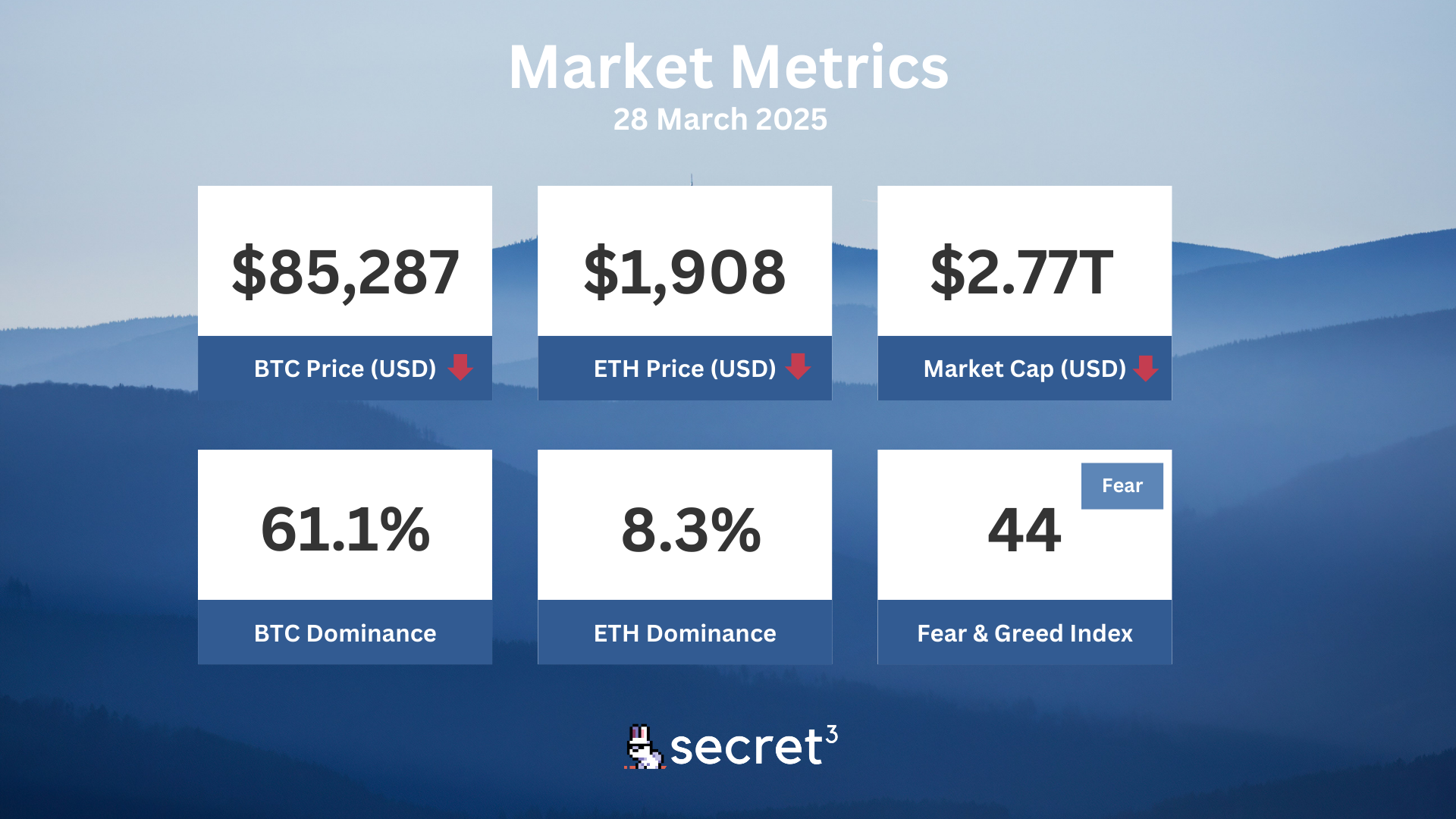

Market Metrics

Fundraising & VC

1. Be Water (Post IPO, $10.8M) - Italian media company editor of Chora Media and Will Media

2. Warlock (Seed, $8M) - Omni-chain oracle and liquidation engine

3. DeCharge (Seed, $2.5M) - EV charging network built on Solana

4. KiloEx (Public Token Sale, $750K) - Decentralized exchange platform

Regulatory

🚫 Senate Votes to Repeal Controversial IRS DeFi Broker Rule

- The US Senate passed a resolution to abolish a rule requiring DeFi protocols to report to the IRS.

- President Trump is expected to support the repeal, signaling a shift in crypto regulatory approach.

⚖️ SEC Drops Cases Against Major Crypto Firms

- The SEC has dismissed enforcement actions against Kraken, ConsenSys, and Cumberland DRW.

- This signals a significant shift in regulatory stance under the Trump administration.

🔍 Elizabeth Warren Grills SEC Nominee on Crypto Ties

- Senator Warren criticized Paul Atkins, Trump's SEC chair nominee, for his connections to the crypto industry.

- Raised concerns about potential conflicts of interest and demanded transparency.

🚔 FBI Seizes $200,000 in Crypto Linked to Hamas

- US authorities confiscated crypto funds allegedly earmarked for Hamas.

- This highlights ongoing efforts to disrupt illicit financing through cryptocurrencies.

🏛️ South Korean Court Lifts Ban on Upbit Exchange

- A court temporarily lifted a three-month ban on crypto exchange Upbit serving new clients.

- This highlights ongoing regulatory challenges faced by crypto exchanges in South Korea.

Technical Analysis

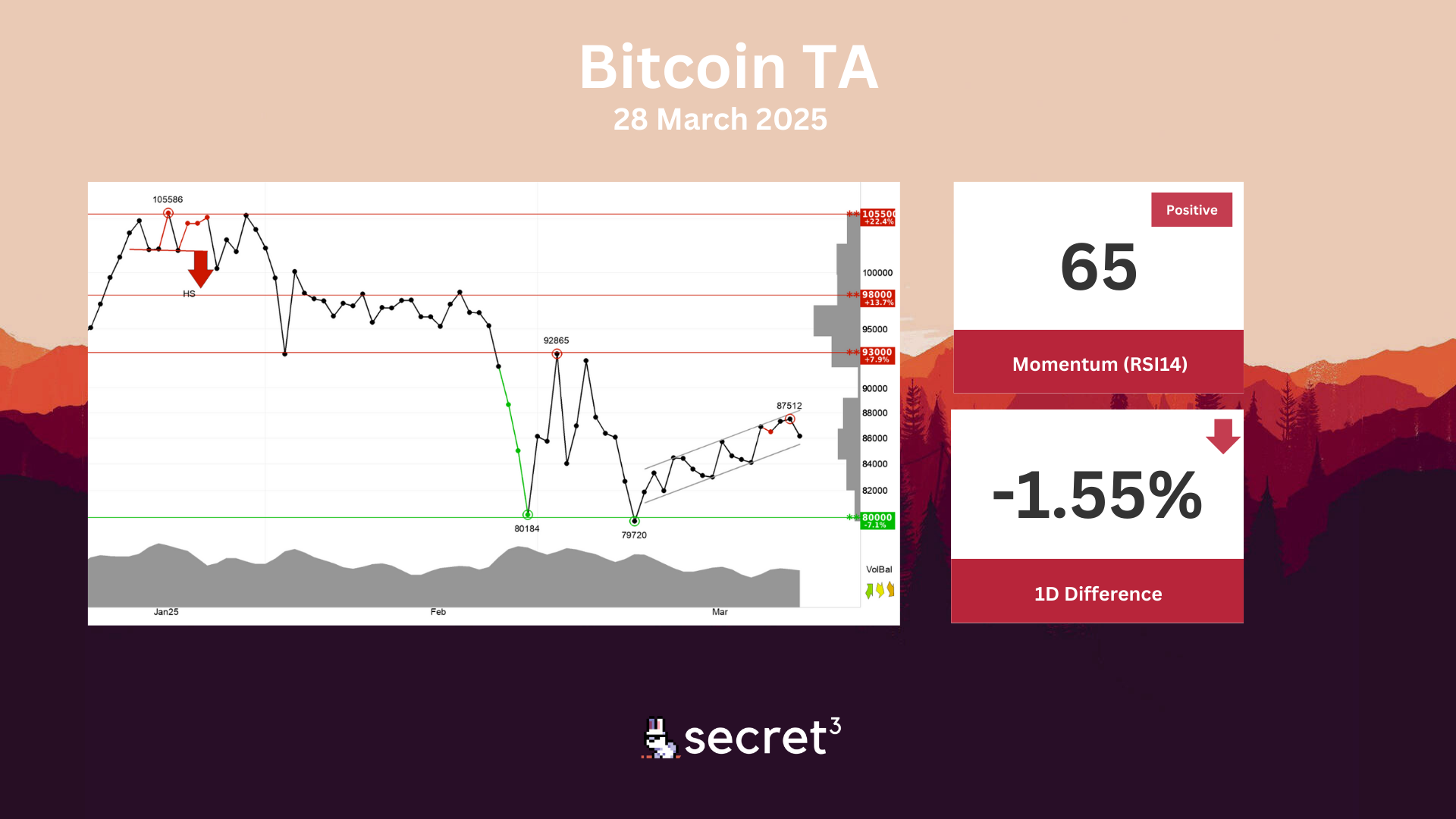

Bitcoin - Investors have paid higher prices over time to buy Bitcoin and the currency is in a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. The currency has support at points 80000 and resistance at points 93000. The currency is assessed as technically slightly positive for the short term.

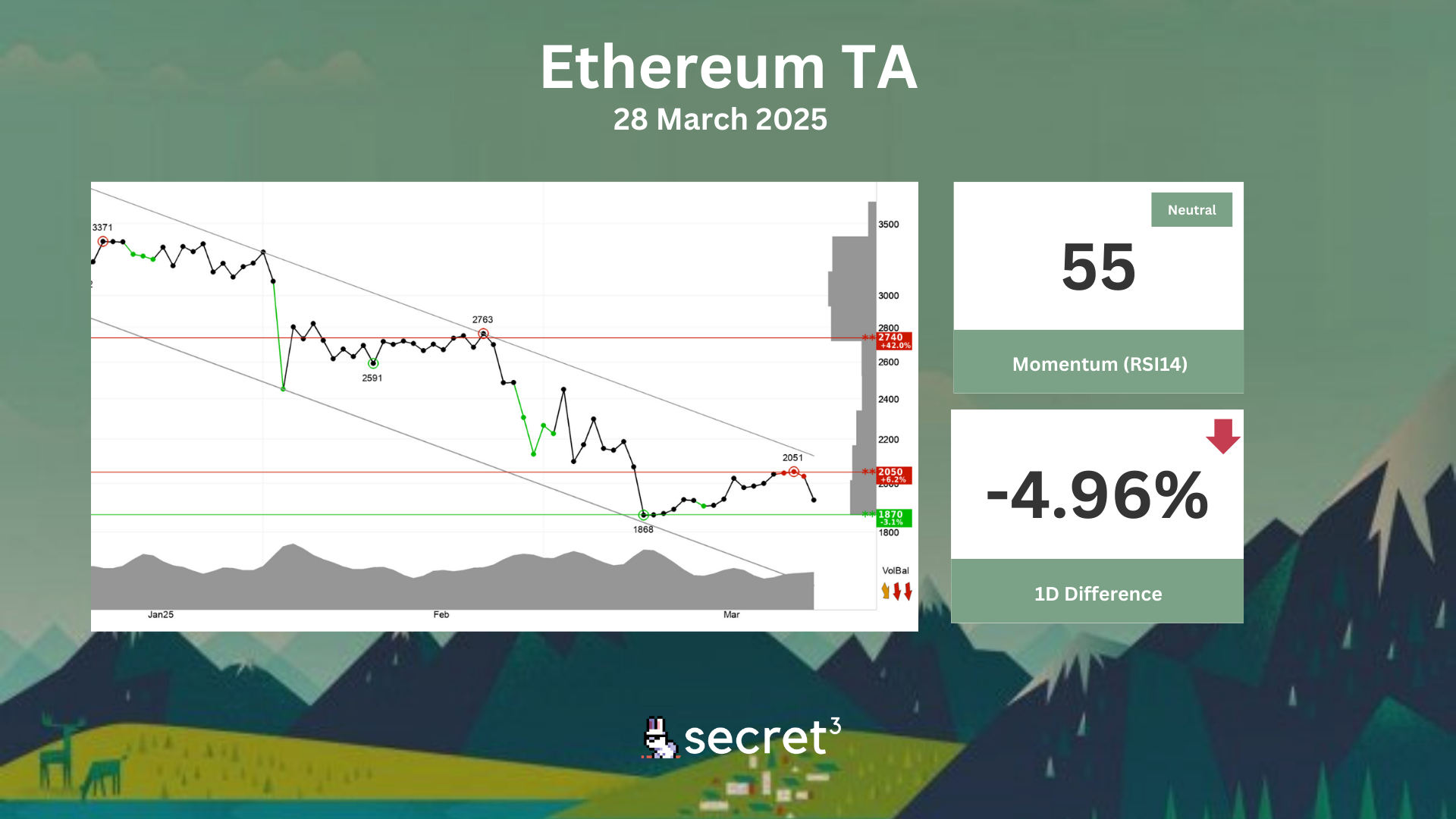

Ethereum - Ethereum is in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Ethereum. The currency is between support at points 1870 and resistance at points 2050. A definitive break through of one of these levels predicts the new direction. The volume balance is negative and weakens the currency in the short term. RSI diverges positively against the price, which indicates a possibility for a reaction up. The currency is overall assessed as technically negative for the short term.