gm 28/02

Summary

gm, The SEC drops several high-profile investigations and lawsuits against major players like Coinbase, Consensys, and Gemini. This regulatory shift has been accompanied by a sharp market downturn, with Bitcoin falling below $80,000 and experiencing its largest three-day slide since the FTX collapse. The broader crypto market has seen substantial outflows from Bitcoin ETFs and increased fear among investors. Amid these challenges, positive developments include Uniswap partnering with Robinhood and payment platforms to enhance crypto-to-fiat transactions, and the formation of the Open Agents Alliance by prominent crypto firms to develop open AI services. These events signal a complex and evolving landscape for crypto, balancing regulatory easing with market volatility.

News Headlines

🔒 Ethereum's MetaMask Wallet Announces Major Updates

- MetaMask revealed plans for batched transactions, integration of Contract Accounts, and support for Bitcoin and Solana.

- A new card feature will allow users in selected U.S. states to spend crypto anywhere Mastercard is accepted.

🌐 Ripple Partners with BDACS for XRP Custody in South Korea

- Ripple Labs has partnered with South Korean custodian BDACS to provide institutional-grade custody for XRP and RLUSD.

- This move aims to enhance support for financial institutions in South Korea as the country prepares for increased institutional crypto adoption.

🤖 AI and Crypto Firms Form Open Agents Alliance

- Coinbase, NEAR, and other firms have formed the Open Agents Alliance to develop open AI services using shared infrastructure.

- The alliance aims to promote secure, open-source, and affordable access to AI technologies.

💳 Avalanche Foundation Launches Visa Credit Card for Crypto Payments

- The Avalanche Foundation has introduced a Visa credit card allowing users to spend cryptocurrencies at fiat-only retailers.

- Users can load the card with crypto assets like USDC, USDT, and AVAX, with a spending limit set at half the loaded crypto's USD value.

📊 Illicit Crypto Transactions Hit Record $40B in 2024

- Chainalysis reports illicit crypto transactions reached $40 billion in 2024, with stablecoins becoming the preferred method for illegal activities.

- Despite the rise, illicit transactions now represent a smaller percentage of overall crypto activity compared to previous years.

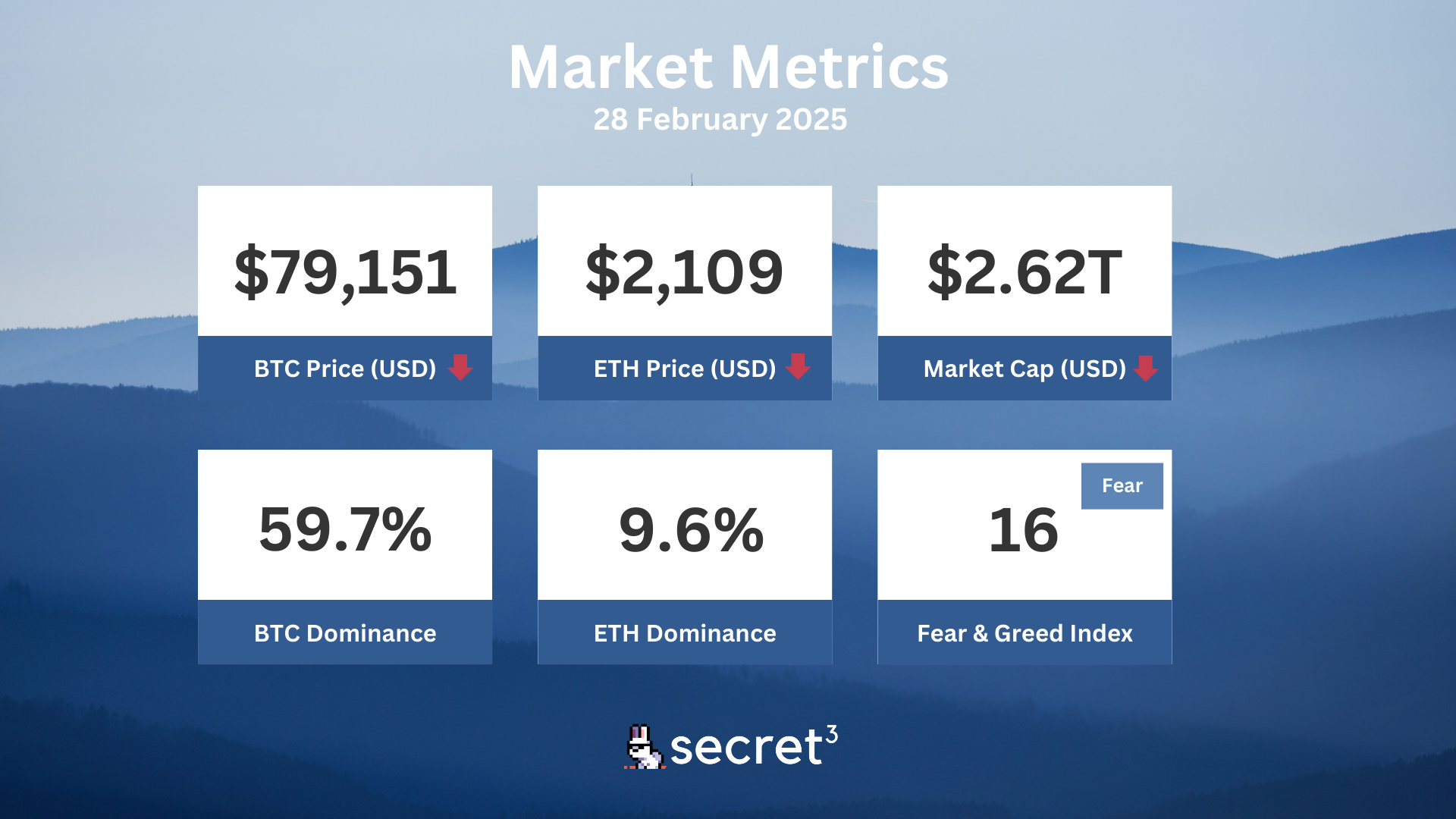

Market Metrics

Fundraising & VC

1. Raise (Strategic, $63M) - Blockchain-based gift cards

2. iDEGEN (Undisclosed, $25M) - AI agent trained on unfiltered crypto Twitter

3. Orochi Network (Seed, $12M) - Verifiable data infrastructure

4. Ligero (Seed, $4M) - Privacy tools for Web2 and Web3

On-chain Data

1. Portal (PORTAL) token unlocked today ($4.17M, 19.54%)

2. Open Campus (EDU) token unlocked today ($4.07M, 7.24%)

3. Biconomy (BICO) token unlocked today ($1.10M, 0.8%)

4. ZetaChain (ZETA) token unlock in 1 day ($12.22M, 6.48%)

Regulatory

🚫 House Democrats Propose Ban on Presidential Memecoins

- The MEME Act aims to prohibit high-ranking officials from creating or promoting cryptocurrency tokens.

- The bill targets potential exploitation of public office for financial gain in the crypto space.

💰 Texas Advances Bitcoin Reserve Bill to Senate Floor

- Texas Senate Bill 21, establishing a strategic Bitcoin and cryptocurrency reserve, passed the Senate Banking Committee unanimously.

- The bill empowers the state to acquire, sell, and trade cryptocurrencies as a hedge against inflation and economic instability.

🌐 Pakistan Considers National Crypto Council

- Pakistan's Finance Ministry is exploring the establishment of a National Crypto Council to evaluate cryptocurrency legalization.

- The proposed council aims to develop policies fostering a secure and sustainable crypto ecosystem.

🗳️ Arizona Crypto Reserve Bills Pass Senate

- Two crypto reserve bills in Arizona have passed the Senate, moving closer to becoming law.

- These bills aim to create a Digital Assets Strategic Reserve Fund and allow public funds to invest in crypto assets.

😄 SEC Clarifies Memecoins Not Considered Securities

- The SEC has officially stated that memecoins are generally not classified as securities under its interpretation of the Howey test.

- This clarification suggests a more relaxed regulatory approach to certain types of crypto assets under the current administration.

Technical Analysis

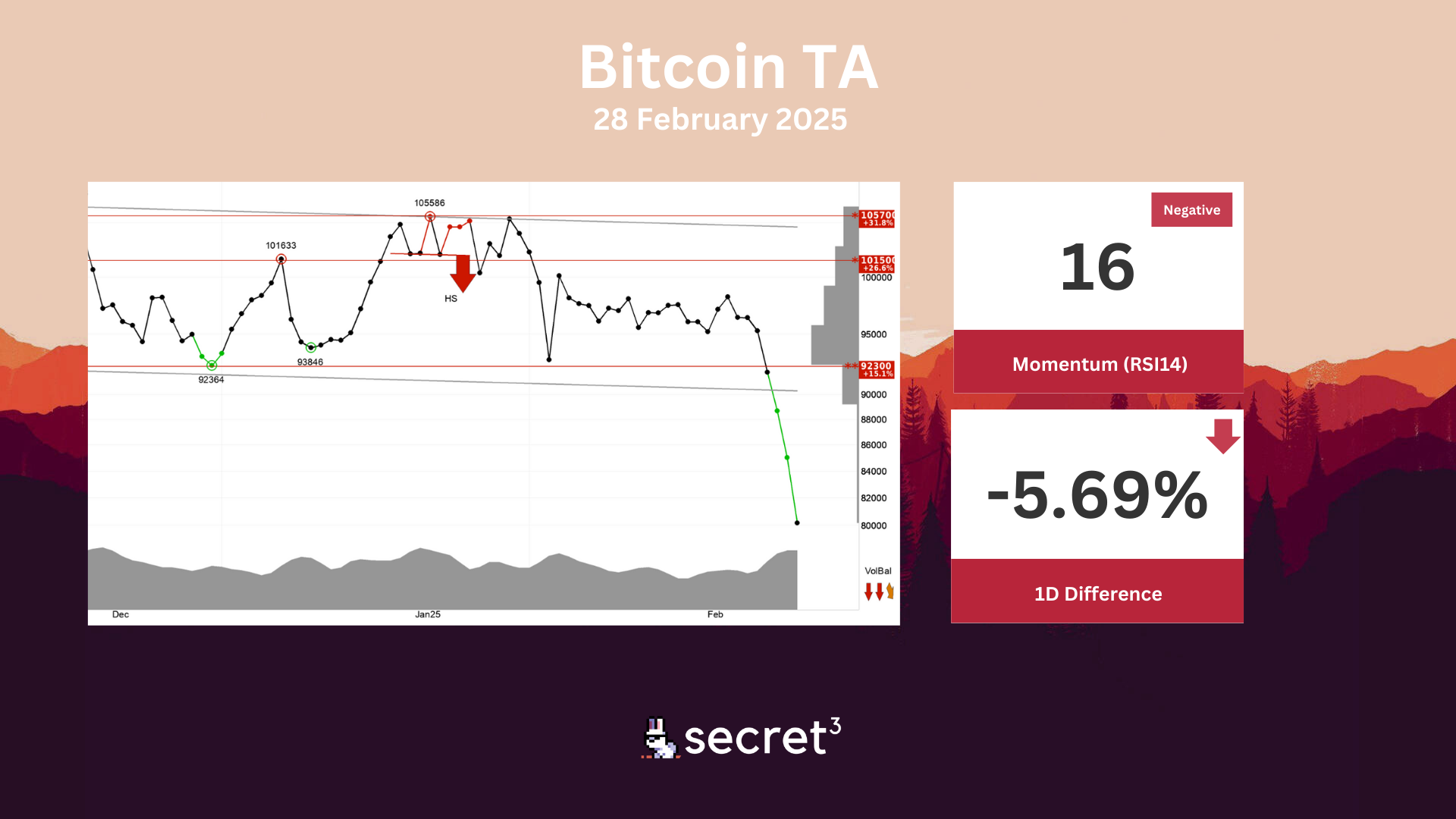

Bitcoin - Bitcoin has broken down from an approximate horizontal trend channel in the short term. This signals a continued weak development, and the currency now meets resistance on possible reactions up towards the floor of the trend channel. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 92300 points. Negative volume balance shows that volume is higher on days with falling prices than days with rising prices. This indicates decreasing optimism among investors. RSI below 30 shows that the momentum of the currency is strongly negative in the short term. Investor have steadily reduced the price to sell the currency, which indicates increasing pessimism and continued falling prices. However, particularly in big stocks, low RSI may be a sign that the stock is oversold and that there is a chance for a reaction upwards. The currency is overall assessed as technically negative for the short term.

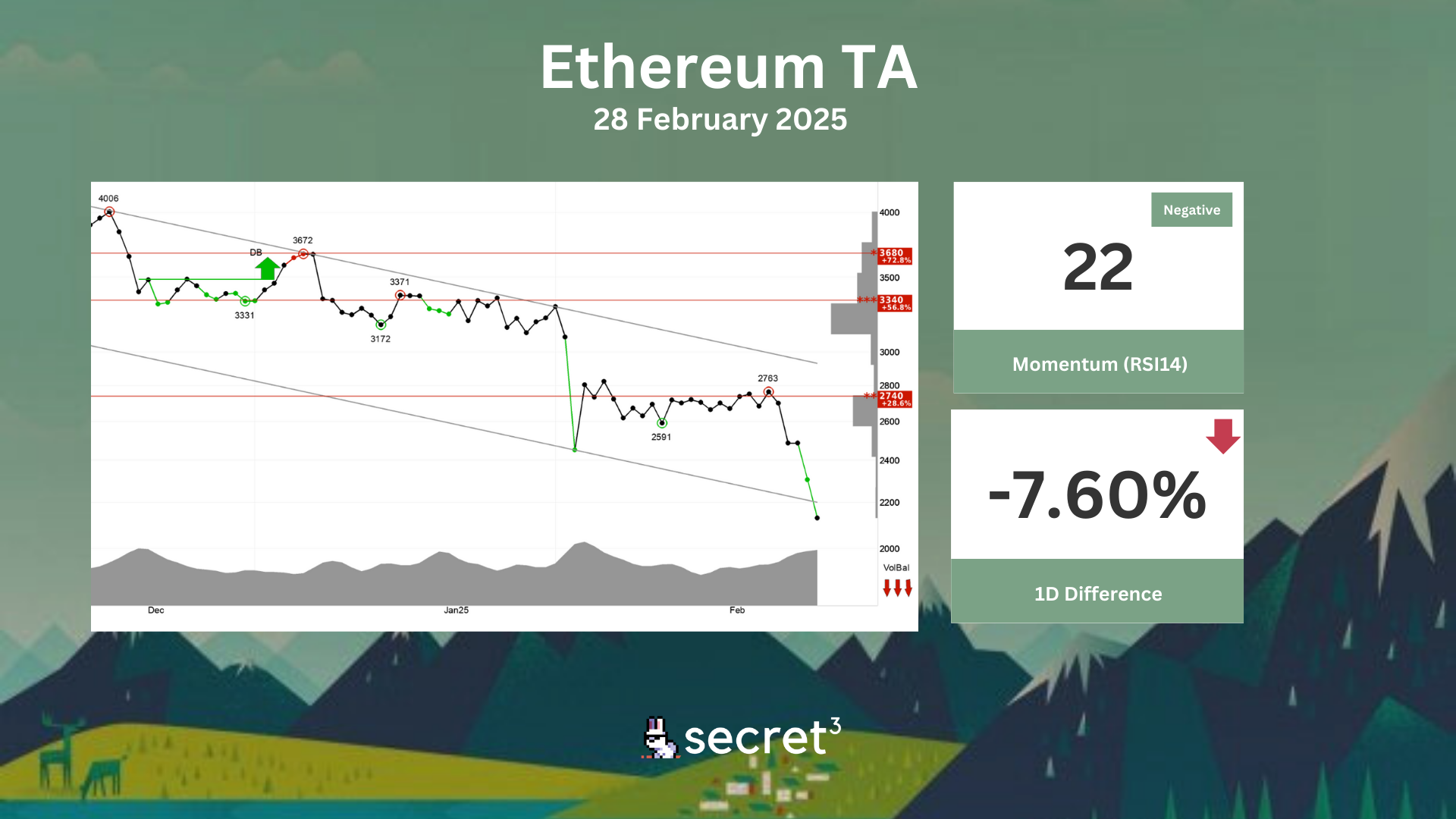

Ethereum - Ethereum has broken the falling trend channel down in the short term. This signals an even stronger falling rate, but the negative development may result in corrections up in the short term. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2740 points. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. RSI is below 30 after the falling prices of the past weeks. The currency has strong negative momentum and further decline is indicated. However, particularly in big stocks, low RSI may be a sign that the stock is oversold and that there is a chance for a reaction upwards. The currency is overall assessed as technically negative for the short term.

Governance & Code

💰 Yearn DAO | Epoch 37 dYFI emission (Active Vote)

- This proposal seeks to gather consensus on how 90% of the emitted dYFI in epoch 37 is distributed.

👻 Aave DAO | BGD. Aave ClinicSteward (Preliminary Discussion)

- This proposal seeks to introduce the Aave ClinicSteward smart contract to liquidate and repay non-healthy positions with bad debt on Aave v3 using funds from the Aave Collector before the activation of the Umbrella system.

💧 Lido DAO | SSV Lido Module (SSVLM) Proposal (Preliminary Discussion)

- This proposal from Clusterform, an independent SSV Labs subsidiary company, aims to approve the architecture, mechanics, economics, and responsibilities of the different stakeholders of the SSV Lido Module (SSVLM).