gm 27/03

Summary

gm, Fidelity Investments is set to launch its own stablecoin and is currently testing a tokenized U.S. Treasury market, highlighting the escalating institutional interest in digital assets. Concurrently, GameStop plans to raise $1.3 billion to invest in Bitcoin as part of its treasury assets, reflecting a growing corporate trend of incorporating cryptocurrencies into financial strategies. On the legislative side, U.S. lawmakers are making headway with bills aimed at regulating stablecoins and structuring the crypto market, suggesting a move towards more definitive regulations. However, the crypto market itself remains unstable, with Bitcoin struggling to break the $90,000 mark and various altcoins experiencing notable price fluctuations. In a significant policy shift, President Trump is expected to repeal an IRS rule that mandates DeFi platforms to report taxpayer information, a change signaling a more supportive government stance towards the DeFi sector. In the public markets, trading platform eToro has filed for an IPO, with Kraken also preparing to raise significant capital, indicating a potential boom in crypto-related IPOs and broader acceptance of crypto enterprises in mainstream finance.

News Headlines

🚨 Abracadabra DeFi Platform Drained of $13M in Attack

- The DeFi platform Abracadabra suffered a $13 million exploit targeting cauldrons associated with GMX liquidity tokens.

- This incident raises concerns about security vulnerabilities in liquidity provision protocols within DeFi.

📊 Fidelity Files for Spot Solana ETF on Cboe Exchange

- Fidelity Investments has submitted an application to launch a Spot Solana ETF, expanding its cryptocurrency offerings.

- This move reflects growing institutional interest in providing regulated crypto investment products beyond Bitcoin and Ethereum.

💼 $41B Investment Firm Focuses Solely on Bitcoin ETFs as Safer Bet

- A $41 billion investment firm is opting to concentrate exclusively on Bitcoin ETFs, viewing them as a safer investment option.

- The firm believes Bitcoin ETFs offer a more stable and regulated way to gain exposure to the leading cryptocurrency.

🔄 Celo Migrates to Ethereum Layer-2 Using OP Stack

- Celo has officially transitioned to become an Ethereum layer-2 protocol using optimistic rollups.

- The migration aims to enhance security, scalability, and efficiency within the Celo network.

🏗️ Blockchain Data Provider Chronicle Raises $12M for Tokenized Asset Infrastructure

- Chronicle secured $12 million in funding to enhance its infrastructure for supporting tokenized assets.

- The investment reflects increasing interest in asset tokenization and its potential to transform traditional finance.

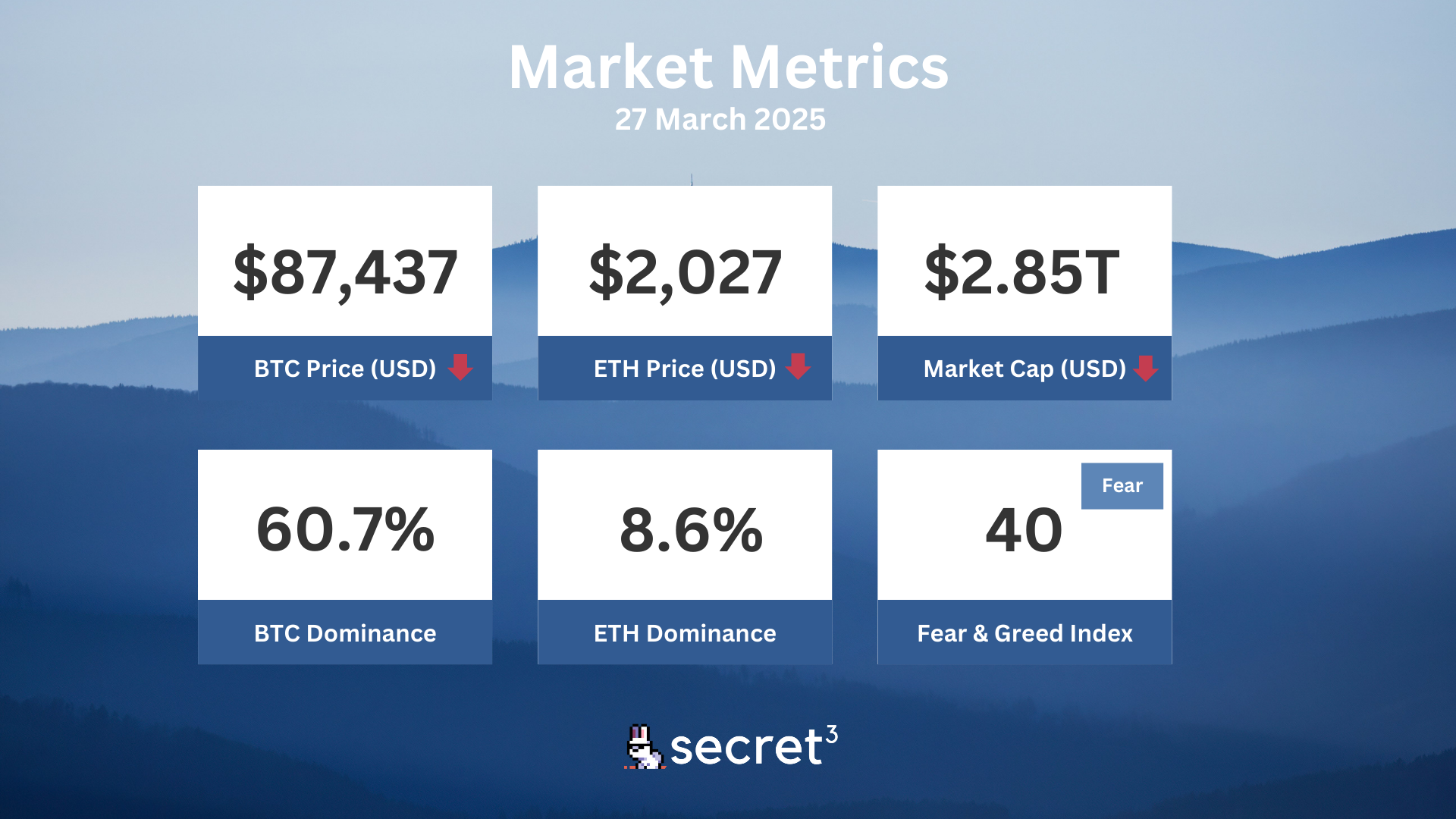

Market Metrics

Fundraising & VC

1. Spot Zero (Pre Seed, $4.5M) - 3D ARPG adventure game

2. Planetarium (Undisclosed, $3M) - Community-driven Web3 game company

3. Wave (Public Token Sale, $100K) - AI-enhanced DEXs trading bot

Regulatory

💰 Ripple to Get $75M Back from SEC, Drops Cross-Appeal

- Ripple Labs will reclaim $75 million previously ordered as a fine against the SEC, marking a turning point in their ongoing legal battle.

- The company has decided to drop its cross-appeal, potentially signaling a strategic shift to minimize legal costs and focus on core operations.

🔍 SEC's Crypto Task Force to Host 4 More Industry Roundtables

- The SEC's Crypto Task Force will host four additional roundtables focusing on key issues in the cryptocurrency industry.

- These discussions could have significant implications for future crypto regulations in the United States.

📜 U.S. House Stablecoin Bill Poised to Go Public

- A new stablecoin bill is expected to be introduced in the U.S. House, aiming to bring clarity and regulatory oversight to the stablecoin market.

- This legislative move could address issues related to stablecoin issuance and management, potentially impacting the broader crypto ecosystem.

🌎 Wyoming's Stablecoin Launch Set for July

- Wyoming Governor Mark Gordon announced the state's stablecoin could be ready for launch by July, partnering with LayerZero.

- This initiative marks a significant step in state-level adoption of blockchain technology and could influence other states' approaches to digital assets.

🏛️ Hester Peirce Calls for SEC Rulemaking to 'Bake In' Crypto Regulation

- SEC Commissioner Hester Peirce emphasized the need for lasting changes in crypto regulation through formal rulemaking and new legislation.

- Her call for clarity and durability in digital asset regulations could influence future SEC approaches to the crypto industry.

Technical Analysis

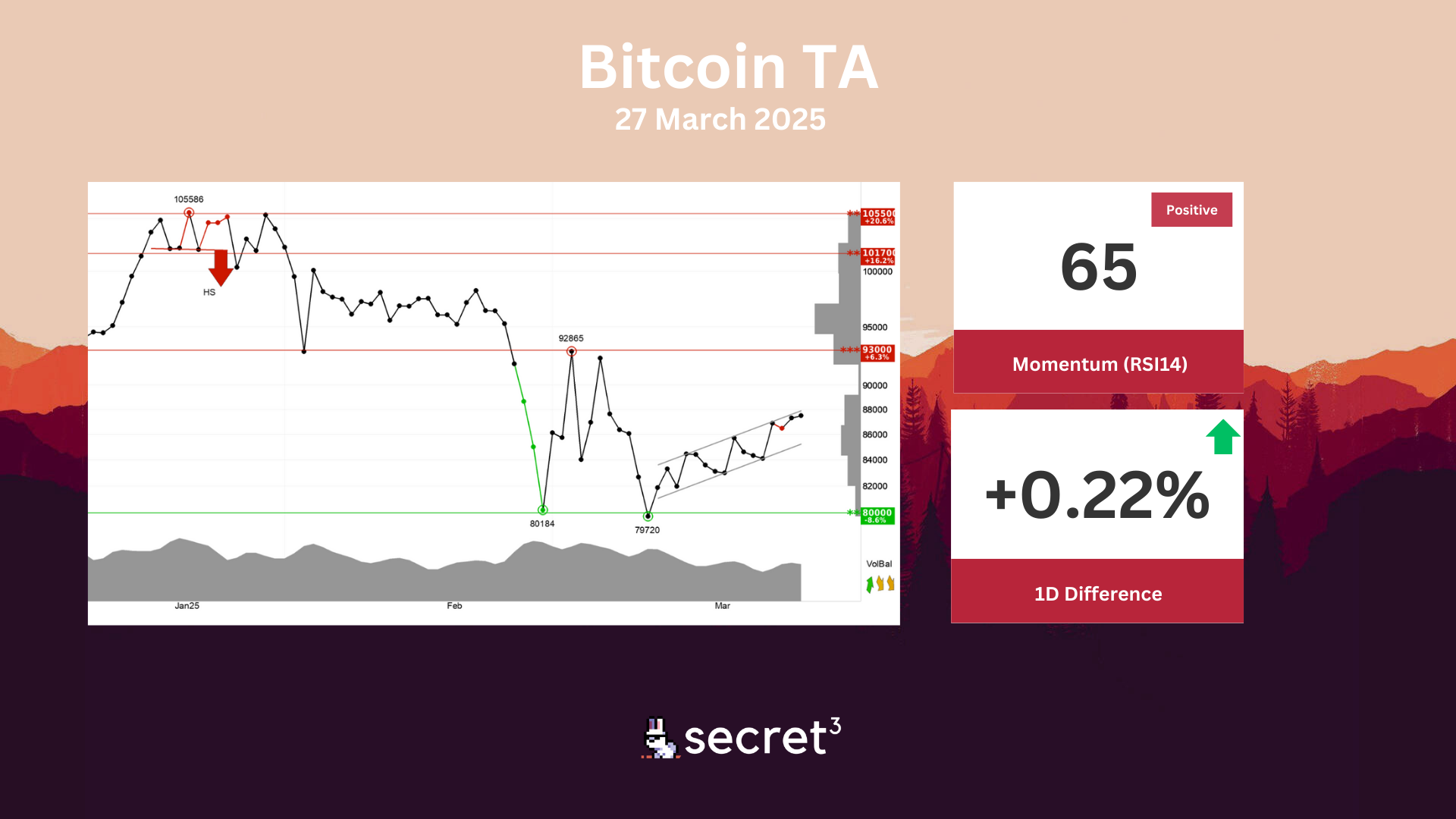

Bitcoin - Investors have paid higher prices over time to buy Bitcoin and the currency is in a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. The currency has support at points 80000 and resistance at points 93000. The currency is assessed as technically slightly positive for the short term.

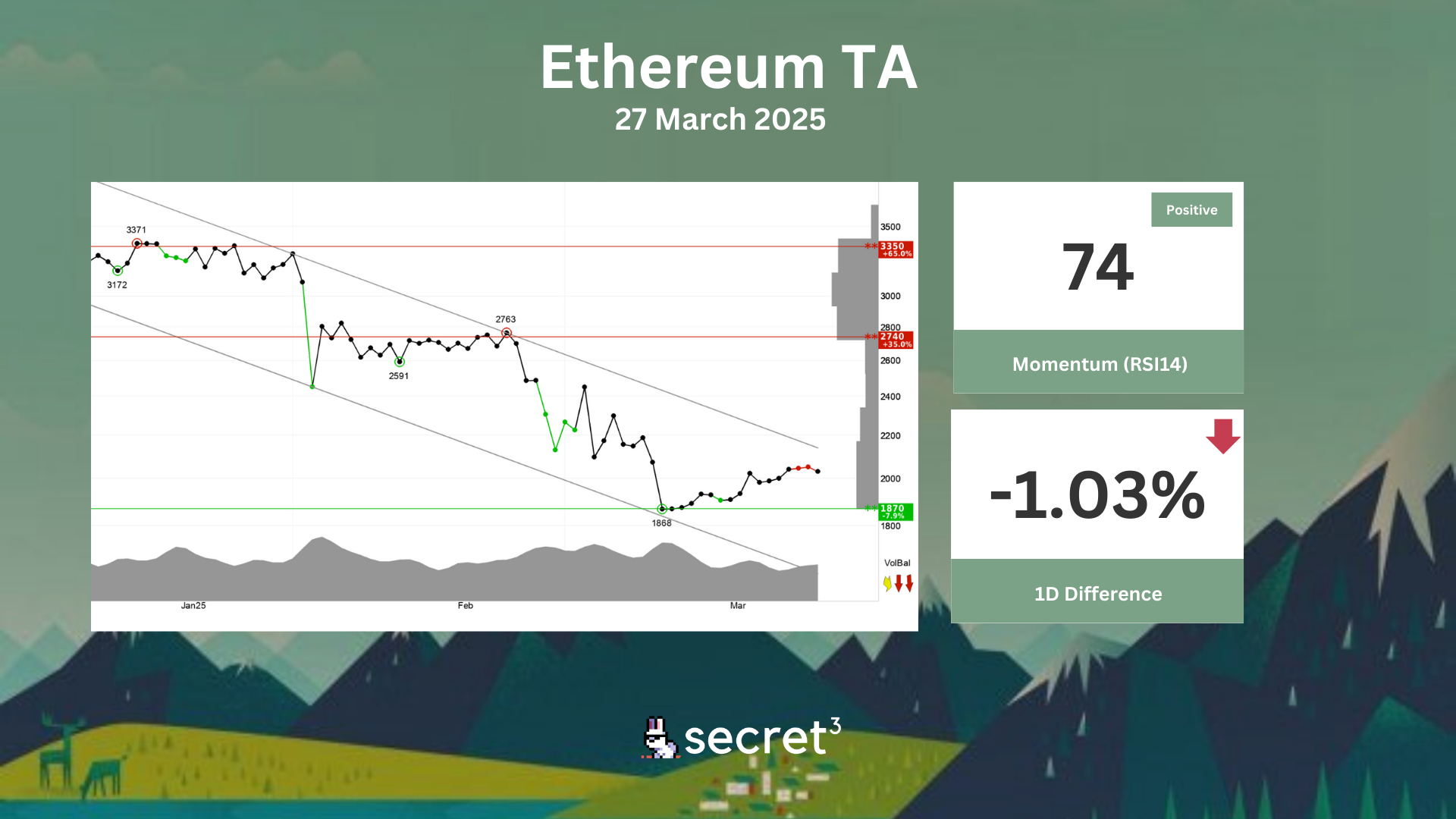

Ethereum - Investors have accepted lower prices over time to get out of Ethereum and the currency is in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency has support at points 1870 and resistance at points 2740. Negative volume balance shows that volume is higher on days with falling prices than days with rising prices. This indicates decreasing optimism among investors. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Ethereum. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically negative for the short term.