gm 27/02

Summary

gm, Bitcoin experienced a sharp decline, falling to a three-month low of around $85,000, while other major cryptocurrencies also saw substantial drops. This downturn was exacerbated by record outflows from U.S. spot Bitcoin ETFs, totaling over $1 billion in a single day. Meanwhile, regulatory shifts continue to shape the landscape, with the SEC closing investigations into several crypto firms, including Uniswap and Gemini. On the security front, the FBI confirmed North Korean hackers' involvement in the recent $1.4 billion Bybit hack, highlighting ongoing cybersecurity challenges in the industry.

News Headlines

🚀 Strategy's Bitcoin Holdings Reach $43 Billion Despite Stock Drop

- Strategy (formerly MicroStrategy) now holds over 499,000 Bitcoin worth $43+ billion, with an average purchase price of $66,300 per BTC.

- The company's stock has dropped 50% from recent highs, but it remains profitable on its BTC holdings with an unrealized gain of $10.65 billion.

💰 Bitwise Raises $70M to Expand Crypto Asset Management

- Crypto asset manager Bitwise raised $70 million in equity funding led by Electric Capital and other prominent investors.

- The funds will be used to strengthen Bitwise's balance sheet, enhance investment capabilities, and facilitate employee growth.

📉 Bitcoin ETFs See Record $938M Daily Outflow Amid Price Drop

- U.S. spot Bitcoin ETFs experienced a record single-day outflow of $937.78 million as BTC prices fell below $87,000.

- The decline in Bitcoin futures premiums has reduced the attractiveness of cash and carry trading strategies.

🌐 XRP Ledger Unveils Institutional DeFi Roadmap

- Ripple Labs announced plans to develop an institutional DeFi ecosystem on the XRP Ledger.

- Key features include a permissioned DEX, credit-based DeFi lending, and enhanced smart contract capabilities.

🏦 Bank of America Plans Stablecoin Launch Pending Regulation

- Bank of America CEO Brian Moynihan announced plans to launch a stablecoin once regulatory clarity is established.

- The bank aims to offer a fully dollar-backed stablecoin to facilitate more efficient cross-border payments and transactions.

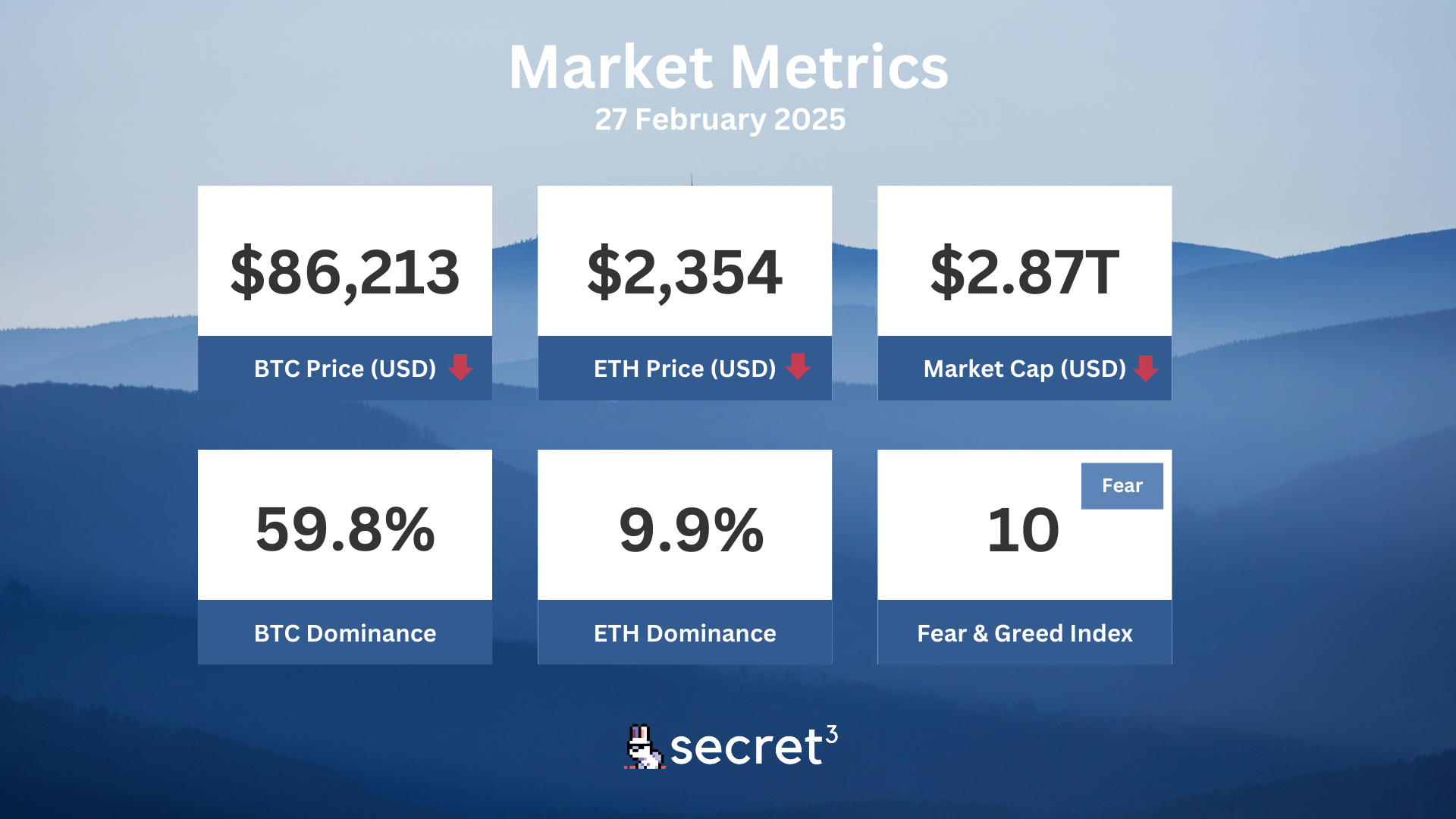

Market Metrics

Fundraising & VC

1. Bitwise Asset Management (Post IPO, $70M) - Crypto asset management firm

2. Ethena (Strategic, $16M) - Synthetic dollar protocol on Ethereum

3. GEODNET (Strategic, $8M) - Web3 RTK network

4. Byzantine Finance (Pre Seed, $3M) - Gateway infrastructure for restaking

5. Memes Lab (Seed, $2.3M) - Meme infrastructure on TON

On-chain Data

1. Grass (GRASS) token unlocked today ($7.15M, 1.52%)

2. Portal (PORTAL) token unlock in 1 day ($4.44M, 19.54%)

3. Open Campus (EDU) token unlock in 1 day ($4.56M, 7.24%)

4. Biconomy (BICO) token unlock in 1 day ($1.22M, 0.81%)

5. ZetaChain (ZETA) token unlock in 2 days ($13.90M, 6.48%)

Regulatory

💼 Former Congressman McHenry Joins a16z as Senior Advisor

- Patrick McHenry, former Chair of the House Financial Services Committee, has joined crypto-focused VC firm Andreessen Horowitz.

- McHenry aims to help innovators navigate complex policy environments and remove barriers for tech startups.

⚖️ US Appeals Court Largely Upholds Dismissal of Uniswap Lawsuit

- The court affirmed dismissal of claims that Uniswap and VCs were liable for scam tokens on the platform.

- However, some state law claims were allowed to proceed, giving plaintiffs another chance to argue their case.

🌐 Circle CEO Calls for US Registration of Stablecoin Issuers

- Jeremy Allaire argued all dollar-backed stablecoin issuers serving US customers should register with authorities.

- He emphasized the need for consumer protection and fair competition in the stablecoin market.

🏛️ Stablecoin Regulation Takes Center Stage in Senate Hearing

- The Senate Banking Committee's digital assets subcommittee held its first hearing, focusing on stablecoin regulation.

- Lawmakers and experts emphasized the need for clear rules around stablecoins as a priority.

🚫 Oklahoma Advances Bitcoin Reserve Bill as Other States Reject

- Oklahoma's House Committee passed a bill allowing the state treasurer to invest in Bitcoin and stablecoins.

- However, five other states have rejected similar proposals due to concerns about volatility and risk.

Technical Analysis

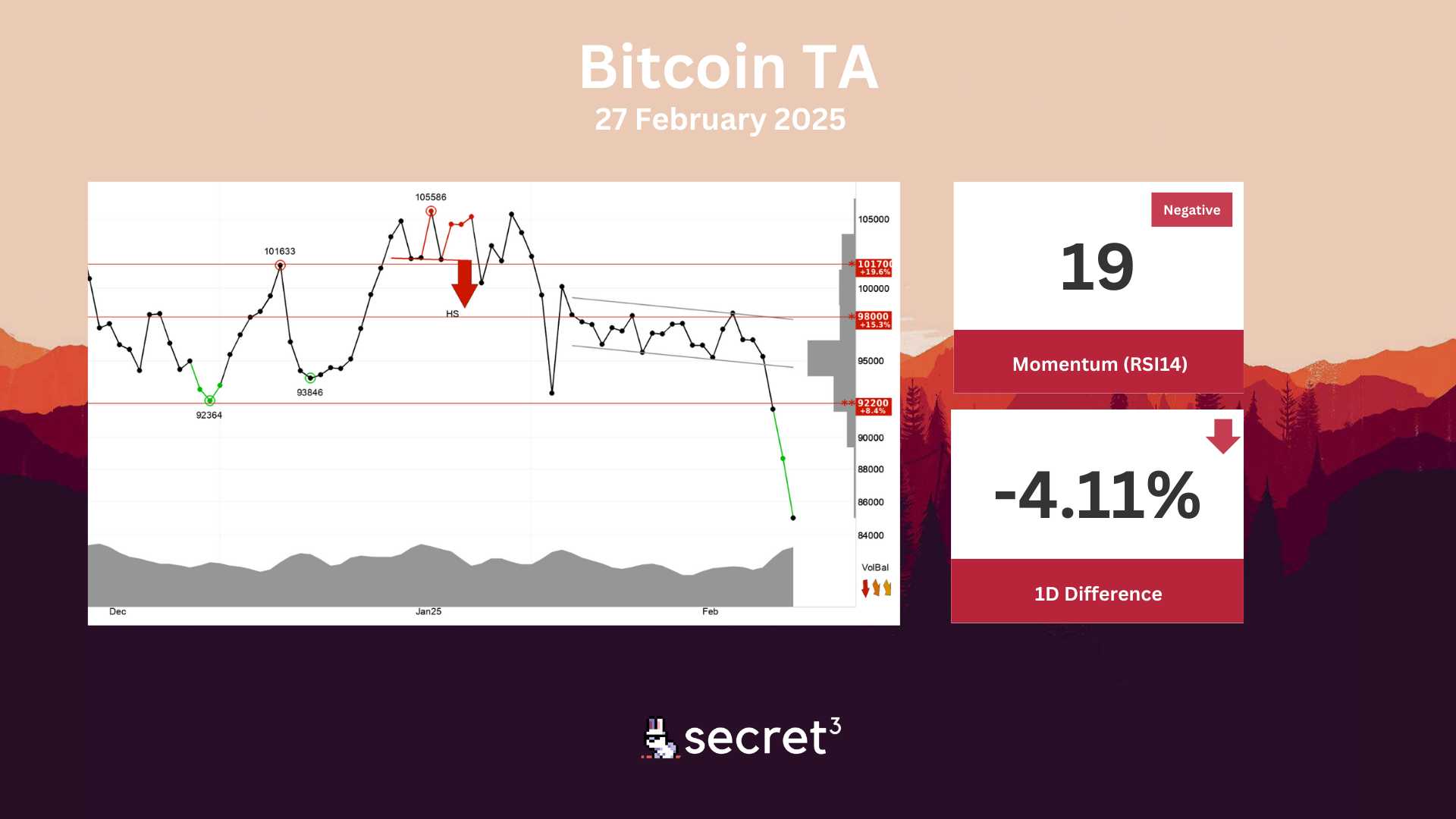

Bitcoin - Bitcoin has broken the falling trend channel down in the short term, which indicates an even stronger falling rate. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 92200 points. RSI is below 30 after the falling prices of the past weeks. The currency has strong negative momentum and further decline is indicated. However, particularly in big stocks, low RSI may be a sign that the stock is oversold and that there is a chance for a reaction upwards. The currency is overall assessed as technically negative for the short term.

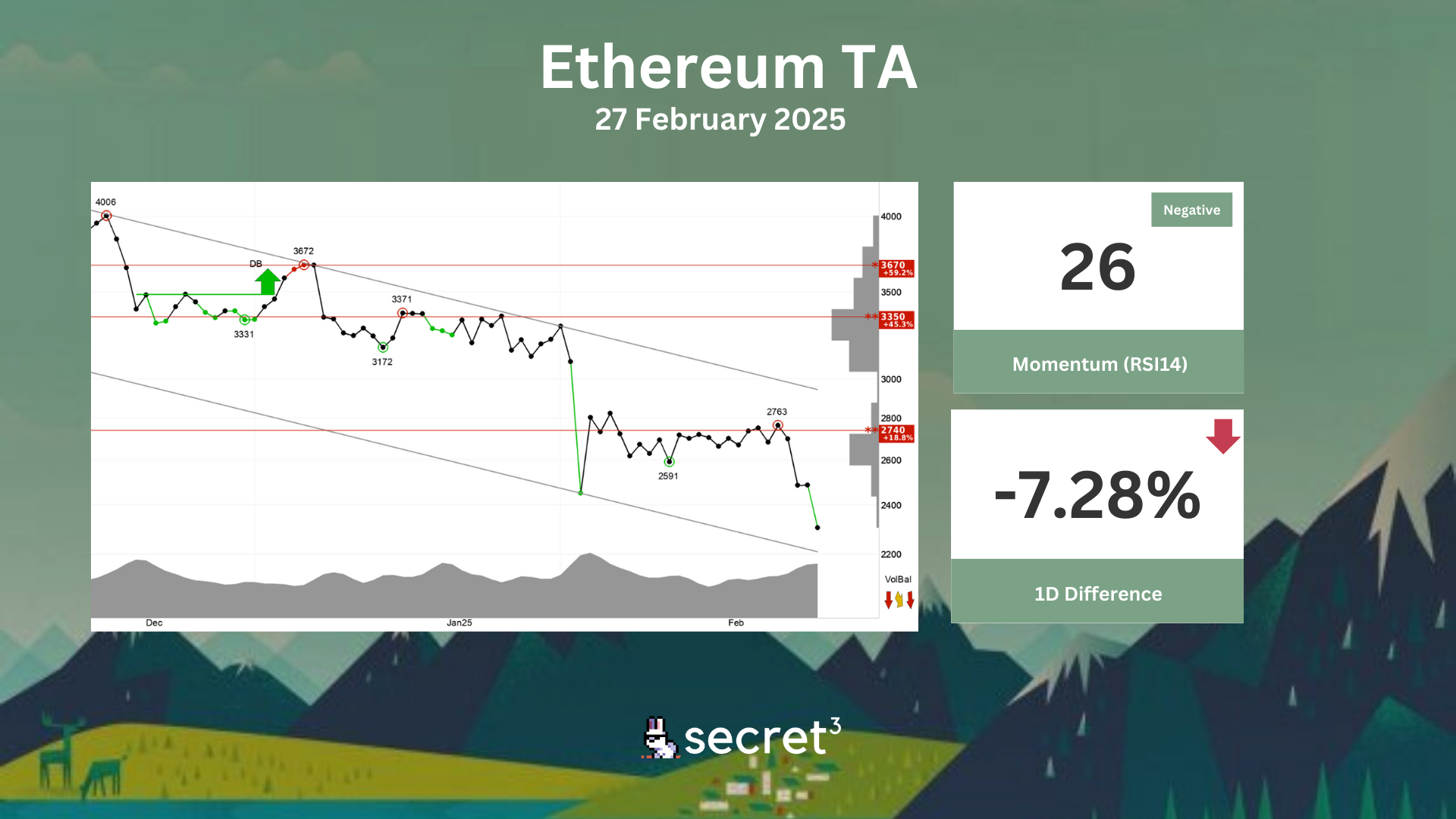

Ethereum - Investors have accepted lower prices over time to get out of Ethereum and the currency is in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Ethereum. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2740 points. Volume has previously been low at price tops and high at price bottoms. This confirms the trend. RSI below 30 shows that the momentum of the currency is strongly negative in the short term. Investor have steadily reduced the price to sell the currency, which indicates increasing pessimism and continued falling prices. However, particularly in big stocks, low RSI may be a sign that the stock is oversold and that there is a chance for a reaction upwards. The currency is overall assessed as technically negative for the short term.

Governance & Code

⚡ dYdX DAO | Launch Incentives - Season 9 Distribution (218) (Active Vote)

- This proposal aims to distribute $1.5 million in DYDX tokens from the dYdX Chain Community Treasury to qualifying users in trading season 9 of the dYdX Chain Launch Incentives Program.

💢 Across DAO | Straddl.io Expansion Proposal (Preliminary Discussion)

- Straddl.io, a bridging platform built on Across Protocol, has submit a proposal requesting 100,000 ACX tokens (~$27,000) to expand its services by integrating additional DeFi functionalities and support development, contributor compensation, and user engagement initiatives.

💰 Compound DAO | Risk Parameter Recommendations (Feb. 2025)

- This proposal seeks to implement the following risk parameter adjustments in response to observed delays in collateral liquidations during the Feb. 3, 2025, market downturn and volatility analysis of WETH and wstETH liquidity conditions.