gm 26/05

Summary

gm, Bitcoin rebounded above $109,600 after President Trump postponed proposed EU tariffs, easing global trade tensions that had previously triggered a market decline. In security news, a U.S. judge overturned fraud convictions in the Mango Markets case, setting a significant precedent for DeFi exploits, while scammers have escalated tactics by sending physical phishing letters impersonating Ledger to crypto users. Meanwhile, Pakistan allocated 2,000 megawatts of surplus electricity for Bitcoin mining and AI infrastructure to attract foreign investment, and Strategy's Michael Saylor hinted at another Bitcoin purchase as institutional demand continues to strengthen, with Bitwise projecting Bitcoin inflows could reach $420 billion by 2026.

News Headlines

🏦 Ethereum Positioned as "Digital Oil" for Wall Street Investors

- Etherealize co-founder Vivek Raman describes Ethereum as "digital oil," creating a powerful analogy to explain its vital role in the broader crypto ecosystem to traditional finance investors. Unlike oil, Ethereum has a more predictable supply with capped annual issuance of 1.5% and ongoing burning of transaction fees.

- As tokenization becomes more widespread, Ethereum could evolve to serve as a neutral asset connecting various industries, potentially solidifying its status as a strategic asset for institutions navigating tokenized markets.

🔒 Pavel Durov Blocked from Attending Oslo Freedom Forum

- Telegram co-founder Pavel Durov cannot physically attend the Oslo Freedom Forum due to French court rulings that denied his travel request to Norway, forcing him to deliver his keynote speech remotely instead. Human Rights Foundation CEO Thor Halvorssen expressed disappointment at Durov's inability to attend this important event.

- Durov has been vocal about censorship issues, recently revealing that French intelligence officials had asked him to censor conservative political content during Romanian elections—a request he firmly rejected, emphasizing his commitment to protecting freedom of expression.

⚡ AI Agents Identified as Crypto's Next Major Security Vulnerability

- AI agents integrated into cryptocurrency wallets, trading bots, and on-chain assistants using the Model Context Protocol (MCP) significantly increase the attack surface for hackers. Security firm SlowMist has identified four key attack vectors: data poisoning, JSON injection, competitive function override, and cross-MCP call attacks, all of which exploit vulnerabilities in third-party plugins.

- Experts warn that crypto developers often underestimate security requirements, recommending strict plugin verification and regular behavioral reviews to prevent potential threats as AI agent deployment grows within the crypto ecosystem.

🏠 Real Estate Tokenization Misunderstood by Crypto Leaders, Expert Claims

- Contrary to dismissive remarks by Securitize COO Michael Sonnenshein at Paris Blockchain Week, real estate tokenization addresses significant inefficiencies in the traditional market including lengthy transaction processes and high barriers to entry. Tokenization enables fractional ownership with minimal investment amounts, democratizing access to real estate investments for average investors.

- The blockchain technology facilitates secure, transparent fractional investments in institutional-grade properties, with growing support from traditional finance institutions that are increasingly adopting tokenization technology to make previously exclusive investments available to everyone.

💼 Cathie Wood: Crypto ETFs Will Maintain Relevance Despite Growing Wallet Adoption

- ARK Invest CEO Cathie Wood asserts that cryptocurrency ETFs will maintain their market relevance even as crypto wallet adoption increases, describing ETFs as a necessary stepping stone that offers convenience for consumers who find wallets complicated. Statistics show approximately 200 million active Bitcoin wallets globally alongside $44.49 billion in Bitcoin ETF inflows since January 2024.

- Wood views Ether as an entry point for new investors exploring smart contracts, predicting they'll expand to other cryptocurrencies like Solana as they learn more about the technology, while remaining optimistic about institutional interest in Bitcoin as 'digital gold' despite some regulatory challenges.

Market Metrics

Fundraising & VC

No fundraising data today.

Regulatory

🔒 Banking Groups Ask SEC to Drop Cybersecurity Incident Disclosure Rule

- Major banking associations have petitioned the SEC to repeal the rule requiring public companies to report cybersecurity incidents within four days, arguing it conflicts with national security needs.

- The petition claims the disclosure requirements compromise cybersecurity efforts and can be exploited by criminals, with potential implications for publicly listed crypto companies like Coinbase.

🔍 Blockchain Security Firm Releases Cetus Hack Post-Mortem Report

- Dedaub revealed that the $223 million Cetus hack exploited a vulnerability in liquidity parameters that wasn't detected by code overflow checks, allowing attackers to create massive liquidity positions.

- The Sui Foundation and Cetus announced that $163 million of the stolen funds were frozen by validators, sparking debate about decentralization and highlighting the need for improved security measures in DeFi protocols.

💰 Coinbase Faces Another Data Breach Lawsuit Claiming Stock Drop Damages

- Coinbase is facing a proposed class-action lawsuit from investors alleging the company's failure to disclose a data breach and FCA violation led to significant stock price drops.

- The lawsuit claims the stock fell 7.2% following disclosure of a $20 million extortion attempt related to the breach, seeking damages for affected stockholders who purchased at allegedly inflated prices.

👁️ Is World's Biometric ID Model a Threat to Self-Sovereignty?

- Sam Altman's World project, which verifies human uniqueness through iris scans for its WLD token, faces criticism for potentially contradicting decentralization and privacy principles.

- Critics warn that linking basic services to biometric data could lead to societal exclusion, raising concerns about the implications in authoritarian contexts and the need for systems that prioritize user sovereignty.

🏛️ Top US Politician Dismisses Trump Crypto Dinner Concerns Amid Calls for Probe

- House Speaker Mike Johnson has dismissed corruption concerns related to President Trump's dinner with prominent memecoin holders, including foreign nationals like Tron CEO Justin Sun.

- 35 House Democrats are seeking an investigation into potential violations of federal bribery laws, while others have introduced the "Stop TRUMP in Crypto Act" to prevent the president from benefiting from cryptocurrencies while in office.

Technical Analysis

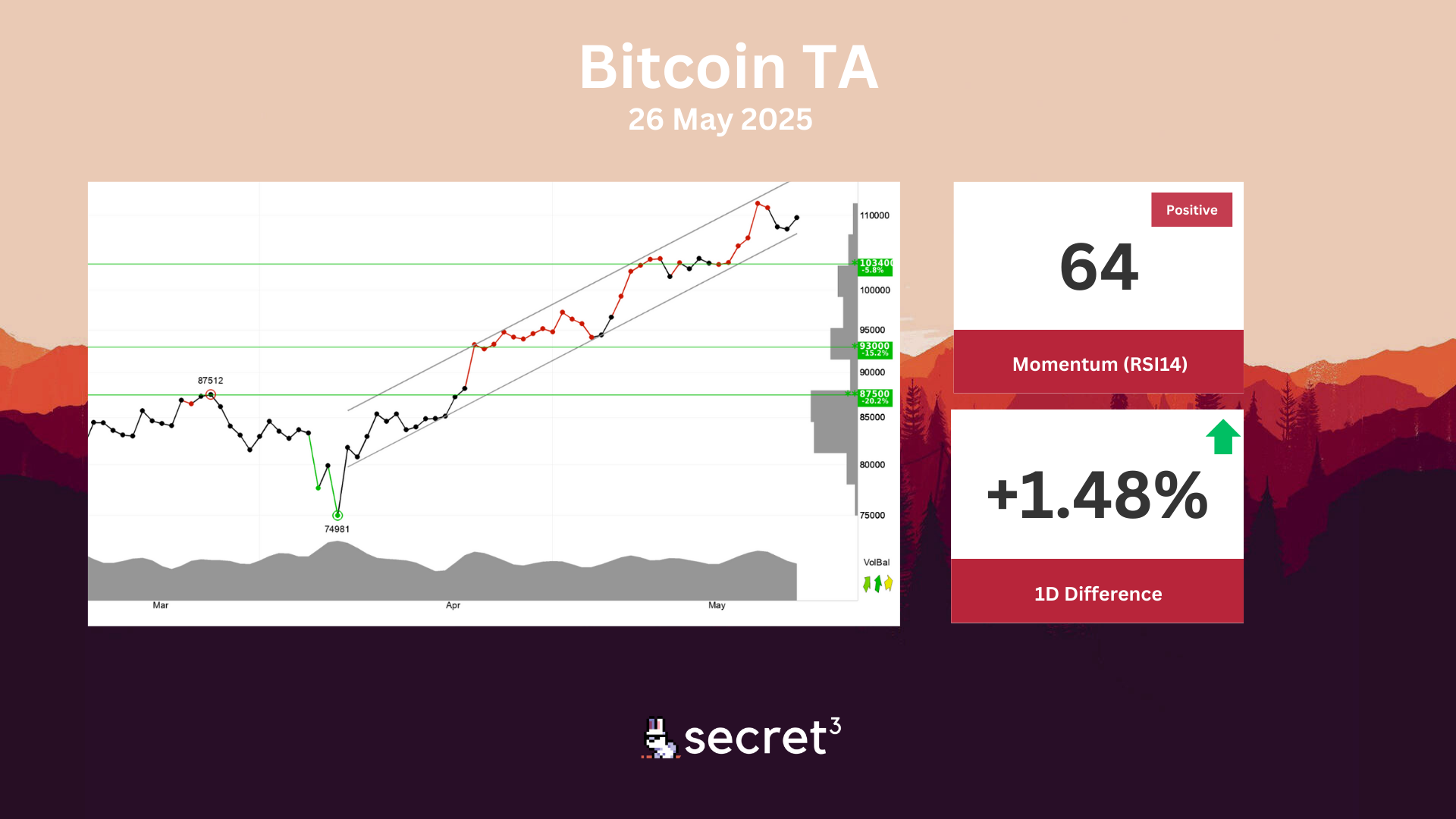

Bitcoin - Bitcoin is in a rising trend channel in the short term. This shows that investors over time have bought the currency at higher prices and indicates good development for the currency. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 103400 points. Positive volume balance, with high volume on days of rising prices and low volume on days of falling prices, strengthens the currency in the short term. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically positive for the short term.

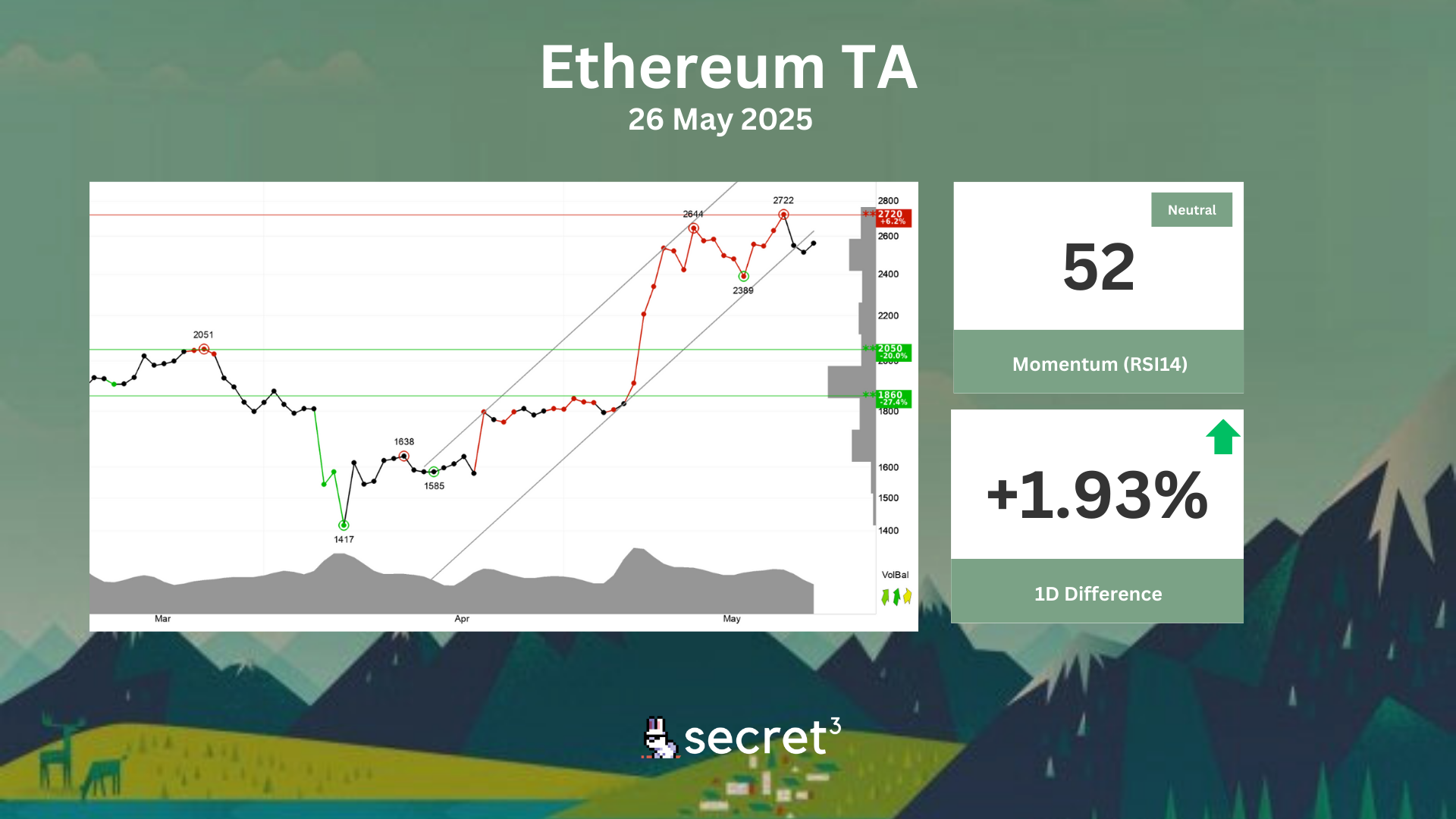

Ethereum - Ethereum has broken the floor of the rising trend channel in the short term, which indicates a weaker initial rising rate. The currency has support at points 2050 and resistance at points 2720. Volume has previously been high at price tops and low at price bottoms. Volume balance is also positive, which weakens the trend break. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically positive for the short term.