gm 26/04

Summary

gm, Bitcoin surged above $95,000, driven by strong institutional interest and positive regulatory shifts. Coinbase announced a partnership with PayPal to waive fees on USD-PYUSD conversions, aiming to advance stablecoin adoption. The Federal Reserve withdrew previous crypto guidance for banks, potentially easing restrictions on crypto-related activities. Meanwhile, ARK Invest raised its bullish Bitcoin price forecast to $2.4 million by 2030, reflecting growing confidence in the asset's long-term potential. These events collectively signal increasing mainstream acceptance and integration of cryptocurrencies, particularly Bitcoin, into the broader financial ecosystem.

News Headlines

💼 Binance Launches Fund Accounts for Asset Managers

- Binance has introduced Fund Accounts, a new solution designed for asset managers to streamline collateral management.

- The feature allows portfolio managers to consolidate investor assets into omnibus accounts, enhancing trade execution efficiency.

💳 Stripe Launches Stablecoin Testing Program

- Stripe has begun testing a new US dollar stablecoin for companies outside the US, UK, and Europe.

- This initiative follows Stripe's acquisition of the stablecoin payments network Bridge, aiming to compete with traditional banking systems.

📊 Bitcoin ETF Inflows Continue for Seventh Straight Day

- Bitcoin ETFs experienced $442 million in inflows, bringing total assets under management to $108 billion.

- The surge correlates with President Trump's comments on reducing Chinese tariffs, contributing to Bitcoin's price increase.

🏛️ SEC Chair Paul Atkins Emphasizes Crypto Policy Action Without Waiting for Congress

- New SEC Chairman Paul Atkins stated the agency will reshape securities policy to foster innovation in digital assets.

- Atkins indicated a need to rethink special-purpose broker dealers and custody policies related to cryptocurrencies.

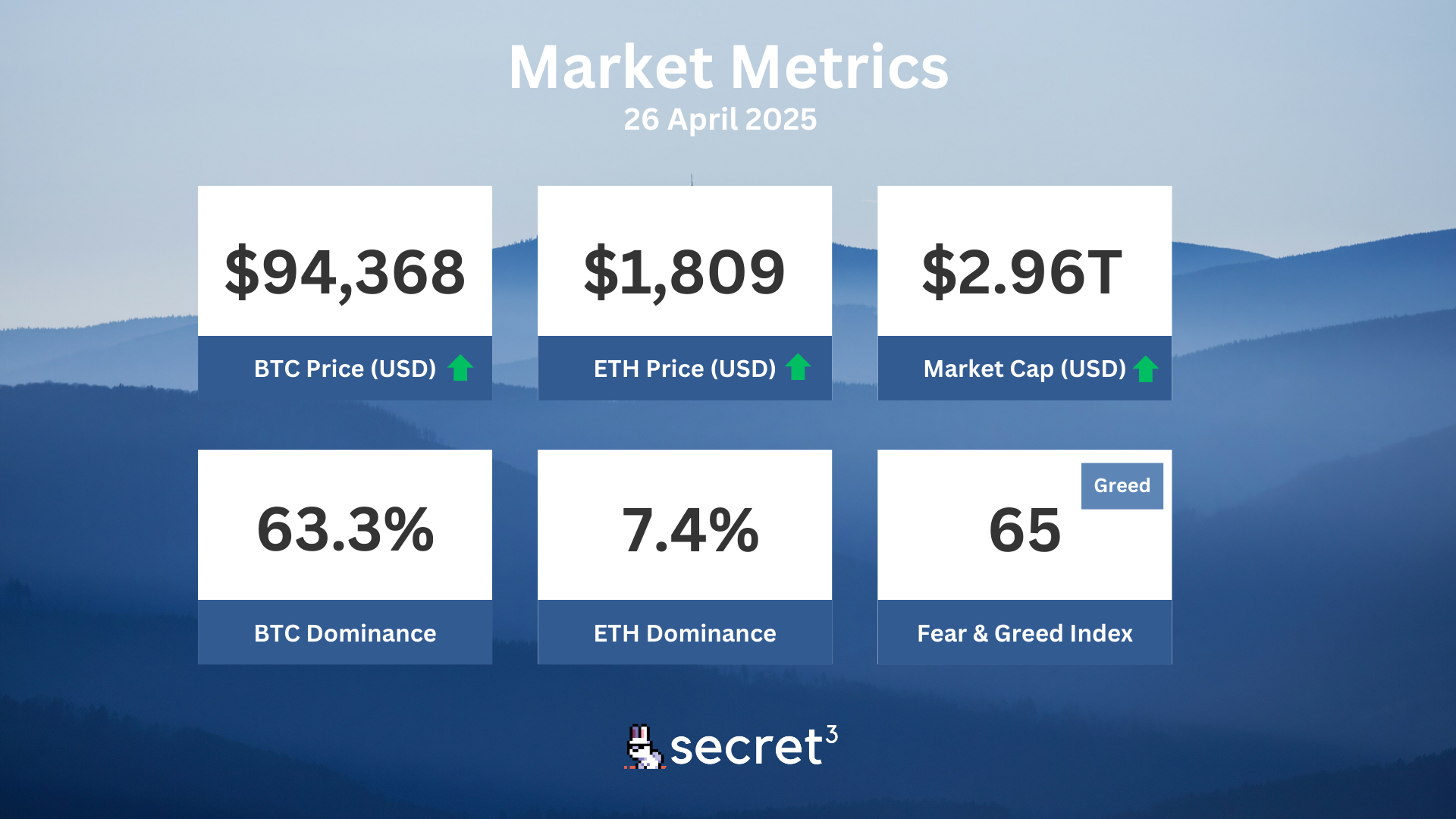

Market Metrics

Fundraising & VC

1. Nous Research (Series A, $50M) - AI accelerator company

2. SkyAI (Public Token Sale, $50M) -Web3 data infrastructure platform

3. Inco Network (Strategic, $5M) - Modular confidential computing network

On-chain Data

1. Xai (xai) token unlocked today ($2.76M, 3.71%)

2. Grass (GRASS) token unlock in 1 day ($6.82M, 1.35%)

3. Open Campus (EDU) token unlock in 2 days ($3.13M, 8.3%)

4. Geodnet (geod) token unlock in 2 days ($2.78M, 3.84%)

Regulatory

🌐 Nasdaq Proposes Crypto Regulation Framework to SEC

- Nasdaq urged the SEC to treat certain digital assets as "stocks by any other name" for regulatory purposes.

- The exchange proposed a clearer taxonomy for cryptocurrencies, advocating for regulation of some tokens under existing securities laws.

💰 Swiss National Bank Rejects Bitcoin as Reserve Asset

- The Swiss National Bank declined to include Bitcoin in its reserves, citing liquidity and volatility risks.

- This decision comes despite arguments that a small Bitcoin allocation could have significantly improved portfolio returns.

🏦 Circle Denies Seeking US Banking License

- Circle's chief strategy officer refuted claims that the company is pursuing a US federal bank charter.

- The company instead plans to comply with upcoming regulatory standards for payment stablecoins.

🏛️ Nigerian Court Approves Arrest of CBEX Promoters

- A Nigerian high court authorized the arrest of six individuals allegedly involved in a $620,000 investment fraud related to Crypto Bridge Exchange (CBEX).

- This case highlights ongoing scrutiny of cryptocurrency exchanges in Nigeria amid broader regulatory challenges.

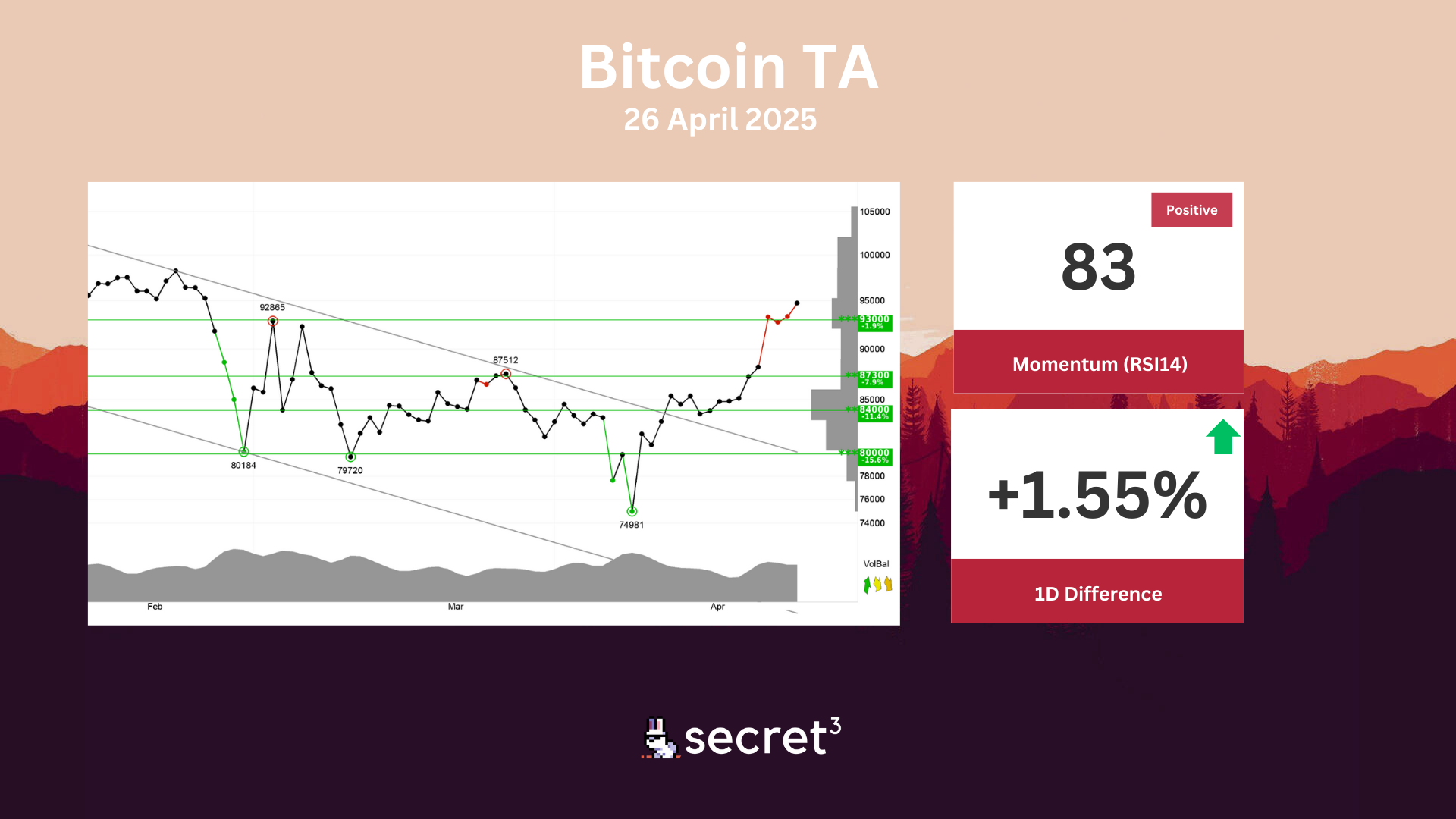

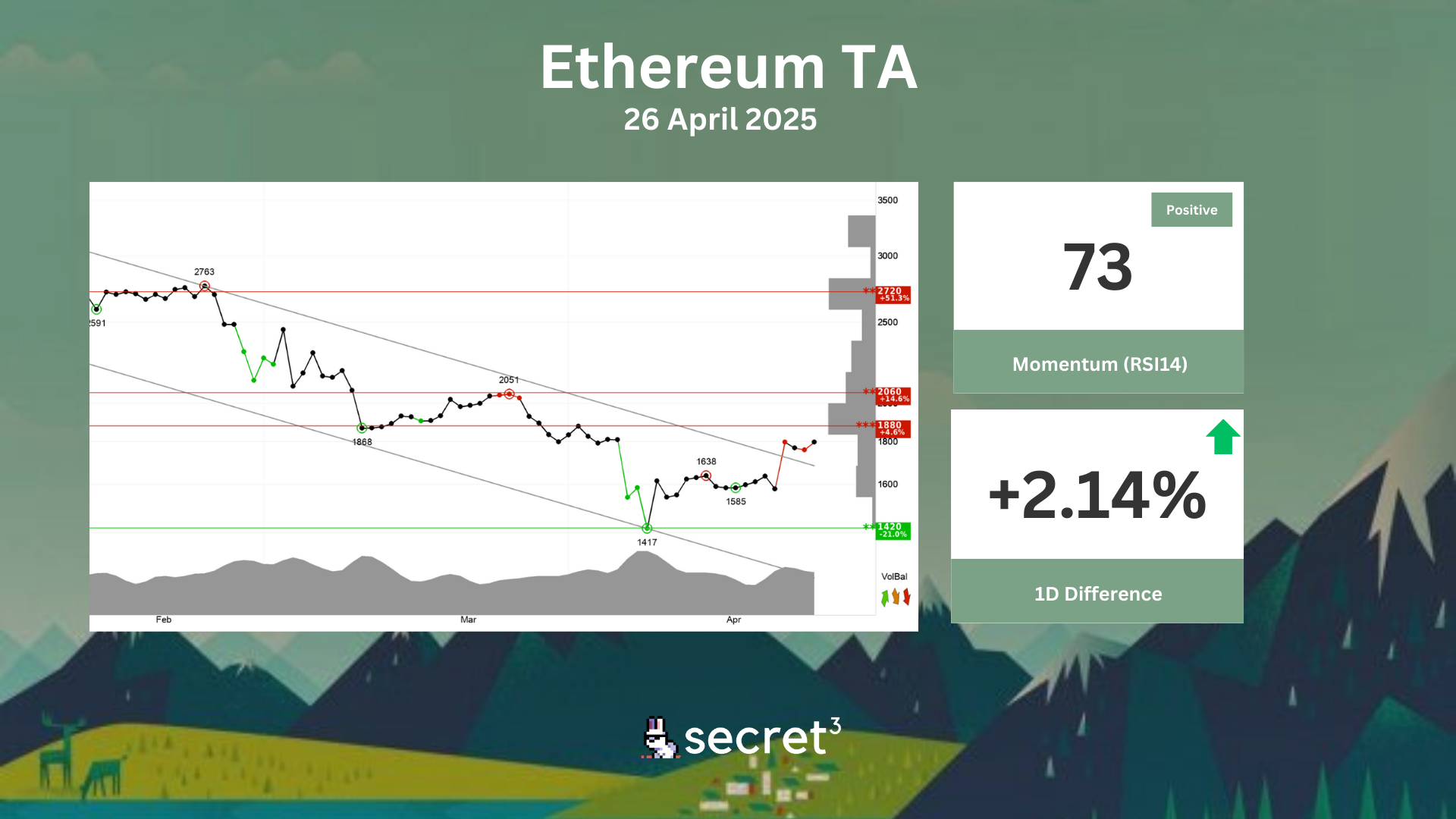

Technical Analysis

Bitcoin - Bitcoin has broken the ceiling of the falling trend in the short term, which indicates a slower initial falling rate. The currency has broken up through resistance at points 93000. This predicts a further rise. RSI is above 70 after a good price increase the past weeks. The currency has strong positive momentum and further increase is indicated. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.

Ethereum - Ethereum has broken through the ceiling of a falling trend channel in the short term. This indicates a slower falling rate initially, or the start of a more horizontal development. The currency is approaching resistance at 1880 points, which may give a negative reaction. However, a break upwards through 1880 points will be a positive signal. RSI above 70 shows that the currency has strong positive momentum in the short term. Investors have steadily paid more to buy the currency, which indicates increasing optimism and that the price will continue to rise. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically negative for the short term.

Governance & Code

⚖️ Balancer DAO | Allocate Funds for Production Testing of New Balancer Products

- This proposal aims to transfer $250,000 worth of ARB tokens to a multisig controlled by Balancer contributors to allow "more concrete production tests" of new pool models in place of the current ones which involve individual contributors providing liquidity.

✨ Stargate Finance DAO | Balanced Earnings Distribution: Increasing Value Accrual for STG Stakers

- This proposal aims to revise Stargate DAO’s earnings distribution model by allocating 50% of monthly transfer fees and investment income to veSTG token holders, with the remaining 50% retained as Protocol-Owned Liquidity (POL).