gm 26/03

Summary

gm, President Trump's media company announced plans to collaborate with Crypto.com on launching a series of "Made in America" ETFs. This move has sparked interest in the market, with Cronos (CRO) token surging 30%. Meanwhile, BlackRock expanded its crypto offerings by launching its iShares Bitcoin ETP across multiple European stock exchanges. On the regulatory front, Kentucky enacted a "Bitcoin Rights" bill, protecting crypto users' rights to self-custody and operate nodes. These developments, coupled with Bitcoin's price stabilizing above $87,000 and increased institutional interest, signal growing mainstream acceptance of cryptocurrencies and blockchain technology.

News Headlines

💰 Fidelity Investments to Launch Its Own Stablecoin: FT

- Fidelity Investments is set to launch its own stablecoin named FT, marking a significant entry into the cryptocurrency market for the financial services giant.

- The stablecoin aims to provide more efficient, secure, and cost-effective transactions for both retail and institutional investors within the crypto ecosystem.

📈 Crypto Investment Products See $644M Inflow, Reversing Outflow Streak

- Cryptocurrency investment products experienced inflows of $644 million last week, reversing a five-week streak of outflows.

- Bitcoin exchange-traded funds attracted $724 million, while other assets like Solana, Polygon, and Chainlink also contributed modestly. Ethereum, however, saw significant outflows of $86 million.

🐶 Dogecoin Foundation Launches 10M DOGE Reserve

- The Dogecoin Foundation has acquired 10 million DOGE tokens as part of a new reserve initiative, valued at approximately $1.80 million.

- This strategic move aims to bolster community confidence in the cryptocurrency and serve as a foundation for future developments within the Dogecoin ecosystem.

🏗️ Tokenized Real Estate Trading Platform Launches on Polygon

- DigiShares has launched RealEstate.Exchange (REX) on the Polygon blockchain, enabling tokenized real estate trading for retail investors.

- The platform will initially feature two luxury properties in Miami and aims to address liquidity issues in the real estate industry through fractional investments.

📊 eToro Files for IPO After Crypto Drives 2024 Revenue Surge

- Trading platform eToro has filed for an IPO on Nasdaq, seeking to raise up to $400 million at an estimated valuation of $4.5 billion.

- The company reported a significant revenue increase in 2024, surging to $12.6 billion, with 96% attributed to cryptocurrency trading.

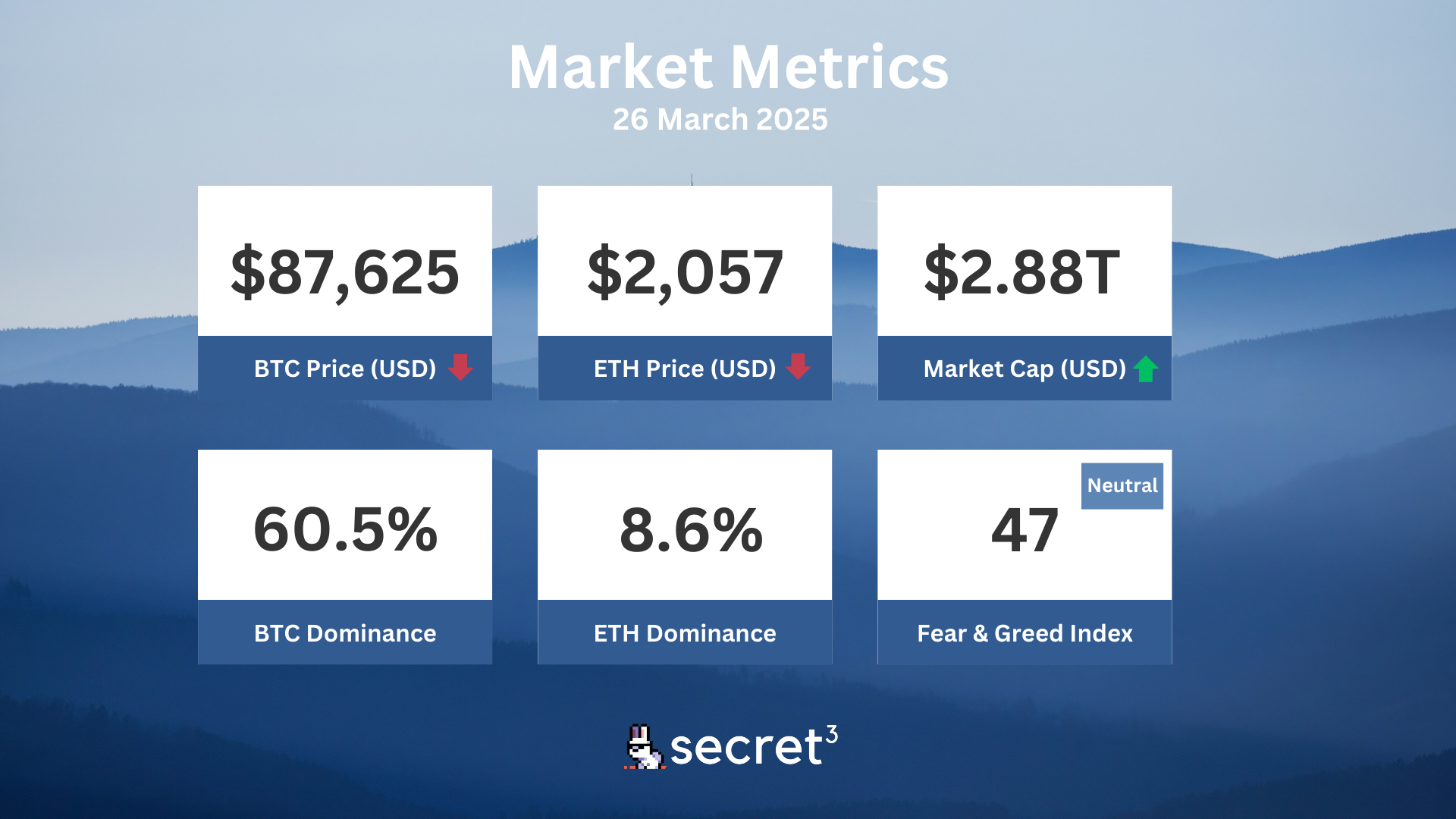

Market Metrics

Fundraising & VC

1. Tabit Insurance (Undisclosed, $40M) - Insurance solutions for digital assets and fintech sectors

2. CoreSky (Series A, $15M) - Meme incubation platform

3. Chronicle Protocol (Seed, $12M) - Blockchain-agnostic oracle solution

4. Wecan (Strategic, Undisclosed) - Decentralized software solutions

Regulatory

🔍 SEC Drops Investigation into Web3 Gaming Firm Immutable

- The SEC concluded its investigation into Immutable without taking enforcement action, ending a 5-month inquiry into potential securities law violations.

- This decision signals a potential easing of regulatory scrutiny towards crypto firms under recent SEC leadership changes.

🏛️ Arizona's Strategic Crypto Reserve Bills Head for Full Floor Vote

- Arizona is set to vote on two bills aimed at establishing strategic digital asset reserves, including seized assets and public fund investments in Bitcoin.

- If passed, these bills could allow up to 10% of available funds to be invested in Bitcoin, signaling growing acceptance of cryptocurrencies at the state level.

⚖️ Kentucky Passes Bitcoin and Ethereum Self-Custody Law

- Kentucky enacted a law protecting individuals' rights to self-custody cryptocurrencies and operate nodes without discrimination.

- The law clarifies that crypto mining and staking rewards are not securities and exempts blockchain operations from money transmitter regulations.

🔒 Security Concerns Slow Crypto Payment Adoption Worldwide — Survey

- A report by Bitget Wallet reveals that security concerns are the primary barrier to mainstream adoption of cryptocurrency payments, with 37% of surveyed investors citing these risks.

- Despite security concerns, 46% of users prefer crypto payments for their speed and efficiency.

Technical Analysis

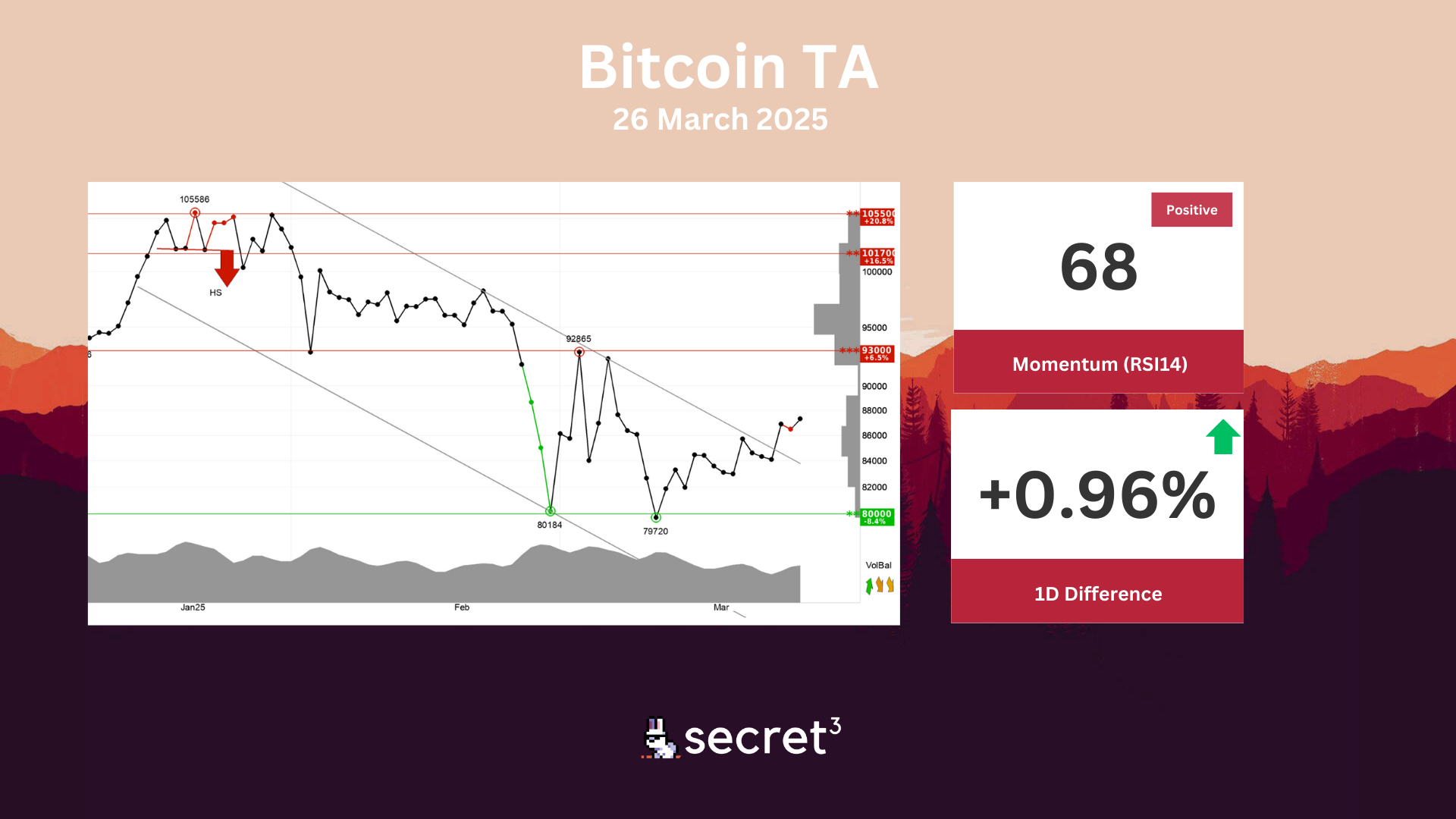

Bitcoin - Bitcoin has broken the ceiling of the falling trend in the short term, which indicates a slower initial falling rate. The currency has support at points 80000 and resistance at points 93000. The currency is assessed as technically slightly negative for the short term.

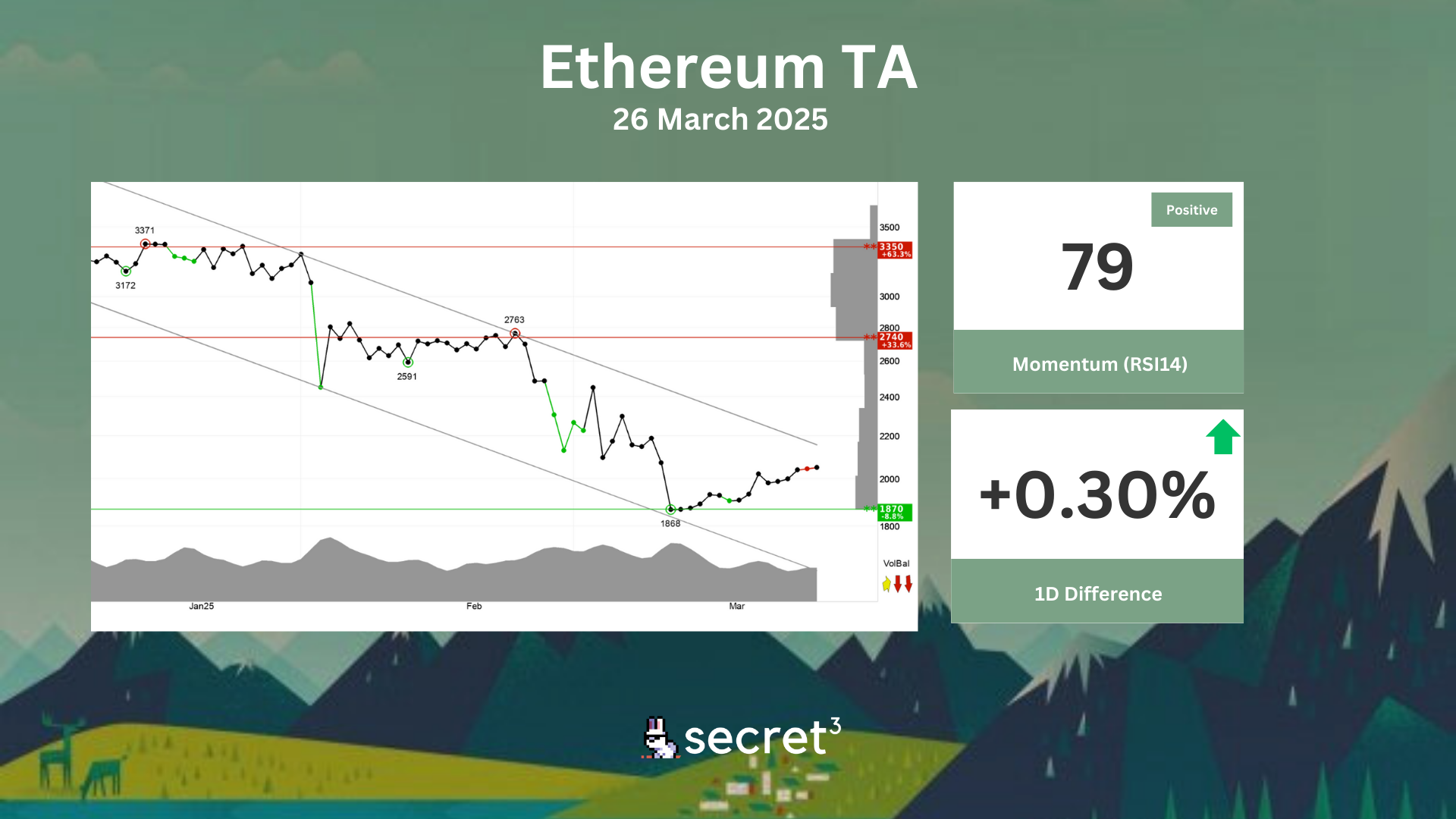

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Ethereum. The currency has support at points 1870 and resistance at points 2740. Negative volume balance weakens the currency in the short term. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Ethereum. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically negative for the short term.