gm 26/01

Summary

gm, MetaMask announces its expansion beyond Ethereum to support Bitcoin and other ecosystems. This strategic move comes amid a stagnant Ethereum landscape and growing interest in cross-chain functionality. Meanwhile, the tokenized bond market is projected to reach $300 billion by 2030, highlighting the increasing integration of traditional finance with blockchain technology. On the regulatory front, U.S. Congressional Republicans have launched an investigation into alleged debanking practices targeting crypto firms, potentially signaling a shift in the regulatory environment. Additionally, Bitcoin continues to show strength, trading above $104,000, with analysts noting bullish behavior from both short-term and long-term holders.

News Headlines

📊 Tokenized Bond Market Projected to Reach $300 Billion by 2030

- The tokenized bond market is projected to grow 30-fold to at least $300 billion by 2030, up from current levels of over $16.6 billion.

- Advantages of tokenizing bonds include rapid settlement times, reduced transaction costs, and enabling fractional ownership.

💰 MicroStrategy to Redeem $1 Billion in Debt as Bitcoin Stash Nears $50 Billion

- MicroStrategy announced it would redeem its 2027 notes, providing holders with 100% of their principal by February 24, 2025.

- The company has amassed 461,000 Bitcoin valued at nearly $49 billion since starting its purchase strategy in August 2020.

🏦 Nasdaq Files for In-Kind Redemptions for BlackRock's Bitcoin ETF (IBIT)

- Nasdaq submitted a proposed rule change to allow in-kind creation and redemption for the BlackRock iShares Bitcoin Trust (IBIT).

- This change would enable authorized participants to trade shares of the ETF directly for bitcoin, improving efficiency for large institutional investors.

🌐 Solana Stablecoin Supply Doubles Amid Trump Coin Launch

- Solana's stablecoin supply has doubled to a record $10.5 billion, driven by trading frenzy surrounding the newly launched Trump-tied memecoin, TRUMP.

- Circle's USDC on Solana surpassed $8 billion in circulation after adding over $4 billion in January.

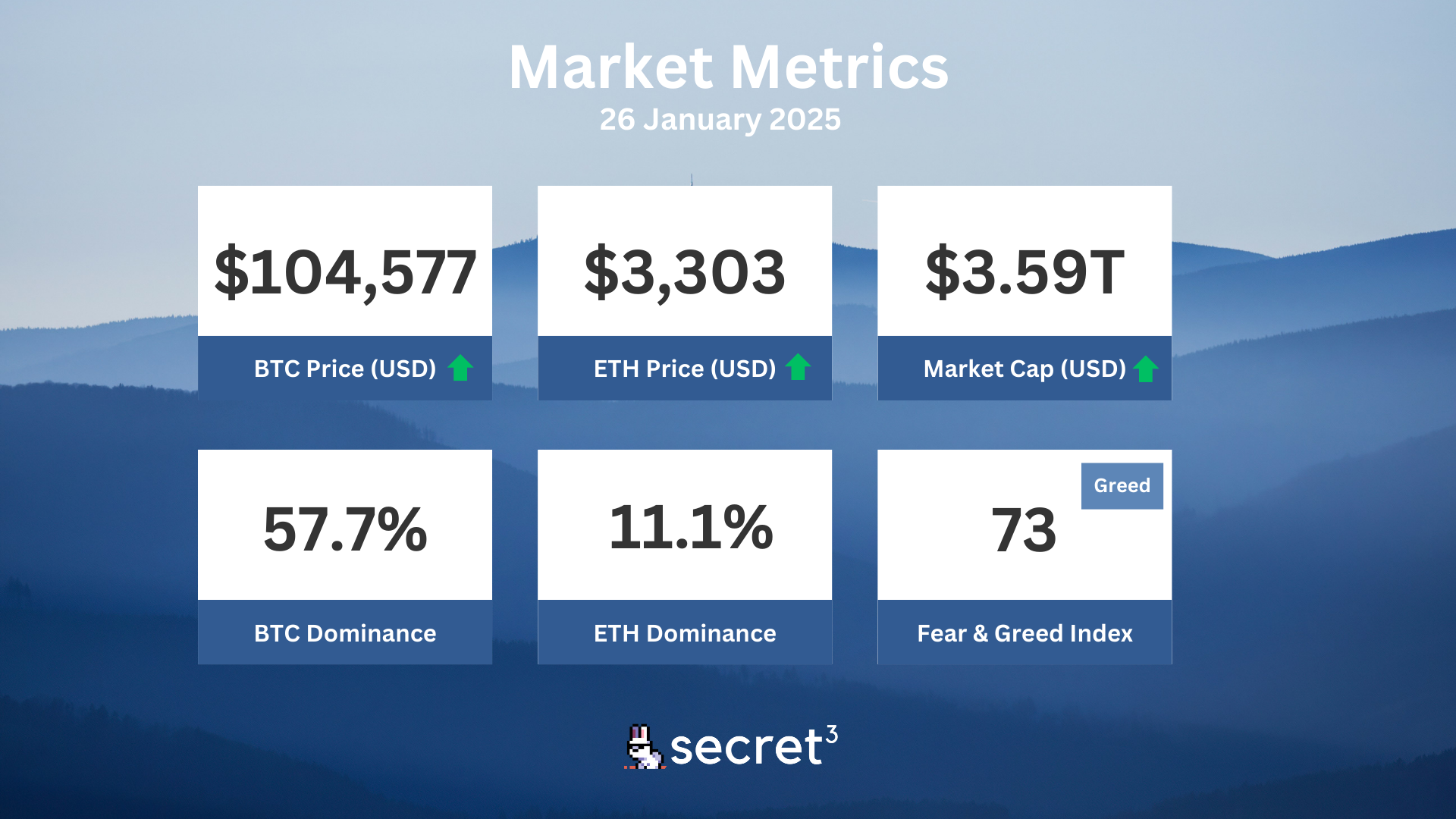

Market Metrics

Fundraising & VC

No fundraising data today.

On-chain Data

1. Xai (xai) token unlocked today ($7.92M, 5.79%)

2. Qi Dao (QI) token unlocked today ($104.50K, 3.22%)

3. Grass (GRASS) token unlock in 1 day ($7.64M, 1.52%)

4. Geodnet (geod) token unlock in 2 days ($4.49M, 4.82%)

Regulatory

🚫 SEC Rescinds SAB 121, Easing Crypto Custody for Banks

- SEC Commissioner Hester Peirce announced the rescission of SAB 121, which had required entities to reflect liabilities for crypto-assets held for users.

- This decision is expected to facilitate banks and financial organizations in custodying spot cryptocurrencies, integrating digital assets into traditional finance.

💼 Andreessen Horowitz Closes UK Office to Focus on US Crypto Efforts

- Andreessen Horowitz is closing its UK office to concentrate on US operations, driven by President Trump's proactive stance on cryptocurrency regulations.

- The firm remains committed to international crypto development but sees more opportunities in the US under the new administration.

🚀 Memecoin ETFs on the Horizon Under New SEC Leadership

- Industry experts suggest that the approval of TRUMP, Dogecoin (DOGE), and Bonk (BONK) ETFs is more probable with the SEC's new crypto-friendly appointees.

- This development follows the launch of President Trump's Official Trump (TRUMP) memecoin.

Technical Analysis

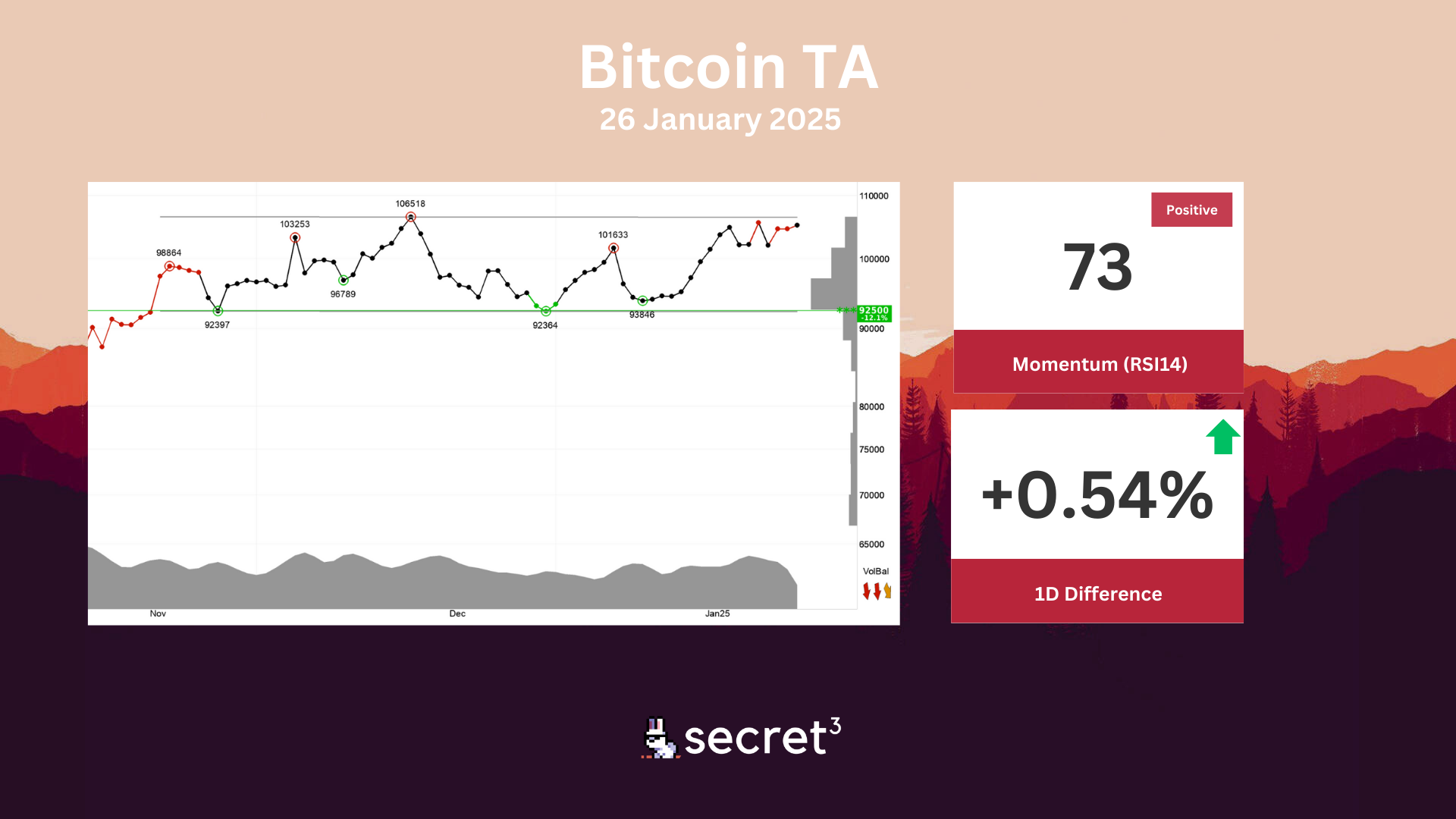

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 92500 points. Negative volume balance indicates that sellers are aggressive while buyers are passive, and weakens the currency. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Bitcoin. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically slightly positive for the short term.

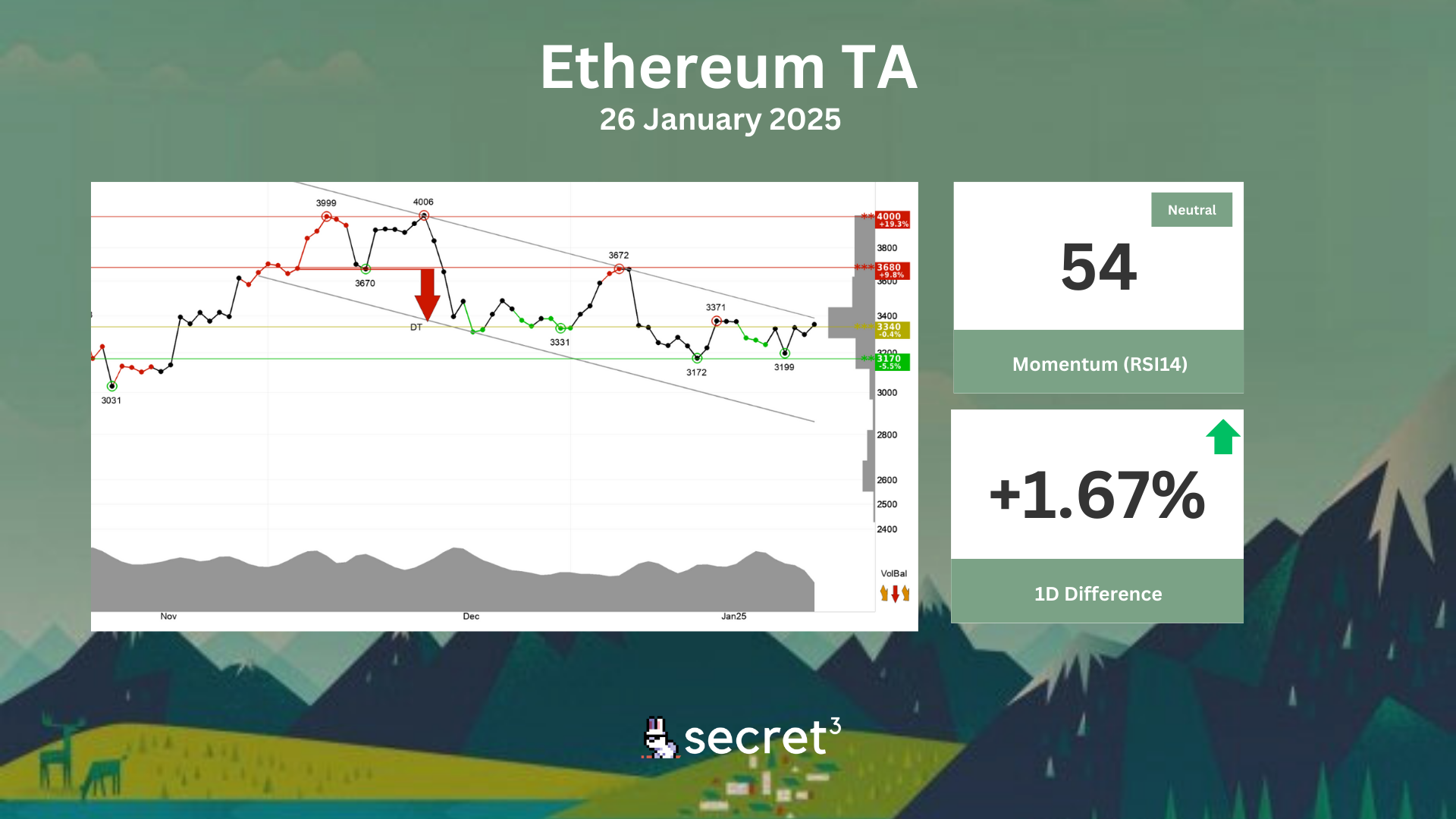

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency has marginally broken up through resistance at points 3340. An established break predicts a further rise. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically slightly negative for the short term.

Governance & Code

🦄 Uniswap DAO | Deploy a DeepDAO Pro Dashboard for Uniswap

- This proposal suggests a six-month pilot program for adopting the DeepDAO Pro Dashboard at Uniswap DAO for $25,000.

💰 Yearn DAO | Make V3 Yearn Vaults Composable with LPs/Protocols

- This proposal seeks to upgrade V3 Yearn vaults to allow them to be easily composed into other protocols & used by liquidity providers by building supporting smart contract infrastructure that enable V3 Yearn Vault receipt tokens deployed into liquidity pools to be pegged to their vault redemption value.