gm 25/05

Summary

gm, Bitcoin and Ethereum ETFs collectively draws over $1 billion in a single day, demonstrating robust investor confidence despite recent price consolidation. Fidelity Digital Assets released research indicating that Bitcoin's current bull market is redefining its role in modern portfolios, highlighting maturation signs including increased hashrate and steady institutional adoption. On the integration front, Kraken announced plans to offer tokenized US-listed stocks and ETFs to non-US investors on the Solana blockchain, part of a broader movement to bridge traditional finance with cryptocurrency markets. Meanwhile, security concerns have escalated with reports of sophisticated phishing attempts targeting Ledger hardware wallet users via physical mail, underscoring the evolving tactics of scammers in the crypto space.

News Headlines

💰 Semler Scientific Buys More Bitcoin as Law Firm Targets Company

- Healthcare technology firm Semler Scientific has acquired an additional $50 million in Bitcoin, raising its total holdings to approximately $466 million as part of its pivot toward becoming a Bitcoin treasury.

- The company faces scrutiny from law firm Bragar Eagel & Squire for potential violations of federal securities laws, adding to existing challenges with the U.S. Department of Justice regarding reimbursement claims related to its QuantaFlo device.

🔍 Judge overturns fraud convictions in Mango Markets exploit case

- A US federal judge vacated fraud and market manipulation convictions against Avraham Eisenberg in the $110 million Mango Markets exploit case, ruling that evidence was insufficient to prove he made materially false representations.

- Eisenberg's defense successfully argued he merely exploited poorly designed permissionless code rather than making false statements, significantly weakening the government's case against him.

⚠️ Industry exec sounds alarm on Ledger phishing letter delivered by USPS

- Scammers impersonating Ledger are sending physical letters to crypto users via USPS, urging them to "validate" their wallets through a QR code or risk losing funds, as revealed by BitGo CEO Mike Belshe.

- This alarming development highlights the evolving tactics of crypto scammers, following other significant attacks including a $330 million Bitcoin phishing scam and Coinbase's recent data breach affecting 69,461 users.

🐕 Most Trump Crypto Dinner VIPs Have Moved or Dumped Their Coins

- On-chain data reveals that out of the top 25 VIP holders of the TRUMP meme coin who attended Trump's exclusive dinner, only eight retained their tokens by the next day, with average holdings dropping from $4.78 million to $2.11 million.

- Tron founder Justin Sun is among the few who kept his holdings of nearly 1.4 million TRUMP tokens (worth around $18.8 million), while many VIPs moved assets to centralized exchanges, raising concerns about "pay-to-play" dynamics.

🏦 Bitcoin inflows projected to reach $420B in 2026 — Bitwise

- Bitwise forecasts Bitcoin demand will surge to $120 billion by 2025 and $300 billion by 2026, driven by institutional investors, public companies, sovereign wealth funds, and ETFs.

- Spot Bitcoin ETFs have already surpassed gold ETFs with $36.2 billion in net inflows in 2024 and could reach $100 billion annually by 2027, while sovereign nations currently hold approximately 529,705 BTC.

Market Metrics

Fundraising & VC

No fundraising data today.

Regulatory

🦅 Trump's Presidential Seal Use at Crypto Event Under Scrutiny

- President Trump is facing legal questions for using the presidential seal at his private $TRUMP memecoin investor dinner, potentially violating federal law prohibiting use of the seal to suggest government endorsement.

- The White House clarified that the dinner was not an official event, though Trump spoke behind a lectern featuring the official seal to approximately 220 investors.

💼 MicroStrategy Faces Legal Challenges Over Bitcoin Strategy

- MicroStrategy (renamed Strategy) is facing a class action lawsuit alleging the company misled investors about risks associated with its aggressive Bitcoin acquisition strategy.

- Despite legal challenges, the company plans to issue $2.1 billion in preferred stock as part of its recovery strategy from previous losses.

🔍 US House Members Call for Investigation into Trump's Memecoin Dinner

- Over 30 members of Congress have requested a Justice Department investigation into Donald Trump's private dinner for $TRUMP memecoin investors, citing potential violations of the Constitution's emoluments clause.

- The letter expresses concerns that the memecoin promotion could enable foreign governments to influence US policies without proper disclosure, especially since foreign nationals reportedly attended the event.

🔐 Privacy Becoming Essential in AI Era, Says Shielded CEO

- Eran Barak, CEO of Shielded Technologies, emphasizes that onchain privacy protection will become increasingly crucial as AI technology advances and creates new data security vulnerabilities.

- He advocates for privacy tools like zero-knowledge proofs that enable data verification without exposing the underlying information, potentially shifting hacker incentive structures away from individual wallet attacks.

📊 Coinbase Joins S&P 500, Signaling Crypto Mainstream Acceptance

- Coinbase's inclusion in the S&P 500 marks a pivotal moment for the cryptocurrency industry, signaling legitimacy and maturity of crypto infrastructure within traditional finance.

- The move could direct billions of dollars from passive investment flows to Coinbase and encourage other crypto firms like Circle and Chainalysis to pursue public listings with similar ambitions.

Technical Analysis

Bitcoin - Bitcoin is in a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 103400 points. Positive volume balance indicates that volume is high on days with rising prices and low on days with falling prices, which strengthens the currency. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically positive for the short term.

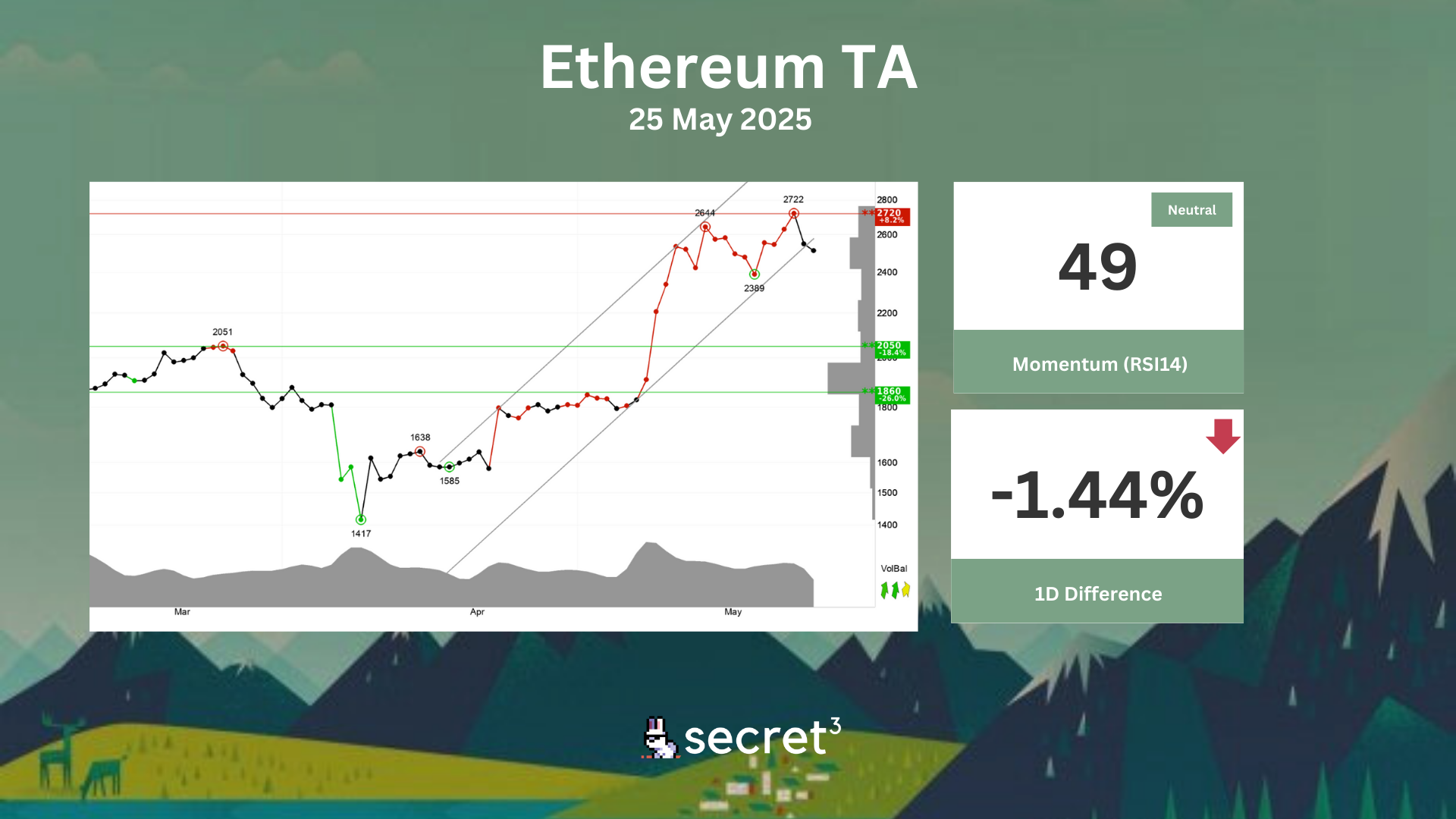

Ethereum - Ethereum has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. The currency has support at points 2050 and resistance at points 2720. Volume tops and volume bottoms correspond well with tops and bottoms in the price. Volume balance is also positive, which weakens the trend break. The currency is overall assessed as technically positive for the short term.