gm 25/03

Summary

gm, MicroStrategy acquires 6,911 Bitcoin, boosting its total holdings past 500,000 BTC. Fidelity Investments filed to tokenize its US Treasury fund on Ethereum, marking a major step in integrating traditional finance with blockchain technology. Trump Media announced a partnership with Crypto.com to launch ETFs, while Circle's USDC stablecoin received approval for use in Japan. Additionally, the crypto market experienced a general uptrend, with Bitcoin approaching $90,000 amid easing concerns about US trade tariffs and positive sentiment from the Federal Reserve. Meanwhile, Arizona is advancing two bills that would permit the state to set up digital asset reserves and invest up to 10% of public funds in Bitcoin, with both proposals nearing a full floor vote.

News Headlines

📈 Crypto ETFs Log First Net Inflows in Weeks

- Bitcoin ETFs in the US reported their first net inflows in five weeks, amounting to $744.35 million.

- BlackRock's iShares Bitcoin Trust led with $537.5 million in inflows.

🐳 Mt. Gox Transfers $1B in Bitcoin to Two Wallets

- Bankrupt crypto exchange Mt. Gox moved 11,501 Bitcoin (approximately $1 billion) on March 25.

- This is the third major Bitcoin transfer by Mt. Gox this month, following previous transactions of 12,000 and 11,833 Bitcoin.

🚨 Binance Suspends Employee Over Insider Trading Allegations

- Binance suspended a staff member for allegedly using confidential information to engage in front-running related to a token launch.

- The employee reportedly purchased tokens through multiple wallets before any public announcement of a Token Generation Event.

💹 Solana (SOL) Price Rallies Above $140

- Solana's native token, SOL, surged 8.5%, reclaiming the $142 mark for the first time in two weeks.

- Key factors contributing to SOL's rally include increased network activity, heightened interest from top traders, and anticipation of a spot Solana ETF approval.

🤝 Trump Media Partners with Crypto.com to Launch ETFs

- Trump Media signed a non-binding agreement with Crypto.com to launch a series of ETFs comprising digital assets and securities.

- The ETFs, expected to launch later this year, will focus on a "Made in America" initiative and include tokens like Bitcoin and Cronos.

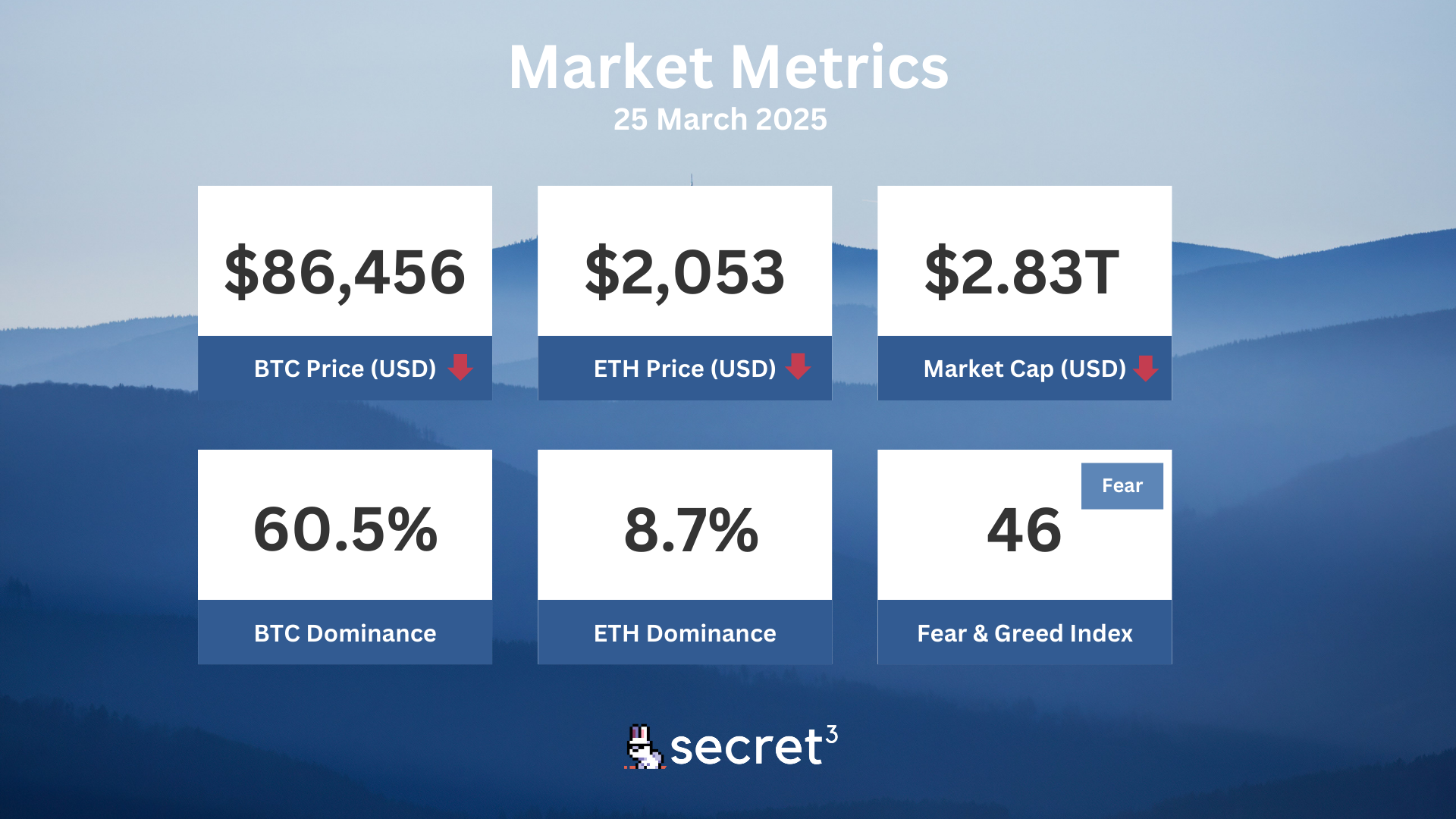

Market Metrics

Fundraising & VC

1. Rain (Series A, $24.5M) - Blockchain-based card issuing and stablecoin interoperability platform

2. Fragmetric (Strategic, $5M) - Liquid restaking protocol on Solana

3. Skate (Public Token Sale, $1M) - Universal application layer

4. Longenesis (Grant, $100K) - Post-market research and patient engagement platform

Regulatory

🏛️ SEC Crypto Roundtable Fails to Achieve Clarity

- The SEC's first crypto task force meeting failed to reach consensus on defining security status of cryptocurrencies.

- Without a permanent chair or full staffing, formal rules are unlikely to be established soon, leaving the regulatory landscape uncertain.

🔍 Massachusetts Probes Robinhood's Sports Prediction Markets

- Massachusetts regulators are investigating Robinhood's new sports prediction markets over concerns about linking gambling to brokerage accounts.

- The probe raises questions about the regulatory status of prediction markets and their potential impact on young investors.

🌐 Abu Dhabi Partners with Chainlink for Tokenization Frameworks

- Abu Dhabi Global Market signed an MoU with Chainlink to integrate traditional finance with blockchain technology.

- The partnership aims to enhance Abu Dhabi's role as a financial hub and foster discussions on innovative technologies.

💱 USDC Stablecoin Approved for Use in Japan

- Circle's USDC stablecoin received regulatory approval for launch in Japan, set to begin on March 26.

- This marks a significant milestone for cryptocurrency adoption in Japan's traditional finance sector.

💼 Crypto ETFs Gain Popularity Among U.S. Advisors

- Crypto ETFs are seeing a surge in popularity among U.S. financial advisors as reputational risks diminish.

- This shift reflects growing acceptance of digital assets in traditional finance and could lead to increased institutional investment.

Technical Analysis

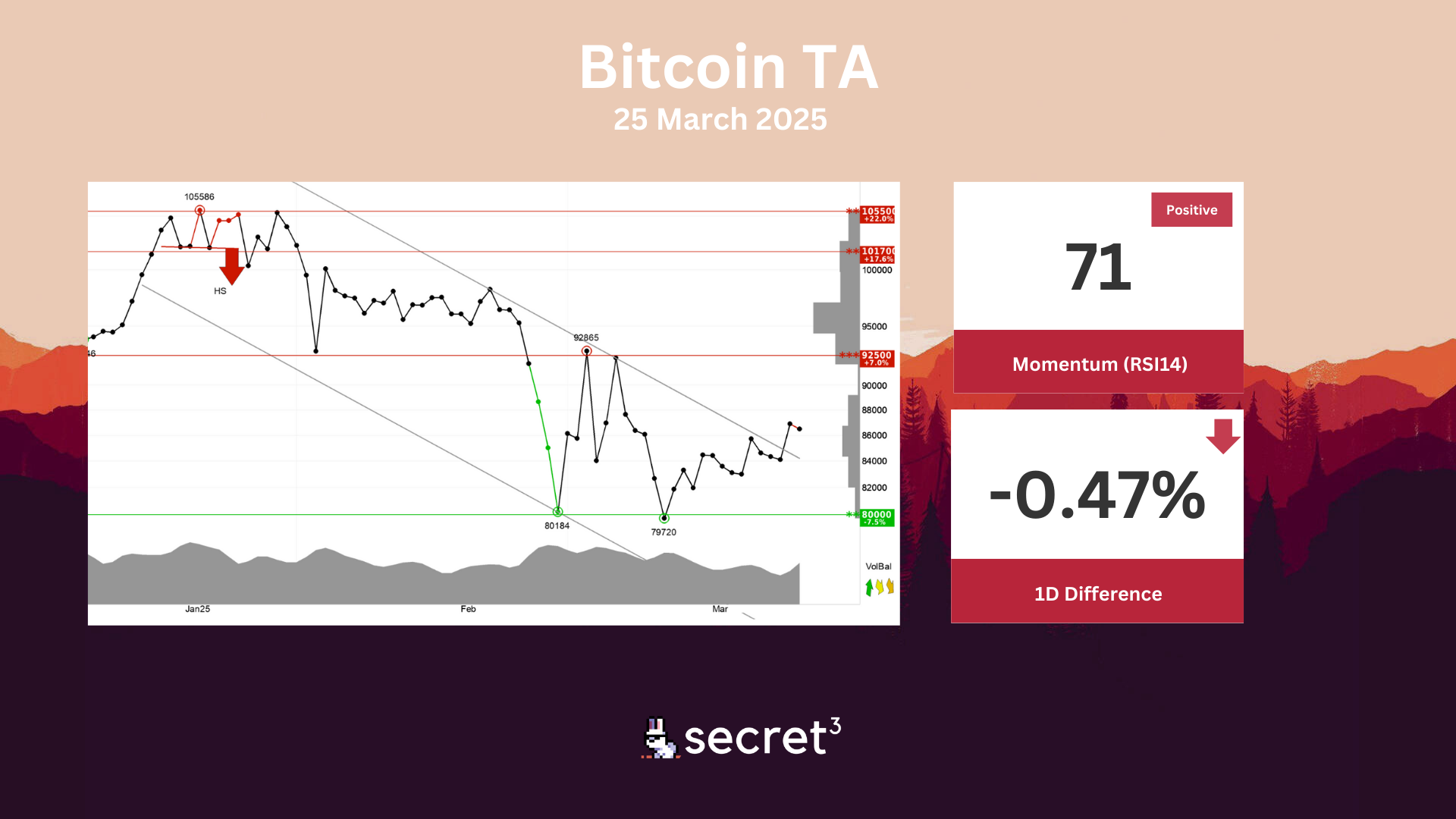

Bitcoin - Bitcoin has broken the ceiling of the falling trend in the short term, which indicates a slower initial falling rate. The currency has support at points 80000 and resistance at points 92500. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Bitcoin. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically slightly negative for the short term.

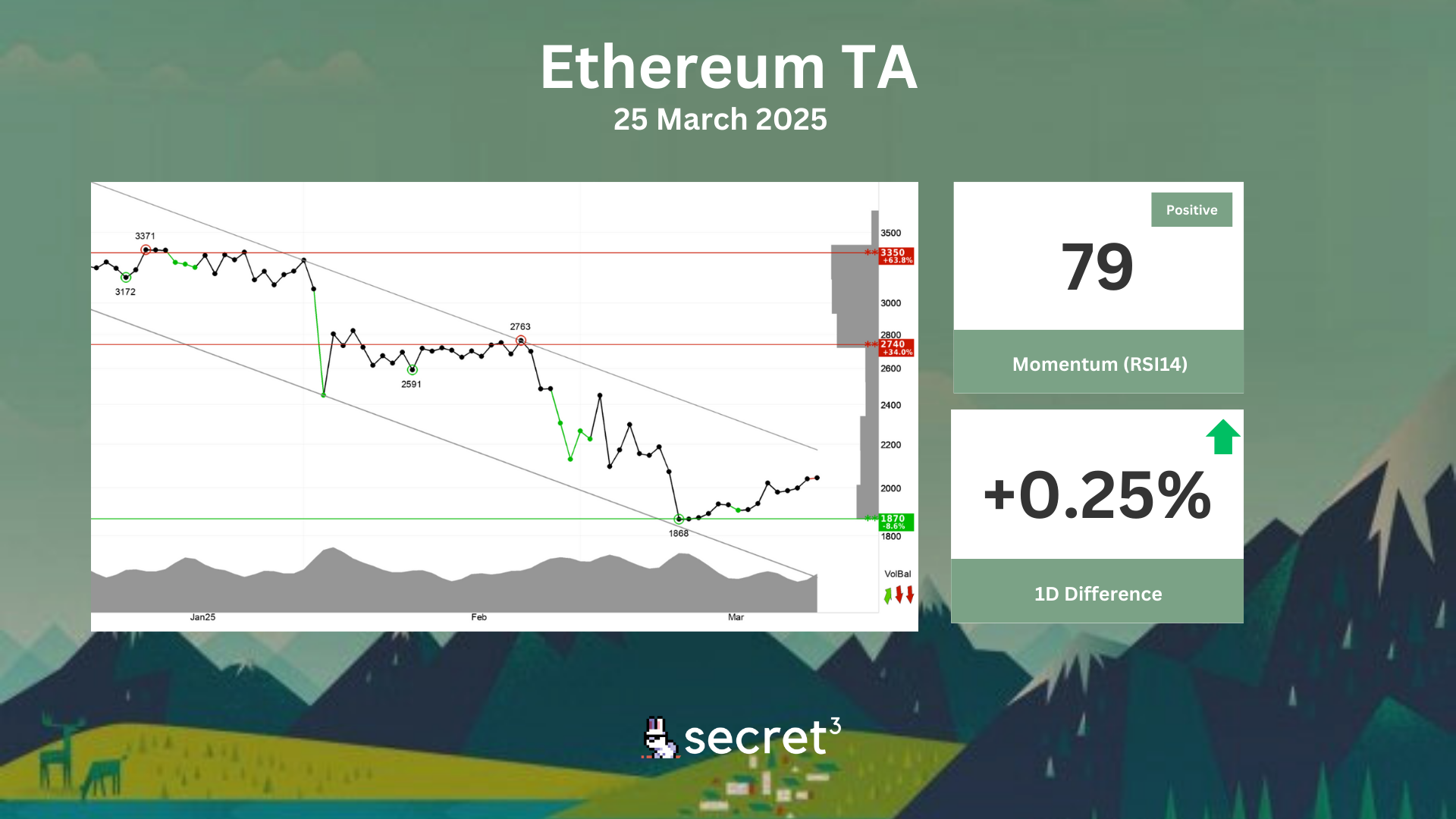

Ethereum - Ethereum is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. The currency has support at points 1870 and resistance at points 2740. The volume balance is negative and weakens the currency in the short term. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Ethereum. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically negative for the short term.