gm 25/02

Summary

gm, The SEC concluded its investigation into Robinhood Crypto without taking enforcement action. Meanwhile, Strategy (formerly MicroStrategy) completed a $2 billion convertible note offering to acquire more Bitcoin, signaling continued institutional interest. Market-wide, cryptocurrencies experienced notable declines, with Bitcoin falling below $95,000 and Ethereum dropping over 8%, while some altcoins like Solana and XRP saw even steeper losses amid broader market uncertainty. Amid these fluctuations, North Korean hackers linked to the Lazarus Group are reportedly laundering over $140 million stolen from Bybit.

News Headlines

💰 Ethena Raises $100M to Develop USDe Stablecoin for Traditional Finance

- Ethena, the developer of the synthetic stablecoin USDe, has raised $100 million to create a new token aimed at traditional financial institutions.

- USDe's market cap has surged to approximately $6 billion, ranking it as the third-largest stablecoin after Tether's USDT and Circle's USDC.

🔒 Bybit Hack Highlights Need for Institutional-Grade Security in Crypto

- Following a $1.4 billion hack at Bybit, Ledger CTO Charles Guillemet emphasized the necessity for stronger institutional-grade security measures in the crypto industry.

- Guillemet criticized current trust-based security models and urged adoption of robust enterprise-grade solutions to combat increasingly sophisticated attacks.

🌉 Celo, Chainlink, and Hyperlane Launch Crosschain USDT on OP Superchain

- Blockchain protocols Celo, Chainlink, and Hyperlane have launched Super USDT, a crosschain version of Tether's USDt, on the OP Superchain.

- Super USDT aims to enhance interoperability and liquidity of USDt, addressing fragmentation issues in traditional bridged USDT.

📉 Crypto Market Downturn: Bitcoin ETFs See Outflows, Altcoins Struggle

- The crypto market has declined significantly, with total market capitalization dropping 3% to approximately $3.1 trillion on February 24.

- Factors contributing to the downturn include the $1.4 billion Bybit hack and ongoing outflows from crypto investment products, totaling $508 million in the week ending February 21.

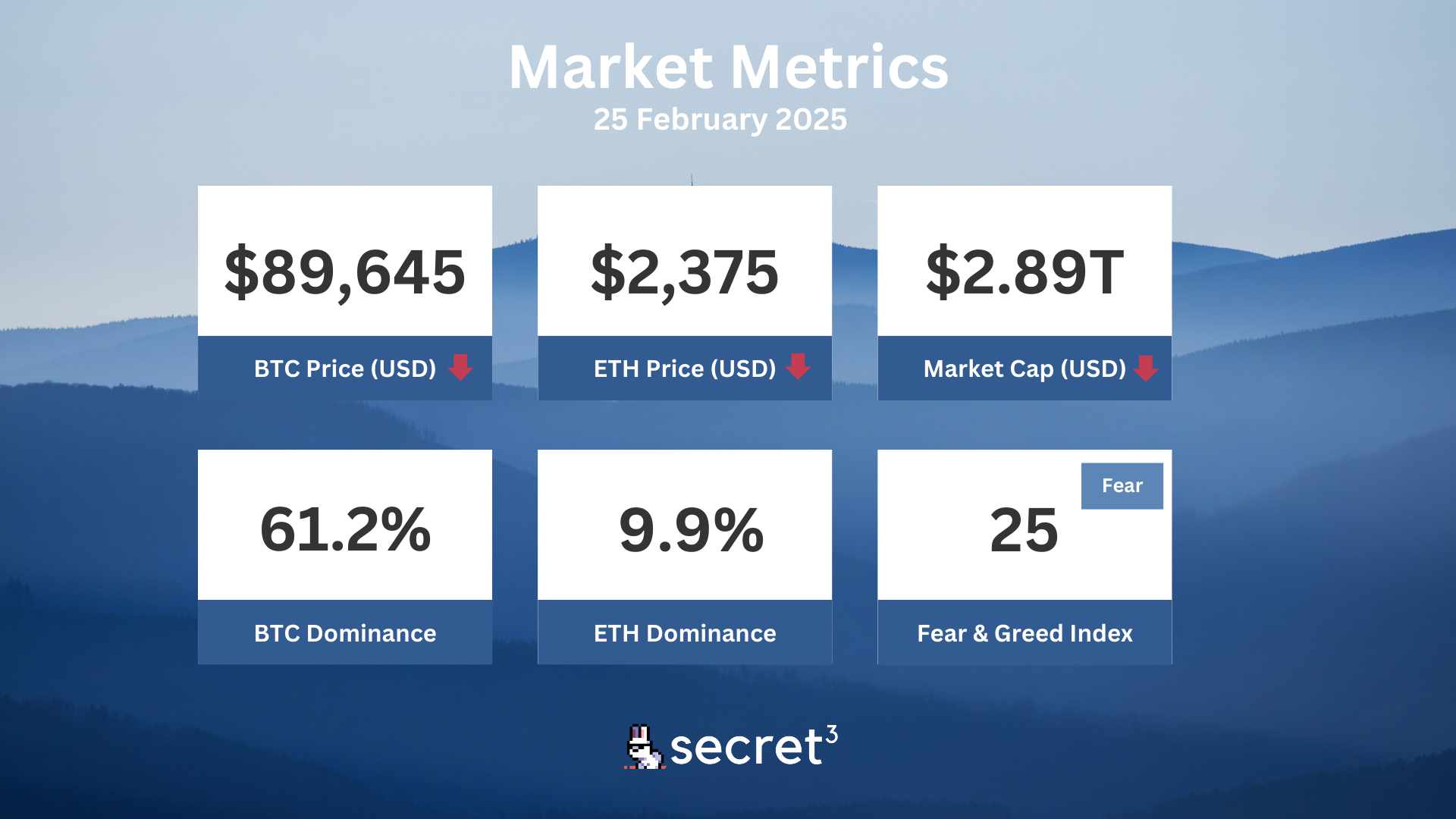

Market Metrics

Fundraising & VC

1. Ethena (Private Token Sale, $100M) - Synthetic dollar protocol on Ethereum

2. Imua (Seed, $5M) - Layer 1 blockchain

3. MeebCo (Strategic, $3M) - Company that manages the Meebits NFT collection and IP

On-chain Data

1. AltLayer (ALT) token unlocked today ($6.97M, 7.18%)

2. Xai (xai) token unlock in 1 day ($3.46M, 4.02%)

3. Grass (GRASS) token unlock in 2 days ($6.33M, 1.52%)

4. Portal (PORTAL) token unlock in 3 days ($3.86M, 19.54%)

Regulatory

🏦 DekaBank Launches Crypto Trading for Institutional Clients

- DekaBank, a major German financial institution, has introduced cryptocurrency trading and custody services for institutional clients.

- The bank received regulatory approval for a crypto custody license from Germany's BaFin.

🔍 Adam Back Blames EVM for Bybit Hack

- Bitcoin advocate Adam Back attributes the $1.4 billion Bybit hack to the 'mis-design' of the Ethereum Virtual Machine (EVM).

- Back criticized the EVM's complexity, describing it as 'fragile' and 'unsecurable'.

💻 EDX Markets Adds XRP, SOL, and Trump Coin to Offerings

- Wall Street-backed crypto exchange EDX Markets has added 17 new cryptocurrencies to its platform.

- The expansion aims to attract institutional investors and accommodate growing demand for crypto.

💹 Crypto ETPs Face $508M Outflow as Bitcoin Sell-off Continues

- Crypto exchange-traded products experienced $508 million in outflows last week, primarily from Bitcoin ETFs.

- The US saw the majority of outflows, while Europe continued to attract steady inflows.

🏛️ SEC Closes Robinhood Crypto Investigation Without Action

- The SEC's Enforcement Division has concluded its investigation into Robinhood Crypto without recommending any enforcement action.

- This decision comes less than a year after Robinhood received a Wells notice from the SEC regarding potential securities violations.

Technical Analysis

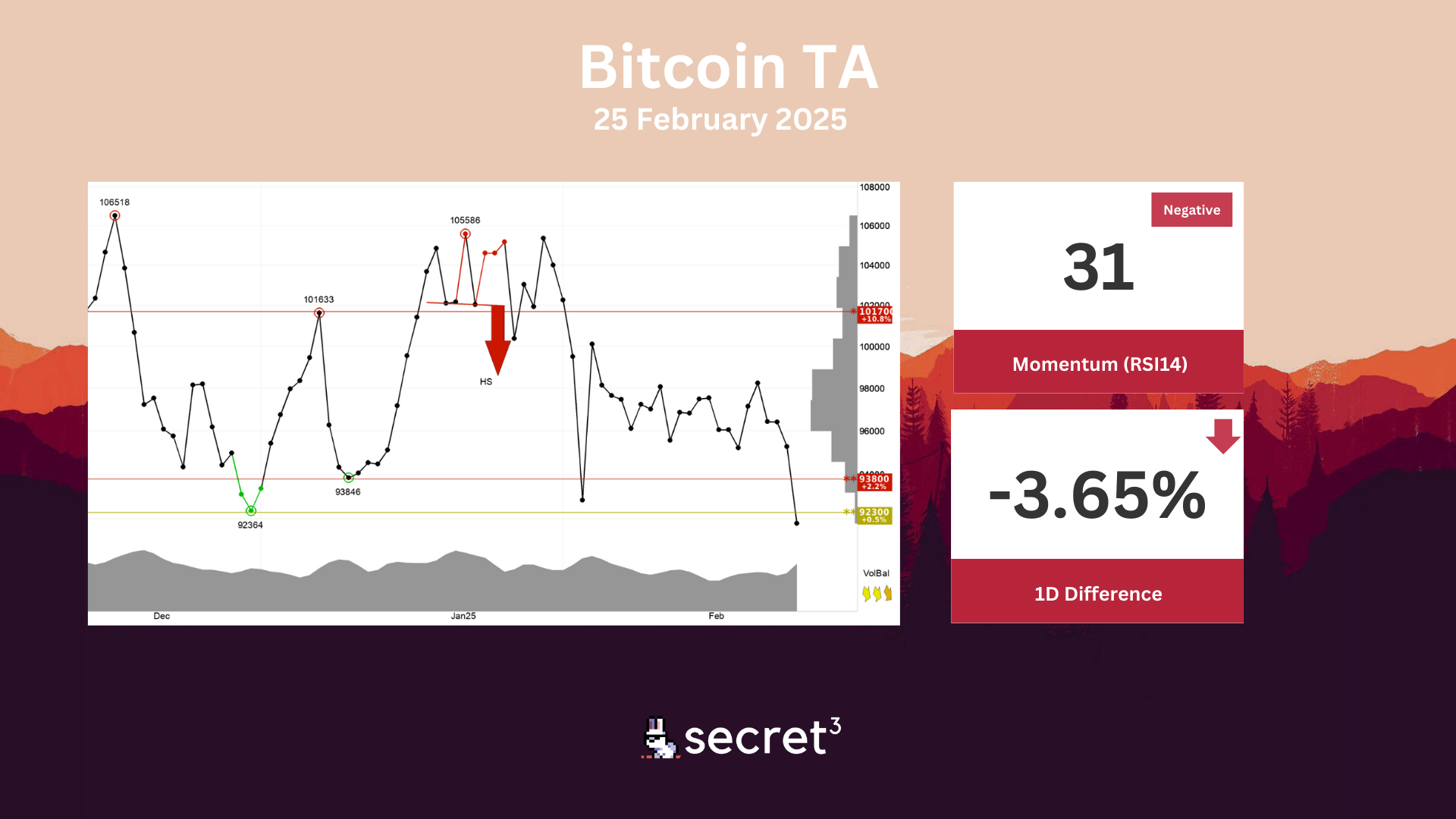

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. The currency has broken down through support at points 92300. This predicts a further decline. The currency is assessed as technically negative for the short term.

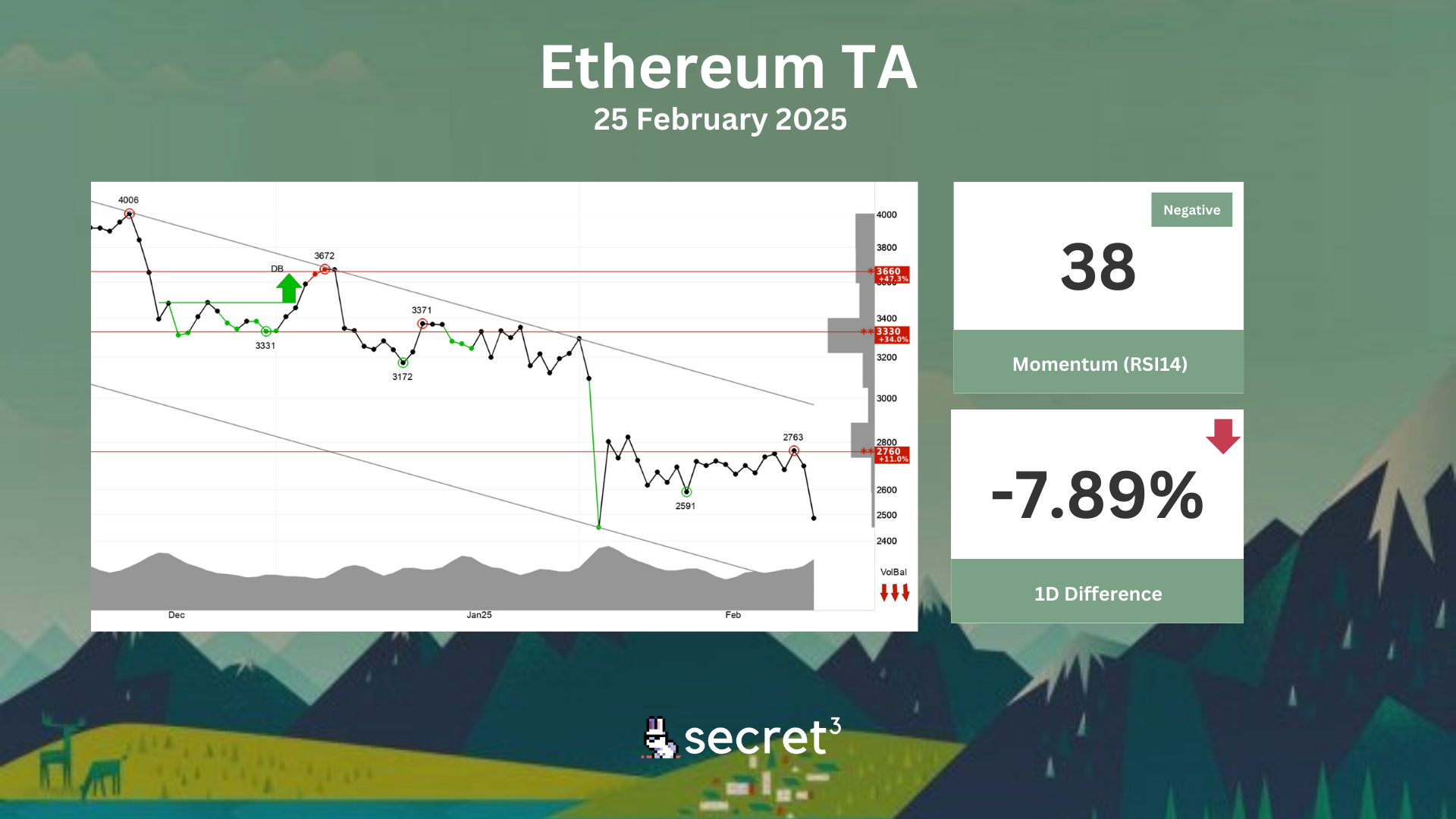

Ethereum - Ethereum is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2760 points. Volume has previously been low at price tops and high at price bottoms. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

🐒 ApeCoin DAO | Artiflex AI (Preliminary Discussion)

- This proposal requests $337,000 to fund the development of Artiflex AI, a platform on ApeChain that aims to enable users to customize, enhance, and create AI-generated NFTs.

⚙️ Frax DAO | Frax North Star Proposal (Preliminary Discussion)

- This proposal from the Frax Core Team aims to implement the upgrading of FXS, the Frax North Star Hardfork, the Tail Emission Plan, and the Flox Capacitator Boost.

⚖️ Balancer DAO | Grant Maxis Role for Balancer Contract Registry

- This proposal aims to grant the Balancer Maxis multisig the role for functions related to the new Balancer Contract Registry, which will contain all v3 contracts.