gm 25/01

Summary

gm, The cryptocurrency market has seen significant developments highlighted by President Donald Trump's executive order establishing a working group on digital asset markets and considering the creation of a national digital asset stockpile. This move has sparked optimism in the crypto community, with Bitcoin rising above $105,000. The SEC's rescission of the controversial SAB 121 accounting rule is viewed as a positive step for institutional crypto adoption. Meanwhile, Solana's ecosystem experienced a surge in activity, with its stablecoin supply doubling to a record $10.5 billion, driven largely by trading around the newly launched TRUMP memecoin. These events underscore the growing intersection of politics, regulation, and market dynamics in the crypto space.

News Headlines

📊 Bitcoin Whales Accumulating After Trump Inauguration

- Large Bitcoin holders are re-entering the market after profit-taking earlier in January.

- This accumulation is attributed to expectations of pro-crypto policies under Trump.

💰 BlackRock Bitcoin ETF May Allow In-Kind BTC Redemptions

- Nasdaq filed a proposal to allow in-kind redemptions for BlackRock's iShares Bitcoin ETF (IBIT).

- This would enable institutional investors to redeem ETF shares directly for Bitcoin.

🌐 Andreessen Horowitz Closes UK Office to Focus on US Crypto Efforts

- Venture capital firm Andreessen Horowitz is shutting down its UK office.

- The decision is driven by Trump's pro-crypto stance and regulatory changes in the US.

💻 MetaMask Expands Beyond Ethereum to Include Bitcoin Functionality

- MetaMask is developing Bitcoin integration as part of a multi-chain approach.

- The wallet aims to provide a comprehensive Bitcoin experience within its platform.

🏦 MicroStrategy Announces Debt Buyback Amid Potential Tax on BTC Gains

- MicroStrategy issued a redemption notice for its $1.05 billion 2027 convertible senior notes.

- The company may face taxes on $19 billion in unrealized Bitcoin gains.

Market Metrics

Fundraising & VC

1. SignalPlus (Series B, $11M) - Crypto derivatives solutions

2. Breez (Undisclosed, $5M) - Bitcoin payments

3. Printr (Pre Seed, $2.5M) - Chain-abstracted token marketplace

4. MinionLab (Pre Seed, $2M) - Decentralized network of autonomous AI agents

On-chain Data

1. AltLayer (ALT) token unlocked today ($14.15M, 7.92%)

2. Xai (xai) token unlock in 1 day ($7.71M, 5.79%)

3. Grass (GRASS) token unlock in 2 days ($6.82M, 1.52%)

Regulatory

🏛️ Trump Signs Executive Order on Crypto, Bans CBDCs

- President Trump signed an executive order creating a crypto working group and banning central bank digital currencies (CBDCs).

- The order aims to explore federal regulations for stablecoins and potentially develop a national digital asset stockpile.

⚖️ Congress Investigates Alleged Crypto Debanking Under Biden Administration

- The House Oversight Committee is investigating claims that crypto firms were denied banking services under Biden.

- Letters were sent to crypto executives seeking information on potential politically-motivated debanking.

🌐 ECB Member Reiterates Need for Digital Euro After Trump's Order

- ECB board member Piero Cipollone stressed the need for a digital euro following Trump's stablecoin-focused order.

- Concerns were raised that Trump's stance could push users towards stablecoins over traditional banks.

🤝 Ripple Seeks Deadline for Cross-Appeal Brief in SEC Case

- Ripple requested an April 16 deadline for its cross-appeal brief in the ongoing SEC case.

- The brief will address the SEC's claims regarding XRP classifications.

🚨 THORChain Halts Bitcoin and Ether Lending Amid Insolvency Risks

- THORChain suspended its lending and savers programs for Bitcoin and Ether.

- The protocol faces liabilities of around $200 million, primarily in these cryptocurrencies.

Technical Analysis

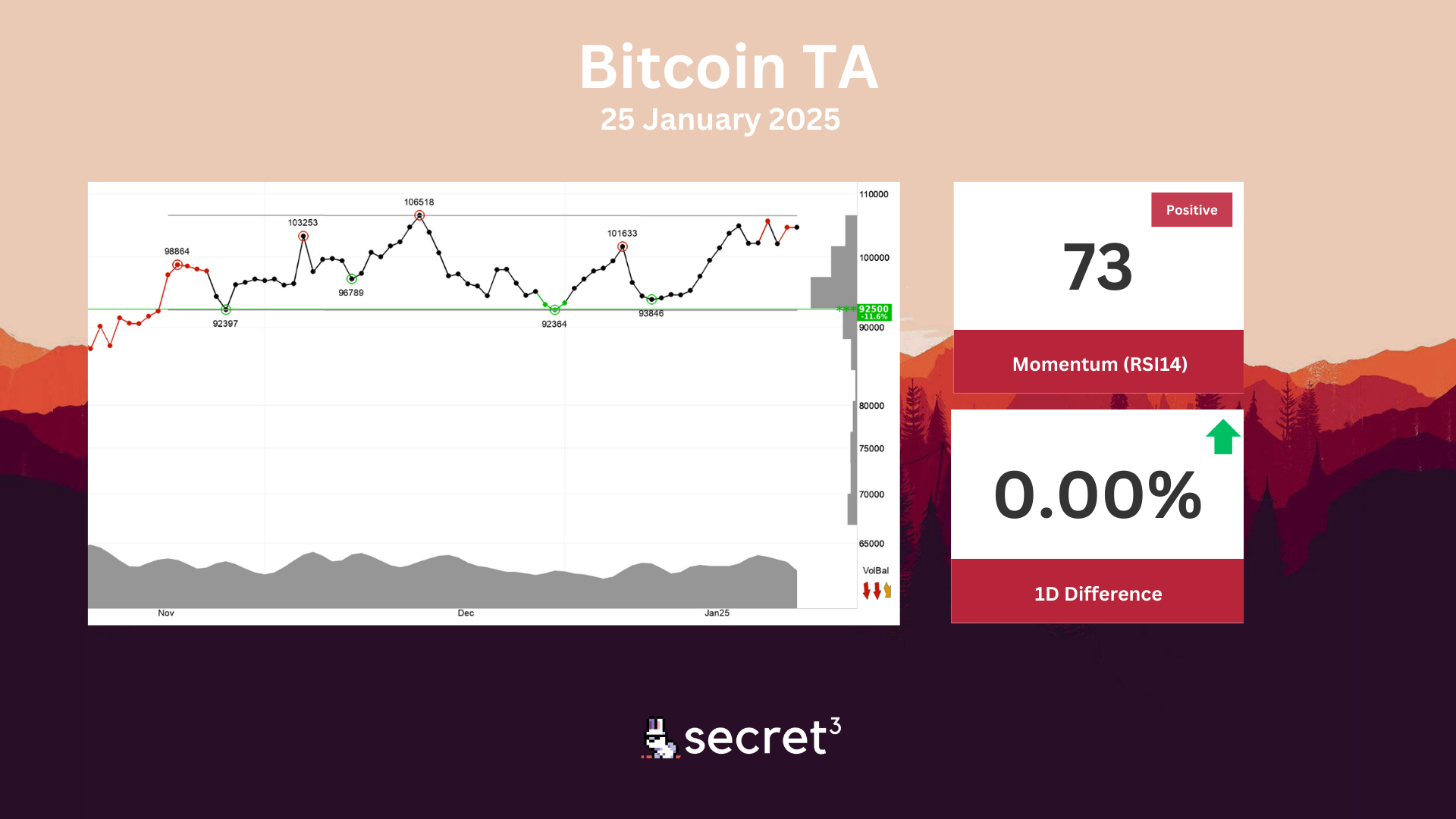

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term. This indicates that investors are uncertain and waiting for signals of further direction. A break upwards will be a positive signal, while a break downwards will be a negative signal. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 92500 points. The volume balance is negative and weakens the currency in the short term. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Bitcoin. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically slightly positive for the short term.

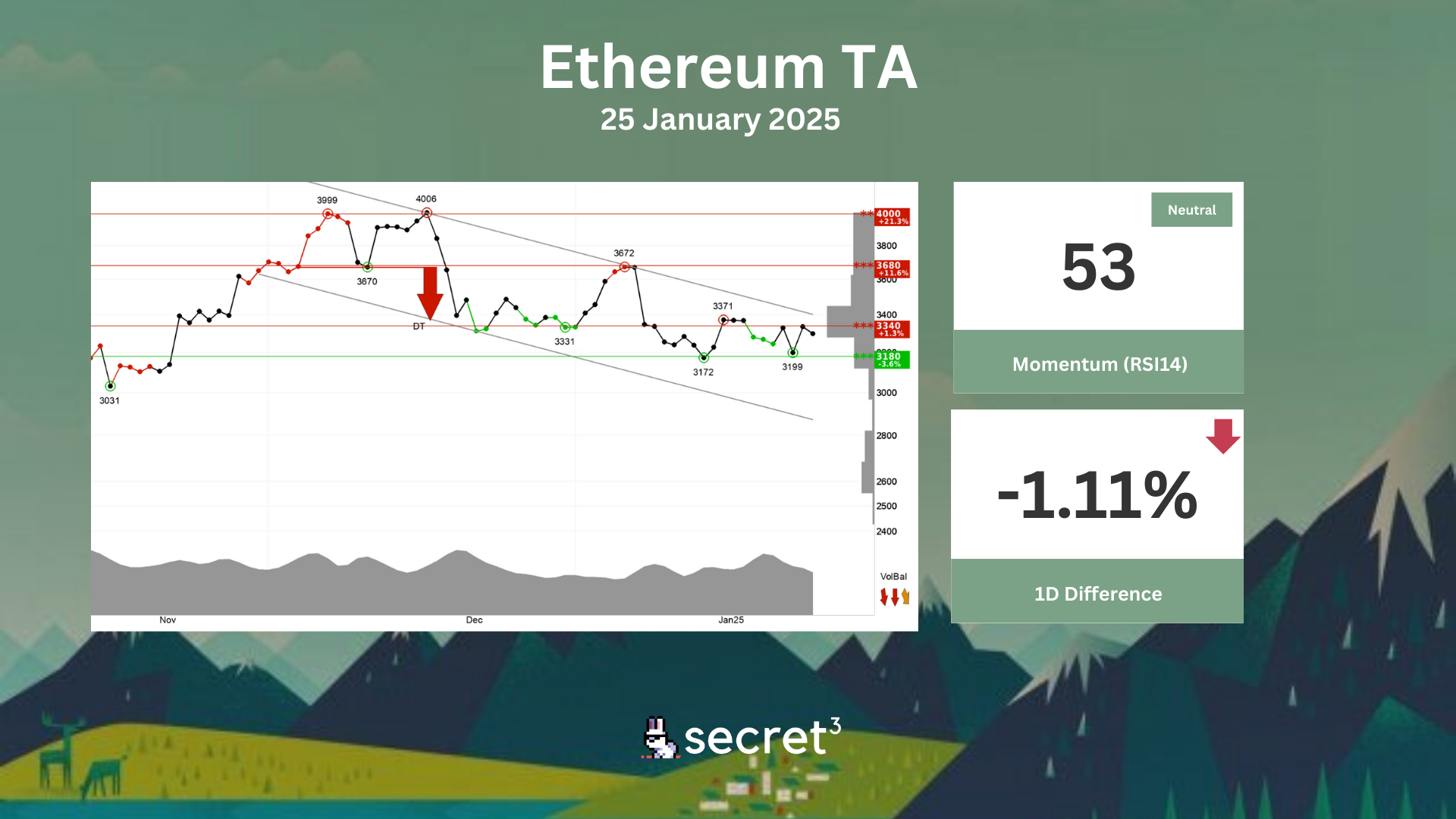

Ethereum - Ethereum is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. The currency is between support at points 3180 and resistance at points 3340. A definitive break through of one of these levels predicts the new direction. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

⚡ dYdX DAO | Kuyen Labs - VIP Affiliate Whitelist Proposal (204) (Active Vote)

- This proposal aims to whitelist new and existing VIP affiliates of the Kuyen Labs VIP Affiliate Program listed in the associated forum discussion.

⚔️ Spartan Council | Enable sUSDC As Margin (SCCP 386) (Active Vote)

- This proposal aims to add the ability to use sUSDC as margin on Base.

💰 Yearn DAO | Enable No-Code Deployment of V3 Vaults

- This proposal seeks to make V3 Vault generation available to everyone, without requiring developer experience.