gm 23/02

Summary

gm, The crypto market is grappling with the aftermath of a record-breaking $1.4 billion hack of the Bybit exchange, which has been attributed to North Korea's Lazarus Group. This massive security breach primarily involved Ethereum and staked ETH, contributing to significant price volatility for Ethereum. In regulatory news, the SEC has signaled a shift towards a more crypto-friendly approach, dropping investigations into both Coinbase and OpenSea, potentially easing pressure on the broader crypto and NFT markets. Meanwhile, Bitcoin has shown resilience, maintaining levels near $96,000 despite the market turbulence, while altcoins have begun to show signs of increased activity.

News Headlines

🌐 Over 50 Non-Crypto Companies Building on Ethereum

- A report highlights that over 50 non-crypto companies, including 20 financial institutions, are building on Ethereum.

- Major financial firms are exploring tokenized real-world assets on Ethereum and its layer 2 solutions.

🏦 Costa Rica Launches First Bitcoin ETF Through National Bank

- Costa Rica's largest commercial bank, Banco Nacional, is launching a Bitcoin ETF through its investment arm.

- This marks the first crypto investment product accessible through the country's banking system.

🚀 Altcoin Season Begins, Driven by Stablecoin Holders

- CryptoQuant CEO announces the start of altcoin season, primarily driven by stablecoin holders.

- Altcoin trading volume has reached approximately 2.7 times that of Bitcoin.

🌎 95% of Latin American Crypto Users Plan to Increase Holdings in 2025

- A Binance Research survey reveals high enthusiasm for crypto investment in Latin America.

- The region saw 116% growth in crypto users in 2024, reaching 55 million users.

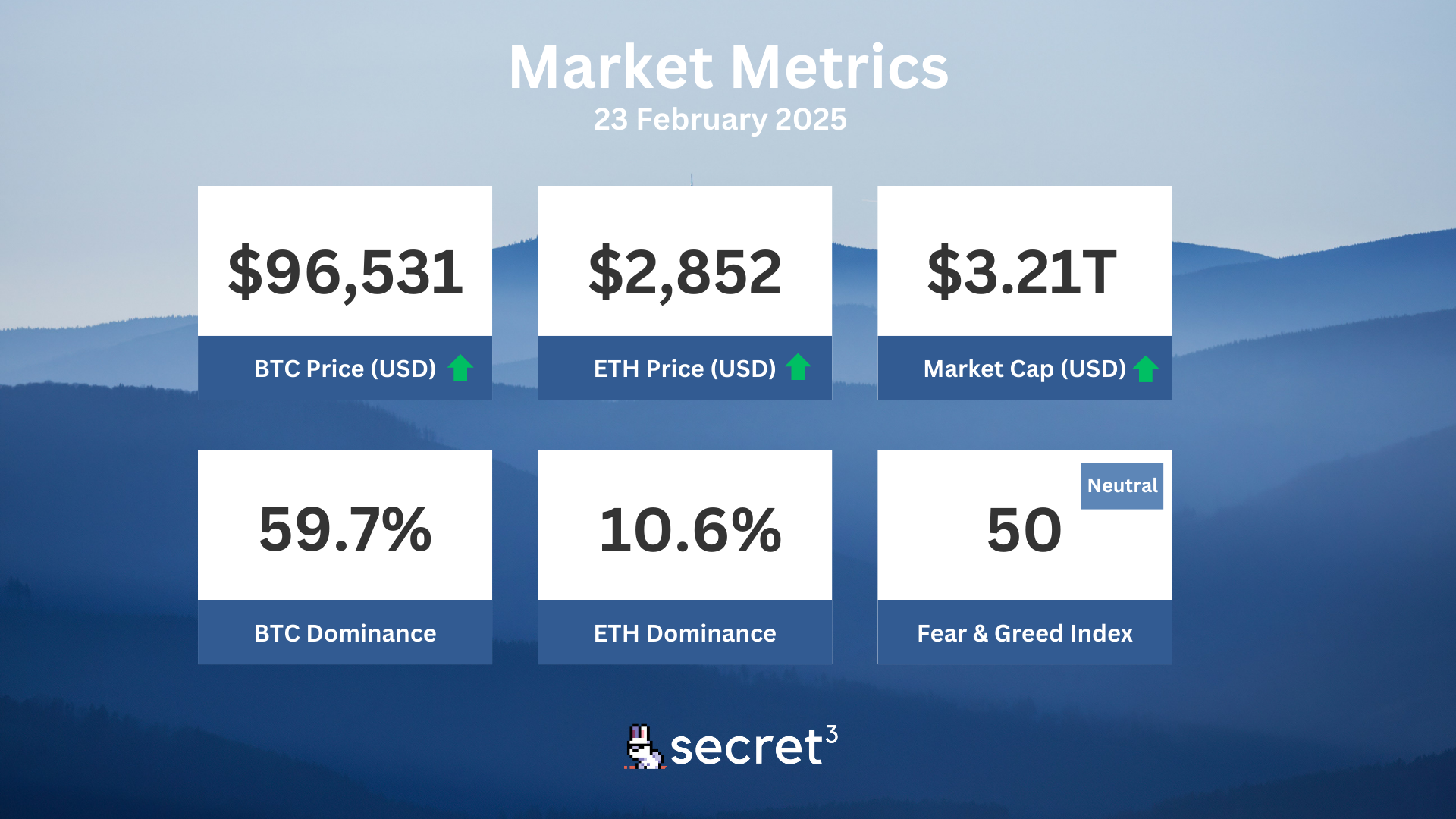

Market Metrics

Fundraising & VC

1. Infinity Ground (Seed, $2M) - Custom Agentic IDE & IDK

2. Dojo Coding (Pre Seed, Undisclosed) - Web3 developer training and incubation platform

On-chain Data

1. Coin98 (C98) token unlocked today ($1.42M, 1.59%)

2. Renzo (REZ) token unlocked today ($779.90K, 2.22%)

3. AltLayer (ALT) token unlock in 2 days ($8.86M, 7.18%)

Regulatory

🏦 U.S. Marshals Service Struggles with Cryptocurrency Management

- The U.S. Marshals Service is unable to provide an estimate of its crypto holdings, raising concerns about its management capabilities.

- This issue could impede plans for a national bitcoin reserve and highlights the need for better understanding of digital assets in government agencies.

🔒 North Korean Lazarus Group Behind Bybit Hack

- The Lazarus Group, linked to North Korea, has been identified as responsible for the $1.4 billion Bybit hack.

- This connection raises concerns about state-sponsored cyber threats in the crypto space and may lead to increased international regulatory cooperation.

💰 Coinbase's Political Spending Leads to Legal Victories

- Coinbase's aggressive political lobbying, including $70 million in spending, has contributed to favorable regulatory outcomes.

- This strategy highlights the growing influence of crypto companies in shaping regulatory landscapes through political engagement.

🔍 SEC Ends Investigation into NFT Marketplace OpenSea

- The SEC is concluding its investigation into OpenSea without pursuing enforcement action, easing pressure on the NFT market.

- This decision, along with the Coinbase case dismissal, indicates a shift in the SEC's regulatory approach to crypto and digital assets.

Technical Analysis

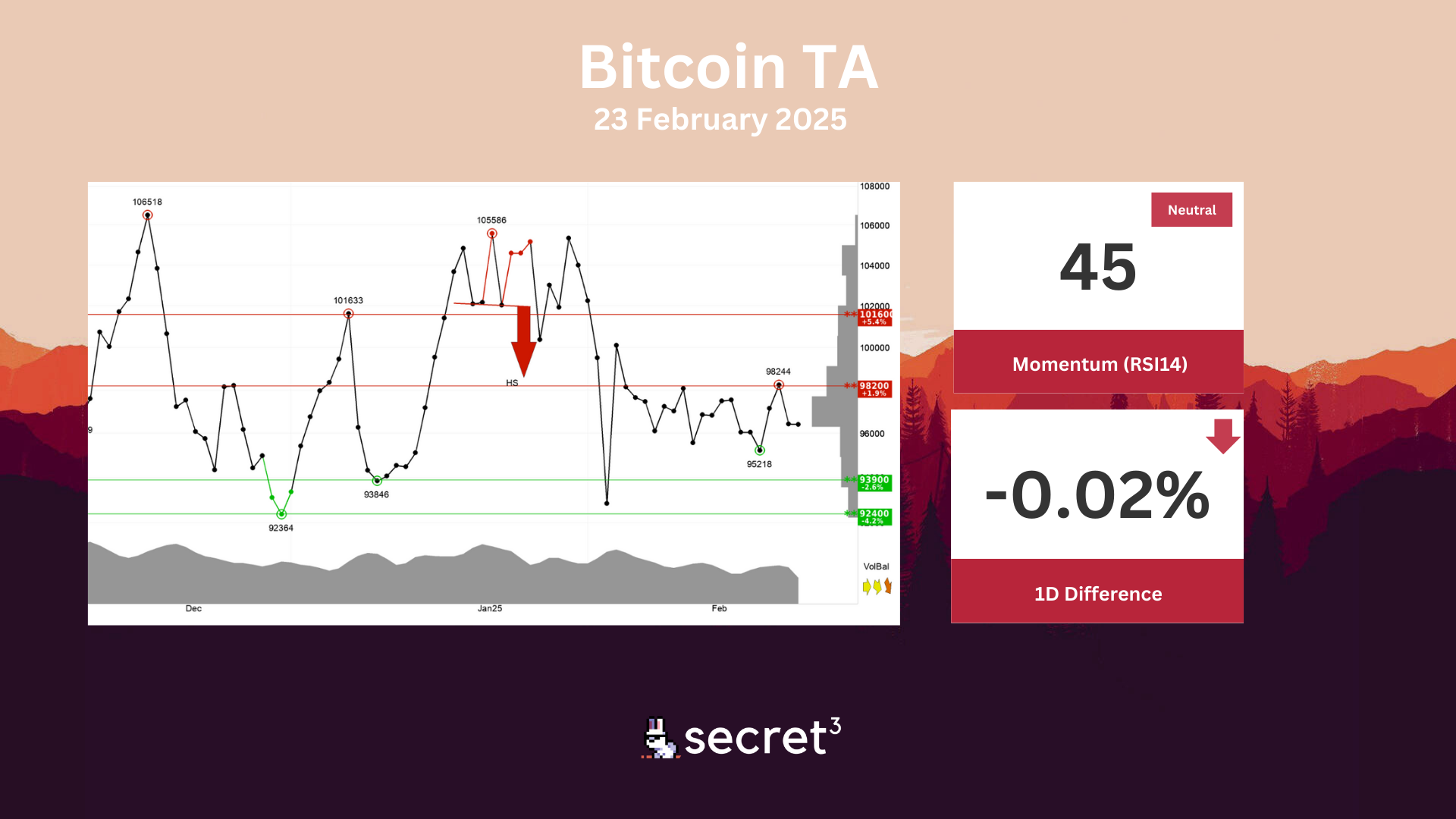

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term. This indicates that investors are uncertain and waiting for signals of further direction. A break upwards will be a positive signal, while a break downwards will be a negative signal. The currency has support at points 93900 and resistance at points 98200. The RSI curve shows a rising trend, which is an early signal of a possible trend reversal upwards for the price as well. The currency is overall assessed as technically neutral for the short term.

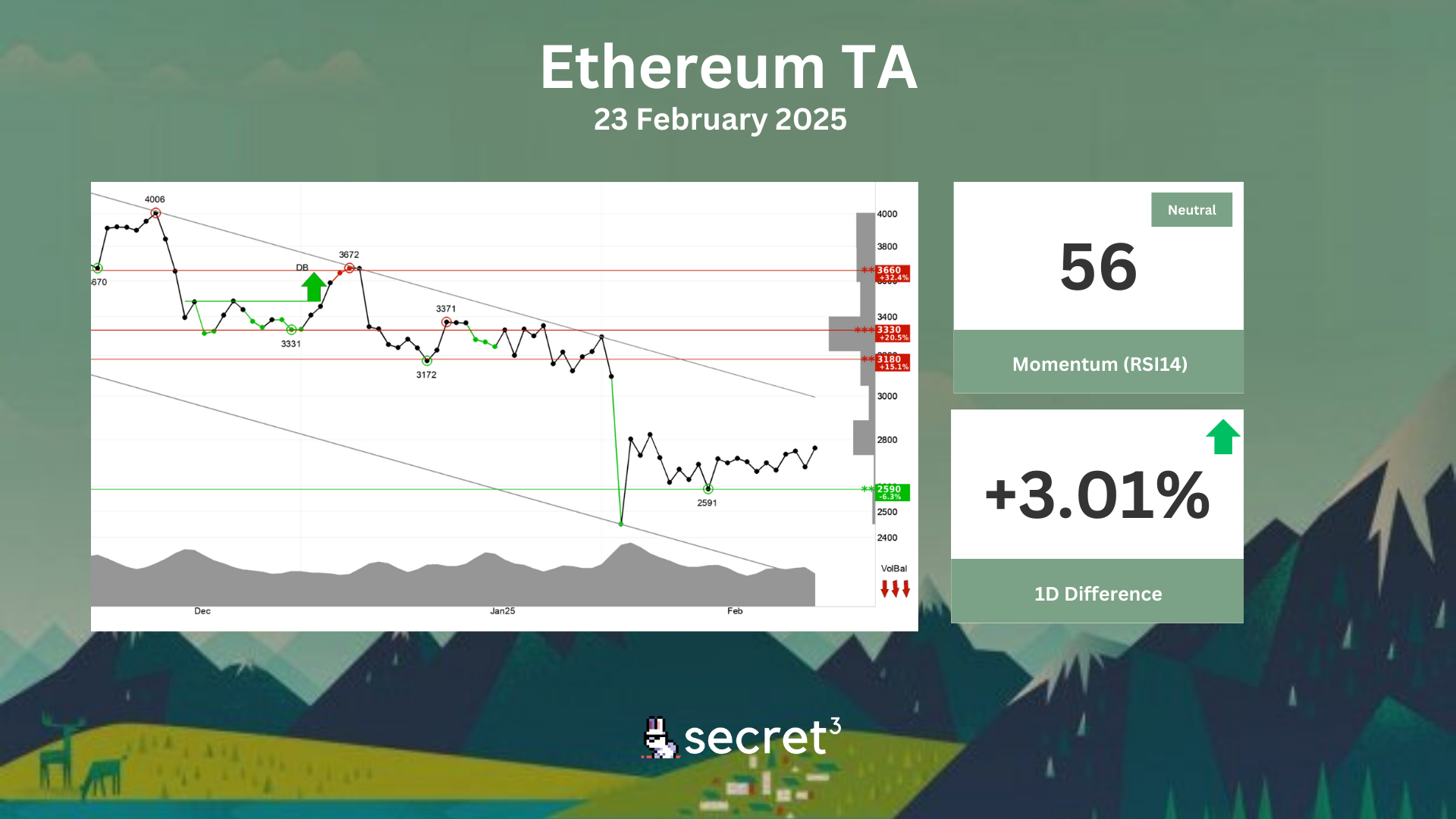

Ethereum - Ethereum is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. The currency has support at points 2590 and resistance at points 3180. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. The RSI curve shows a rising trend, which is an early signal of a possible trend reversal upwards for the price as well. The currency is overall assessed as technically negative for the short term.

Governance & Code

👻 Aave DAO | Deploy Aave v3 on megaETH (Preliminary Discussion)

- This proposal seeks to deploy an Aave V3 pool on megaETH.

☁️ Sky DAO | SparkLend Mainnet - Onboard LBTC (Preliminary Discussion)

- This proposal aims to onboard LBTC to SparkLend Ethereum.