gm 22/02

Summary

gm, The SEC's agreement to drop its lawsuit against Coinbase sparked optimism, leading to a brief rally in Bitcoin and other cryptocurrencies. However, this positive momentum was quickly overshadowed by a major security breach at Bybit, resulting in a $1.4 billion hack, reportedly carried out by North Korea's Lazarus Group. This incident caused a market-wide pullback, with Bitcoin retreating from near $100,000 to around $96,500. Meanwhile, regulatory shifts continue, with the SEC also ending its investigation into NFT marketplace OpenSea, signaling a potential easing of regulatory pressure on the crypto industry under the new administration.

News Headlines

📊 BlackRock Bitcoin ETF Surpasses 50% Market Share Despite Sell-Off

- BlackRock's Bitcoin ETF now holds over $56.8 billion in Bitcoin, capturing more than 50% market share among spot Bitcoin ETFs.

- This milestone was achieved despite recent outflows from Bitcoin ETFs totaling over $364 million in a three-day period.

🌐 Stripe and PayPal Driving Stablecoin Growth - Polygon Labs CEO

- Major payment providers like Stripe and PayPal are key catalysts for stablecoin industry growth, according to Polygon Labs CEO.

- These companies have made it easier for businesses to transact using fiat-equivalent tokens, driving adoption.

🏦 European Central Bank Advances Wholesale CBDC Development

- The ECB is developing a wholesale central bank digital currency (CBDC) payment system for financial institutions.

- This initiative aims to create a more integrated European financial ecosystem and compete with private stablecoins.

💰 Bybit Exchange Hacked for $1.4 Billion in Largest Crypto Theft Ever

- Cryptocurrency exchange Bybit suffered a $1.4 billion hack, the largest in crypto history, linked to North Korea's Lazarus Group.

- The hackers exploited a multisignature wallet vulnerability to steal Ethereum and other assets from Bybit's cold wallet.

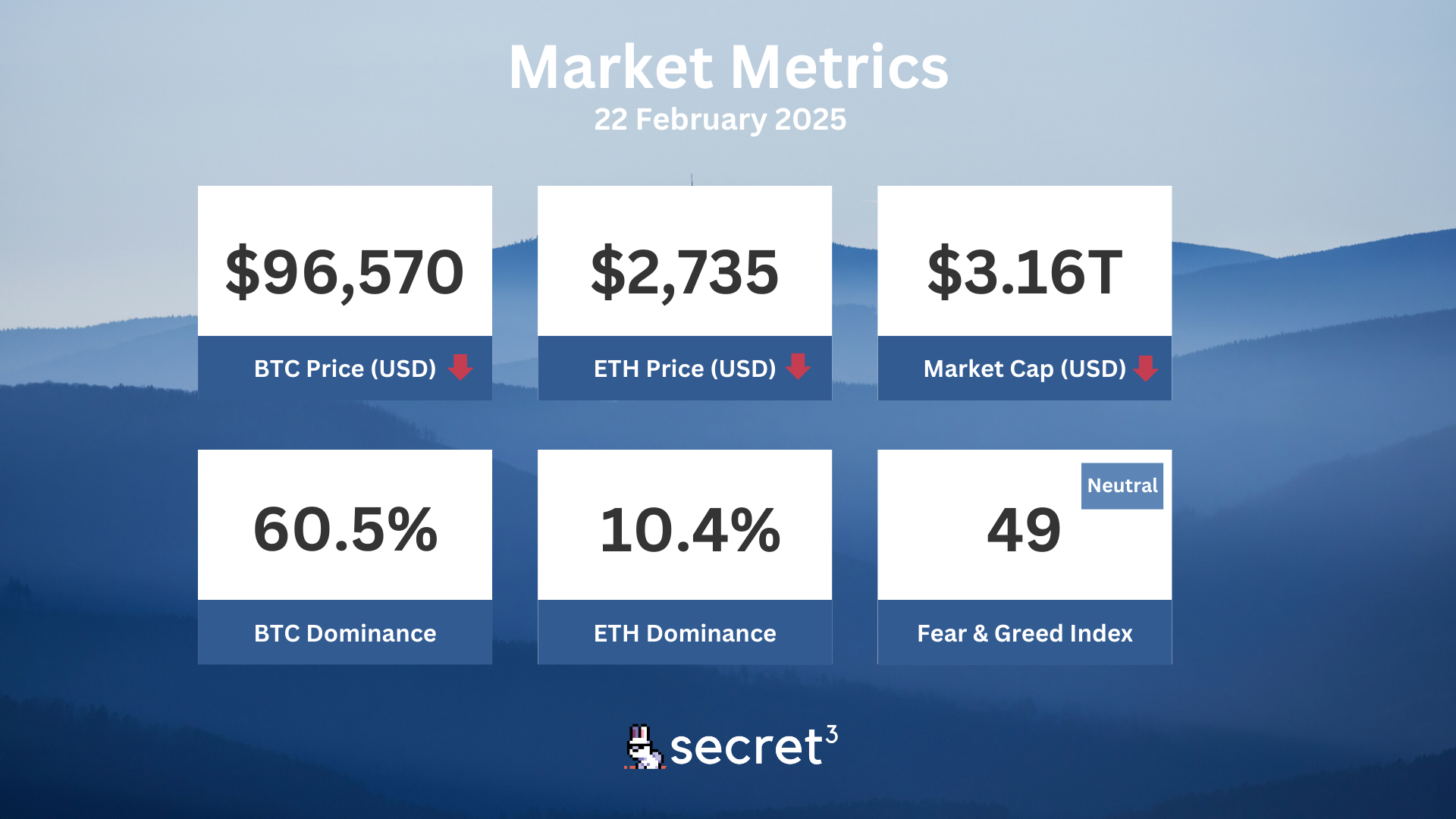

Market Metrics

Fundraising & VC

1. Primus Labs (Seed, $6.5M) - Cryptographic layer for secure data intelligence

2. Acre (Private Token Sale, $4M) - Bitcoin rewards network

3. AMMO (Pre Seed, $2.5M) - Architectures for massive multiagent online

4. WalletConnect (Private Token Sale, $1.5M) - Onchain UX ecosystem

On-chain Data

1. Space ID (ID) token unlocked today ($5.63M, 2.1%)

2. Coin98 (C98) token unlock in 1 day ($1.37M, 1.59%)

3. Renzo (REZ) token unlock in 1 day ($723.82K, 2.22%)

4. AltLayer (ALT) token unlock in 3 days ($8.42M, 7.18%)

Regulatory

💰 Figure Markets Launches SEC-Registered Yield-Bearing Stablecoin

- Figure Markets introduced YLDS, the first SEC-registered yield-bearing stablecoin.

- The stablecoin is backed by securities in prime money market funds and operates on the Provenance Blockchain.

🏛️ U.S. Senators Push for SEC to Allow Crypto Staking in ETFs

- Bipartisan senators are urging the SEC to reconsider its stance on allowing crypto staking in ETFs.

- They argue that staking is crucial for the security and vitality of digital asset protocols.

🌐 Kraken Considers Launching USD Stablecoin Amid Tether Delisting

- Kraken is exploring the launch of its own USD stablecoin in response to European regulations.

- This move comes as Kraken prepares to delist Tether's USDt due to regulatory pressures.

🚨 Russia Faces Surge in Crypto Crime, Supreme Court Prepares Legislation

- Russia is experiencing an increase in crypto-related crimes, prompting legislative action.

- The Supreme Court is preparing to classify cryptocurrencies as property in criminal proceedings.

🏦 Costa Rica's Largest Bank to Launch Bitcoin ETF

- Banco Nacional, Costa Rica's largest commercial bank, is set to launch a bitcoin ETF.

- This marks the first crypto investment product available through the country's banking system.

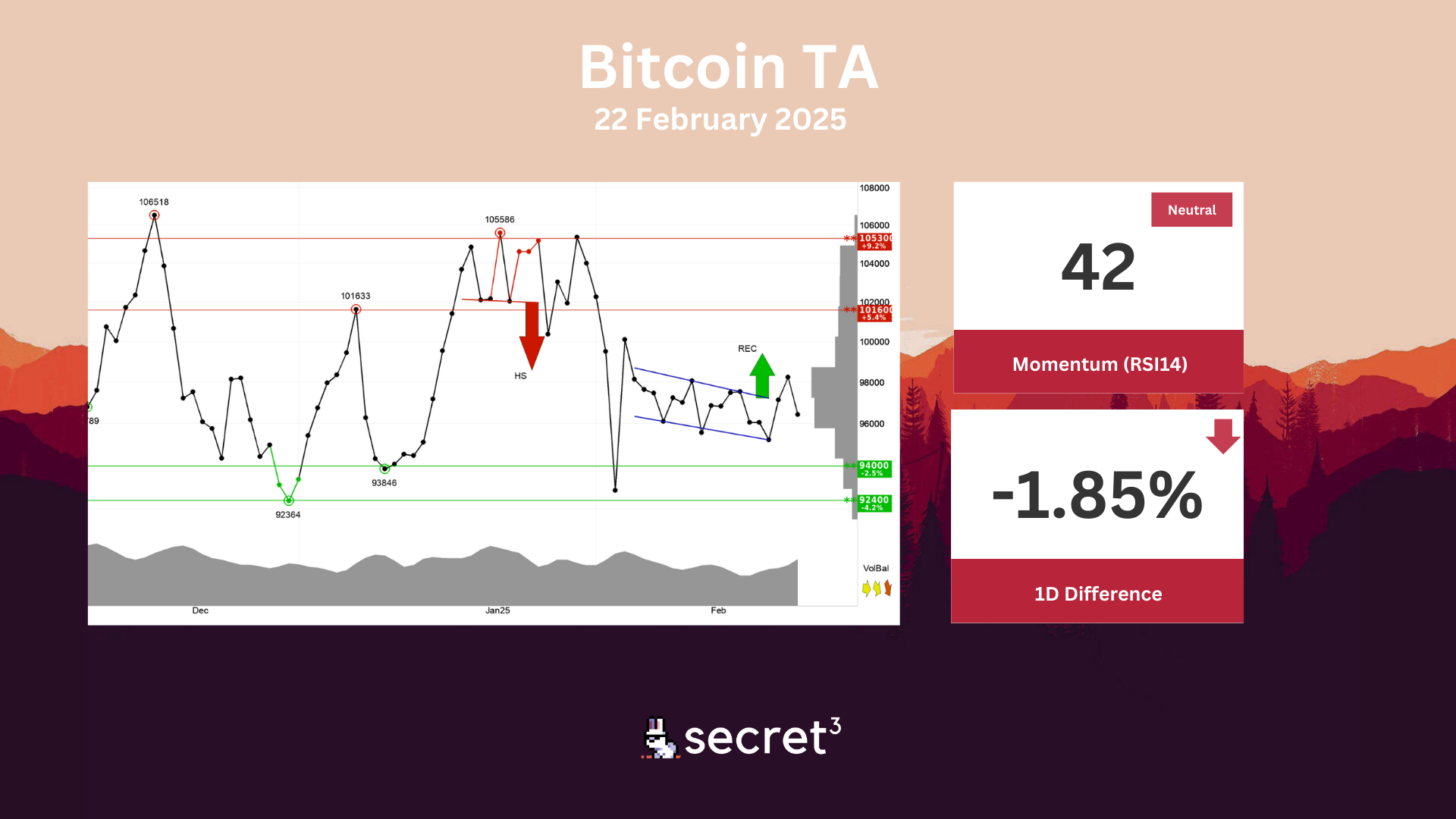

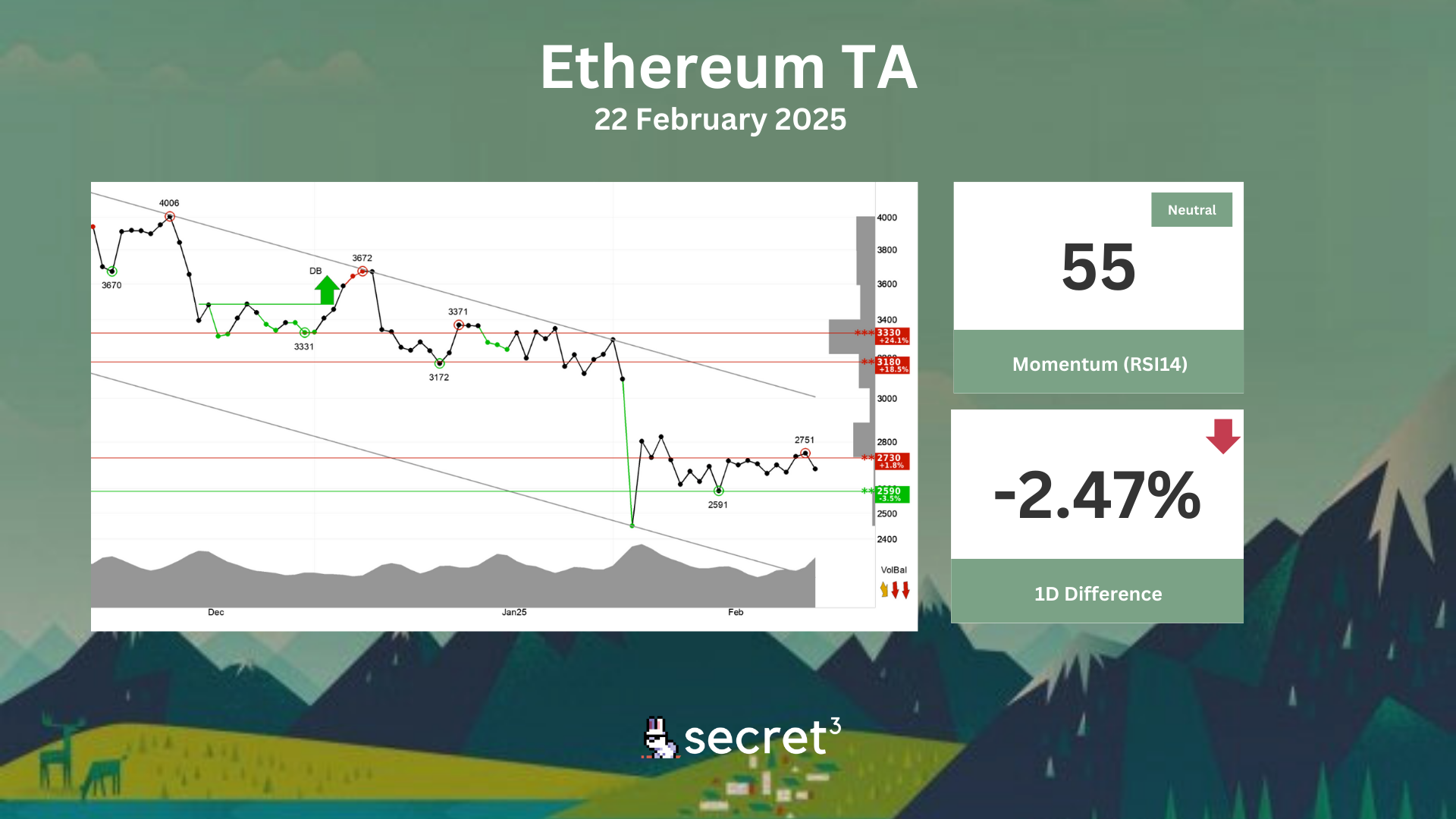

Technical Analysis

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. The currency has support at points 94000 and resistance at points 101600. The RSI curve shows a rising trend, which is an early signal of a possible trend reversal upwards for the price as well. The currency is overall assessed as technically neutral for the short term.

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency is between support at points 2590 and resistance at points 2730. A definitive break through of one of these levels predicts the new direction. Volume has previously been low at price tops and high at price bottoms. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

❄️ Everclear DAO | CLEAR Transfer Migrations (EGP 25) (Upcoming Vote)

- This proposal seeks to migrate CLEAR's minting rights from the Amarok bridge to Everclear due to the bridge undergoing a sunsetting process.

🐒 ApeCoin DAO | Vogue for Business (Preliminary Discussion)

- This proposal requests $75,000 in APE to fund Vogue, a podcast/platform aimed at "facilitating conversations for the APE ecosystem and helping build partnerships."