gm 21/05

Summary

gm, JPMorgan CEO Jamie Dimon announced the bank will soon allow clients to purchase Bitcoin despite his personal skepticism about cryptocurrencies. The U.S. Senate advanced the GENIUS Act stablecoin regulation bill with a key procedural vote of 66-32, potentially establishing a comprehensive framework for the $250 billion stablecoin market. Meanwhile, Ripple launched regulated XRP futures on CME with $1.5 million in first-day trading volume and expanded its cross-border blockchain payments in the UAE, partnering with Zand Bank and Mamo to enhance payment efficiency. As Bitcoin trades above $107,000 and approaches its all-time high, institutional interest continues to strengthen, evidenced by significant inflows into Bitcoin ETFs and Standard Chartered's prediction that BTC could reach $500,000 by early 2029.

News Headlines

💰 German Government Missed $2.3B Profit After Selling Bitcoin at $57K

- The German government lost a potential profit of over $2.3 billion after selling 49,858 Bitcoin at an average price of $57,900 in summer 2024, a decision that has proven costly as BTC now trades above $104,700.

- Blockchain analysis showed the government hastily sold across multiple exchanges without optimizing for profitability, prioritizing liquidity over minimal market impact.

🌊 Fluid's ETH-USDC Pool Suffers $8.5M in Losses Due to Flawed Design

- Fluid's ETH-USDC liquidity pool has lost over $8.5 million since December 2024 due to an ineffective rebalancing mechanism that failed during significant price volatility.

- The pool's structure allowed arbitrageurs to extract value rather than generate fees for liquidity providers, prompting Fluid to plan a v2 upgrade with dynamic fees and customizable LP ranges.

💳 Circle Explores $5B Sale Options Instead of IPO

- Circle, the USDC stablecoin issuer, is considering selling to either Coinbase or Ripple for at least $5 billion instead of proceeding with its planned IPO.

- Coinbase already holds a minority share in Circle and shares revenue from USDC's reserve interest, while Ripple has shown interest in acquiring the company despite Circle's official statement that it remains "committed to its IPO plans."

💸 El Salvador's Bitcoin Holdings Surge to $644M as Price Rallies

- El Salvador's Bitcoin reserves have increased to over $644 million, representing a $137 million gain in just one month, with the country now holding 6,181 BTC and ranking as the sixth-largest sovereign holder globally.

- Despite IMF loan agreements limiting cryptocurrency acquisitions, El Salvador continues to quietly accumulate Bitcoin at a rate of about 30 BTC per month, adhering to a strategy of buying one Bitcoin daily.

🔍 Coinbase Faces Multiple Lawsuits Following Customer Data Breach

- Coinbase is facing at least six lawsuits filed between May 15-16, with users accusing the exchange of failing to implement adequate security measures to protect customer data compromised after support agents were bribed.

- Plaintiffs allege Coinbase's response was fragmented and inadequate, failing to provide timely information to affected individuals, while the exchange has confirmed it declined a $20 million ransom and expects significant reimbursement expenses.

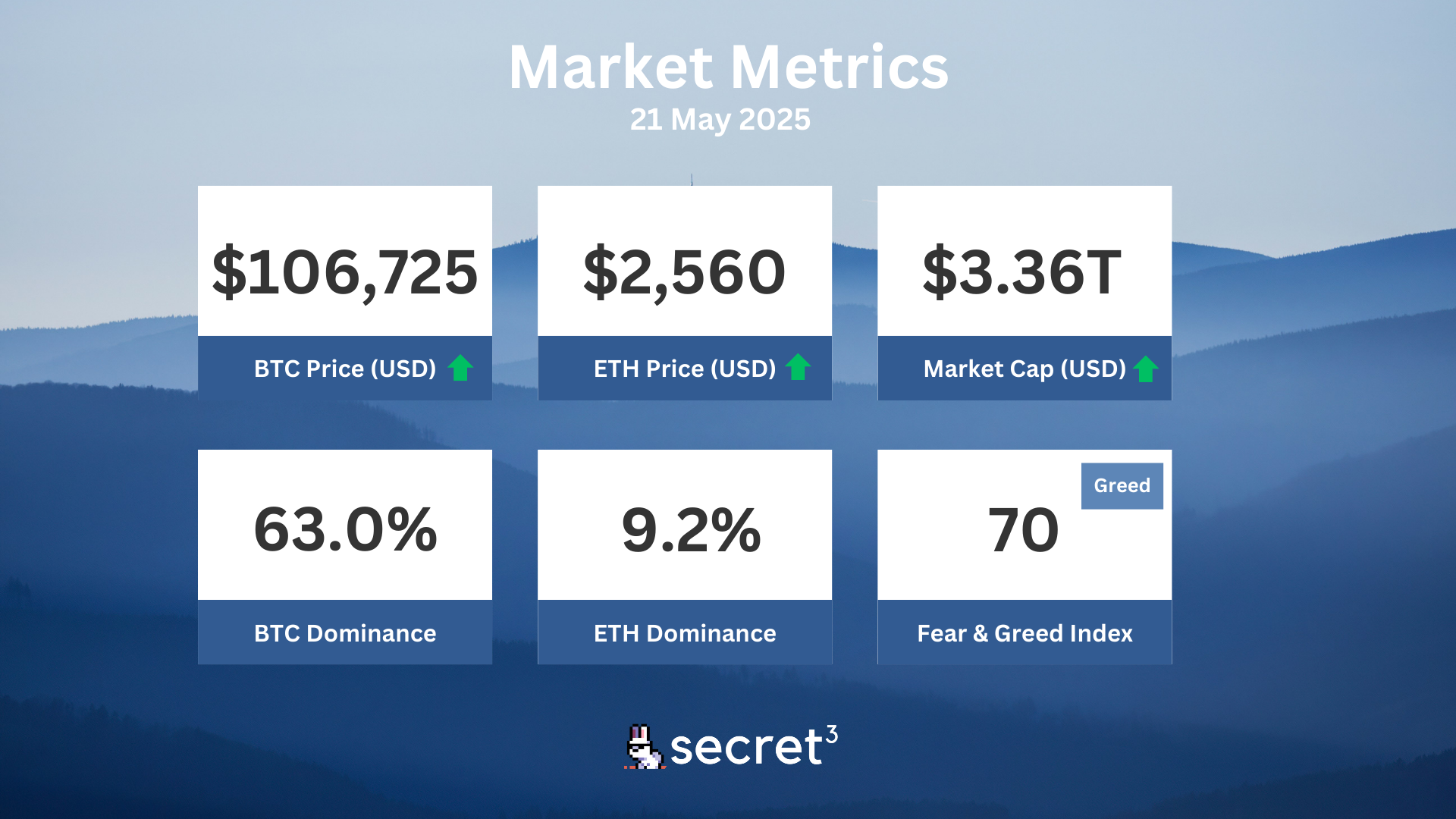

Market Metrics

Fundraising & VC

1. Slash (Series B, $41M) - Business banking for entrepreneurs

2. Catena Labs (Seed, $18M) - AI-native financial institution

3. TrueX (Series A, $11M) - Crypto exchange platform

4. Rover (Seed, $4.1M) - Liquid staking for BTC on Botanix

Regulatory

🔄 SEC Delays Decision on Solana ETF Filings

- The SEC has postponed decisions on several Solana ETF applications from 21Shares, Bitwise, VanEck, and Canary Capital, citing the need to evaluate legal and policy matters.

- The delay follows previous approvals for Bitcoin and Ethereum ETFs, as the SEC continues to cautiously approach the expanding ecosystem of crypto-based investment products.

⚖️ Genesis Sues DCG, Seeks $3.3 Billion Recovery

- Genesis has filed two lawsuits against parent company Digital Currency Group (DCG) and CEO Barry Silbert, alleging fraud and misappropriation of over $3.3 billion.

- The suits claim DCG used Genesis as a source for self-serving loans and concealed transfers, with over $1.2 billion allegedly withdrawn during key market distress periods.

🔐 Coinbase Working with DOJ on Customer Data Hack

- Coinbase confirmed it's collaborating with the U.S. Department of Justice following a hack that compromised customer data, with hackers demanding $20 million in Bitcoin.

- The exchange has offered a similar bounty for information leading to the capture of the attackers, while confirming no funds, passwords, or private keys were affected.

🏙️ NYC to Launch Crypto Advisory Council

- Mayor Eric Adams announced the formation of a digital assets advisory council aimed at making New York City the global "crypto capital."

- The initiative seeks to attract fintech jobs and implement blockchain technology for city services, including potentially managing birth and death records.

🔎 Indian Supreme Court Urges Crypto Regulation

- India's Supreme Court criticized the government for its lack of regulatory clarity regarding cryptocurrencies while simultaneously imposing a 30% tax on digital assets.

- Justice Surya Kant expressed concerns about the rising popularity of cryptocurrencies as a potential threat to the economy without proper regulatory oversight.

Technical Analysis

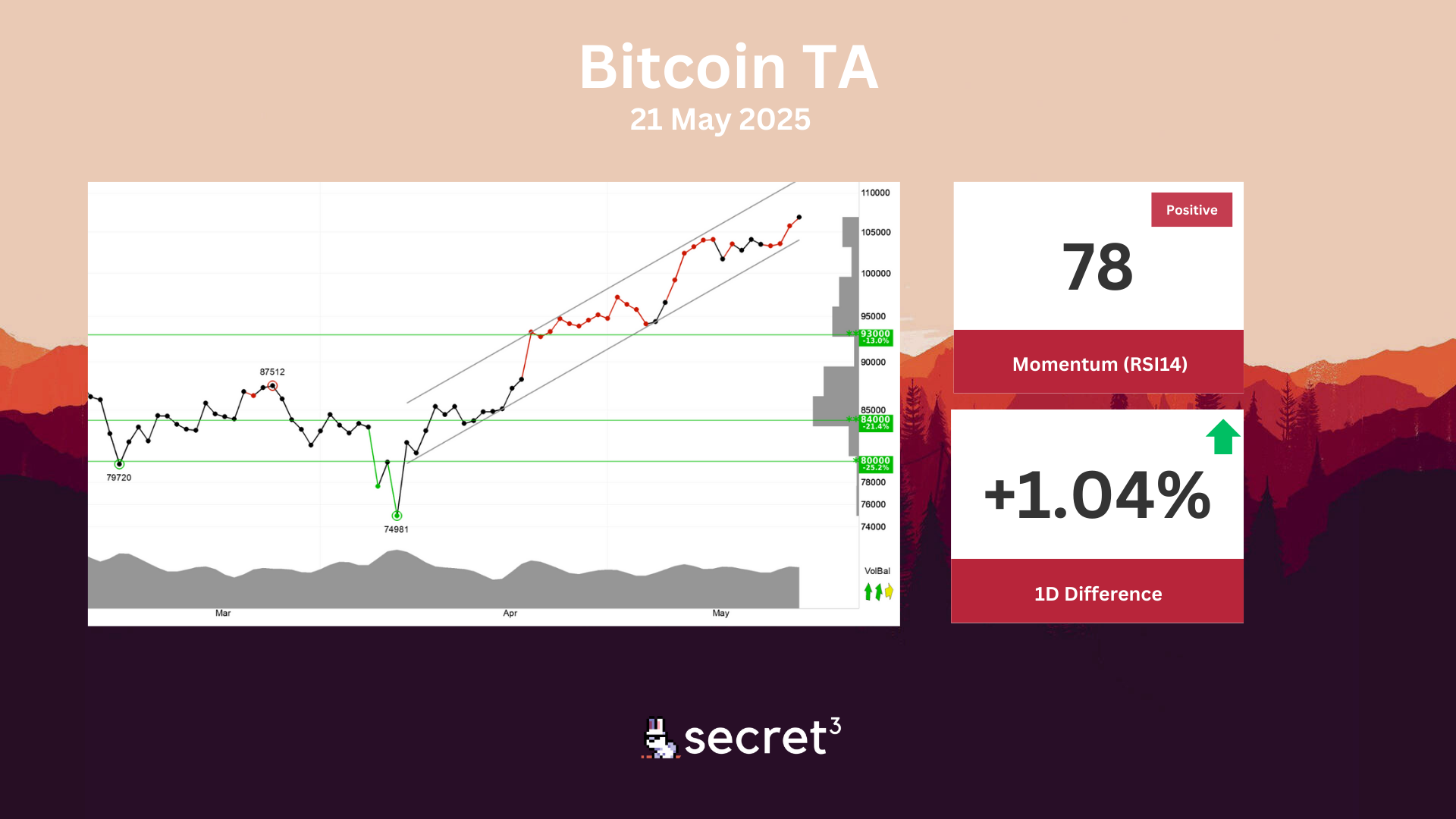

Bitcoin - Bitcoin is in a rising trend channel in the short term. This shows that investors over time have bought the currency at higher prices and indicates good development for the currency. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 93000 points. Positive volume balance indicates that volume is high on days with rising prices and low on days with falling prices, which strengthens the currency. RSI is above 70 after a good price increase the past weeks. The currency has strong positive momentum and further increase is indicated. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.

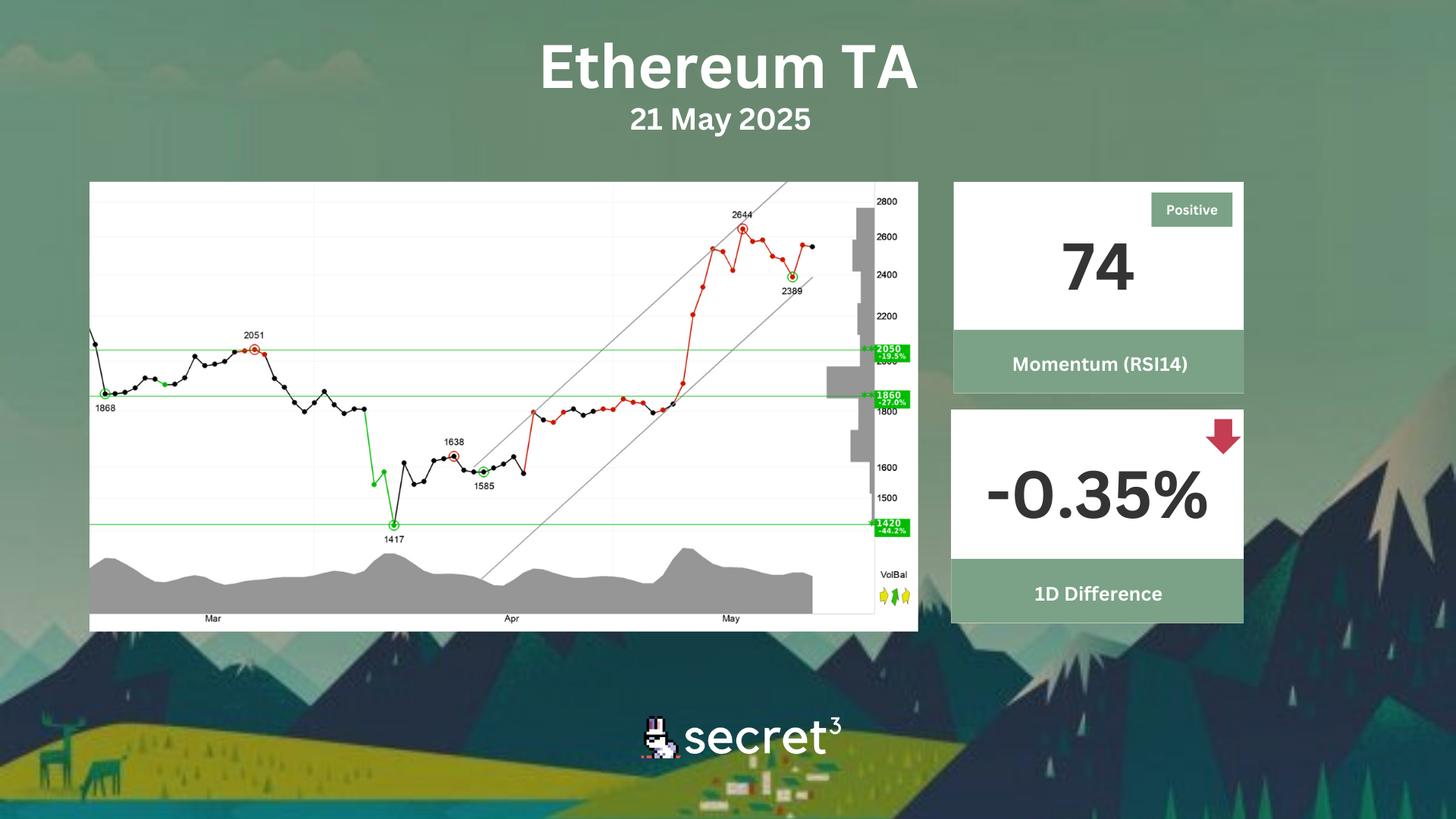

Ethereum - Ethereum is in a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 2050 points. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Ethereum. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.