gm 21/02

Summary

gm, Brazil approves the first spot XRP ETF and the SEC acknowledges multiple XRP ETF filings in the US, driving XRP's price up by 8%. Coinbase launched CFTC-regulated Solana futures contracts, potentially paving the way for a Solana ETF. Meanwhile, the European Central Bank announced plans to develop a blockchain-based payments system, signaling increased institutional interest in distributed ledger technology. Amidst these positive developments, concerns arose as a report revealed that pig butchering scams cost crypto investors $5.5 billion in 2024, highlighting the ongoing challenges of fraud in the industry.

News Headlines

📊 Franklin Templeton Launches Bitcoin and Ethereum Index ETF

- Franklin Templeton introduced the Franklin Crypto Index ETF (EZPZ), including both spot Bitcoin and Ether.

- The fund incorporates assets from the US CF Institutional Digital Asset Index, consisting of approximately 87% Bitcoin and 13% Ether.

🌟 Ethereum Creator Vitalik Buterin Disappointed With ETH Community

- Buterin expressed disappointment towards parts of the Ethereum community for their reluctance to embrace blockchain gambling applications.

- He raised concerns that Ethereum may lose its competitive edge to rivals like Solana if it does not open up to a broader array of applications.

🔮 DeFi Boom Predicted to Exceed "DeFi Summer" Starting September

- Charles d'Haussy, CEO of the dYdX Foundation, anticipates a significant boom in decentralized finance starting in September.

- He expects more entry points for newcomers and increased institutional engagement in this "DeFi festival."

📈 Spot Bitcoin ETF Inflows Stall, But CME BTC Basis Hints at Price Reversal

- Bitcoin ETF inflows have dropped to about 41,000 BTC in Q1 2025 compared to 100,000 BTC in Q1 2024.

- The 1-month basis of CME Bitcoin futures has dropped, suggesting potential bullish reversal signals.

💰 Strategy (Formerly MicroStrategy) Announces $2B Convertible Note Offering to Buy More Bitcoin

- Strategy launched a $2 billion senior convertible note offering aimed at acquiring additional Bitcoin and financing operational costs.

- The notes feature a 0% coupon rate, maturing on March 1, 2030, and can be converted into shares of Class A common stock.

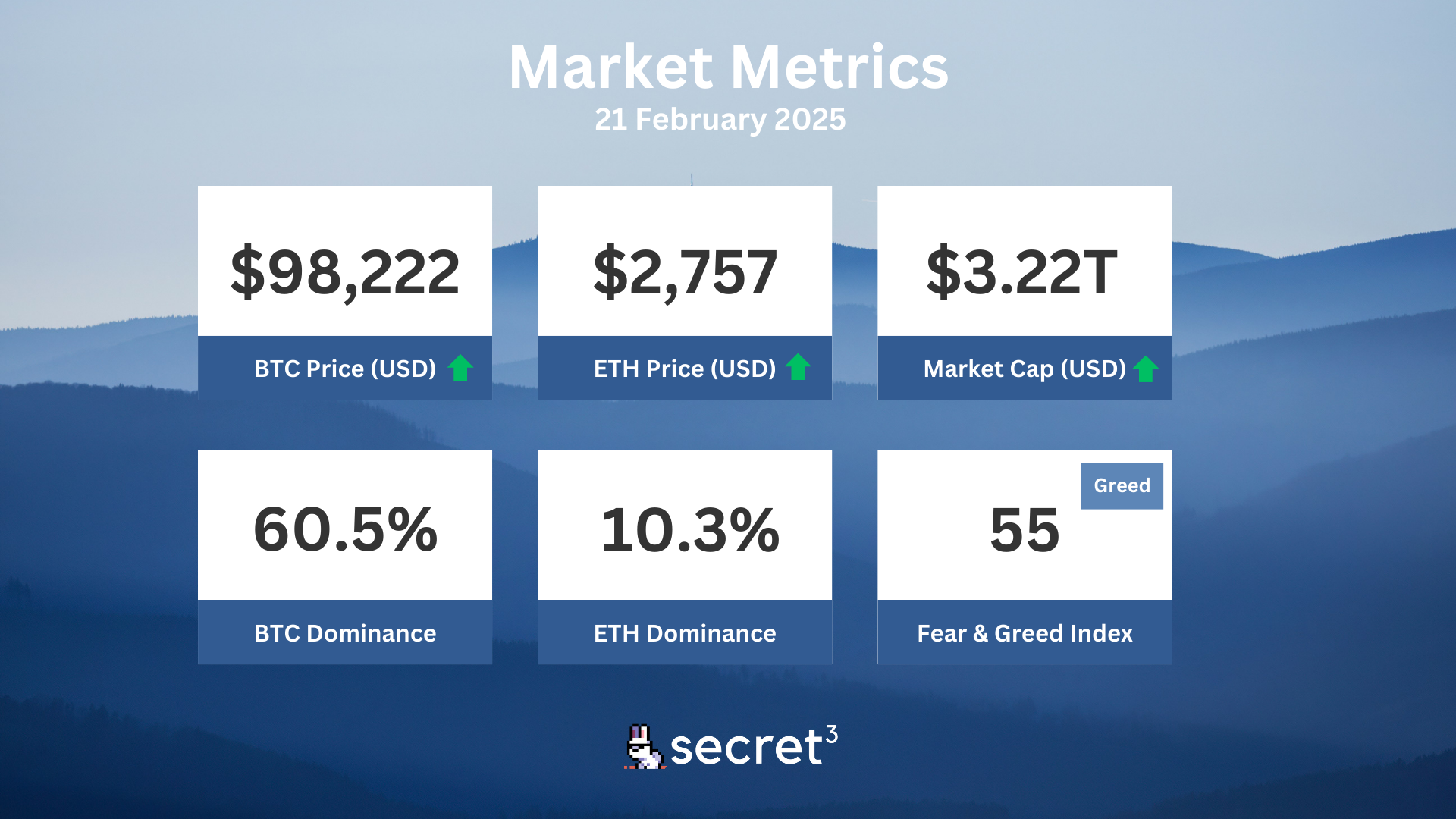

Market Metrics

Fundraising & VC

1. MANSA (Undisclosed, $7M) - Liquidity solutions for cross-border payments

2. ResearchHub (Strategic, $2M) - Open publication of transparent research

3. Nil Foundation (Public Token Sale, $600K) - Ethereum L2, powered by zkSharding

On-chain Data

1. Space ID (ID) token unlock in 1 day ($5.90M, 2.1%)

2. Coin98 (C98) token unlock in 2 days ($1.46M, 1.59%)

3. Renzo (REZ) token unlock in 2 days ($778.92K, 2.22%)

4. AltLayer (ALT) token unlock in 4 days ($9.13M, 7.18%)

Regulatory

🏛️ SEC Launches New Crypto Crime Fighting Unit

- The SEC announced the Cyber and Emerging Technologies Unit to combat crypto-related crime, replacing the previous Crypto Assets and Cyber Unit.

- The new unit will have 30 fraud specialists and attorneys focused on addressing fraud involving blockchain, cryptocurrency, AI and cybersecurity breaches.

💱 SEC Approves First Yield-Bearing Stablecoin Security

- The SEC approved Figure Markets' application for YLDS, a yield-bearing stablecoin offering 0.5% interest to holders.

- This marks a significant shift in the SEC's stance towards the stablecoin market and could pave the way for similar products.

🚫 SEC Drops Appeal in Crypto Broker-Dealer Case

- The SEC voluntarily dismissed its appeal regarding the classification of crypto dealers, signaling a shift in its regulatory approach.

- This decision aligns with a more cooperative stance towards the crypto industry under new SEC leadership.

⚖️ Australian Regulator Warns of Crypto Risks Under Trump Policies

- The Australian Competition and Consumer Commission raised concerns about U.S. plans to ease crypto regulations.

- They warn of increased risks for consumers, particularly regarding investment scams, as the U.S. aims to become the "crypto capital of the world".

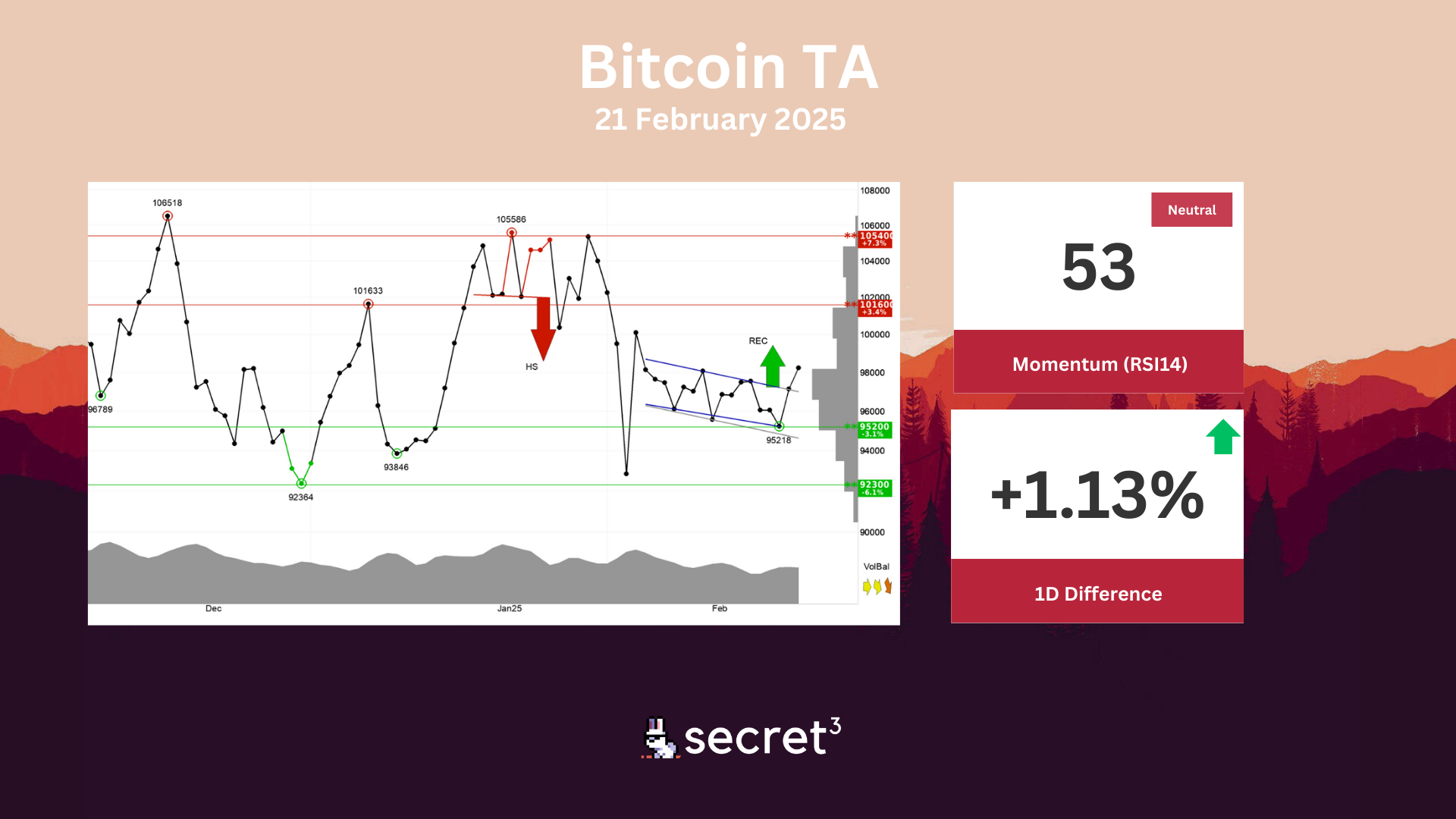

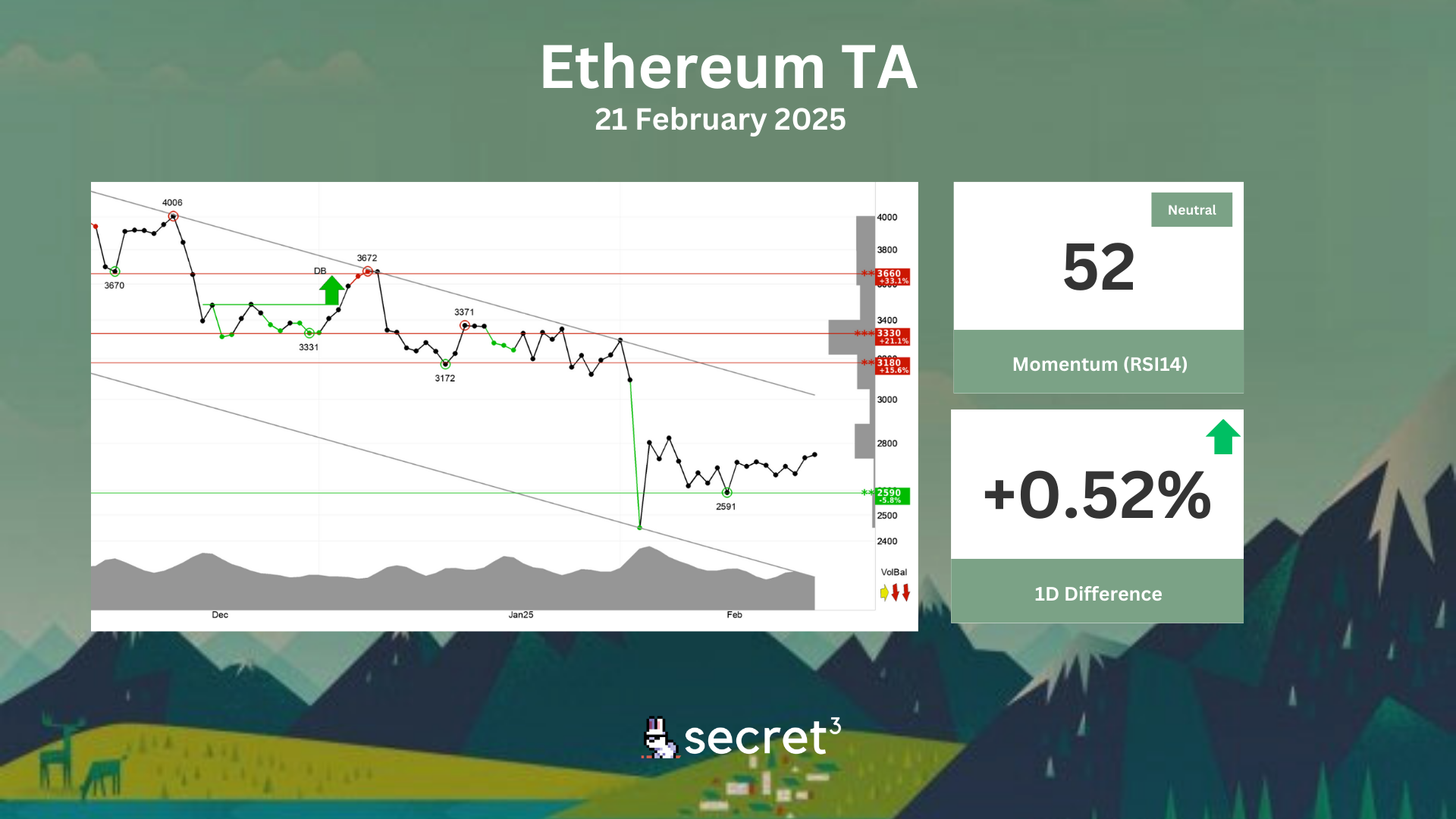

Technical Analysis

Bitcoin - Bitcoin has broken through the ceiling of a falling trend channel in the short term. This indicates a slower falling rate initially, or the start of a more horizontal development. The currency has given a positive signal from the rectangle formation by a break up through the resistance at 97222. Further rise to 99433 or more is signaled. The currency has support at points 95200 and resistance at points 101600. The RSI curve shows a rising trend, which could be an early signal of the start of a rising trend for the price as well. The currency is overall assessed as technically neutral for the short term.

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency has support at points 2590 and resistance at points 3180. Volume has previously been low at price tops and high at price bottoms. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

🏔️ Arbitrum DAO | Arbitrum Audit Program (Active Vote)

- This proposal requests 30 million ARB to implement a program designed to "allocate funds to projects that require financial assistance to pay for an audit."

🌐 Origin DAO | Yield Forwarding Request: scUSD (Active Vote)

- This proposal seeks to enable yield forwarding and pool booster for scUSD on SwapX.

❄️ Everclear DAO | Governance Task Force Renewal (Preliminary Discussion)

- This proposal seeks to restructure the current Governance Task Force (GTF) by condensing all tasks into a single role, responsible for the specific set of tasks listed in the forum discussion.