gm 20/03

Summary

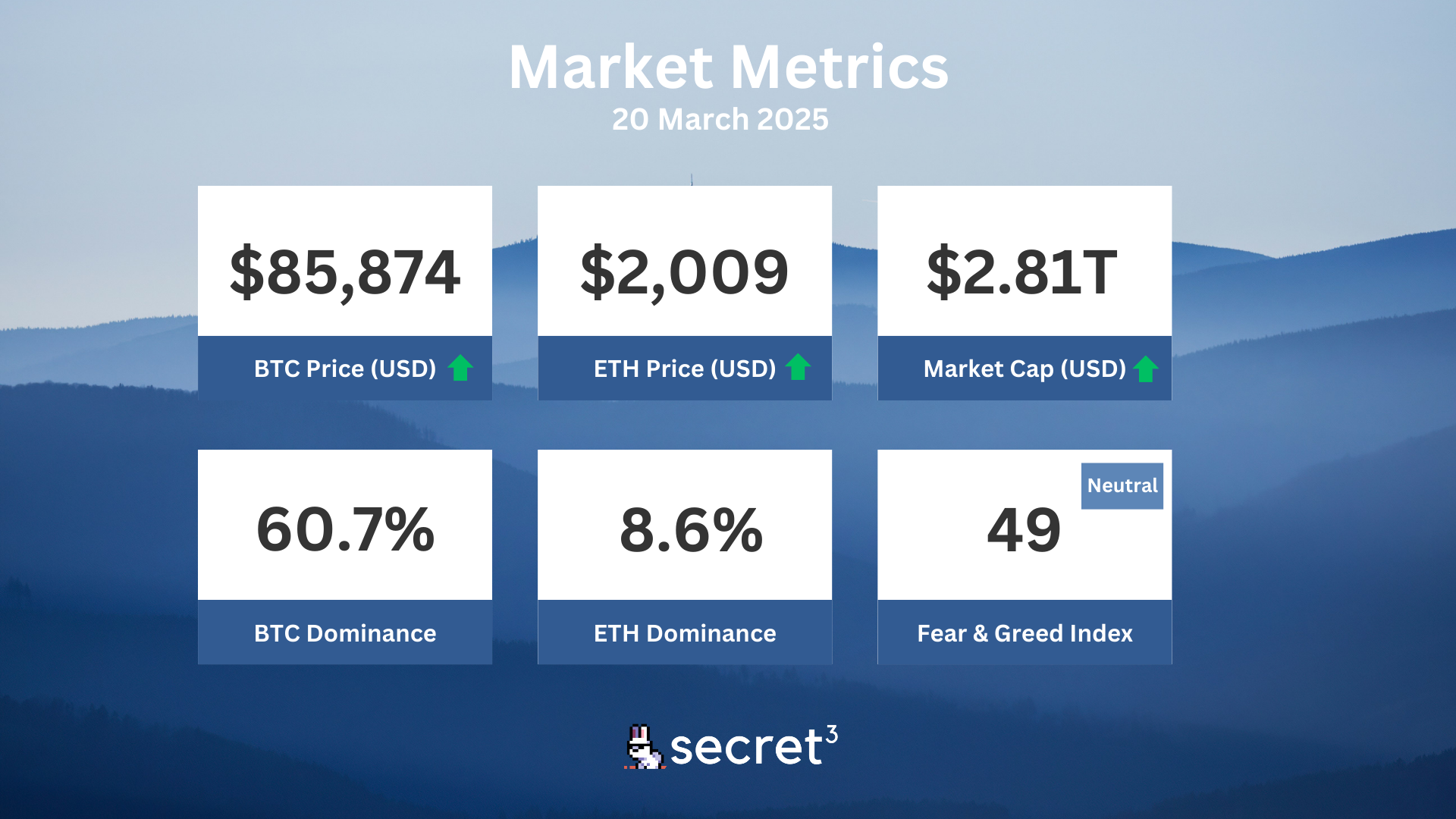

gm, The SEC dropped its enforcement action against Ripple, causing XRP to surge by 12%. Institutional interest in crypto continues to grow, as evidenced by Kraken's reported $1.5 billion acquisition of NinjaTrader to offer crypto futures in the US. The Federal Reserve's decision to maintain interest rates while projecting two rate cuts in 2025 has positively impacted the crypto market, with Bitcoin reaching $86,000 and Ethereum surpassing $2,000. Additionally, Solana's first futures ETFs are set to launch, potentially attracting more institutional investors to the asset.

News Headlines

💼 BlackRock Digital Assets Head Challenges Bitcoin's "Risk-On" Perception

- Robert Mitchnick argues that the crypto industry's portrayal of Bitcoin contributes to its reputation as a high-risk asset.

- He emphasizes Bitcoin's characteristics as global, scarce, non-sovereign, and decentralized, suggesting it shouldn't be viewed as inherently risky.

🌐 Ethereum Price Surges 8% as Large Holders Accumulate

- Ethereum's price jumped nearly 8% to $2,064, driven by significant accumulation from large holders who added over 400,000 ETH to their balances.

- The surge follows a successful breakout from an ascending triangle pattern, with analysts eyeing $2,142 as the next potential target.

💱 70% of EU Crypto Payments Go to Retail, Food and Beverages

- A report from Oobit reveals that 70% of cryptocurrency payments in the EU are for retail, food, and beverage purchases.

- The average crypto payment size is $8.36, with 92% of payments utilizing the USDt stablecoin.

🏗️ Dubai Launches Real Estate Tokenization Pilot, Forecasts $16B Market by 2033

- Dubai has initiated a pilot program to tokenize real estate assets, aiming to revolutionize property investments through blockchain technology.

- The initiative is expected to create a $16 billion market by 2033, enhancing liquidity and accessibility in the real estate sector.

Market Metrics

Fundraising & VC

1. Via Science (Series B, $28M) - Web3 solutions for data security

2. Utila (Series A, $18M) - MPC wallet infrastructure for institutions

3. Privy (Undisclosed, $15M) - Wallet infrastructure platform

4. Pluralis (Pre Seed, $7.6M) - Decentralized AI model training

Regulatory

🏛️ Trump to Address Crypto Industry at Digital Asset Summit

- President Donald Trump will speak at the Digital Asset Summit, marking the first time a sitting US president addresses a crypto conference.

- The appearance follows recent administration moves supporting digital assets, including executive orders and forming a crypto advisory team.

💼 Stablecoin and Market Structure Bills Expected by August

- US lawmakers are close to passing legislation on stablecoins and crypto market structure by August 2025.

- The Senate Banking Committee has endorsed the GENIUS Act, setting guidelines for stablecoin collateralization and compliance.

🌐 US Needs Competitive Edge in Tokenized Real-World Assets

- Chainlink co-founder Sergey Nazarov emphasizes the need for the US to create a competitive advantage in tokenized real-world assets.

- The tokenized RWA market could reach $100 trillion as assets transition to blockchain technology.

💰 Gotbit Founder Forfeits $23M in Crypto Market Manipulation Case

- Aleksei Andriunin, founder of Gotbit, agrees to forfeit $23 million in crypto assets as part of a plea deal for market manipulation charges.

- The case has broader implications, with multiple individuals and companies charged for similar offenses.

🚨 Australian Authorities Target Crypto Scammers

- Australian authorities launch crackdown on scammers impersonating Binance, addressing fraudulent attacks on local users.

- The operation involves collaboration between the Australian Federal Police, National Anti-Scam Centre, and Binance Australia.

Technical Analysis

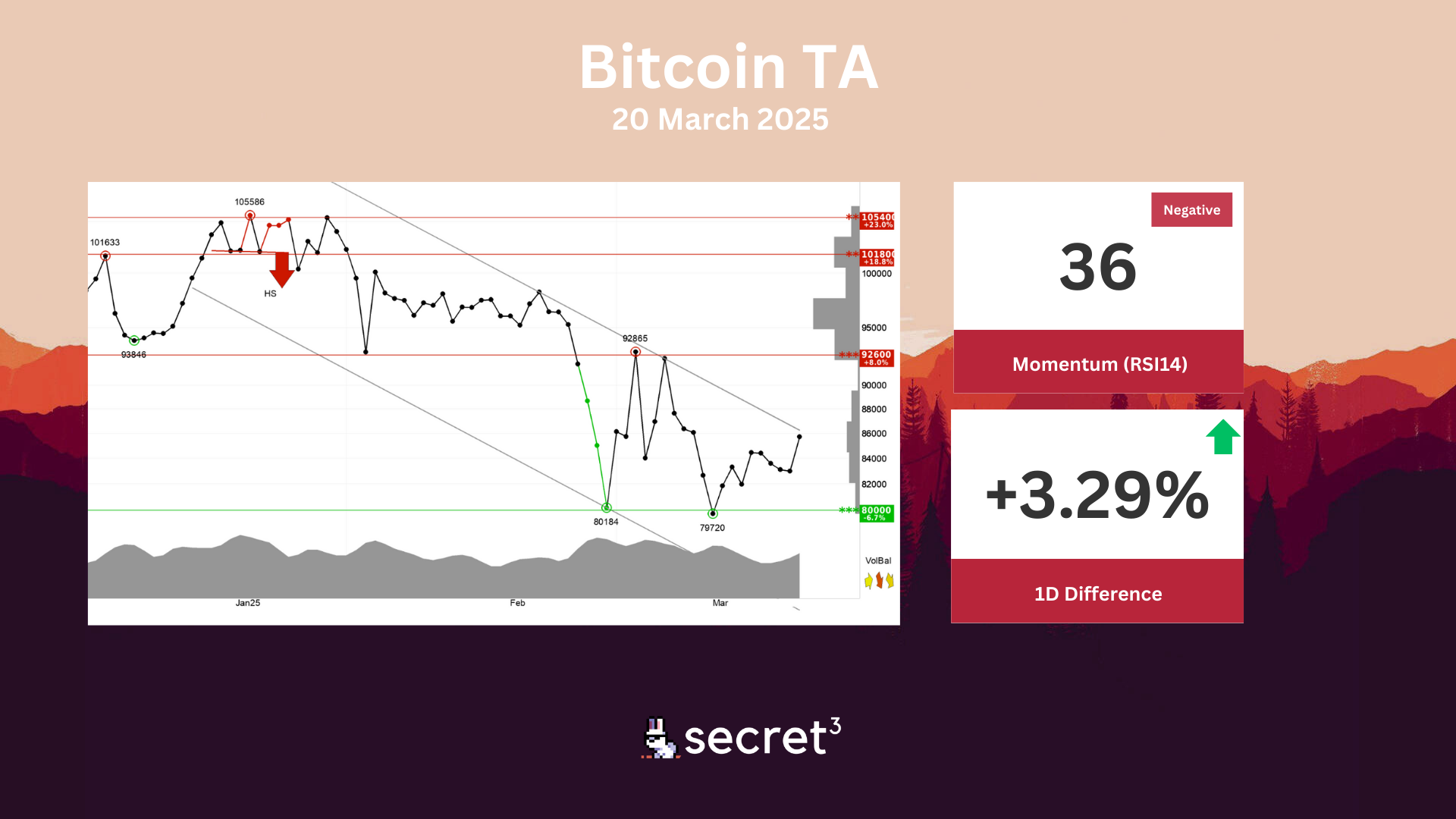

Bitcoin - Bitcoin is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. The currency has support at points 80000 and resistance at points 92600. The currency is assessed as technically negative for the short term.

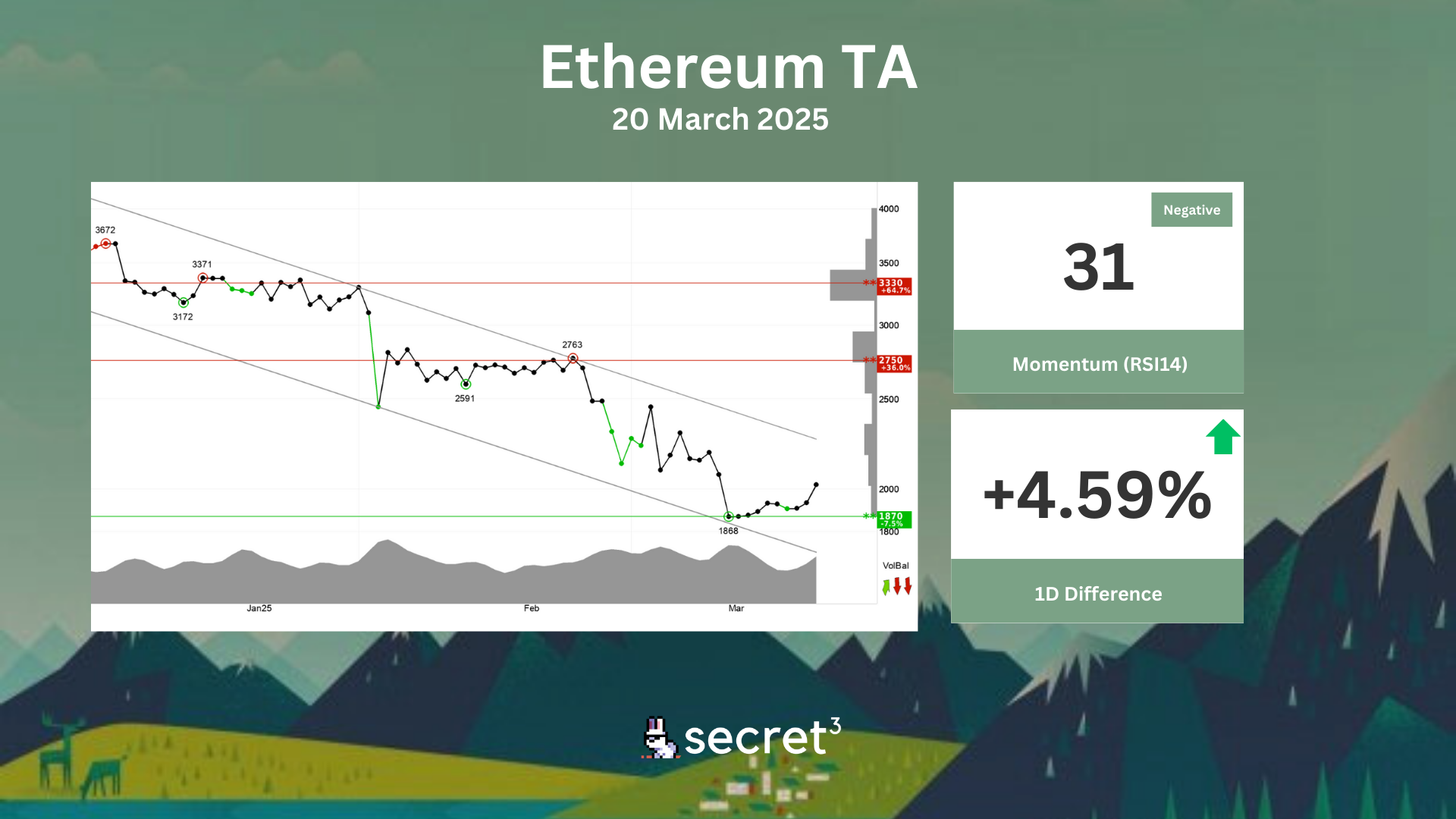

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Ethereum. The currency has support at points 1870 and resistance at points 2750. Negative volume balance shows that volume is higher on days with falling prices than days with rising prices. This indicates decreasing optimism among investors. The currency is overall assessed as technically negative for the short term.