gm 20/02

Summary

gm, Bitcoin maintained stability around $96,900 while other altcoins experienced notable movements. The FTX creditor repayment process began, marking a crucial step in resolving the exchange's bankruptcy. Solana faced challenges due to recent memecoin controversies, causing a decline in its ecosystem's activity. Regulatory shifts were evident as the SEC paused some crypto enforcement cases and acknowledged new ETF filings for XRP and Litecoin. Meanwhile, Coinbase launched CFTC-regulated Solana futures, potentially paving the way for institutional adoption and ETF developments.

News Headlines

🏦 Binance.US Restores Full USD Services After 19 Months

- Binance.US has reinstated USD deposit and withdrawal services after operating as a "crypto-only" platform for 19 months due to regulatory pressures.

- The exchange can now offer trading for over 160 cryptocurrencies, aiming to regain its footing in the US market.

💼 Czech National Bank Considers Adding Bitcoin to Reserves

- The Czech National Bank is exploring the possibility of establishing a Bitcoin test portfolio as part of its reserves.

- Bank governor Aleš Michl emphasized the importance of understanding Bitcoin's technology and economic impact rather than fearing it.

🏦 eToro Secures MiCA License for Crypto Services Across EEA

- eToro has obtained a MiCA license from Cyprus, allowing it to offer crypto services across the European Economic Area.

- This approval enables the platform to provide trading and custody services in 30 countries.

🔍 Microsoft Debuts Quantum Computing Chip, Raising Concerns for Crypto Security

- Microsoft has launched its Majorana 1 quantum computing chip, potentially accelerating quantum computer development.

- This advancement raises concerns about future threats to cryptocurrency security, particularly for encryption methods used in Bitcoin and Ethereum.

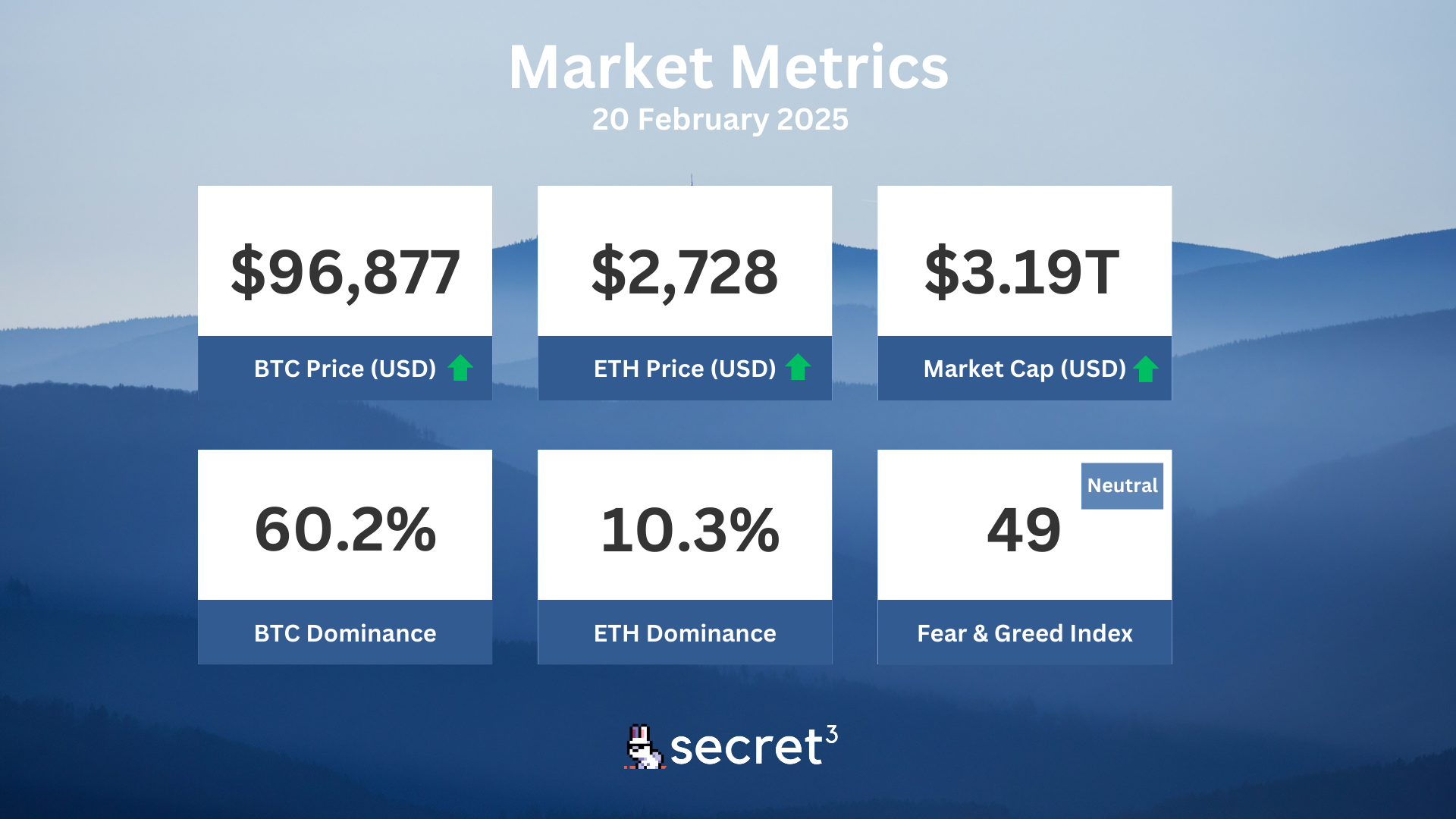

Market Metrics

Fundraising & VC

1. Cygnus Finance (Pre Seed, $20M) - Modular real yield layer

2. Universal (Undisclosed, $9M) - decentralized finance platform

3. Fluent Labs (Extended Seed, $7.5M) - EVM, SVM and Wasm blended in one chain

On-chain Data

1. NAVI (NAVX) token unlocked today ($358.94K, 1.03%)

2. Nym (NYM) token unlocked today ($377.39K, 0.62%)

3. Space ID (ID) token unlock in 2 days ($5.72M, 2.1%)

4. Coin98 (C98) token unlock in 3 days ($1.41M, 1.59%)

Regulatory

⚖️ Nigeria Files $81.5B Lawsuit Against Binance

- Nigeria is suing Binance for $81.5 billion, claiming $2 billion in back taxes and $79 billion in economic damages.

- The government alleges Binance destabilized the naira and operated without proper registration since 2019.

🌎 Hong Kong Unveils 'ASPIRe' Roadmap to Become Global Crypto Hub

- Hong Kong's Securities and Futures Commission launched a strategy to establish the city as a leading cryptocurrency hub.

- The plan addresses issues like liquidity fragmentation and market volatility through a five-pillar approach.

🏛️ Brazil Approves First-Ever Spot XRP ETF

- Brazil becomes the first country to approve a spot XRP exchange-traded fund (ETF).

- The Hashdex Nasdaq XRP Index Fund will debut on the B3 exchange.

🚀 Coinbase Launches CFTC-Regulated SOL Futures in US

- Coinbase has introduced CFTC-regulated Solana futures contracts on its US derivatives exchange.

- This development aims to promote institutional adoption of Solana and could facilitate potential SOL ETF creation.

🏦 10 Stablecoin Issuers Approved Under EU's MiCA, Tether Excluded

- The EU has approved ten firms to issue stablecoins under its MiCA regulatory framework.

- Notably absent is Tether, the largest stablecoin issuer by market cap.

Technical Analysis

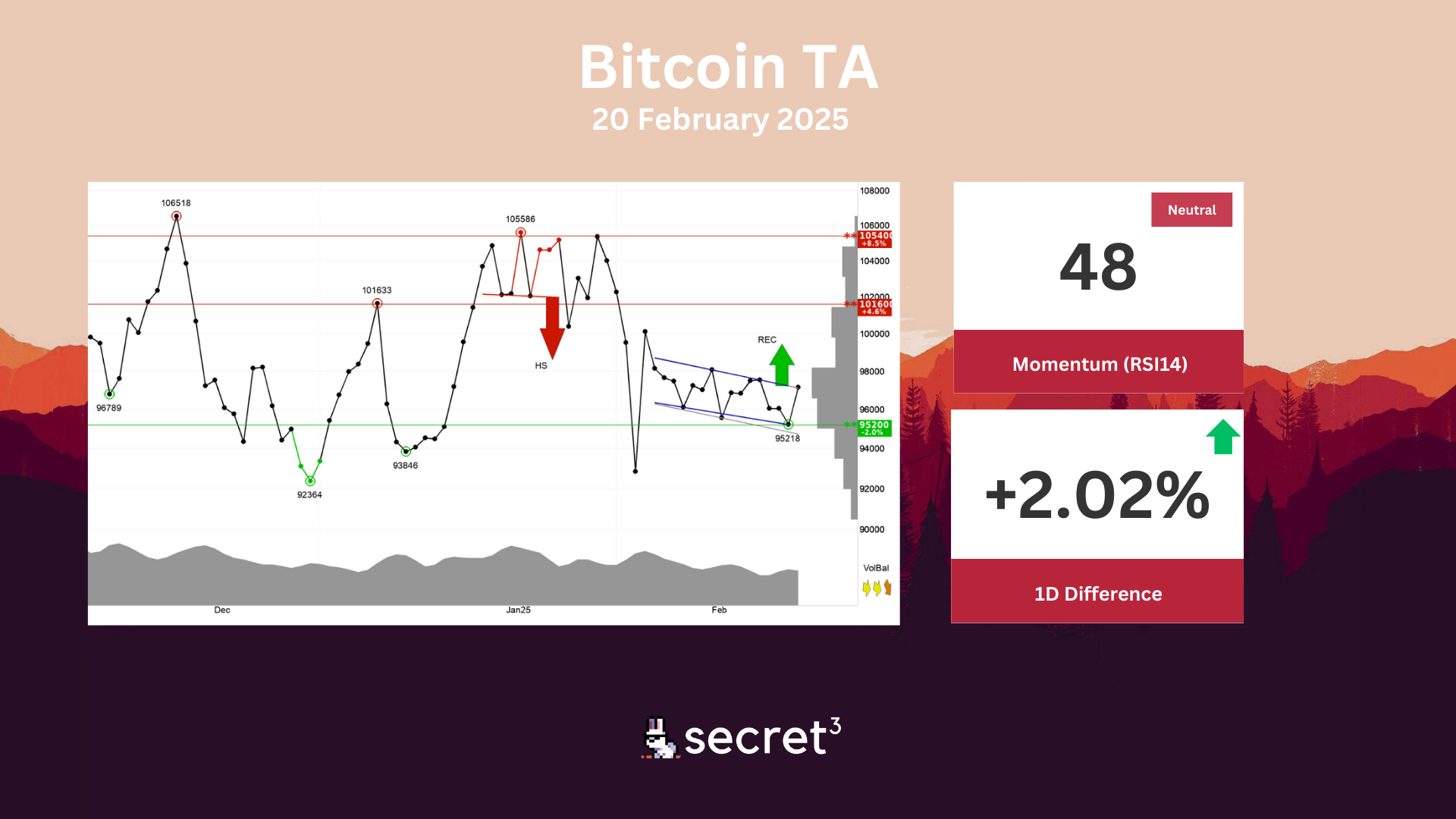

Bitcoin - Bitcoin has broken through the ceiling of a falling trend channel in the short term. This indicates a slower falling rate initially, or the start of a more horizontal development. The price has broken the resistance at 97222 of a rectangle pattern, which signals a further rise. The currency has support at points 95200 and resistance at points 101600. The RSI curve shows a rising trend, which could be an early signal of the start of a rising trend for the price as well. The currency is overall assessed as technically neutral for the short term.

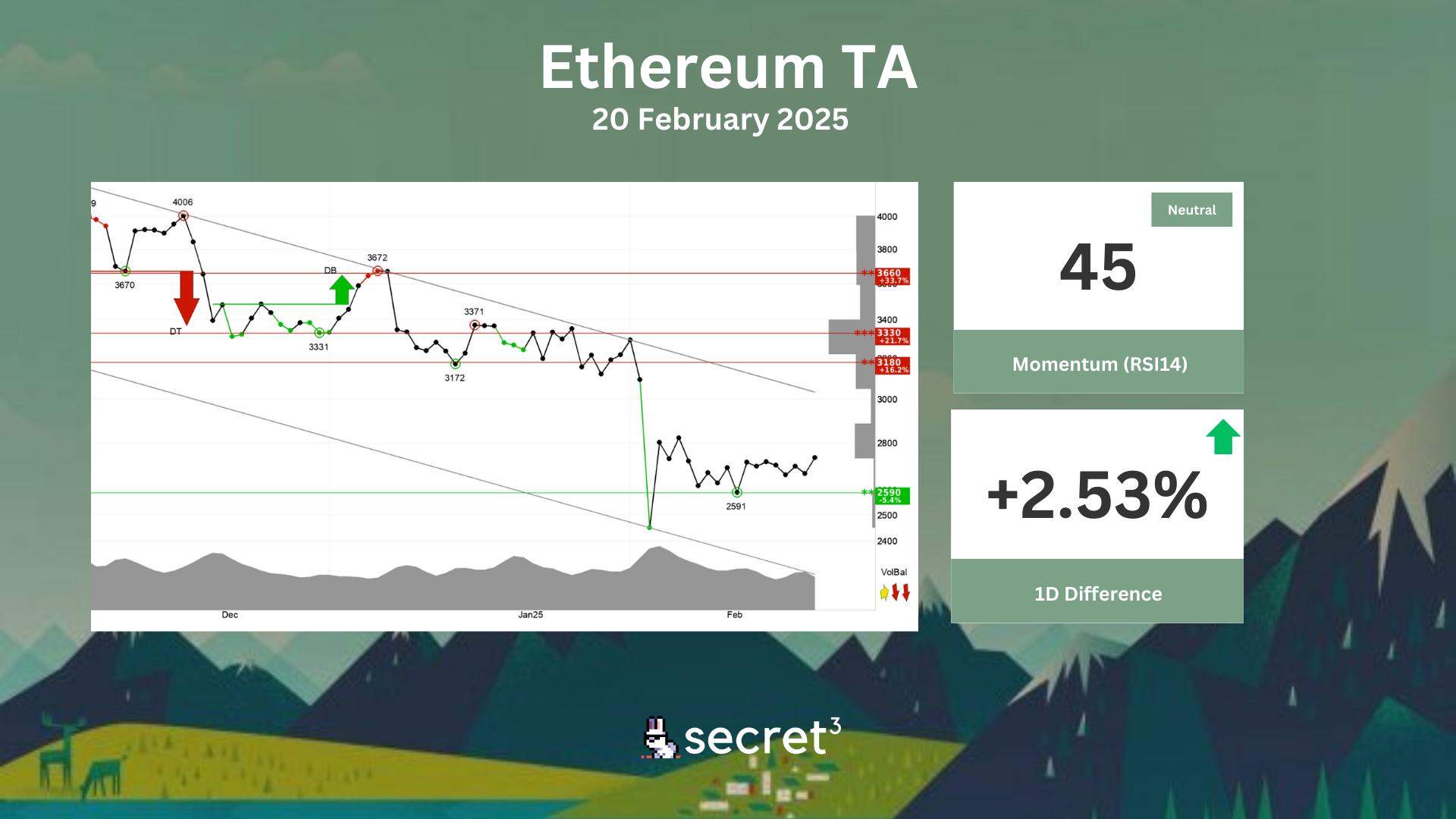

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency has support at points 2590 and resistance at points 3180. Volume has previously been low at price tops and high at price bottoms. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

🦄 Uniswap DAO | Uniswap Delegate Reward Initiative - Cycle 3 (Active Vote)

- This proposal seeks $540,000 of UNI tokens for Cycle 3 of the Uniswap Delegate Reward Initiative.

☁️ Sky DAO | Smart Burn Engine Liquidity Unwind (Preliminary Discussion)

- This proposal seeks to unwind a portion of the Smart Burn Engine's LP tokens to the Pause Proxy in an effort to prevent malicious actors from acquiring the tokens.