gm 19/02

Summary

gm, FTX began its first round of creditor repayments, distributing approximately $1.2 billion to users owed less than $50,000. Meanwhile, the fallout from the LIBRA token scandal continued to impact the market, with Solana (SOL) experiencing a sharp decline of over 8% amid concerns about memecoin-related risks. Bitcoin dropped below $95,000, while Ethereum saw renewed interest with positive inflows into spot ETFs ahead of its upcoming Pectra upgrade. Overall, the market sentiment remains cautious, influenced by recent controversies and ongoing regulatory developments.

News Headlines

🚀 Robinhood Plans Crypto Products Launch in Singapore

- Robinhood aims to launch cryptocurrency services in Singapore by late 2025, following its $200 million acquisition of Bitstamp.

- This expansion capitalizes on Singapore's growing status as a digital assets hub and the global crypto market surge to $3.2 trillion.

🔒 Blockchain Security Firm Blockaid Raises $50M

- Blockaid secured $50 million in Series B funding to enhance blockchain security solutions.

- The company reported scanning over 2.4 billion transactions and blocking 71 million attacks in the past year.

🌐 Tether Co-Founder Launches Yield-Bearing Stablecoin

- Reeve Collins, Tether co-founder, is launching USP, a new decentralized stablecoin offering yield backed by real-world assets.

- The stablecoin will be deployed on Ethereum and Solana blockchains, allowing users to mint USP in exchange for yield-bearing USI tokens.

💼 BitGo Launches OTC Trading Desk, Rumored 2025 IPO

- BitGo introduced a global OTC trading desk for digital assets, offering spot and derivatives trading for over 250 assets.

- The company is reportedly exploring a public launch in the second half of 2025.

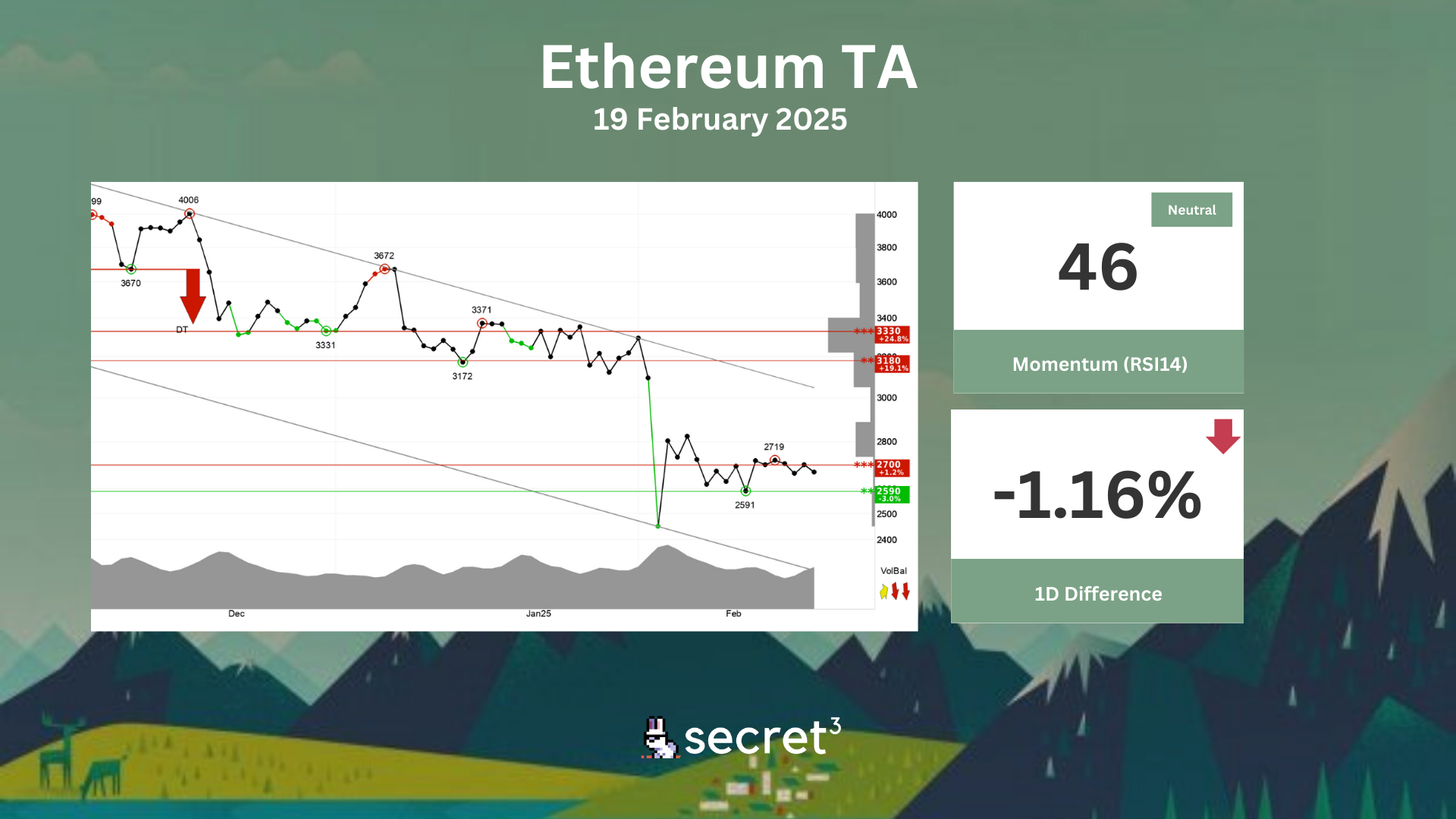

💱 Ethereum Price Rally Fizzles as Crypto Market Slides

- Ethereum briefly rallied 7% to $2,850 before giving up gains as the broader crypto market declined.

- ETH futures open interest rose 12%, indicating increased trader interest relative to BTC.

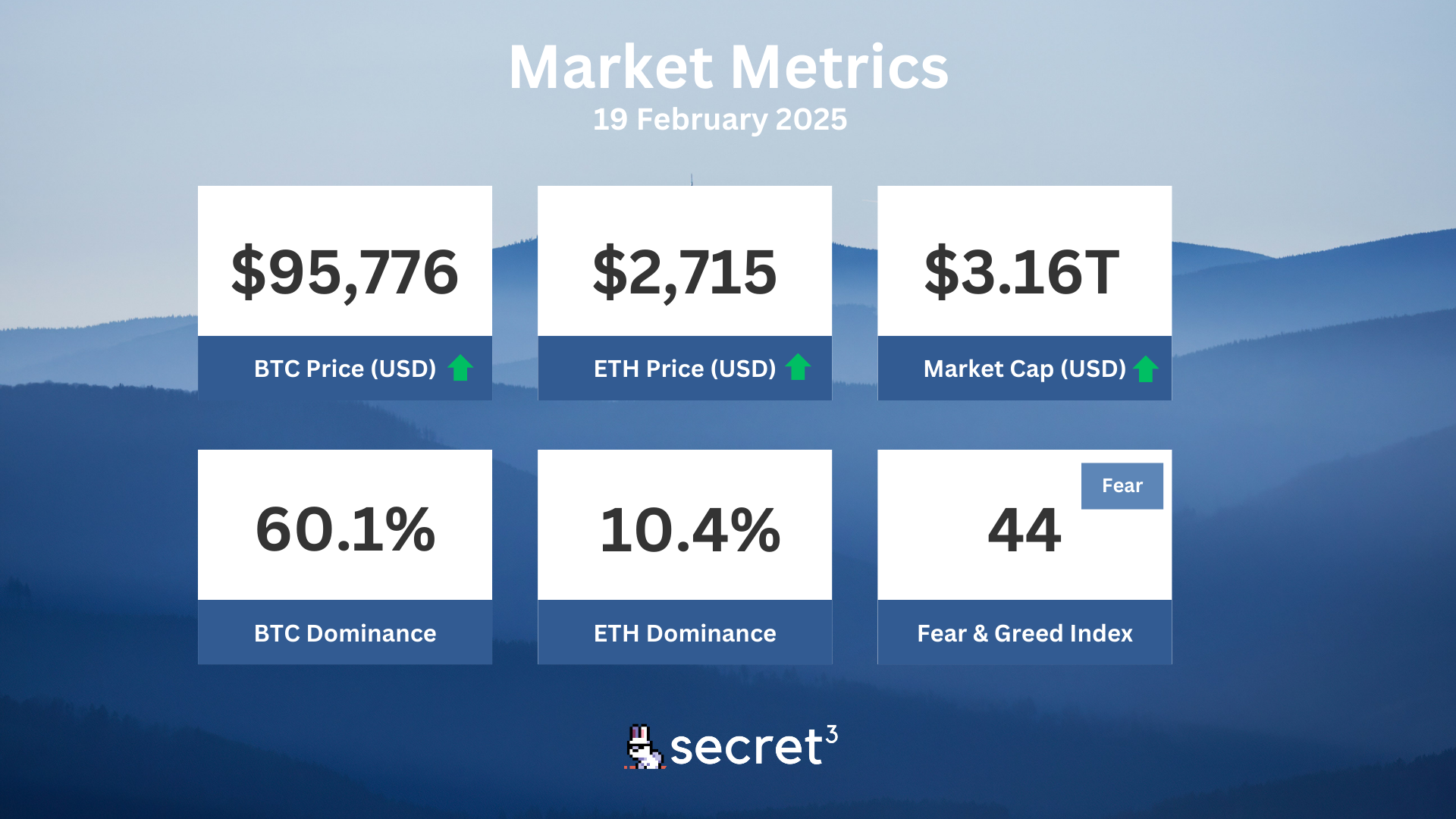

Market Metrics

Fundraising & VC

1. Blockaid (Series B, $50M) - Onchain security

2. Altius Labs (Pre Seed, $11M) - modular VM-agnostic execution layer

3. Talentir (Seed, Undisclosed) - Onchain YouTube and Tiktok distribution technology

On-chain Data

1. NAVI (NAVX) token unlock in 1 day ($332.79K, 1.03%)

2. Nym (NYM) token unlock in 1 day ($373.53K, 0.62%)

3. Space ID (ID) token unlock in 3 days ($5.61M, 2.1%)

4. Coin98 (C98) token unlock in 4 days ($1.36M, 1.59%)

Regulatory

💼 Howard Lutnick Confirmed as US Commerce Secretary

- The US Senate confirmed Howard Lutnick, a cryptocurrency advocate, as the new Secretary of Commerce.

- Lutnick will divest from his stake in Tether and other holdings within 90 days.

⚖️ Norway Charges Four in $87M Crypto Fraud Case

- Norwegian authorities have charged four individuals in connection with an $86.5 million crypto investment fraud.

- The scheme allegedly involved promoting non-existent investment packages containing cryptocurrencies and shares.

🌐 Nigeria to Tax Cryptocurrency Transactions

- Nigeria plans to amend its digital asset regulations to impose taxes on cryptocurrency transactions.

- The Nigerian Securities and Exchange Commission aims to enhance crypto licensing for better transaction monitoring.

🏦 AUSTRAC Takes Action Against 13 Crypto Firms

- Australia's financial intelligence agency, AUSTRAC, has initiated regulatory action against 13 cryptocurrency firms.

- Nine firms had their registrations canceled, suspended, or not renewed for compliance failures.

🏛️ Hong Kong Reaffirms Commitment to Crypto Market

- Hong Kong's financial secretary Paul Chan Mo-po stated the city's commitment to being a stable and open market for crypto.

- The city aims to establish itself as a regional crypto hub, investing in infrastructure and talent development.

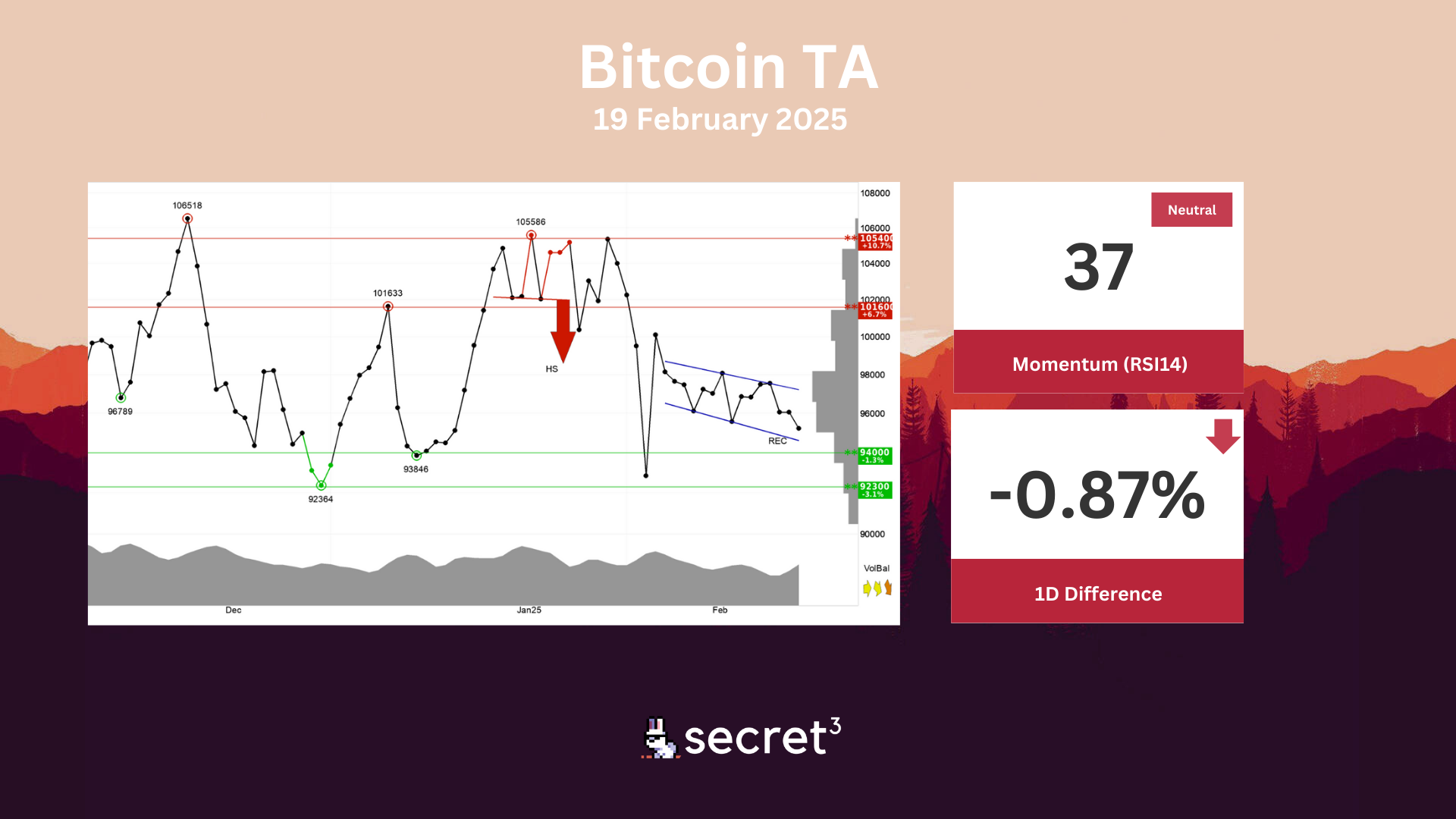

Technical Analysis

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. The currency is moving within a rectangle formation between support at 94610 and resistance at 97222. A decisive break through one of these levels indicates the new direction for the currency. The currency has support at points 94000 and resistance at points 101600. The currency is overall assessed as technically neutral for the short term.

Ethereum - Ethereum is in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency is between support at points 2590 and resistance at points 2700. A definitive break through of one of these levels predicts the new direction. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

🔰 MetisDAO | Ecosystem Proposal: Exoli (Active Vote)

- This proposal aims to onboard the Exoli, a Web3 platform, into the Metis ecosystem.

🌐 Origin DAO | Yield Forwarding Request: EGGS (Active Vote)

- This proposal aims to enable yield forwarding and treasury booster for the EGGS pool on SwapX.

👻 Aave DAO | Risk Steward Parameter Updates Phase 3

- This proposal seeks to modify the Risk Steward parameters to improve the efficiency of risk parameter management and reduce governance overhead.