gm 18/04

Summary

gm, Bitcoin remained relatively stable around $85,000, while Solana (SOL) outperformed with a 6% gain, driven by the launch of spot Solana ETFs in Canada and increased network activity. Binance disclosed its role in advising global governments on Bitcoin reserves and crypto policies, reflecting growing institutional interest. Meanwhile, the crypto industry saw advancements in infrastructure, with Ethena and Securitize unveiling plans for a new blockchain focused on real-world assets, and EigenLayer implementing a crucial 'slashing' feature to enhance its staking protocol's security.

News Headlines

📊 VanEck's NODE to Track Broad Range of Digital Asset Stocks

- VanEck received SEC approval to launch the Onchain Economy ETF (NODE), set to trade starting May 14 with a 0.69% management fee.

- The ETF will actively manage 30-60 stocks linked to the digital asset sector, including crypto exchanges, mining, and infrastructure.

🔓 EigenLayer Adds Key 'Slashing' Feature, Completing Original Vision

- EigenLayer, the Ethereum restaking protocol, is launching its 'slashing' feature to enhance accountability and security.

- The feature penalizes malicious operators, addressing concerns about pooled staking risks.

🌟 Stellar Blockchain Sees $3B of Real World Assets Being Tokenized in 2025

- Stellar blockchain aims to reach $3 billion in tokenized real-world assets (RWAs) by the end of 2025, a 10x increase from 2024.

- The Stellar Development Foundation is collaborating with firms like Franklin Templeton, Wisdom Tree, Paxos, and others to advance asset tokenization.

💰 Lombard Finance Launches Toolkit to Unlock Bitcoin's $154B DeFi Opportunity

- Lombard Finance released a software development kit to facilitate easy Bitcoin staking, targeting $154 billion in idle BTC on centralized exchanges.

- The SDK allows users to stake BTC and receive LBTC tokens with a 3% annual yield, aiming to boost BTC's functionality in DeFi.

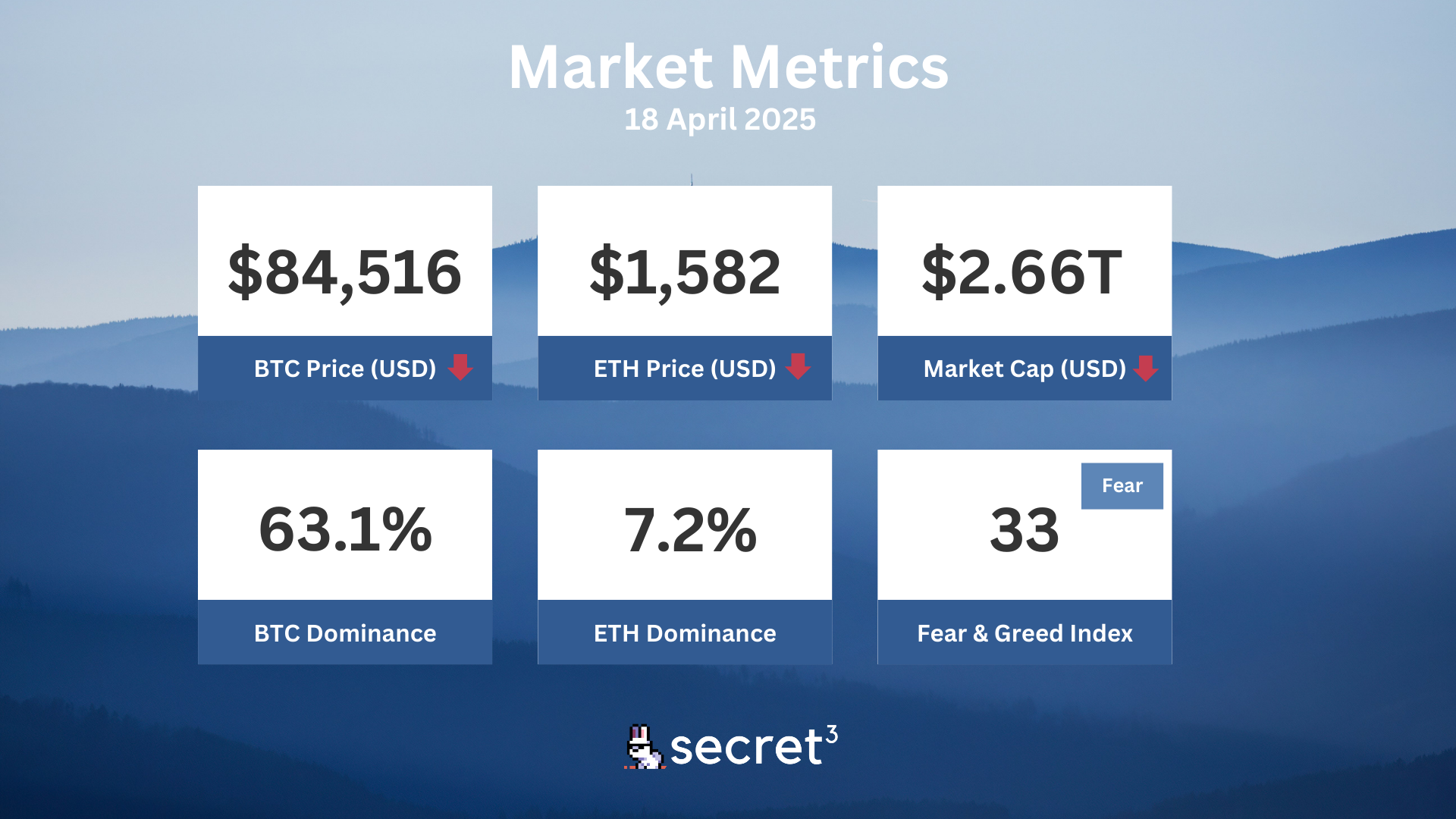

Market Metrics

Fundraising & VC

1. LayerZero (Private Token Sale, $55M) - Blockchain interoperability protocol

2. ORO (Seed, $6M) - Data infrastructure platform

3. Neutrl (Seed, $5M) - DeFi protocol offering market-neutral crypto yields

Regulatory

🏦 Fed Chair Powell Reaffirms Support for Stablecoin Legislation

- Federal Reserve Chair Jerome Powell emphasized the need for a legal framework for stablecoins.

- Powell highlighted stablecoins as a digital product with significant consumer appeal that requires robust federal oversight.

💼 Kyrgyzstan Grants Legal Status to CBDC "Digital Som"

- Kyrgyzstan's President signed a law giving legal status to the "digital som" CBDC.

- The law grants the central bank exclusive rights to issue and regulate the digital currency.

🌐 Slovenia Proposes 25% Tax on Crypto Transactions

- Slovenia's finance ministry is proposing a 25% tax on profits from crypto trading for residents.

- The draft law aims to tax individuals when they sell cryptocurrency for fiat or use it for purchases.

🔍 SEC to Hold Roundtable on Crypto Custody

- The SEC is set to hold a roundtable discussion on cryptocurrency custody with industry representatives.

- The event will include talks on broker-dealers and investment firm custody amidst increasing demand for digital asset custody services.

Technical Analysis

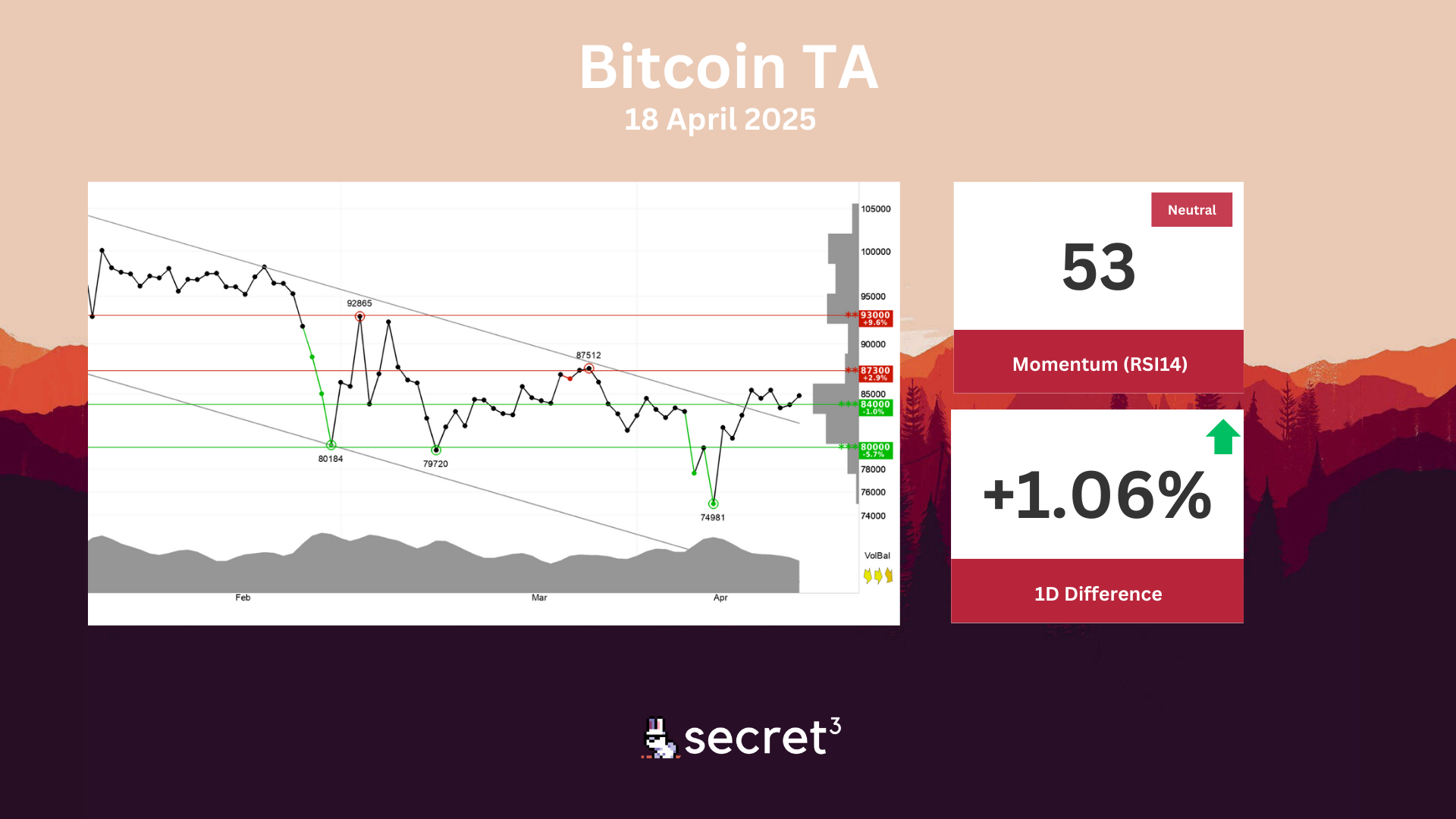

Bitcoin - Bitcoin has broken through the ceiling of a falling trend channel in the short term. This indicates a slower falling rate initially, or the start of a more horizontal development. The currency is between support at points 84000 and resistance at points 87300. A definitive break through of one of these levels predicts the new direction. The RSI curve shows a rising trend, which could be an early signal of the start of a rising trend for the price as well. The currency is overall assessed as technically slightly negative for the short term.

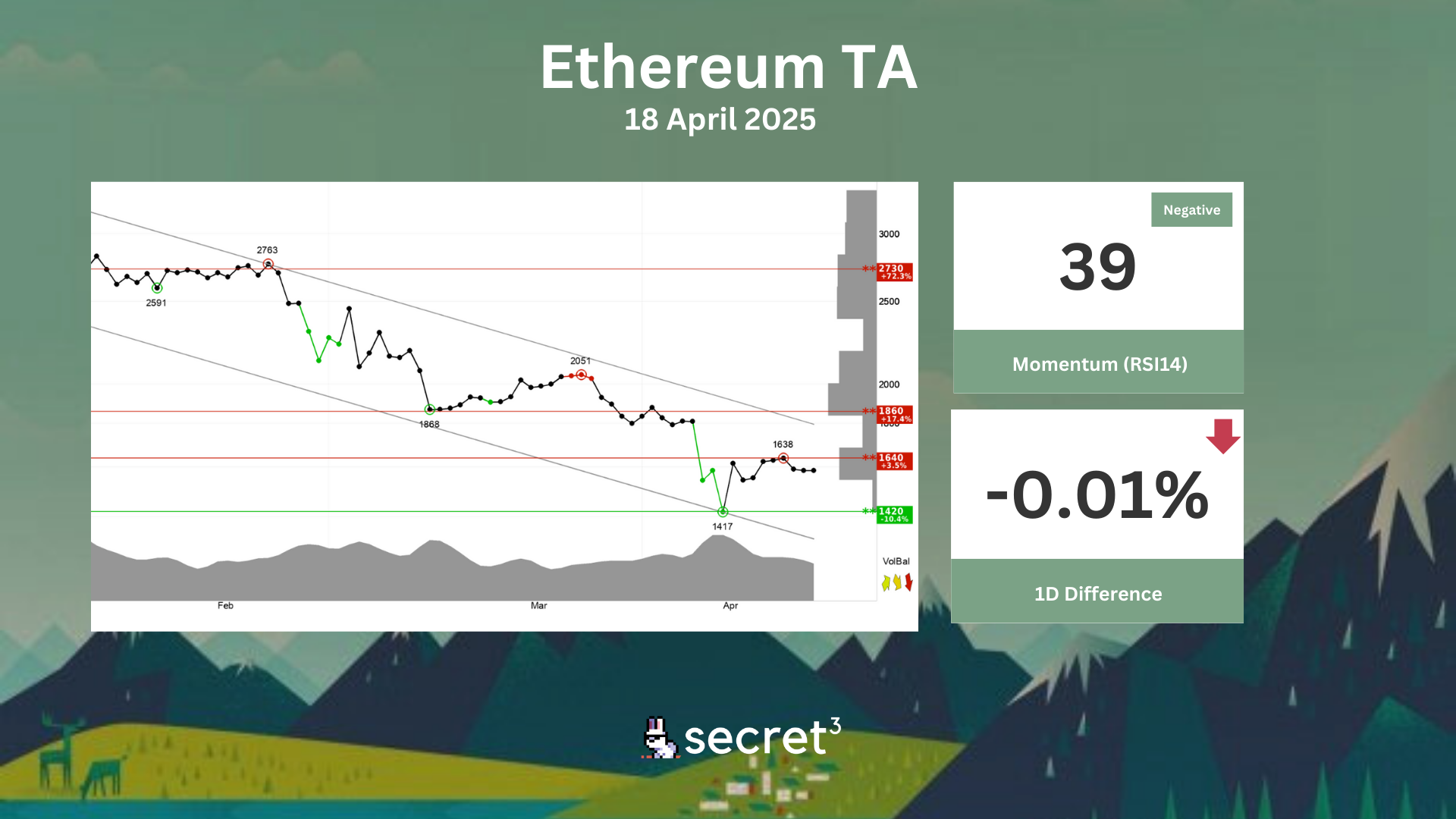

Ethereum - Investors have accepted lower prices over time to get out of Ethereum and the currency is in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency is approacing resistance at 1640 points, which may give a negative reaction. However, a break upwards through 1640 points will be a positive signal. The currency is assessed as technically negative for the short term.