gm 17/05

Summary

gm, Coinbase faced a serious security breach involving compromised customer support agents in India, potentially costing the company up to $400 million in remediation. Despite this setback, Coinbase's stock surged following its inclusion in the S&P 500. Meanwhile, stablecoin adoption is accelerating rapidly, with a Fireblocks survey revealing 90% of institutions are now using or exploring stablecoins, particularly for cross-border payments. On the regulatory front, progress continues on the Senate's GENIUS Act for stablecoin regulation, with lawmakers expressing optimism that the bill could pass as early as next week, while the DOJ announced it will proceed with the trial of Tornado Cash developer Roman Storm, maintaining most charges despite dropping one count.

News Headlines

🚨 Crypto Exchange CEO's Daughter Targeted in Paris Kidnap Attempt

- The daughter and grandson of Paymium's CEO were targeted in a failed kidnapping attempt in Paris, highlighting a disturbing trend of crypto-related abductions in France.

- This follows earlier kidnappings including Ledger co-founder David Ballard, with French Interior Minister announcing plans to meet with crypto entrepreneurs to discuss protective measures.

🔐 Coinbase fires compromised agents in India, says security chief

- Coinbase terminated several customer support agents in India who were involved in social engineering attacks that allowed cybercriminals to access user data.

- The breach could potentially cost Coinbase between $180-400 million in remediation and reimbursement, affecting less than 1% of monthly users.

💰 FTX estate to start distributing more than $5B on May 30

- FTX will begin distributing over $5 billion to creditors starting May 30, marking the second round of disbursements since the exchange's bankruptcy.

- The recovery plan aims for 98% of creditors to receive at least 118% of their initial claims, following a previous distribution of approximately $1.2 billion in February.

🚀 Galaxy Digital lists on Nasdaq, seeks to tokenize shares

- Galaxy Digital began trading on the Nasdaq on May 16 following a challenging Q1 with a $295 million loss, opening at $23.50 per share.

- The company announced collaboration with the SEC to tokenize its shares, potentially enabling their use in DeFi applications like lending and borrowing.

🏆 Starknet hits 'Stage 1' decentralization, tops ZK-rollups for value locked

- Starknet has achieved "Stage 1" decentralization as recognized by Ethereum co-founder Vitalik Buterin, becoming the largest ZK-rollup network by total value locked at $629 million.

- The system now operates with limited oversight, featuring a security council and mechanisms to prevent censorship, with plans to eventually achieve full "Stage 2" decentralization.

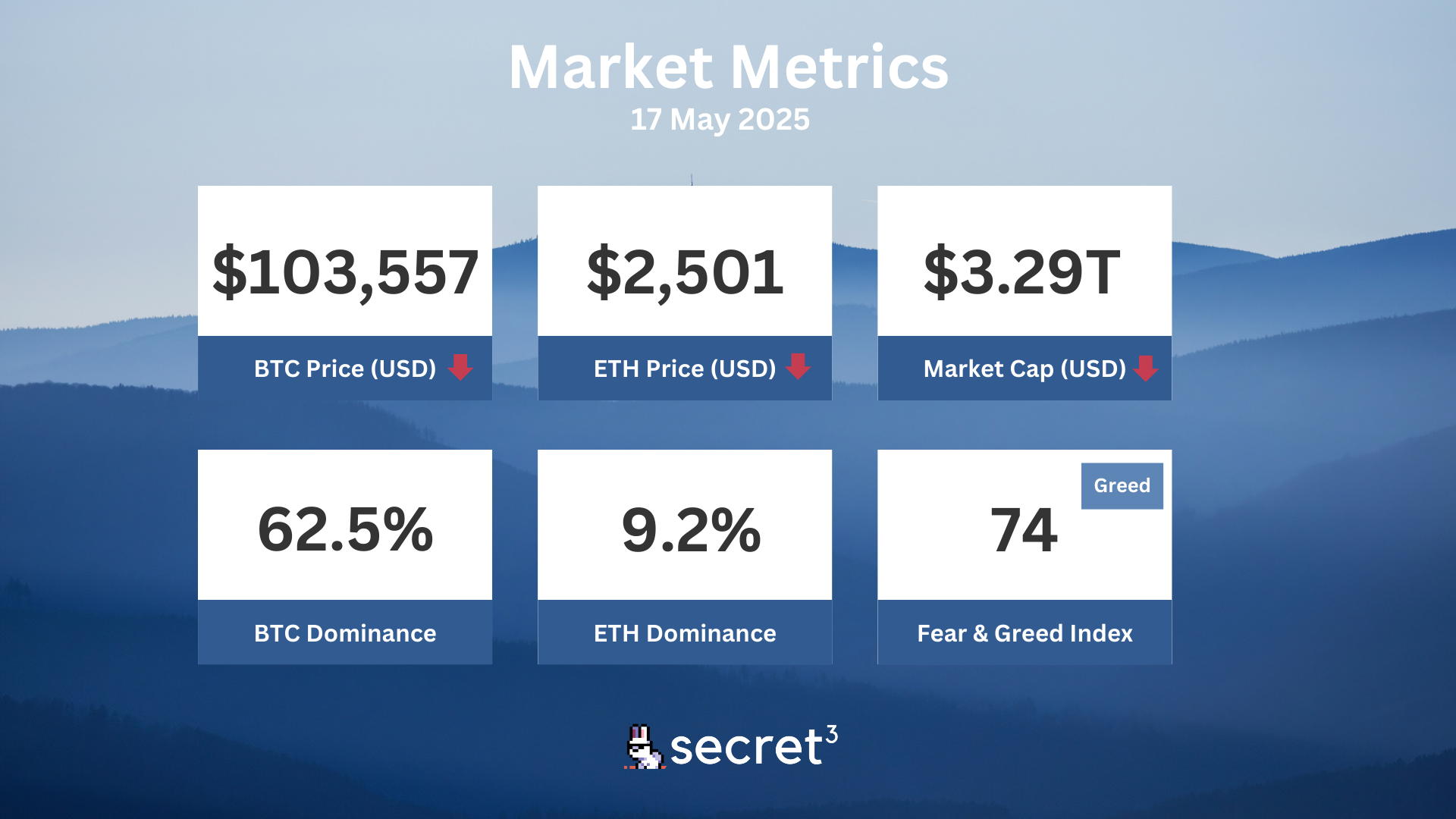

Market Metrics

Fundraising & VC

1. XP (Seed, $6.2M) - Web3 ticketing platform

2. Puffverse (Public Token Sale, $700K) - Disney-like 3D metaverse connecting Web3 and Web2

Regulatory

🔍 SEC Probes Coinbase Over User Number Misstatement Concern

- The SEC is investigating Coinbase regarding potential discrepancies in its reported user numbers, raising questions about regulatory compliance and transparency in crypto exchange financial reporting.

- This probe comes amid Coinbase's recent security breach and adds to the company's ongoing regulatory challenges as it navigates increased scrutiny in the cryptocurrency industry.

👨⚖️ Judge Rejects SEC and Ripple's Bid to Rework XRP Settlement

- A federal judge has denied a joint bid by the SEC and Ripple to approve a settlement that would reduce Ripple's fine from $125 million to $50 million, citing procedural errors.

- Despite this setback, Ripple's legal chief emphasized that the ruling does not affect their earlier victory establishing that XRP is not a security when sold to the general public.

🌍 Europe's MiCA Law Implementation Challenges Industry

- The EU's Markets in Crypto-Assets regulation (MiCA) is entering implementation, requiring licenses for crypto service providers starting January 2025 and imposing strict rules on stablecoins.

- Major players like Tether are withdrawing from the EU market due to regulatory demands, while concerns persist about inconsistent interpretation of regulations across the 27 member states.

⚖️ Ukraine Finalizing Legislation for National Crypto Reserve

- Ukraine is finalizing legislation to establish a national cryptocurrency reserve, joining countries like El Salvador in officially holding Bitcoin as a strategic asset.

- The country has already accumulated Bitcoin worth $4.8 billion primarily through war-effort donations, making it one of the world's largest Bitcoin holders.

🏢 Crypto Firms Expand US Presence Amid Regulatory Shifts

- Major crypto firms including Wintermute, MoonPay, and Crypto.com are expanding their US operations and hiring for policy, compliance, and regulatory roles.

- This trend reflects growing confidence in the US regulatory environment for digital assets and highlights the increasing importance of regulatory expertise in the crypto industry.

Technical Analysis

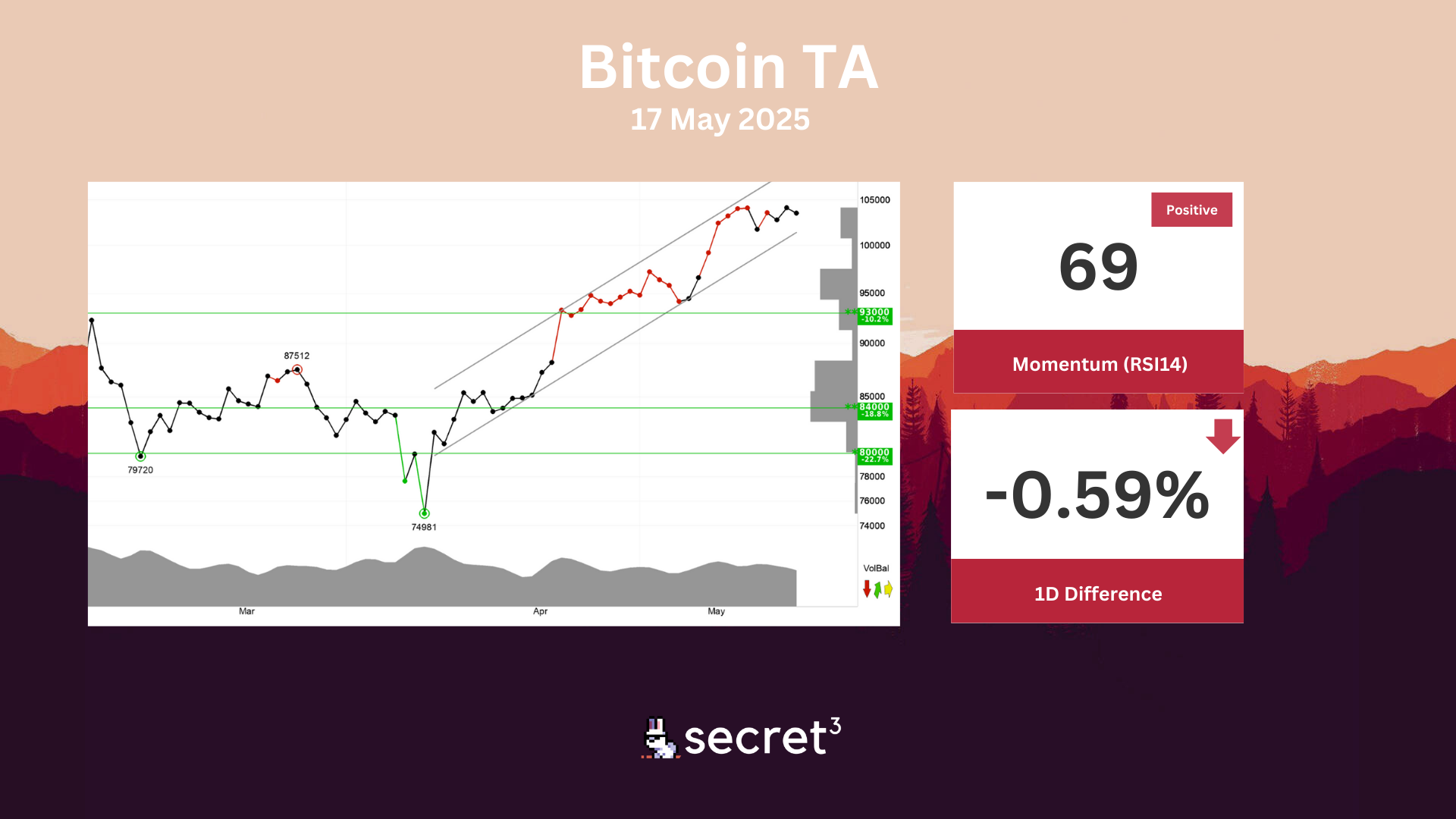

Bitcoin - Bitcoin is in a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 93000 points. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically positive for the short term.

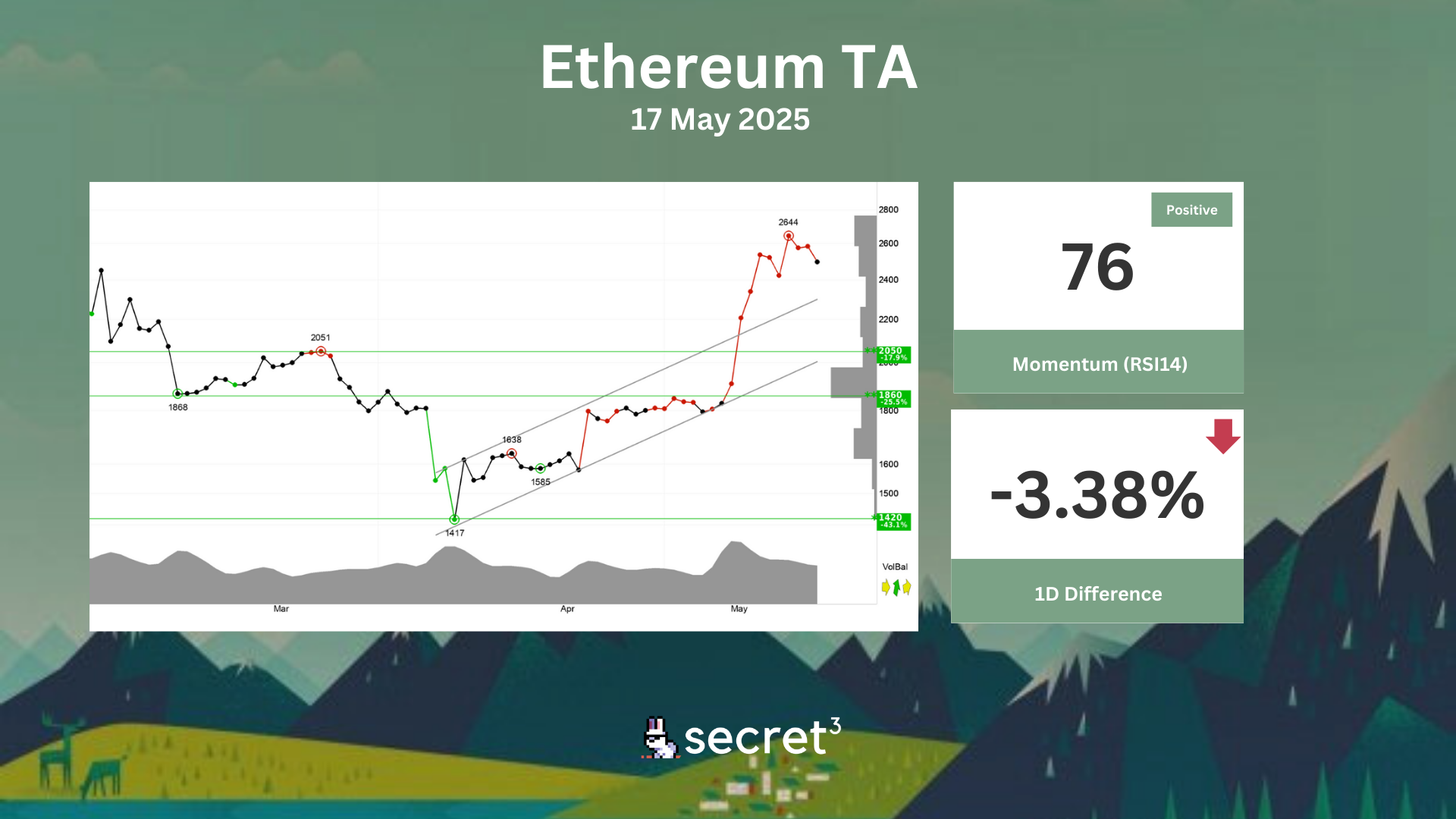

Ethereum - Ethereum has broken the rising trend up in the short term, which indicates an even stronger rising rate. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 2050 points. The volume balance is positive and strengthens the currency in the short term. RSI above 70 shows that the currency has strong positive momentum in the short term. Investors have steadily paid more to buy the currency, which indicates increasing optimism and that the price will continue to rise. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.