gm 16/06

Summary

gm, Bitcoin maintained its position above $105,000 despite escalating tensions between Israel and Iran, bolstered by significant spot Bitcoin ETF inflows exceeding $300 million in a single day. Michael Saylor, co-founder of Strategy (already holding 582,000 BTC), announced plans for another substantial Bitcoin purchase, while Vietnam's National Assembly approved groundbreaking legislation recognizing crypto assets as part of a new digital technology law set to take effect in 2026. Meanwhile, a concerning Bitget report revealed that AI-generated deepfakes accounted for 40% of high-value crypto fraud in 2024, contributing to a $4.6 billion loss from scams—a 24% increase from the previous year—highlighting the evolving sophistication of crypto-related security threats.

News Headlines

💰 Trump Earns $57.3 Million From Crypto Venture World Liberty Financial

- Donald Trump reported earning $57.3 million from World Liberty Financial, his crypto venture co-founded with his sons that raised approximately $550 million from over 85,000 investors. This income is part of Trump's broader financial portfolio exceeding $600 million.

- The venture has attracted bipartisan scrutiny in Congress, with some lawmakers raising concerns about potential conflicts of interest, marking a significant shift from Trump's previously dismissive stance on cryptocurrencies.

💧 TradFi's Liquidity Issues Mirror Crypto's Structural Risks

- The cryptocurrency market, valued at $2.49 trillion in 2024, faces a serious liquidity illusion problem where seemingly robust order books often thin out dramatically during adverse market conditions. This fragility mirrors similar issues in traditional finance, creating a significant structural risk.

- Crypto's fragmented infrastructure leads to uncoordinated liquidity across multiple exchanges, especially problematic for Tier 2 assets, with practices like wash trading exacerbating the issue. Industry experts recommend integration at the protocol level through cross-chain capabilities to unify liquidity pools.

💼 Metaplanet Reaches 10,000 BTC Target, Announces $210M Bond Issuance

- Japanese investment firm Metaplanet has acquired 1,112 BTC for approximately $117.2 million, achieving its target of 10,000 BTC holdings at an average purchase price of $94,697 per Bitcoin. This acquisition coincides with the firm's approval of a $210 million bond issuance to EVO Fund for further Bitcoin purchases.

- Metaplanet aims to build its holdings to 210,000 BTC by 2027, representing about 1% of Bitcoin's total supply, despite being one of the most shorted stocks in Japan with analysts suggesting its valuation implies a dramatically higher Bitcoin price.

🐳 Ethereum Whales Accumulate While Retail Investors Cash Out

- Ethereum whales and sharks have increased their ETH holdings by 3.72% (adding 1.49 million ETH worth approximately $3.79 billion) over the past month, while retail investors have been taking profits. These large holders now control about 41.61 million ETH, representing nearly 27% of the total supply.

- Despite this significant accumulation by large investors, Ether's price has seen only modest gains of 1.8% and 3.8% over the last two weeks and month respectively, with ETH currently trading at $2,575, still 48% below its all-time high.

🖥️ Bybit to Launch Solana-Based DEX 'Byreal' in Q3

- Crypto exchange Bybit is set to launch Byreal, a hybrid decentralized exchange on Solana, in the third quarter of 2025, with a testnet version coming at the end of June. CEO Ben Zhou emphasized that the platform will combine centralized exchange liquidity with decentralized finance transparency.

- The platform will feature CEX-grade liquidity and aims to provide low-slippage, MEV-protected swaps through advanced routing techniques, entering a competitive market dominated by established DEXs like Raydium and Curve with total value locked in DEXs currently at $20.3 billion.

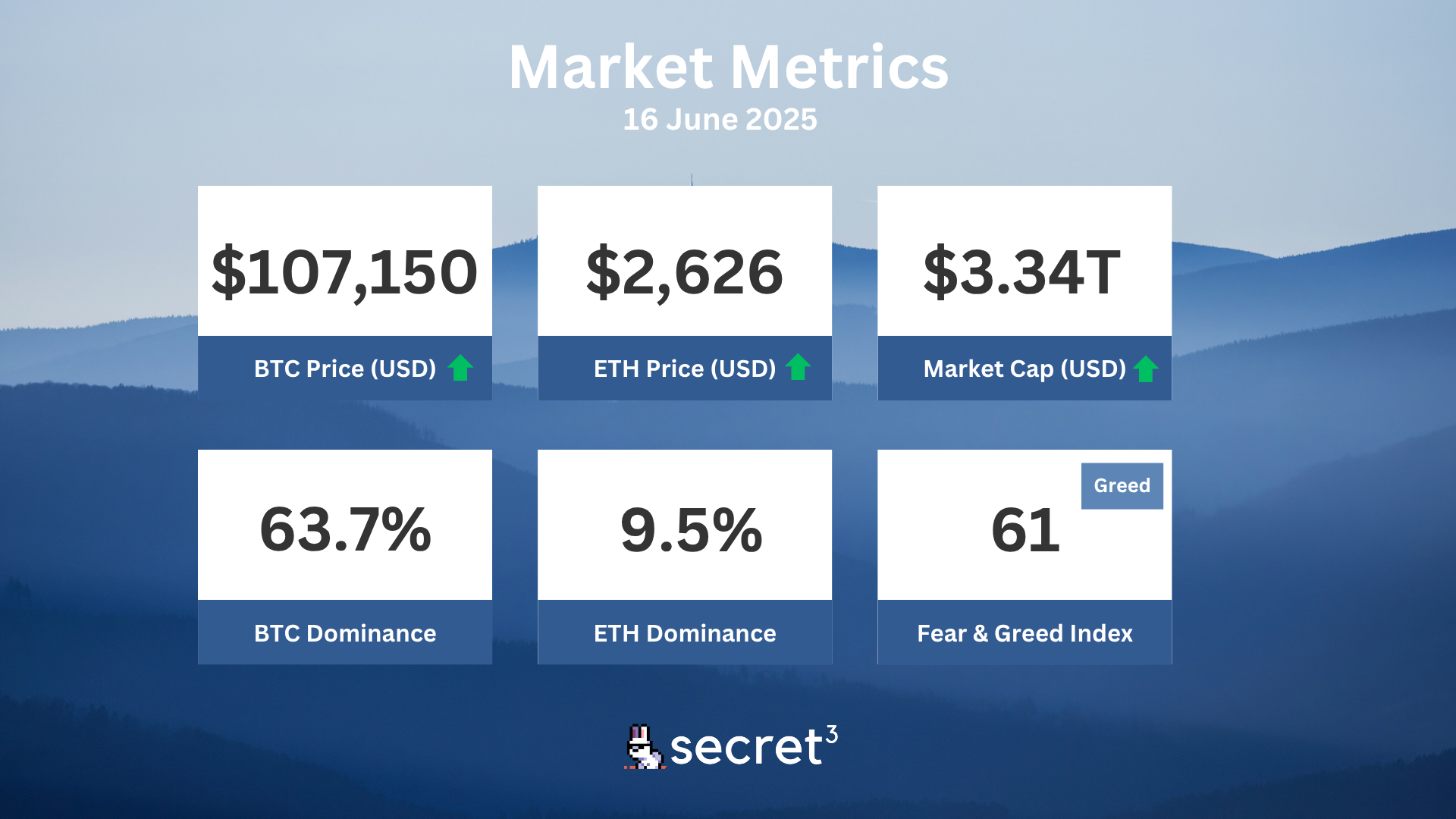

Market Metrics

Fundraising & VC

No fundraising data today.

Regulatory

🤝 Michael Saylor to Advise Pakistan on Crypto Strategy

- Strategy's Michael Saylor has agreed to advise Pakistan on its crypto ambitions during a meeting with the country's finance ministers, discussing how Bitcoin could be integrated into the nation's state reserves.

- Pakistan has established a dedicated Crypto Council tasked with drafting regulations for digital assets, signaling a comprehensive approach toward cryptocurrency integration in its financial system.

🗳️ Crypto Influenced 2024 US Election Outcome

- Trump strategist Chris LaCivita revealed that focusing on cryptocurrency issues played a crucial role in garnering support from traditionally Democratic-leaning demographics during the 2024 election.

- The Republican Party's pro-crypto stance included adding crypto protections to their election platform, marking a historic alignment with digital asset issues that coincided with cryptocurrency adoption reaching 28% among Americans in 2024.

🚨 Rise in Crypto-Related Kidnappings Prompts Security Concerns

- A recent kidnapping of a crypto trader in France highlights a concerning trend of crypto-related abductions, prompting discussions among security officials and industry leaders about necessary safety measures.

- The incident is part of a pattern of similar crimes in France, indicating potential regulatory gaps in protecting high-profile crypto participants and raising questions about disclosure of crypto holdings.

💸 Internet Capital Markets Reshape Corporate Fundraising

- Companies are increasingly turning to digital-native financial instruments, particularly meme coins, as alternative methods for raising capital or promoting their businesses outside traditional venture funding channels.

- Legal concerns persist around these fundraising methods, with regulatory experts advising companies to seek legal guidance to avoid classification as securities under the Howey test and potential enforcement actions.

📊 Australia Could Add Billions Through Digital Finance Reform

- A study presented at the Australian Digital Economy Conference indicates Australia could add 1% to its annual GDP through digital finance innovation and tokenization, with foreign exchange markets alone worth approximately US$4.8 billion annually.

- The report warns that Australia requires strategic collaboration and regulatory reform to capitalize on these opportunities, emphasizing the need for clear licensing rules to foster innovation in the digital asset space.

Technical Analysis

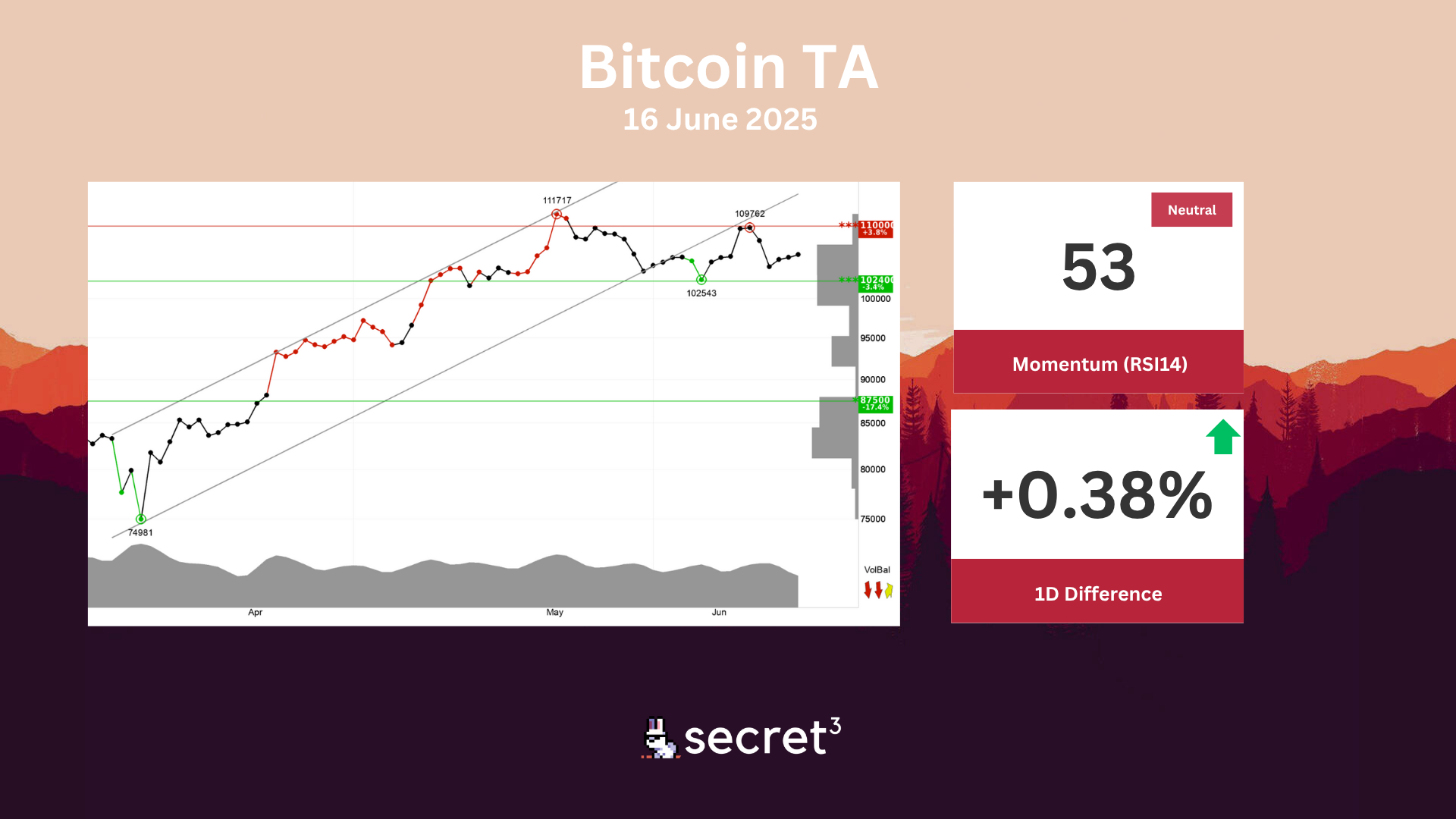

Bitcoin - Bitcoin has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. The currency has support at points 102400 and resistance at points 110000. The volume balance is negative and weakens the currency in the short term. The currency is overall assessed as technically neutral for the short term.

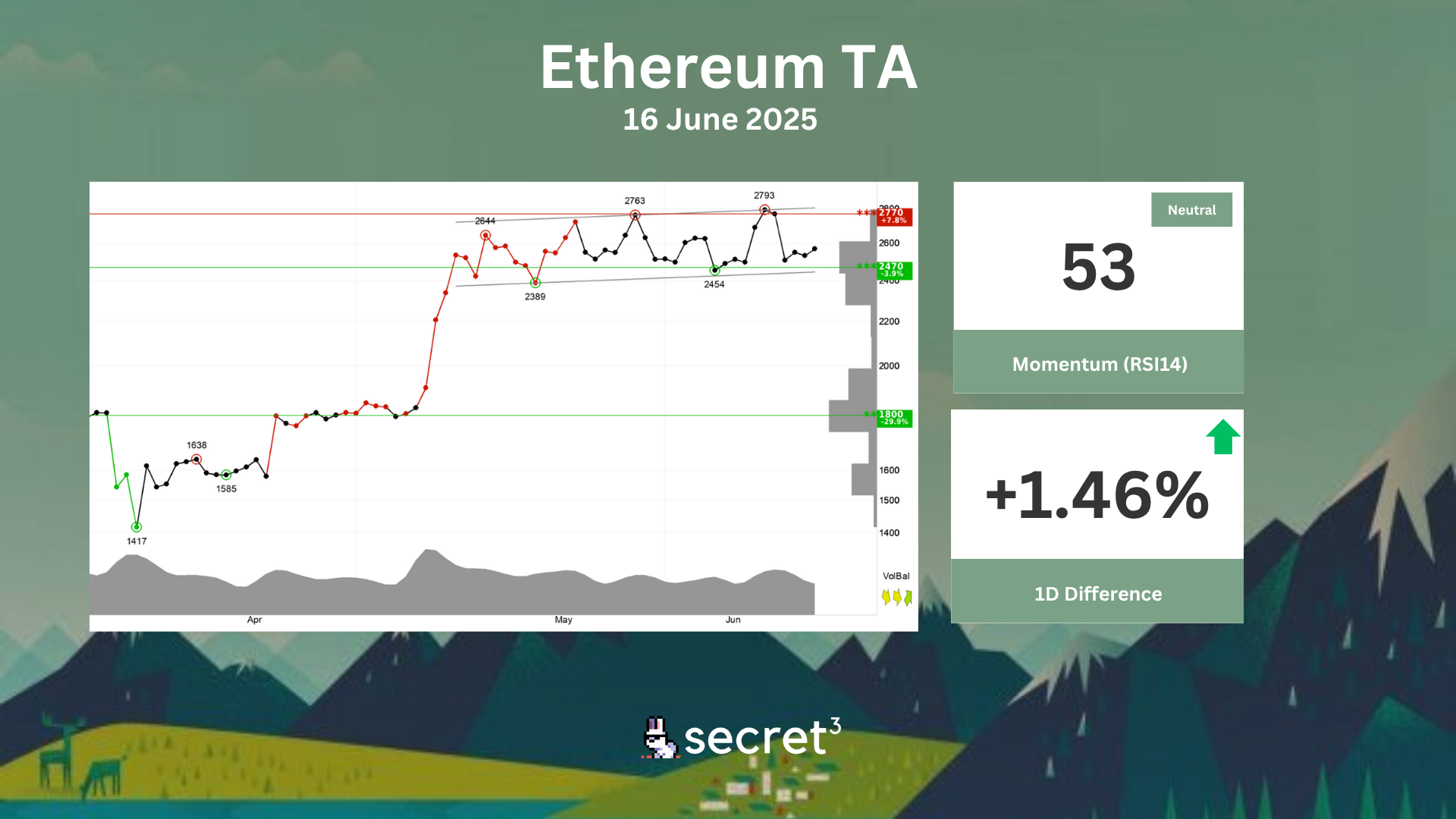

Ethereum - Ethereum is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. The currency is approaching support at 2470 points, which may give a positive reaction. However, a break downwards through 2470 points will be a negative signal. Volume has previously been high at price tops and low at price bottoms. This strengthens the currency and indicates increased chance of a break up. The RSI curve shows a rising trend, which is an early signal of a possible trend reversal upwards for the price as well. The currency is overall assessed as technically slightly positive for the short term.