gm 16/05

Summary

gm, JPMorgan executed its first tokenized Treasury transaction on a public blockchain using Ondo Finance and Chainlink's integration technology. Bitcoin continues to show strength above $100,000 while diverging from gold's performance, with BTC gaining 17% as gold declined 9% from its April highs, fueling discussions about Bitcoin's evolving role as a potential safe haven asset. Meanwhile, the expansion of Bitcoin's utility in DeFi is accelerating with new derivatives hitting Starknet and Sui, including Lombard's LBTC and Stacks' sBTC, providing Bitcoin holders with additional yield opportunities across emerging blockchain ecosystems. On the regulatory front, preparations are intensifying for an upcoming Senate vote on stablecoin legislation, with concerns about Trump's crypto ventures adding complexity to bipartisan agreement while Coinbase faces challenges on multiple fronts, including an SEC probe over user numbers and a significant customer data breach.

News Headlines

🎭 Tether Introduces Decentralized AI Platform 'QVAC'

- Tether has unveiled "QVAC," a decentralized AI platform operating on user devices without reliance on centralized servers, inspired by Isaac Asimov's "Multivac" concept, allowing AI agents to function autonomously across various devices.

- CEO Paolo Ardoino emphasized that QVAC aims to empower users by letting them retain control over their data and computational tasks, contrasting with Big Tech's gatekeeping approach, with plans to release an open-source SDK for AI agent development.

📱 Coinbase Introduces x402 Protocol for Direct Stablecoin Payments

- Coinbase has launched x402, an open protocol utilizing the HTTP 402 status code to facilitate direct stablecoin payments for APIs and apps.

- The protocol enables seamless machine-to-machine transactions without user intervention, addressing limitations of traditional payment systems and supporting real-time micropayments essential for AI-driven economies.

🌐 Ethereum Foundation Launches Trillion Dollar Security Initiative

- The Ethereum Foundation has launched the "Trillion Dollar Security Initiative" to enhance network security, structured in three phases beginning with thorough assessment of wallet user experience, smart contract tooling, and consensus protocols.

- The goal is to strengthen Ethereum's security to the point where institutions and governments can confidently store over one trillion dollars in a single contract, with prominent blockchain security figures leading the community-driven project.

🔍 Coinbase Refuses $20M Ransom After Support Agent Data Breach

- Coinbase rejected a $20 million ransom demand following a data breach where insider support agents stole account data from less than 1% of monthly transacting users in a phishing scheme, affecting customer information but not passwords, keys, or funds.

- Instead of paying the ransom, Coinbase announced a $20 million reward for information leading to the arrest and conviction of those responsible, highlighting ongoing risks of social engineering attacks in the crypto space.

🦊 Dogecoin Active Addresses Surge by 528% Following SEC's ETF Filing Acknowledgment

- Dogecoin has experienced a remarkable 528% increase in active addresses, reaching 469,477, attributed to the SEC's acknowledgment of 21Shares' spot DOGE ETF filing, while futures open interest rose 70% to $1.65 billion.

- Analysts suggest DOGE could reach key targets of $0.40 to $0.42 if it breaks resistance around $0.24, with strong spot-buyer demand and positive long-term holder sentiment pointing to potential upward momentum.

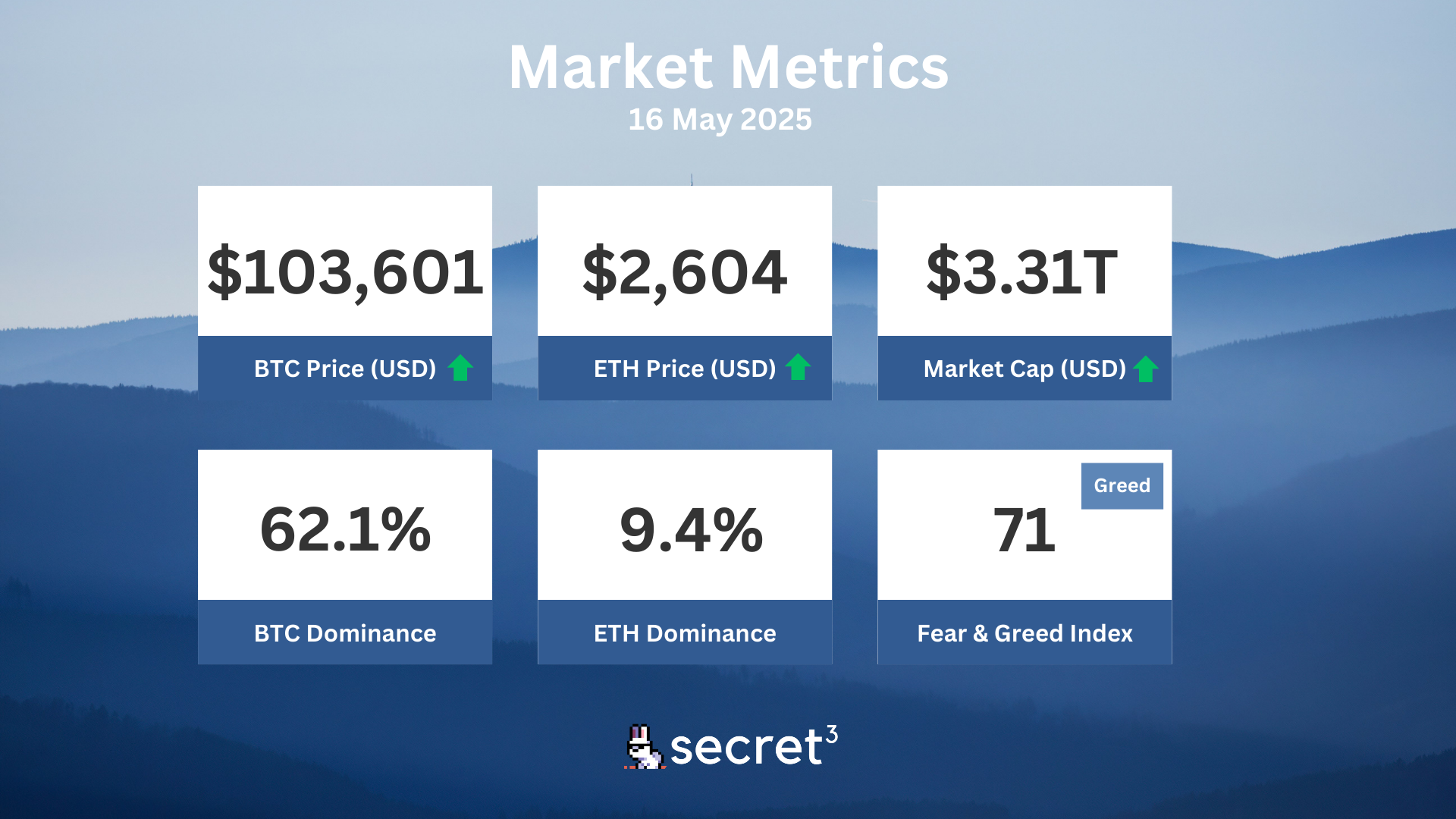

Market Metrics

Fundraising & VC

1. Giza (Undisclosed, $5.2M) - Infrastructure for Xenocognitive Finance

2. UXLINK (Strategic, Undisclosed) - AI-Powered Web3 social platform and infrastructure

Regulatory

🔍 Democrats Demand Treasury Reports on Trump's Crypto Ventures

- Democrat lawmakers have formally requested suspicious activity reports (SARs) from the US Treasury regarding Trump-backed crypto projects, including World Liberty Financial and the Trump token.

- The investigation aims to identify potential violations in campaign finance and anti-corruption laws, with specific concern about foreign influence peddling.

👩⚖️ DOJ Proceeds with Tornado Cash Developer Trial

- The Department of Justice will continue prosecuting Roman Storm despite dropping one charge related to operating an unlicensed money transmitter business.

- The case moves forward despite a recent DOJ memo suggesting a shift in crypto enforcement approach, with Storm still facing serious charges including conspiracy to commit money laundering.

🌎 Canada Misclassified Stablecoins as Securities, Says NDAX Exec

- Tanim Rasul, COO of NDAX, criticized Canada's classification of stablecoins as securities and derivatives, arguing they should be viewed as payment instruments as in European regulations.

- Despite regulatory challenges, Canada's digital asset market generated $224 million in revenue in 2024 with an expected annual growth rate of 18.6% until 2030.

🏝️ Northern Marianas Passes Stablecoin Bill Over Governor's Veto

- The Northern Mariana Islands enacted a bill allowing Tinian to issue a stablecoin backed by US Treasury bills, overriding Governor Arnold Palacios' veto with a 14-2 House vote.

- Tinian, with just over 2,000 residents, aims to establish its "Marianas US Dollar" (MUSD) stablecoin before Wyoming, potentially attracting significant investment to the struggling economy.

Technical Analysis

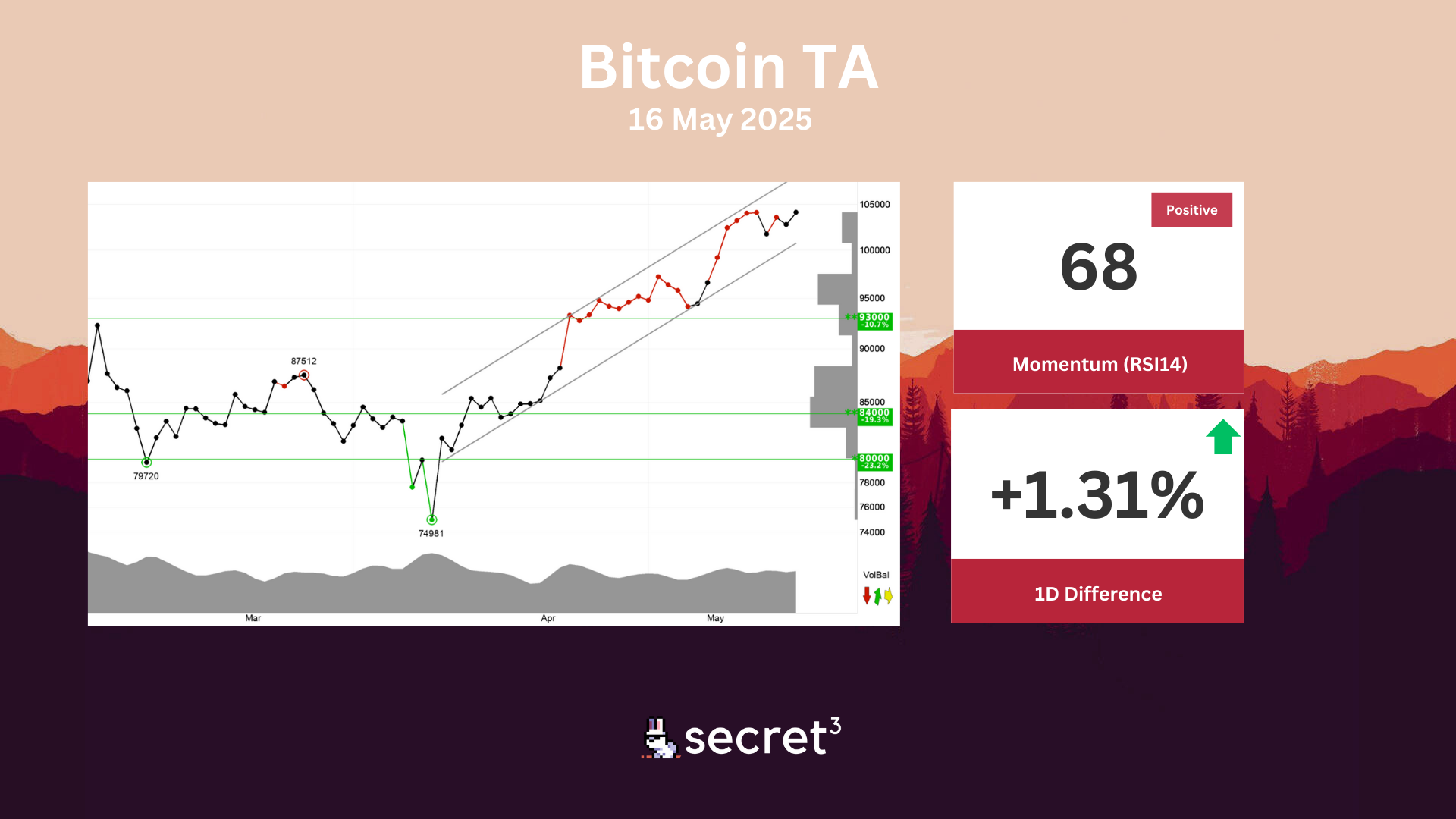

Bitcoin - Bitcoin is in a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 93000 points. Positive volume balance indicates that volume is high on days with rising prices and low on days with falling prices, which strengthens the currency. The currency is overall assessed as technically positive for the short term.

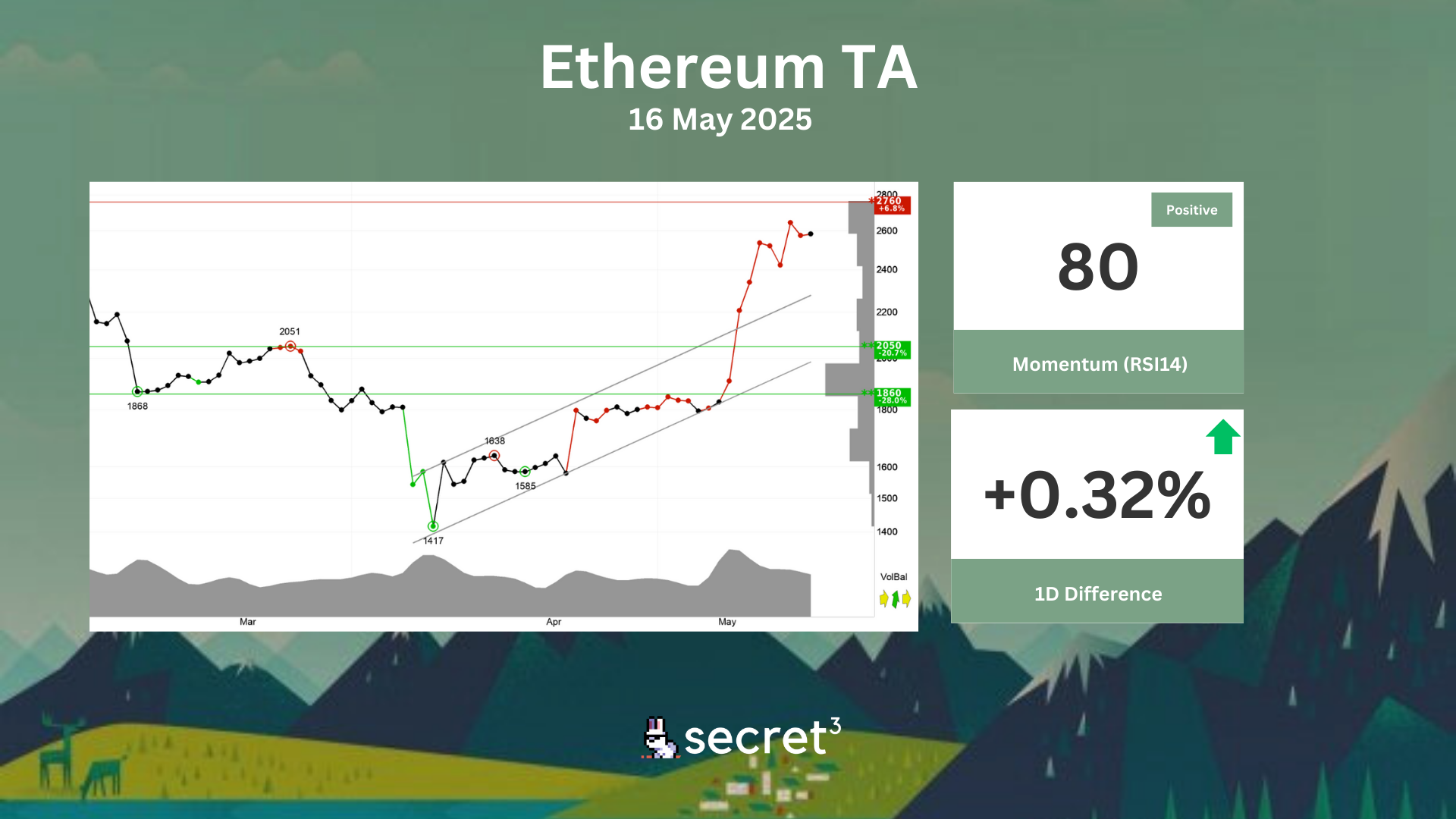

Ethereum - Ethereum has broken the rising trend up in the short term, which indicates an even stronger rising rate. The currency has support at points 2050 and resistance at points 2760. Positive volume balance shows that volume is higher on days with rising prices than days with falling prices. This indicates increasing optimism among investors. RSI above 70 shows that the currency has strong positive momentum in the short term. Investors have steadily paid more to buy the currency, which indicates increasing optimism and that the price will continue to rise. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.