gm 16/02

Summary

gm, Tether, the largest stablecoin issuer, acquires a minority stake in Italian soccer club Juventus, leading to a surge in fan tokens. The SEC requested an extension in its case against Coinbase, citing potential resolution prospects, while Bybit was removed from France's regulatory blacklist after two years of cooperation. Meanwhile, Wisconsin's investment board significantly increased its holdings in BlackRock's Bitcoin ETF, and concerns arose about liquidity fragmentation as January saw a record launch of over 600,000 new cryptocurrencies.

News Headlines

🚀 Inversion Chain Aims to Be the "Berkshire of Crypto" on Avalanche

- Inversion Chain, launched on the Avalanche network, plans to provide customized blockchain solutions for acquired businesses, aiming to simplify crypto experiences for users.

- The project focuses on creating a platform adaptable to various business needs through its own chain, with a goal to retain users and educate them on practical cryptocurrency use cases, especially in mobile and fintech services.

⚽ Fan Tokens Surge Following Tether's Juventus FC Investment

- The Juventus Fan Token (JUV) saw a 120% increase within 24 hours following Tether's investment announcement in Juventus FC.

- Other soccer club fan tokens, including S.S Lazio (LAZIO) and FC Porto (PORTO), also recorded double-digit percentage gains, highlighting the growing influence of crypto investments in traditional sports.

📉 Bitcoin Price Declines for Five Straight Weekends

- Bitcoin has been declining for five consecutive weekends, an unusual trend highlighted by Standard Chartered's analyst Geoff Kendrick.

- Factors contributing to this decline include concerns around recent events such as DeepSeek AI developments and Trump tariff threats, with analysts monitoring the upcoming U.S. Presidents' Day holiday for potential market impacts.

🌴 El Salvador's Bitcoin Experiment: From El Zonte to National Adoption

- El Zonte, a coastal village in El Salvador, has become a pioneering hub for Bitcoin, fostering the world's first Bitcoin circular economy.

- The Bitcoin Beach initiative, inspired by local developments, led to President Nayib Bukele making Bitcoin legal tender in 2021, significantly reducing the percentage of unbanked residents.

🔒 Tether Engages with US Lawmakers on Stablecoin Regulation

- Tether, the largest stablecoin issuer, is engaging with US Congressional lawmakers to influence stablecoin regulation at the federal level.

- This collaboration includes discussions on new stablecoin bills, with Tether aiming to adapt to US laws and contribute to the legislative process, potentially requiring regular audits and one-to-one backing for its stablecoins.

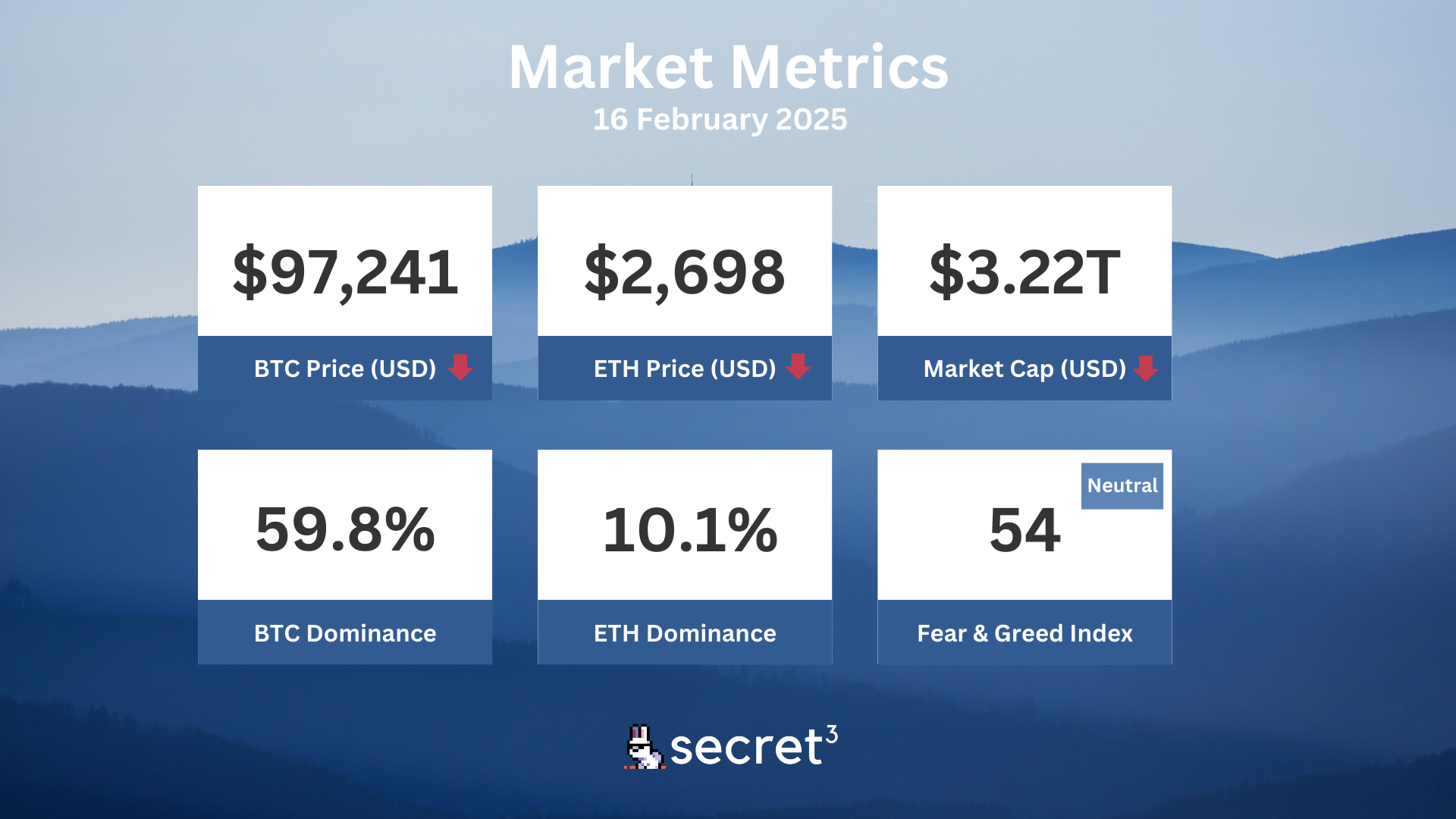

Market Metrics

Fundraising & VC

No fundraising data today.

On-chain Data

1. Arbitrum (ARB) token unlocked today ($44.51M, 2.13%)

2. Avalanche (AVAX) token unlocked today ($42.43M, 0.4%)

3. ApeCoin (APE) token unlock in 1 day ($11.12M, 2.16%)

4. Neon (neon) token unlock in 1 day ($10.11M, 22.51%)

5. Oasis Network (ROSE) token unlock in 2 days ($2.73M, 0.92%)

Regulatory

🏦 West Virginia Proposes Digital Asset Reserve Bill

- West Virginia State Senator Chris Rose introduced a bill allowing the state treasury to invest in digital assets and precious metals.

- The proposed legislation permits investment in digital assets with a market cap over $750 billion, limited to 10% of total assets.

🏛️ US States Introduce Crypto-Focused Legislation

- Nine US states have introduced legislation focused on cryptocurrency since early February 2025.

- This trend indicates growing state-level interest in adopting favorable measures towards the blockchain industry.

📈 NYSE Proposes Ethereum Staking for Grayscale ETFs

- The NYSE has filed for approval to introduce staking in Grayscale's spot Ethereum ETFs.

- If approved, this would allow Grayscale to stake Ether within its ETH trust funds.

🏛️ Bybit Cleared to Operate in France

- Crypto exchange Bybit is no longer considered illegal in France after cooperation with regulators.

- The exchange has been removed from the AMF blacklist and is now seeking a MiCA license for European operations.

Technical Analysis

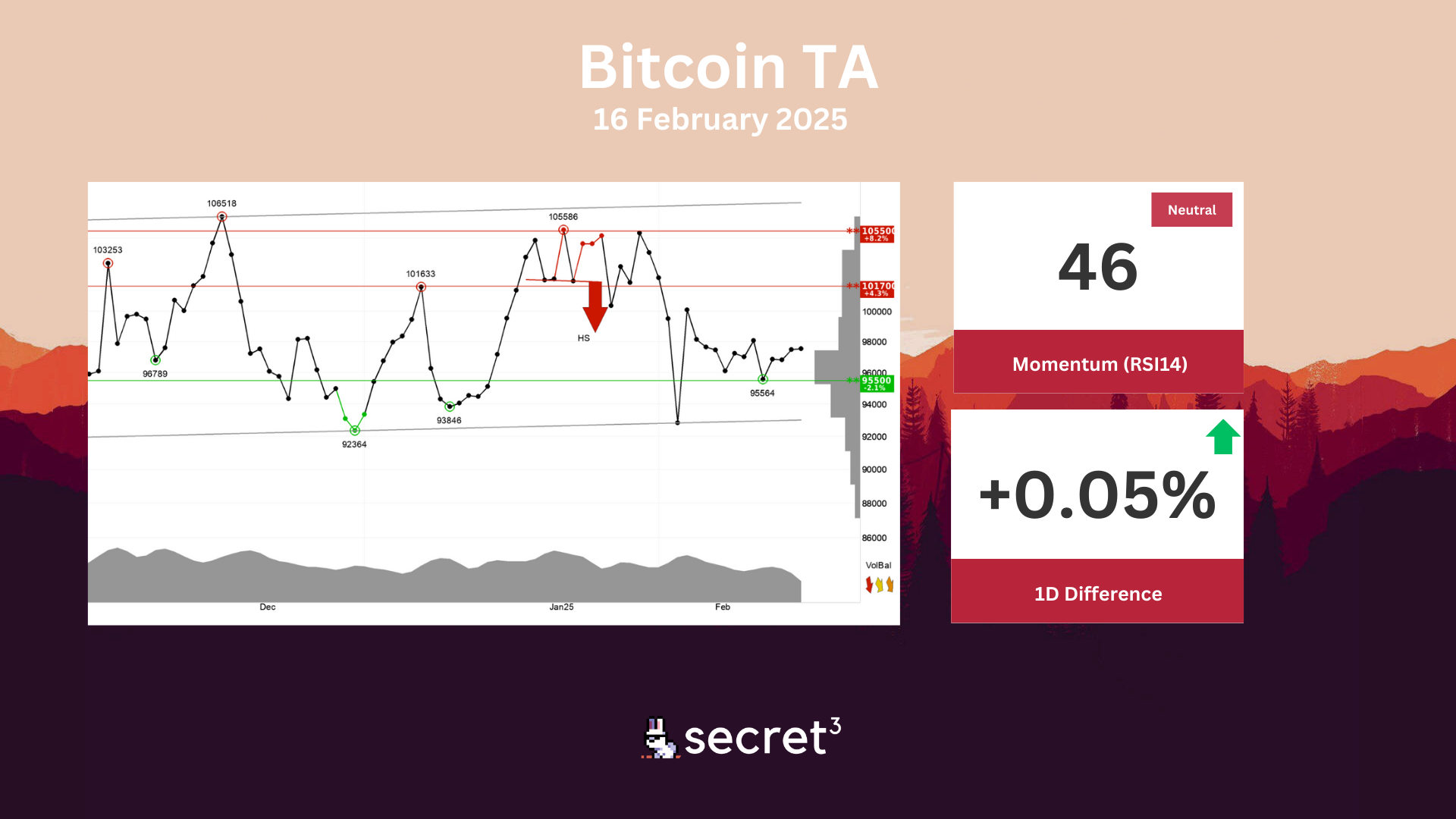

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. The currency has support at points 95500 and resistance at points 101700. The RSI curve shows a rising trend, which is an early signal of a possible trend reversal upwards for the price as well. The currency is overall assessed as technically slightly negative for the short term.

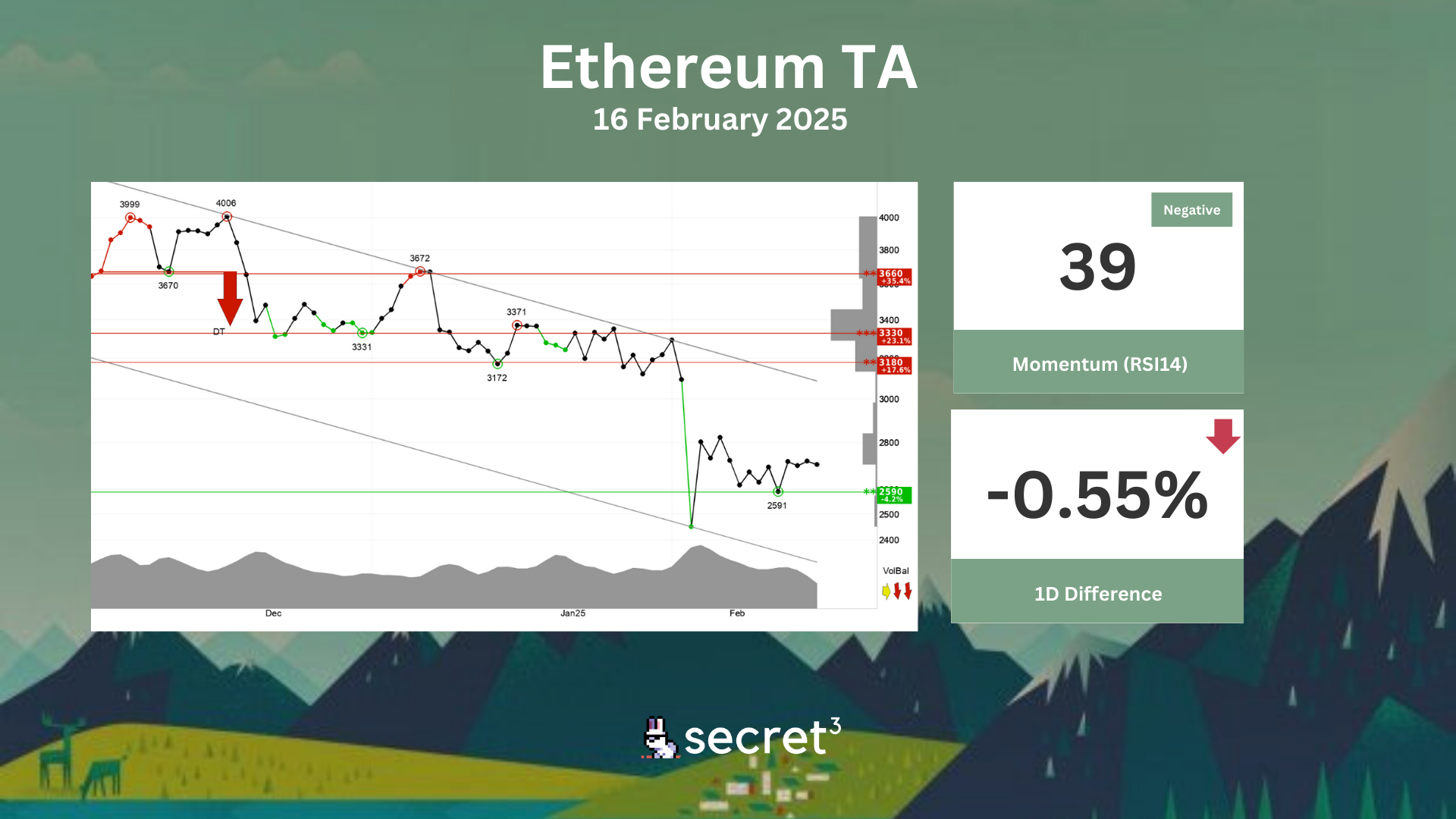

Ethereum - Ethereum is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. The currency has support at points 2590 and resistance at points 3180. Volume has previously been low at price tops and high at price bottoms. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

🌐 Origin DAO | Yield Forwarding Request: HEDGY (Pending Analysis)

- This proposal seeks to enable yield forwarding and treasury booster for the HEDGY pool on SwapX.

🔮 Osmosis DAO | Alloyed TON: Add TON.int3 (907) (Active Vote)

- This proposal seeks to add TON.int3 as a constituent of Alloyed TON, which currently consists of TON.orai.

💧 Lido DAO | Proposal for a Lido Accounting Oracle Second Opinion

- The proposal requests $50,000 to fund the RISC Zero team's development of a zero-knowledge (ZK) proof-based oracle.