gm 15/06

Summary

gm, Bitcoin recovered to around $106,000 after dipping to $102,650 following Israeli airstrikes on Iran. Institutional developments continued to shape the market as SharpLink Gaming acquired 176,271 ETH for nearly $463 million, making it the largest ETH holder among publicly traded companies, while the Ethereum Foundation pledged $500,000 to support Tornado Cash co-founder Roman Storm's legal defense ahead of his pivotal trial. Meanwhile, Coinbase announced major payment innovations, including a stablecoin payment option on Shopify and an American Express credit card offering 2-4% bitcoin cashback, as seven issuers submitted amended Solana ETF filings to the SEC that include staking provisions, reflecting the growing institutional interest in yield-generating crypto products.

News Headlines

💰 Cardano Dips 6% Amid Debate Over $100M Treasury Plan

- Cardano's ADA token fell over 6% as the community debates allocating $100 million (140 million ADA) from the treasury to boost stablecoin liquidity, aimed at strengthening Cardano's DeFi ecosystem.

- The proposal has created division within the community, with concerns about selling pressure competing against Charles Hoskinson's support for the initiative as a potential source of non-inflationary revenue.

🍏 Saylor Says Bitcoin Could Fix Apple's Stock Buybacks

- Michael Saylor suggests that Apple should invest in Bitcoin to enhance its underperforming stock buyback program, contrasting Bitcoin's 11% rally in 2025 with Apple's 18% decline during the same period.

- Saylor points to Bitcoin's 1,000% surge over five years compared to Apple's 137% increase, highlighting the potential for digital asset investments to restore shareholder value amid market challenges.

💼 Crypto Biz: Meta's AI Bet, Fortune 500's Stablecoin Push

- Nearly 29% of Fortune 500 companies are now using or exploring stablecoins, a dramatic increase from just 8% in 2024, as the stablecoin market surpasses $250 billion driven by faster transactions and lower fees.

- Meta Platforms is bolstering its AI capabilities with the acquisition of Scale AI for nearly $15 billion, while Guggenheim expands its digital debt offerings through a partnership with Ripple on the XRP Ledger.

🔔 Circle's NYSE Debut Marks Start of Crypto IPO Season

- Circle's successful IPO on June 5, 2025, saw CRCL soaring nearly 290%, signaling strong investor appetite for crypto and sparking interest in the public markets for other crypto firms.

- Gemini, Bullish, and Kraken are among the companies preparing to go public amid increasing regulatory clarity, with Kraken reportedly considering an IPO in early 2026.

⚠️ Closing Strait of Hormuz Is Biggest Risk to BTC Price This Weekend — Analyst

- Bitcoin's price could face a sharp correction if Iran closes the Strait of Hormuz, a vital route supplying approximately 20% of the world's oil, according to Coin Bureau founder Nic Puckrin.

- Despite short-term geopolitical risks, Bitcoin's long-term outlook remains positive due to the decreasing value of the US dollar and continued accumulation by long-term holders despite current tensions.

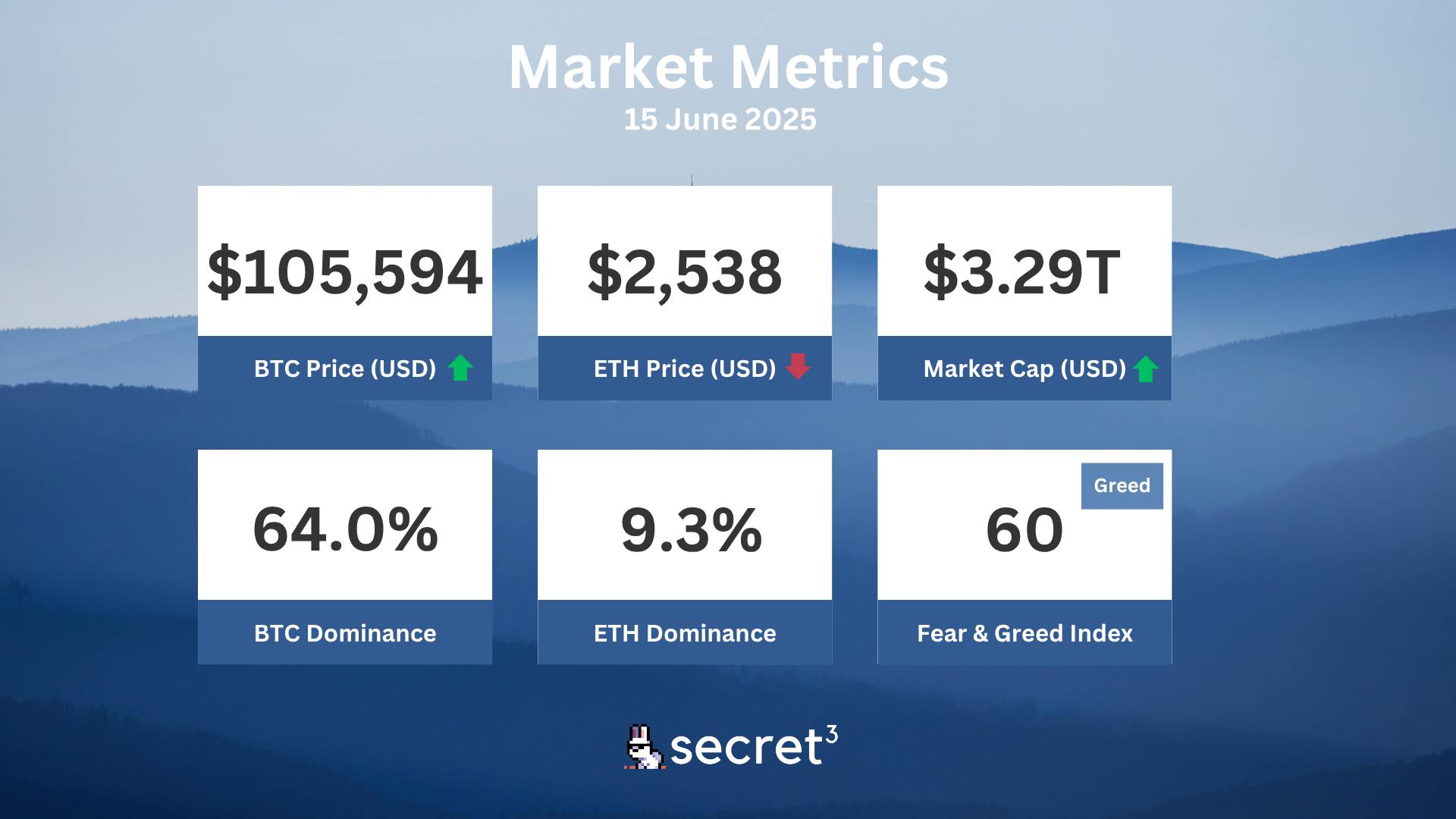

Market Metrics

Fundraising & VC

No fundraising data today.

Regulatory

👨⚖️ Tornado Cash Co-founder Warns DeFi at Risk in Upcoming Trial

- Roman Storm faces serious charges including conspiracy to commit money laundering and operating an unlicensed money transmitter business, with his trial set to begin July 14.

- Storm argues his prosecution sets a dangerous precedent by holding software developers accountable for how their technology is used, potentially threatening the foundational principles of decentralized finance.

⚖️ Crypto Market Manipulator Sentenced to Prison

- Gotbit Consulting and its founder Aleksei Andriunin were sentenced for manipulating crypto markets through wash trading, with the company ordered to forfeit $23 million in cryptocurrency.

- Andriunin received an eight-month prison sentence for developing software to artificially inflate trading prices and volumes of cryptocurrencies, part of a larger federal crackdown on digital asset fraud.

🌞 Solana ETF Applicants Submit Updated SEC Filings

- Seven issuers including 21Shares, Bitwise, Fidelity, Franklin Templeton, Grayscale, VanEck, and Canary Capital have submitted amended S-1 forms to the SEC for Solana ETFs.

- The updated filings specifically include provisions for staking SOL tokens, which could potentially enhance returns for investors, signaling progress despite ongoing regulatory discussions.

🏢 Trump Media's Bitcoin Treasury Registration Approved

- The SEC has "declared effective" Trump Media and Technology Group's S-3 registration statement for its $2.3 billion Bitcoin treasury, allowing for the resale of approximately 56 million shares.

- TMTG's CEO emphasized the company's expansion plans, including enhancing its social media platform and establishing a Bitcoin treasury, reflecting growing corporate interest in cryptocurrency investments.

🔄 Solana ETFs Face Continued SEC Review Process

- Analyst James Seyffart suggests approval for Solana ETFs is unlikely to occur quickly, noting that the process typically involves extensive discussions similar to the lengthy considerations for Bitcoin ETFs.

- All submitting firms included staking language in their applications, with potential for simultaneous approval of staking for spot Solana and Ether ETFs, though the timeline remains uncertain.

Technical Analysis

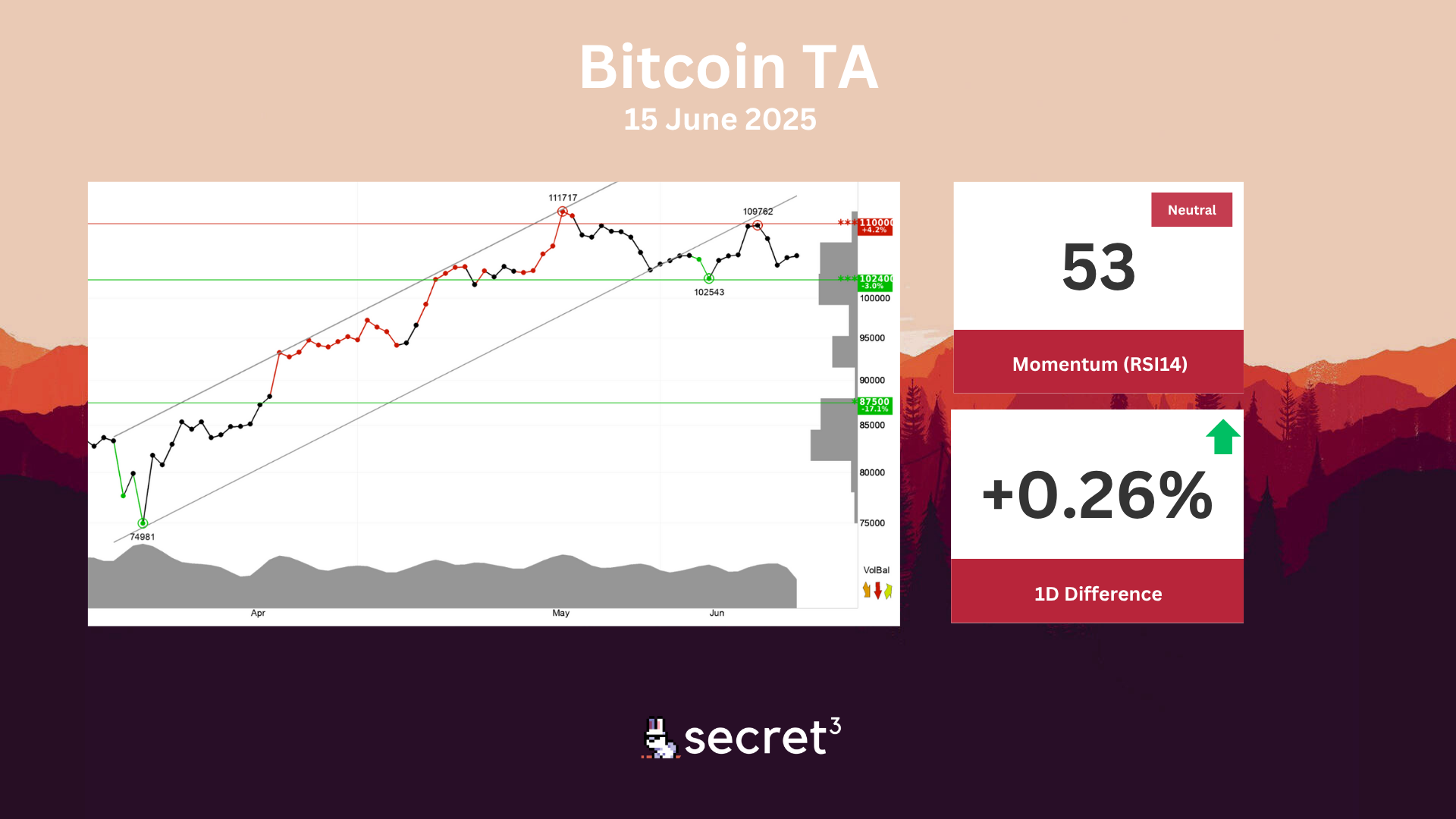

Bitcoin - Bitcoin has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. The currency has support at points 102400 and resistance at points 110000. Negative volume balance indicates that volume is high on days with falling prices and low on days with rising prices, which weakens the currency. The currency is overall assessed as technically neutral for the short term.

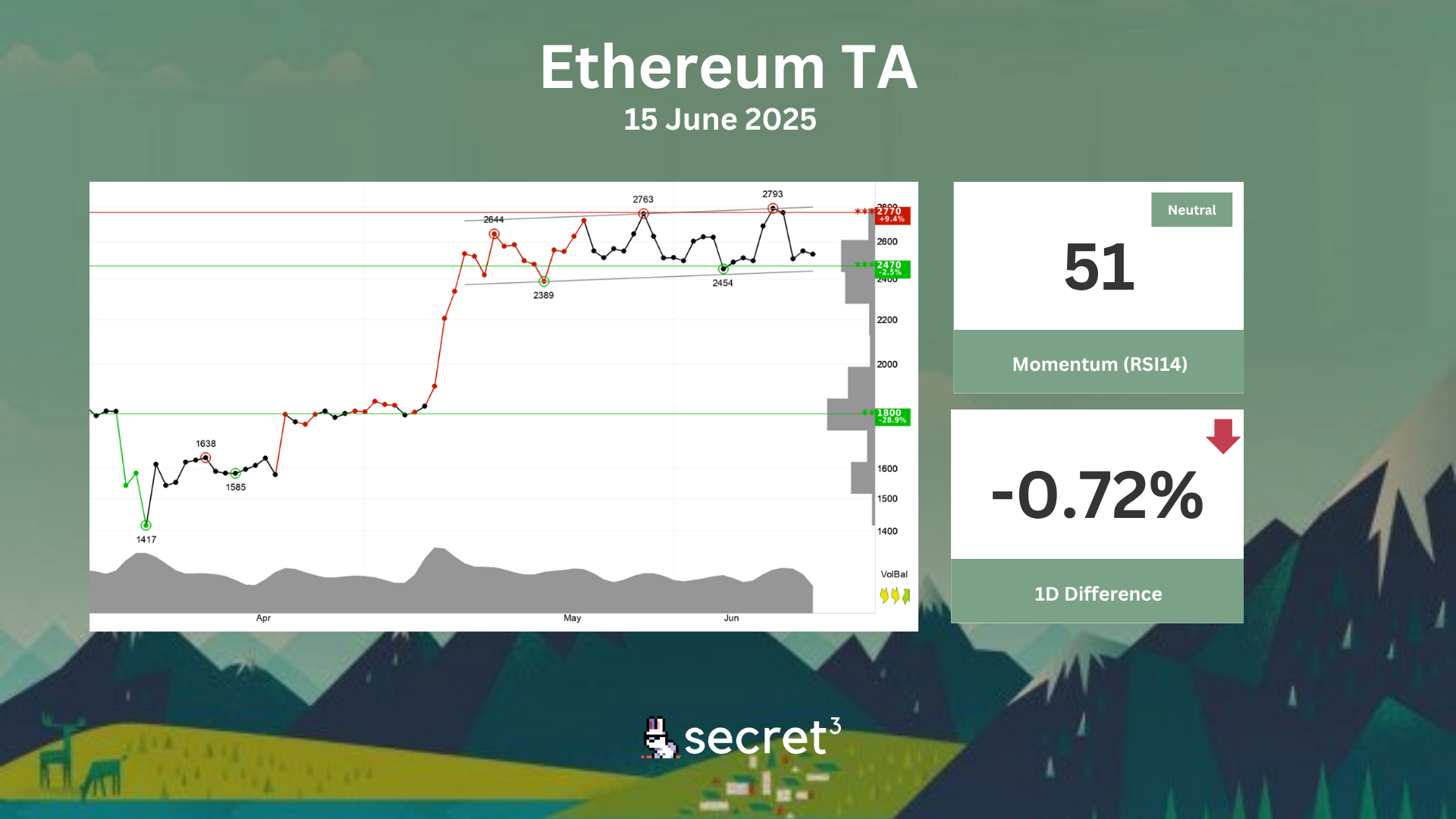

Ethereum - Ethereum is within an approximate horizontal trend channel in the short term. This indicates that investors are uncertain and waiting for signals of further direction. A break upwards will be a positive signal, while a break downwards will be a negative signal. The currency is approaching support at 2470 points, which may give a positive reaction. However, a break downwards through 2470 points will be a negative signal. Volume tops and volume bottoms correspond well with tops and bottoms in the price. This strengthens the currency and indicates increased chance of a break up. The RSI curve shows a rising trend, which is an early signal of a possible trend reversal upwards for the price as well. The currency is overall assessed as technically slightly positive for the short term.