gm 15/05

Summary

gm, Tether made a substantial move by purchasing $459 million worth of Bitcoin to support the launch of Twenty One, a Bitcoin treasury company set to trade on Nasdaq. VanEck launched its tokenized real-world asset fund VBILL, while JPMorgan completed its first tokenized Treasury transaction on a public blockchain, highlighting growing institutional engagement with blockchain technology. Meanwhile, eToro's successful Nasdaq debut saw shares surge 30%, valuing the company at $5.4 billion. On the market front, Bitcoin has been consolidating around the $102,000 level, while Ethereum and other altcoins have shown remarkable strength, with ETH rising over 40% in the past week and analysts noting a potential shift in market dynamics as Bitcoin dominance wanes, signaling what many are calling an "altcoin season."

News Headlines

🔄 Yuga Labs Sells CryptoPunks IP to Infinite Node Foundation

- The Infinite Node Foundation, a nonprofit dedicated to digital art, has acquired the intellectual property of the CryptoPunks NFT collection from Yuga Labs for approximately $20 million.

- With its 10,000 NFTs having a market cap of nearly $1.2 billion and over $3 billion in sales since 2017, CryptoPunks will now be managed by an advisory board including original artists and Yuga Labs representatives.

🌊 Solana Network and DeFi Activity Suggest Further SOL Price Rally

- Solana's total value locked (TVL) has reached $10.9 billion, surpassing the entire Ethereum layer-2 ecosystem, with on-chain metrics indicating potential for further gains.

- The platform's 30-day fee revenue increased by 109% to $43.4 million, while 65% of SOL supply is staked, suggesting that rising fee revenue will likely enhance demand for the token.

💼 CFTC Commissioner Mersinger to Lead Blockchain Association

- Summer Mersinger, a commissioner at the CFTC, will step down to become the CEO of the Blockchain Association starting June 2, succeeding Kristin Smith who is moving to the Solana Policy Institute.

- Mersinger's move opens a nomination slot for President Trump and occurs as Congress seeks clarity on regulatory roles for digital assets, highlighting the evolving landscape in crypto regulation and advocacy.

🤝 Standard Chartered Partners with FalconX to Enhance Crypto Banking Services

- Standard Chartered has formed a partnership with crypto prime broker FalconX to provide banking services to FalconX's global institutional clients.

- The collaboration will initially integrate the bank's infrastructure and access to various currency pairs, with plans to expand beyond traditional banking to meet the increasing demand for crypto solutions.

💵 Mastercard Partners with MoonPay to Launch Stablecoin Cards

- Mastercard has partnered with MoonPay to launch stablecoin cards, allowing users to make payments in stablecoins at over 150 million merchants globally.

- This initiative marks a significant step in Mastercard's ongoing efforts to expand its cryptocurrency services, following other collaborations aimed at creating a comprehensive ecosystem for crypto payments.

Market Metrics

Fundraising & VC

1. KYD Labs (Seed, $7.1M) - Web3 ticketing platform on Aptos blockchain

2. N1 (Public Token Sale, $2M) - Layer 1 blockchain

Regulatory

🏛️ Senate Stablecoin Bill Advances Without Trump-Targeting Provisions

- The US Senate is moving forward with a bipartisan stablecoin bill, potentially passing it by May 26 after removing provisions specifically targeting President Trump's crypto interests.

- Senators Gillibrand and Lummis announced the bill will focus on comprehensive regulation of stablecoins rather than addressing Trump's ethical concerns entirely, though some ethics requirements remain.

🌏 Thailand to Tokenize $150M in Government Bonds

- The Thai government will issue $150 million worth of digital investment tokens, allowing retail investors to purchase government bonds with a minimum investment of just $3.8.

- These "G-tokens" aim to involve more retail investors in the digital economy and will be tradable on licensed digital asset exchanges, with returns expected to be higher than current bank deposit rates.

⚡ Nebraska Approves Crypto Mining Regulations

- Nebraska lawmakers unanimously passed LB 526, a bill imposing new regulations on large-scale crypto mining operations using over 1 megawatt of electricity.

- The legislation requires miners to bear infrastructure upgrade costs, publicly report energy use, and accept service interruptions during periods of grid strain.

💰 Kazakhstan Aims to Become Central Asia's Crypto Hub

- Kazakhstan plans to establish itself as a leading crypto hub in Central Asia through comprehensive regulatory reforms that would lift restrictions on digital asset activities.

- Recommendations include allowing digital asset trading, establishing nationwide crypto regulations, and implementing transparent exchanges, potentially adding billions to the country's budget.

⚖️ South Korean Presidential Candidates Support Bitcoin ETFs

- All three major South Korean presidential candidates have expressed support for legalizing Bitcoin exchange-traded funds (ETFs), potentially aligning the country with trends seen in Hong Kong.

- Despite this pro-crypto stance, experts warn against expecting immediate regulatory changes, citing past unfulfilled political promises regarding cryptocurrency legislation in South Korea.

Technical Analysis

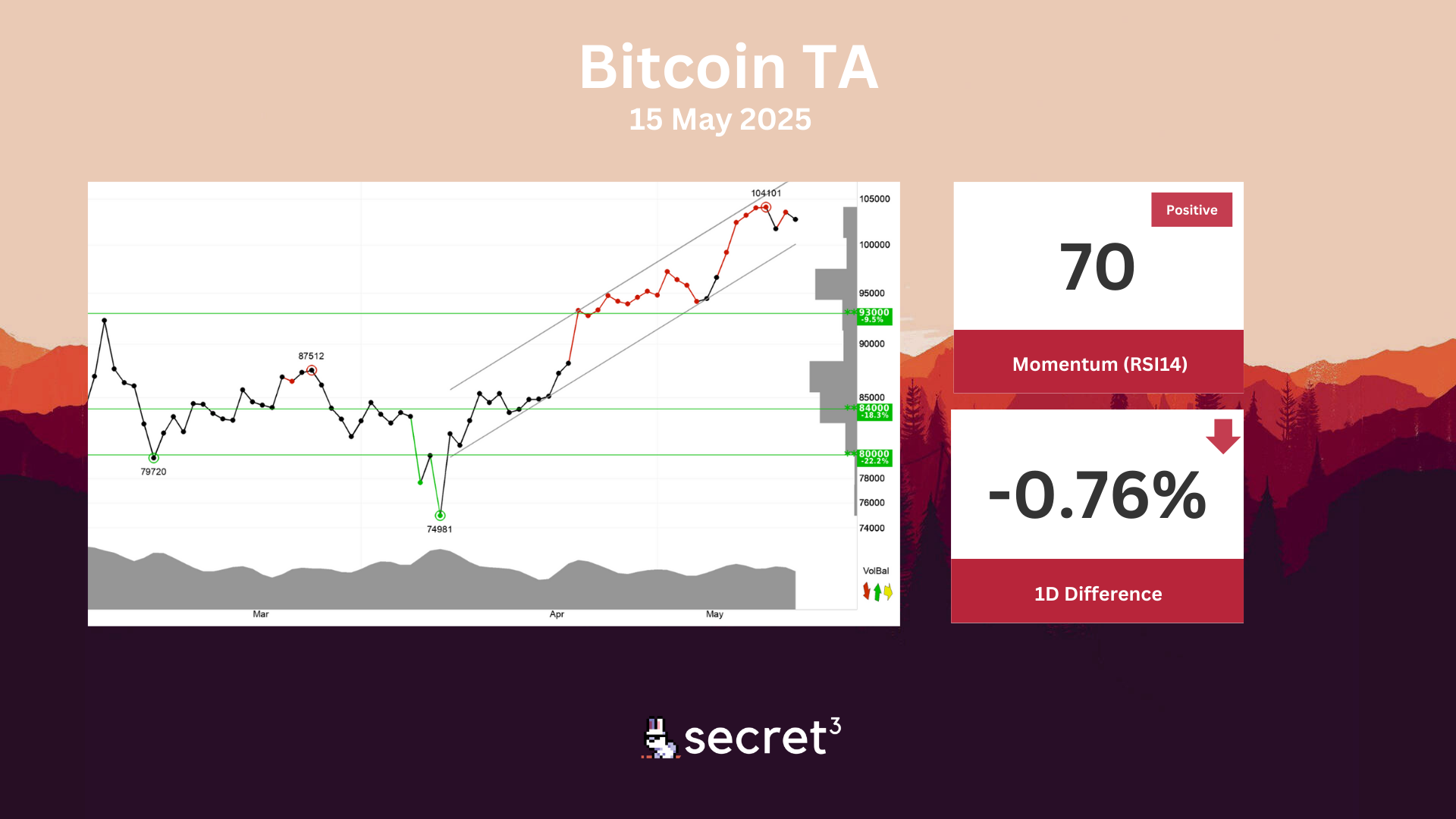

Bitcoin - Bitcoin shows strong development within a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 93000 points. Positive volume balance indicates that volume is high on days with rising prices and low on days with falling prices, which strengthens the currency. The currency is overall assessed as technically positive for the short term.

Ethereum - Ethereum has broken up through the ceiling of the rising trend channel in the short term, which signals an even stronger rising rate. The positive development, however, may give rise to short term corrections down from today's level. The currency has support at points 2050 and resistance at points 2760. The volume balance is positive and strengthens the currency in the short term. RSI is above 70 after a good price increase the past weeks. The currency has strong positive momentum and further increase is indicated. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.