gm 15/03

Summary

gm, The U.S. Senate advanced a significant stablecoin bill and MoonPay acquires stablecoin infrastructure platform Iron. The stablecoin bill, known as the GENIUS Act, passed through a Senate committee with bipartisan support, potentially paving the way for clearer regulations in the sector. Meanwhile, MoonPay's acquisition of Iron aims to enhance its capabilities in stablecoin infrastructure, reflecting growing interest in this area of the crypto ecosystem. Additionally, Bitcoin experienced a moderate recovery, rising above $84,000 amid a broader rally in risk-on assets, although analysts caution that market volatility may persist in the near term.

News Headlines

🚀 Solana Price Could Drop 30% After Death Cross

- Solana's price may decline to $80 if it fails to maintain support between $125-$110 after completing a bearish "death cross" pattern.

- The death cross occurs when the 50-day moving average falls below the 200-day moving average, historically leading to significant price drops for Solana.

📊 Bitcoin and S&P 500 Struggle Below Key Technical Level

- Bitcoin and the S&P 500 are facing downward pressure, struggling to secure prices above the critical 200-day moving average.

- Falling below this level has historically signaled potential further declines for both assets.

💰 Trump-backed World Liberty Financial (WLFI) Completes $590M Token Sale

- World Liberty Financial (WLFI), backed by former President Donald Trump, has successfully completed a token sale raising $590 million.

- The funds are expected to fuel further developments at WLFI, which plans to use blockchain technology to enhance financial services.

🔍 BlackRock Now Holds Over 567,000 BTC, Valued at Over $47 Billion

- BlackRock has amassed over 567,000 Bitcoin, valued at approximately $47.8 billion, positioning it as one of the largest BTC holders globally.

- Their latest acquisition involved a transfer of 268 BTC from a Coinbase Prime wallet to their iShares Bitcoin ETF wallet.

🚀 XRP Flips Ether's FDV Amid Change in Market Dynamics

- XRP's fully diluted valuation (FDV) has surpassed that of Ethereum, reaching nearly $235 billion.

- This shift reflects the growing momentum of XRP's DeFi ecosystem while Ethereum faces challenges from competing layer-1 networks.

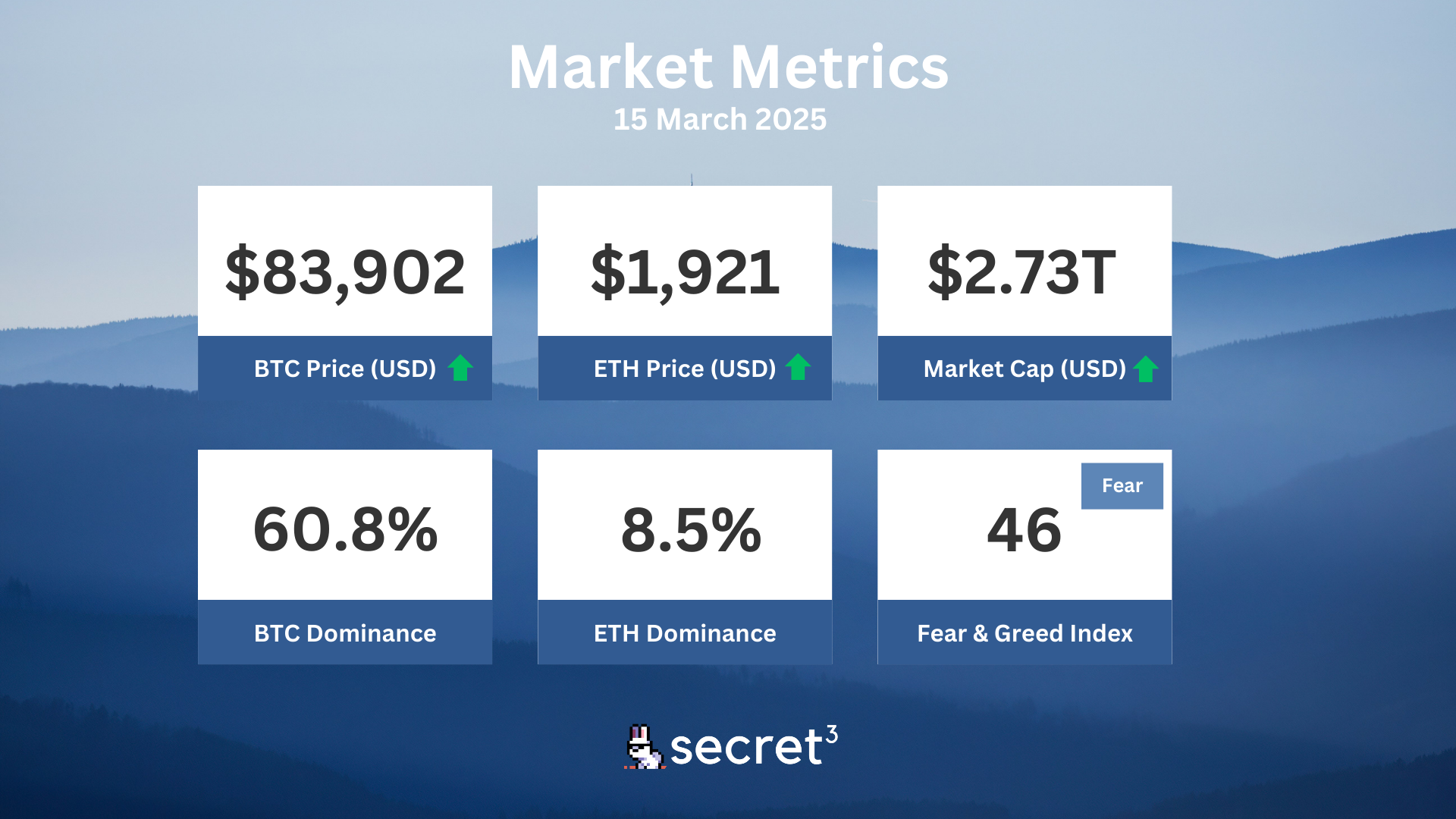

Market Metrics

Fundraising & VC

1. World Liberty Financial (Public Token Sale, $590M) - DeFi protocol

2. RedotPay (Series A, $40M) - Hong Kong-based crypto payment

3. Templar Protocol (Pre Seed, $4M) - Cypher lending protocol for Bitcoin

On-chain Data

1. Sei Network (SEI) token unlocked today ($44.82M, 4.72%)

2. Arbitrum (ARB) token unlock in 1 day ($33.57M, 2.1%)

3. ApeCoin (APE) token unlock in 2 days ($8.10M, 1.95%)

4. Neon (neon) token unlock in 2 days ($6.90M, 22.51%)

5. Melania Meme (MELANIA) token unlock in 3 days ($18.32M, 4.89%)

Regulatory

🚫 US House Repeals IRS DeFi Broker Rule

- The U.S. House of Representatives voted 292-132 to repeal a rule requiring DeFi protocols to report transactions to the IRS.

- This decision was seen as a victory for privacy advocates and the DeFi industry.

📊 Argentina Finalizes Regulations for Virtual Asset Providers

- Argentina's National Securities Commission has established new regulations for virtual asset service providers (VASPs).

- Key requirements include registration, cybersecurity measures, asset custody, and anti-money laundering protocols.

💼 Representative Introduces Bill to Codify Trump's Bitcoin Reserve

- U.S. Rep. Byron Donalds is set to introduce a bill formalizing President Trump's executive order for a U.S. Strategic Bitcoin Reserve.

- The legislation aims to secure the reserve as a permanent part of national financial strategy.

🌐 Russia Using Bitcoin and USDT for Oil Trades with China and India

- Russian oil companies are reportedly using Bitcoin and Tether's USDT for international trade with China and India.

- This method involves intermediaries managing offshore accounts for currency conversions to bypass sanctions.

👨⚖️ AML Bitcoin Creator Found Guilty in Federal Pump-and-Dump Case

- The creator of AML Bitcoin has been found guilty of wire fraud in a federal pump-and-dump scheme.

- The case involved manipulating the stock price of AML Bitcoin for personal gains through deceptive practices.

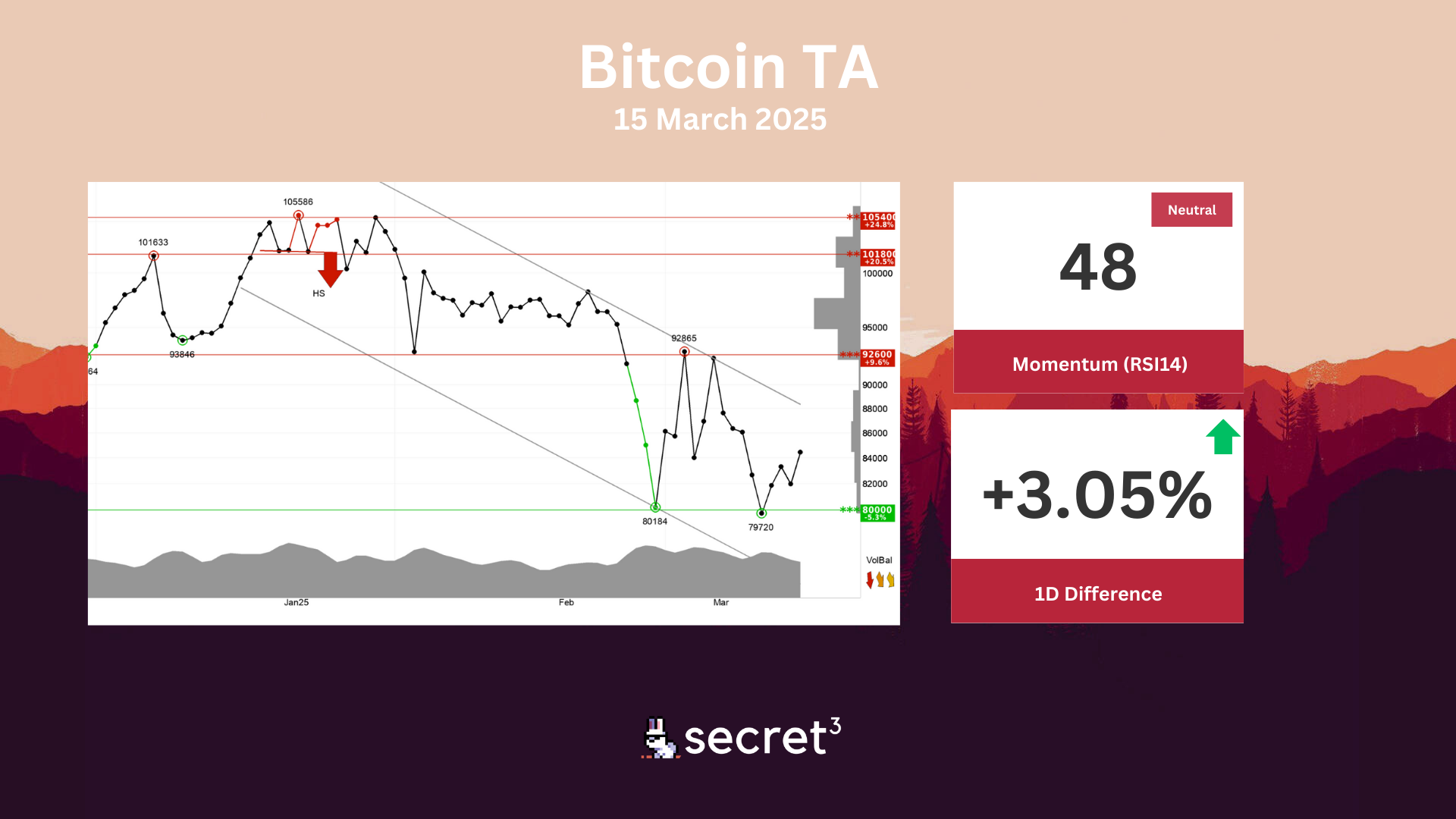

Technical Analysis

Bitcoin - Bitcoin is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. The currency has support at points 80000 and resistance at points 92600. The currency is assessed as technically negative for the short term.

Ethereum - Ethereum has broken the falling trend channel down in the short term, which indicates an even stronger falling rate. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2750 points. The volume balance is negative and weakens the currency in the short term. RSI diverges positively against the price, which indicates a possibility for a reaction up. The currency is overall assessed as technically negative for the short term.

Governance & Code

⚖️ Balancer DAO | Deploy Balancer V3 on OP Mainnet (Preliminary Discussion)

- This proposal seeks to deploy Balancer v3 on OP Mainnet, managed by Beets.

👻 Aave DAO | Launch GHO on Gnosis Chain (Preliminary Discussion)

- This proposal aims to launch GHO on Gnosis chain, with ACI designated as the Emissions Manager for GHO rewards and incentives.