gm 15/02

Summary

gm, The SEC acknowledges Grayscale's filings for spot XRP and Dogecoin ETFs, potentially paving the way for their approval by mid-October. This news sparked rallies in XRP and DOGE prices, up 10% and 8% respectively. Meanwhile, Coinbase reported strong Q4 earnings with $2.3 billion in revenue, driven by increased crypto trading volumes. The company's CEO, Brian Armstrong, predicted that 10% of global GDP could operate on crypto rails by 2030. Additionally, Tether, the stablecoin issuer, acquired a minority stake in Italian soccer club Juventus FC, further integrating crypto into mainstream finance and sports.

News Headlines

🌐 Ethereum TVL Approaches 3-Year High

- Ethereum's total value locked (TVL) reached 21.8 million ETH, its highest since October 2022.

- Ethereum commands 52.8% of the total DeFi market's TVL, led by applications like Lido and Aave.

🏦 Abu Dhabi Sovereign Wealth Fund Invests $436M in Bitcoin ETF

- Mubadala Investment Company invested $436 million in BlackRock's spot Bitcoin ETF in Q4 2024.

- This move positions Abu Dhabi among nations evaluating Bitcoin as a viable asset for government portfolios.

💼 Coinbase CEO Predicts 10% of Global GDP on Crypto Rails by 2030

- Brian Armstrong, CEO of Coinbase, forecasts that 10% of global GDP could operate on crypto rails by 2030.

- He likens the current trend of businesses integrating crypto to the early 2000s internet boom.

🏙️ Dubai Regulator Warns About Memecoin Risks

- Dubai's Virtual Assets and Regulatory Authority (VARA) has issued a warning about the risks associated with memecoins.

- VARA emphasized that memecoins issued from Dubai must adhere to its marketing regulations or face penalties up to $135,000.

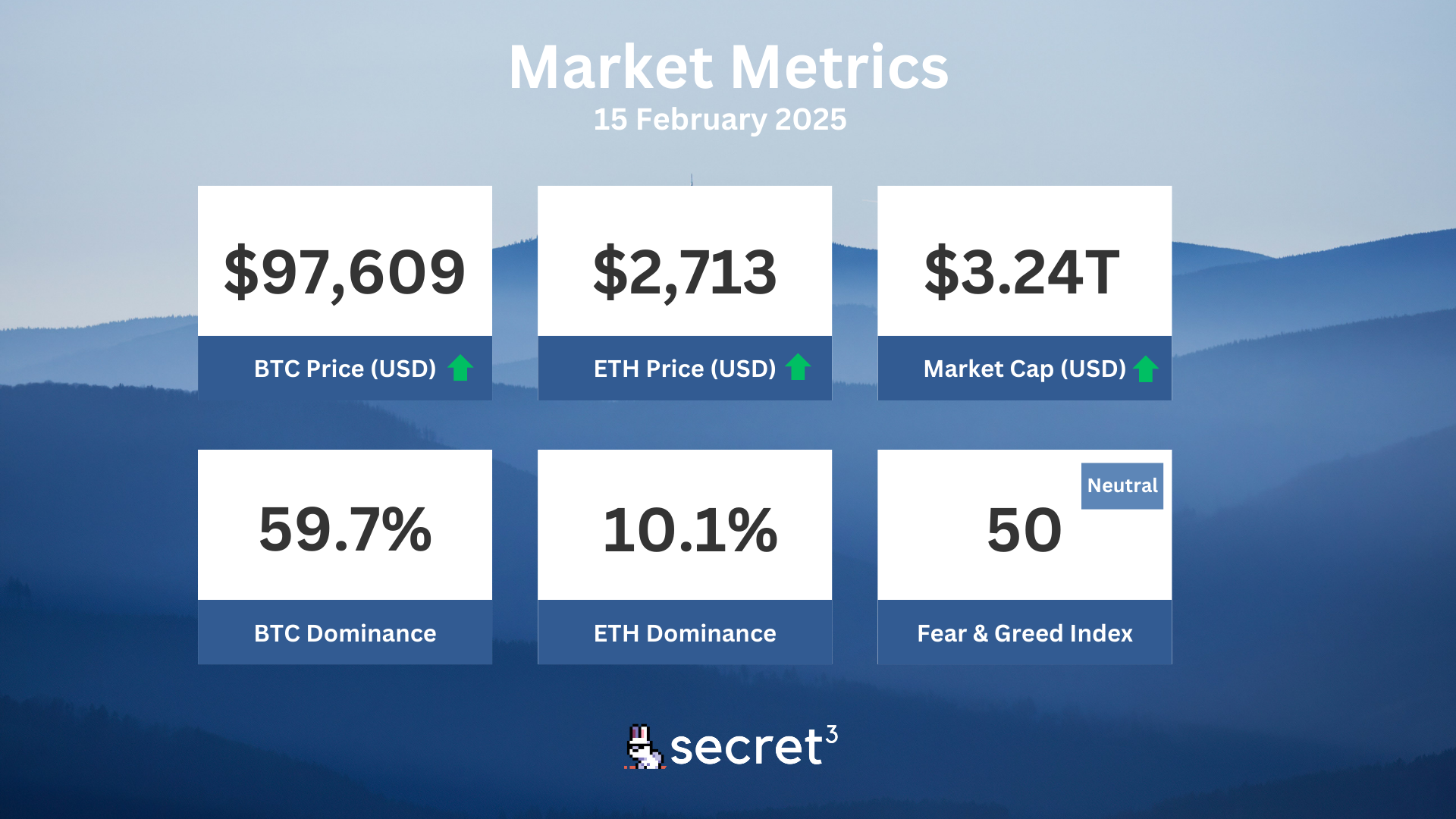

Market Metrics

Fundraising & VC

1. HashKey Group (Undisclosed, $30M) - Digital asset financial services group

2. Metaplanet (Post IPO Debt, $25.9M) - Publicly listed Bitcoin treasury company

3. Glim (Undisclosed, $3.47M) - Financial wellness platform

4. Defi App (Extended Seed, $2M) - Decentralized Superapp

On-chain Data

1. Sei Network (SEI) token unlocked today ($53.12M, 4.96%)

2. Avalanche (AVAX) token unlock in 1 day ($44.37M, 0.4%)

3. Arbitrum (ARB) token unlock in 1 day ($45.62M, 2.13%)

4. ApeCoin (APE) token unlock in 2 days ($11.57M, 2.16%)

Regulatory

🏛️ Crypto Bills Proliferate Across U.S. States

- Nine U.S. states have introduced crypto-focused legislation since early February 2025, covering topics like Bitcoin reserves and digital asset task forces.

- This surge in state-level crypto bills reflects growing interest in adopting favorable measures towards the blockchain industry.

🏦 National Bank of Canada Takes Bearish Stance on Bitcoin

- The National Bank of Canada has applied for a put option to sell over $1.3 million of BlackRock's iShares Bitcoin Trust ETF.

- This move comes as Bitcoin ETFs experienced significant outflows, totaling over $647 million over four consecutive days.

🏆 FBI's 'Operation Level Up' Saves $285M from Crypto Fraud

- The FBI's 'Operation Level Up' initiative has reportedly saved over 4,300 victims from losing more than $285 million to crypto fraud.

- This comes in response to an estimated $3.9 billion lost to cryptocurrency investment fraud in 2023.

📊 SEC Crypto Task Force Meets with Industry on Staking and Regulations

- The SEC's Crypto Task Force held meetings with crypto and traditional finance representatives to discuss regulatory concerns.

- Topics included staking practices, guidelines for exchange-traded products, and a new regulatory framework for digital assets.

💼 Trump Nominates Brian Quintenz to Lead CFTC

- President Trump has nominated Brian Quintenz, currently the global head of policy at a16z, to lead the Commodity Futures Trading Commission (CFTC).

- Quintenz is expected to promote a pro-crypto agenda if confirmed, potentially strengthening blockchain industry representation in Washington.

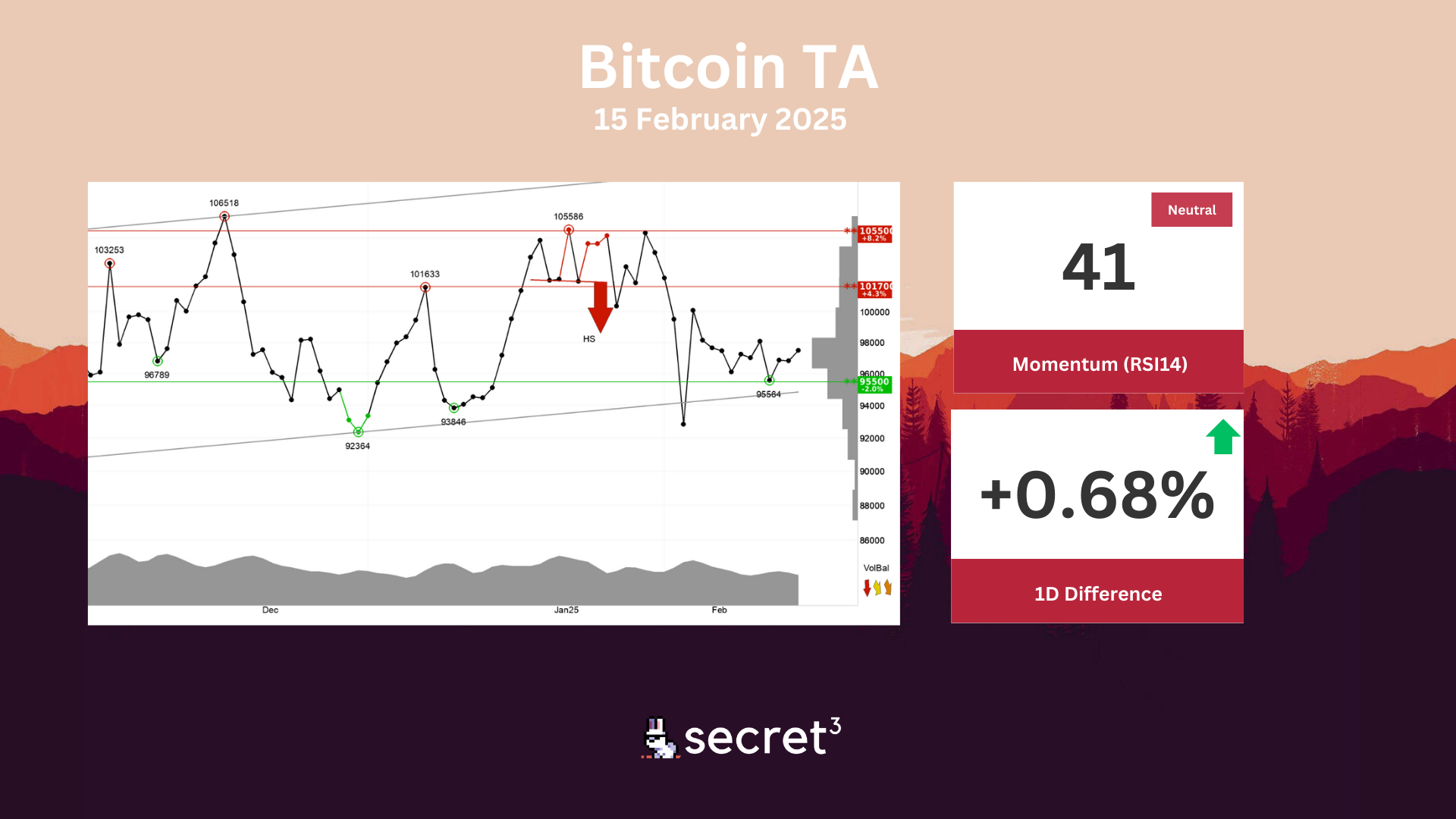

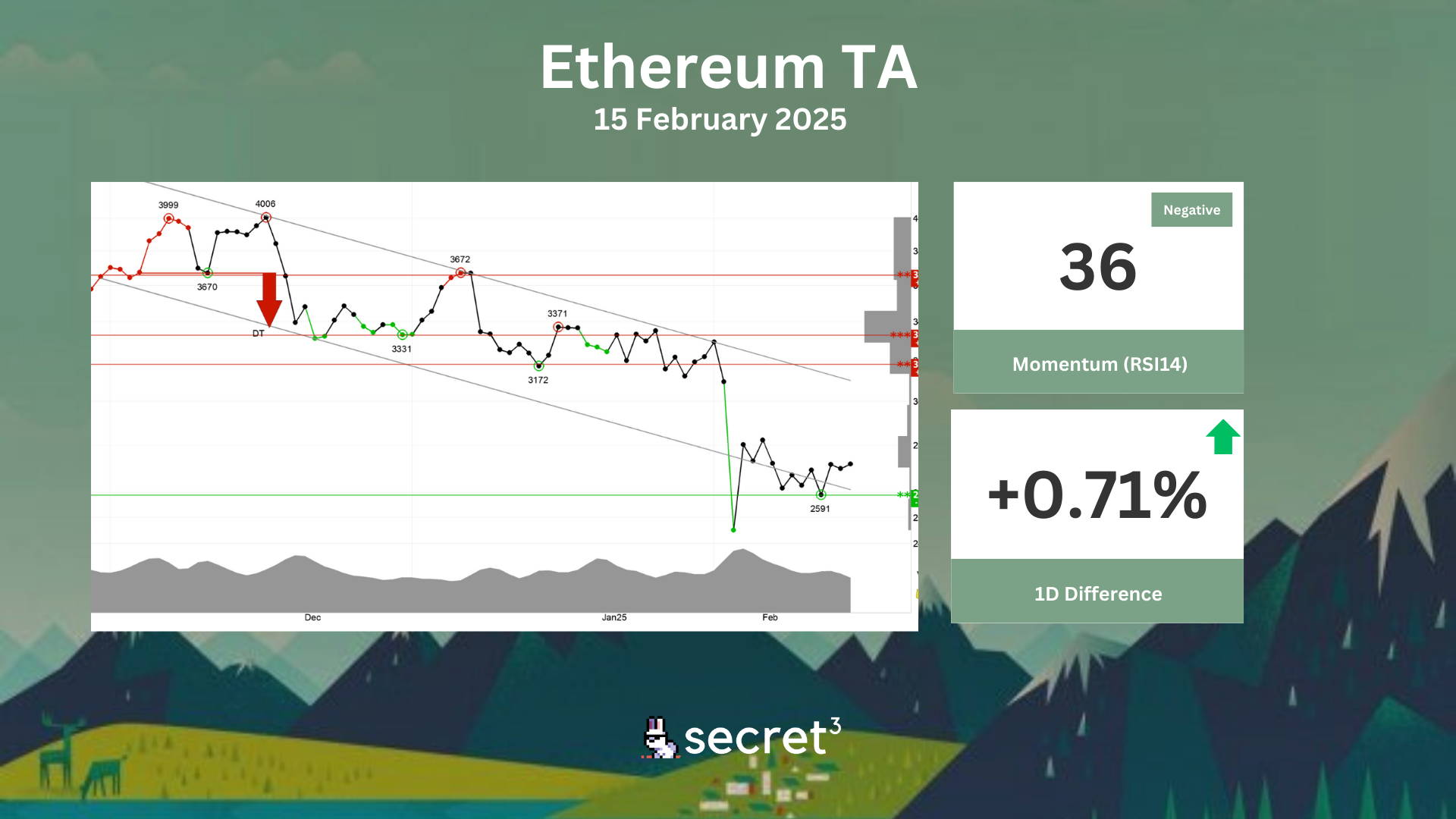

Technical Analysis

Bitcoin - Investors have paid higher prices over time to buy Bitcoin and the currency is in a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. The currency has support at points 95500 and resistance at points 101700. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. This weakens the rising trend and could be an early signal of a coming trend break. The currency is overall assessed as technically neutral for the short term.

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency has support at points 2590 and resistance at points 3180. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

🌐 Origin DAO | Yield Forwarding Request: SILO (Active Vote)

- This proposal aims to enable yield forwarding and treasury booster for the SILO pool on SwapX.

💰 Compound DAO | Add Collateral tBTC Market on Base

- This proposal aims to add a Threshold BTC (tBTC) market to Compound on Base.