gm 14/06

Summary

gm, Multiple corporate treasury developments emerged, including SharpLink Gaming acquiring $463 million in Ethereum (becoming the largest public ETH holder), Trident Digital planning a $500 million XRP treasury, and GameStop increasing its convertible note offering to $2.25 billion amid criticism over its Bitcoin strategy. On the institutional front, Circle's USDC stablecoin launched on Ripple's XRP Ledger, major telecoms like Deutsche Telekom and Alibaba Cloud began running infrastructure nodes on Nillion's privacy-focused platform, and the US Senate scheduled a June 17 vote on the amended stablecoin legislation (GENIUS Act).

News Headlines

🌊 Spark airdrop launches to kickstart decentralized governance

- Spark, the DeFi protocol powering SparkLend and Spark Savings, has launched its Ignition airdrop campaign targeting approximately 50,000 participants who can claim SPK tokens during a six-week window.

- The campaign will be followed by Overdrive, introducing staking rewards for SPK holders, as part of a 10-year emission roadmap that will begin with 1.625 billion SPK tokens annually and taper down to 203 million by year seven.

🏛️ Trump addresses Coinbase summit to discuss crypto plans

- President Trump delivered a prerecorded message at Coinbase's State of Crypto Summit highlighting initiatives such as establishing a national Bitcoin reserve and promoting the GENIUS Act to support dollar-backed stablecoins.

- These efforts coincide with Congressional discussions to regulate payment stablecoins and clarify regulatory roles, although some Democratic lawmakers have indicated potential opposition due to Trump's ties to the crypto industry.

💳 Coinbase Launches Bitcoin Rewards Card to Drive Subscriber Growth

- Coinbase is introducing a credit card offering up to 4% Bitcoin rewards on purchases, exclusively for U.S.-based subscribers of its Coinbase One service, which provides benefits like zero trading fees.

- The launch aligns with Coinbase's strategy to diversify revenue away from transaction fees, with subscription services now contributing significantly to the company's revenue, which reached $698.1 million in Q1 2025.

🔄 DeFi Development Corp. Secures $5B Credit Line for SOL Acquisition

- DeFi Development Corp. has secured a $5 billion equity line of credit with RK Capital to expand its investment in Solana (SOL), allowing the firm to issue and sell shares gradually for flexibility in fluctuating markets.

- The company plans to use revenue from stock sales exclusively for acquiring SOL, having already accumulated nearly $100 million worth, with the CEO emphasizing a cautious approach to maximize SOL per share.

🥇 Tether Acquires 32% Stake in Gold Company Under 'Dual Pillar Strategy'

- Tether has acquired a 31.9% stake in Elemental Altus Royalties Corp. for CAD 121.5 million, emphasizing its strategy of bolstering its portfolio with both gold and Bitcoin as safe havens during economic uncertainty.

- The stablecoin issuer now holds over 100,000 BTC valued at approximately $10.7 billion and nearly 80 tons of physical gold, with CEO Paolo Ardoino reiterating that incorporating gold into investment strategies aligns with their dual pillar approach.

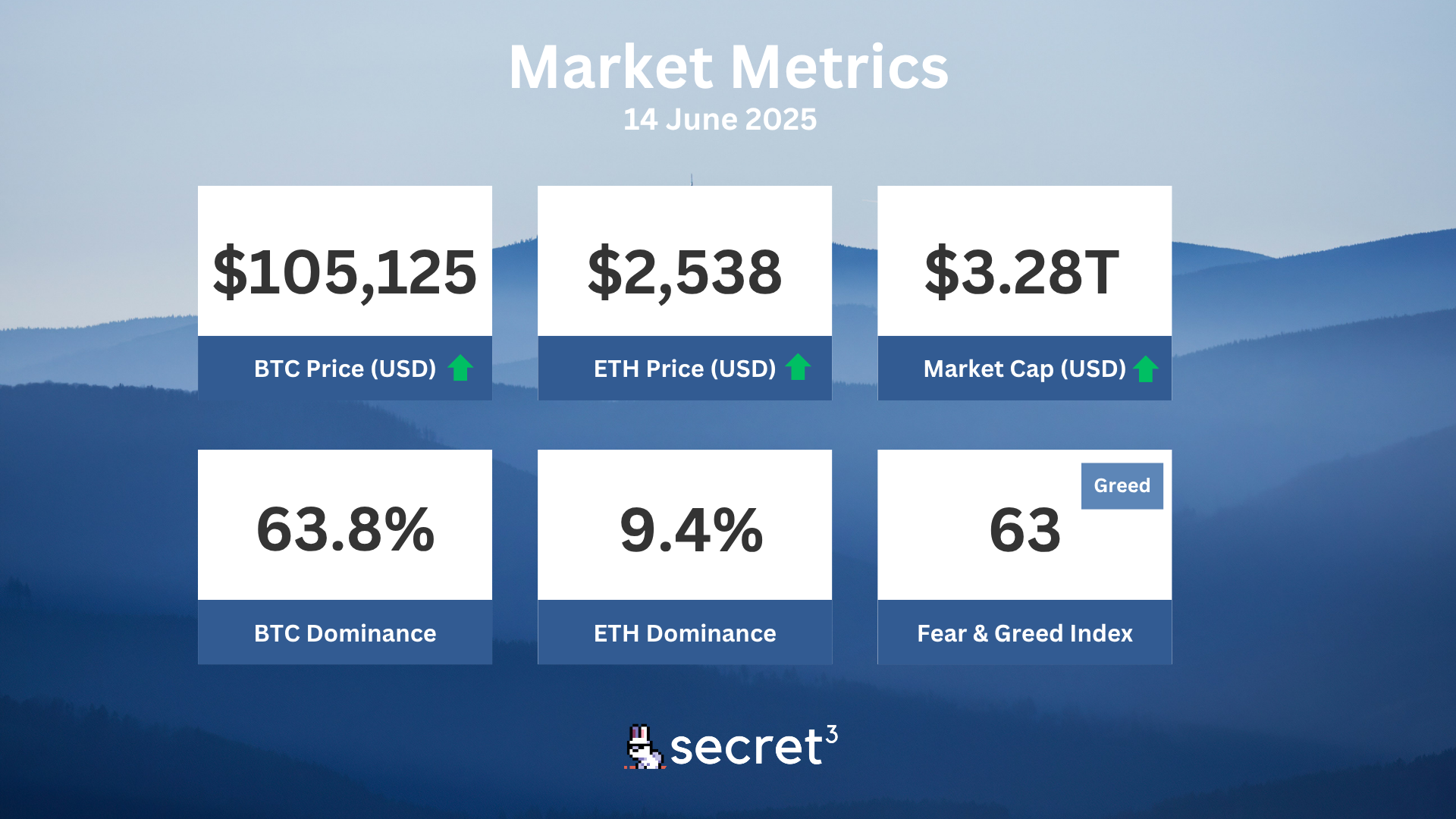

Market Metrics

Fundraising & VC

1. Yupp (Seed, $33M) - AI model discovery and evaluation platform

2. Hyperion (Strategic, Undisclosed) - On-chain hybrid Orderbook-AMM DEX on Aptos

Regulatory

💼 Former Blockchain Exec Joins SEC Leadership

- Jamie Selway, former global head of institutional markets for Blockchain.com, has been appointed as the SEC's director of trading and markets.

- The SEC also appointed Brian Daly, a partner at law firm Akin Gump with cryptocurrency expertise, to head the investment management division as the agency adjusts its regulatory approach.

🏦 Corporate Giants Explore Stablecoin Development

- Retail giants Walmart and Amazon are reportedly exploring the issuance of their own US dollar-backed stablecoins to enhance e-commerce and facilitate cross-border transactions.

- Their potential entry into the stablecoin market could redirect billions from traditional banking partners and significantly reduce transaction costs for both companies.

🔐 Staking Clarity: SEC Defines Legal Crypto Staking

- The SEC has clarified that solo staking, delegated staking, and custodial staking tied to a network's consensus process are not considered securities offerings.

- Staking rewards are now viewed as compensation for services rather than profits, creating a clear regulatory path for validators and stakers to operate without securities concerns.

🛡️ Ethereum Foundation Pledges $500K to Tornado Cash Developer's Defense

- The Ethereum Foundation has donated $500,000 to support the legal defense of Roman Storm, co-founder of Tornado Cash, who faces charges including conspiracy to operate an unlicensed money transmitter.

- The Foundation also pledged to match up to $750,000 in community donations, stating that coding should not be criminalized and that privacy is essential in the ecosystem.

💻 CFTC Won't Tolerate Crypto Lawbreakers Despite Pro-Innovation Stance

- CFTC acting chair Caroline Pham stated that while the agency is pro-innovation, it won't allow lawbreaking in the crypto industry, focusing enforcement on fraudulent actions.

- Pham criticized the Biden administration's approach to crypto regulation, noting it overstepped legal boundaries and adversely affected traditional markets like derivatives.

Technical Analysis

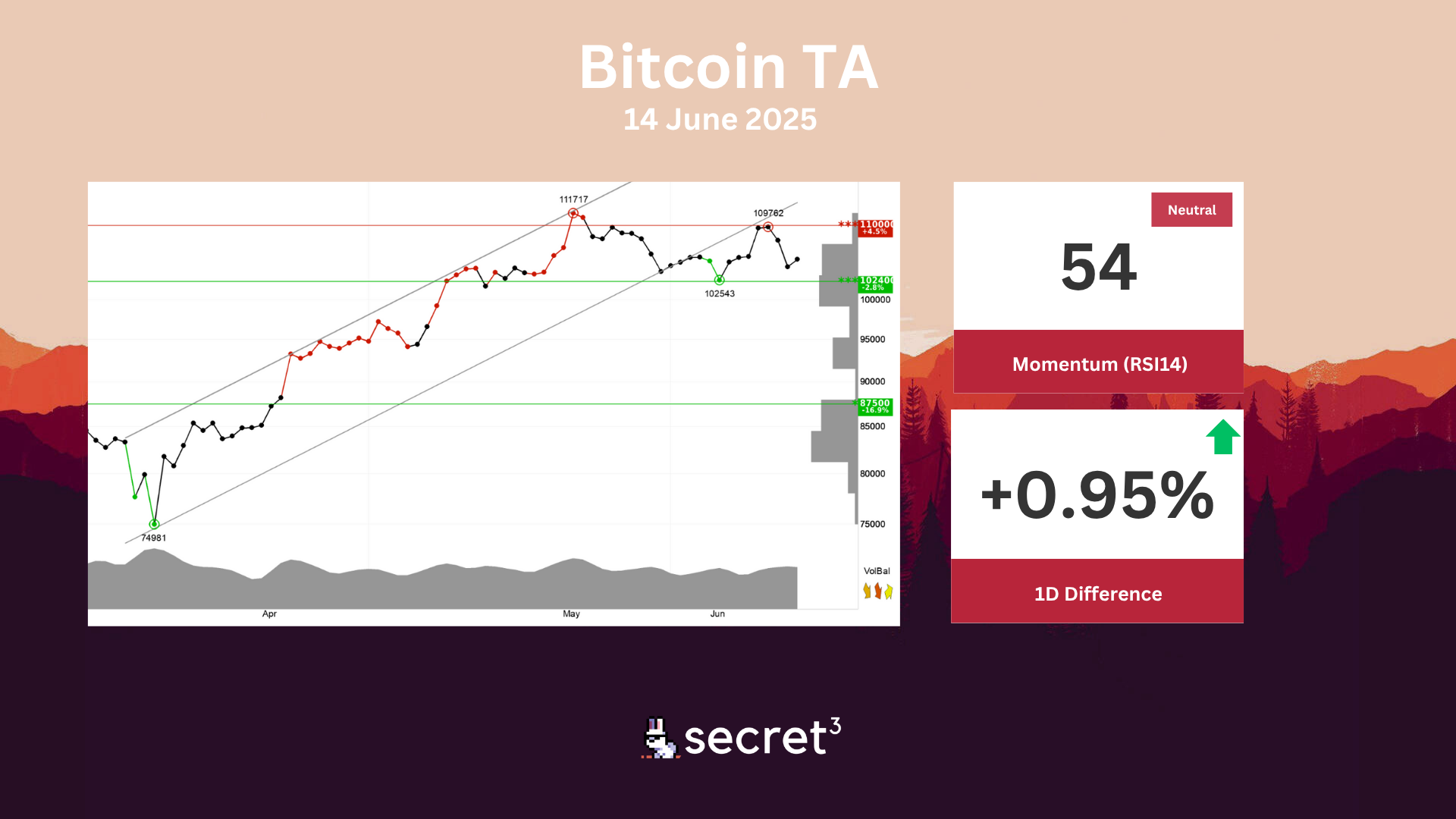

Bitcoin - Bitcoin has broken the floor of the rising trend channel in the short term, which indicates a weaker initial rising rate. The currency has support at points 102400 and resistance at points 110000. The currency is assessed as technically neutral for the short term.

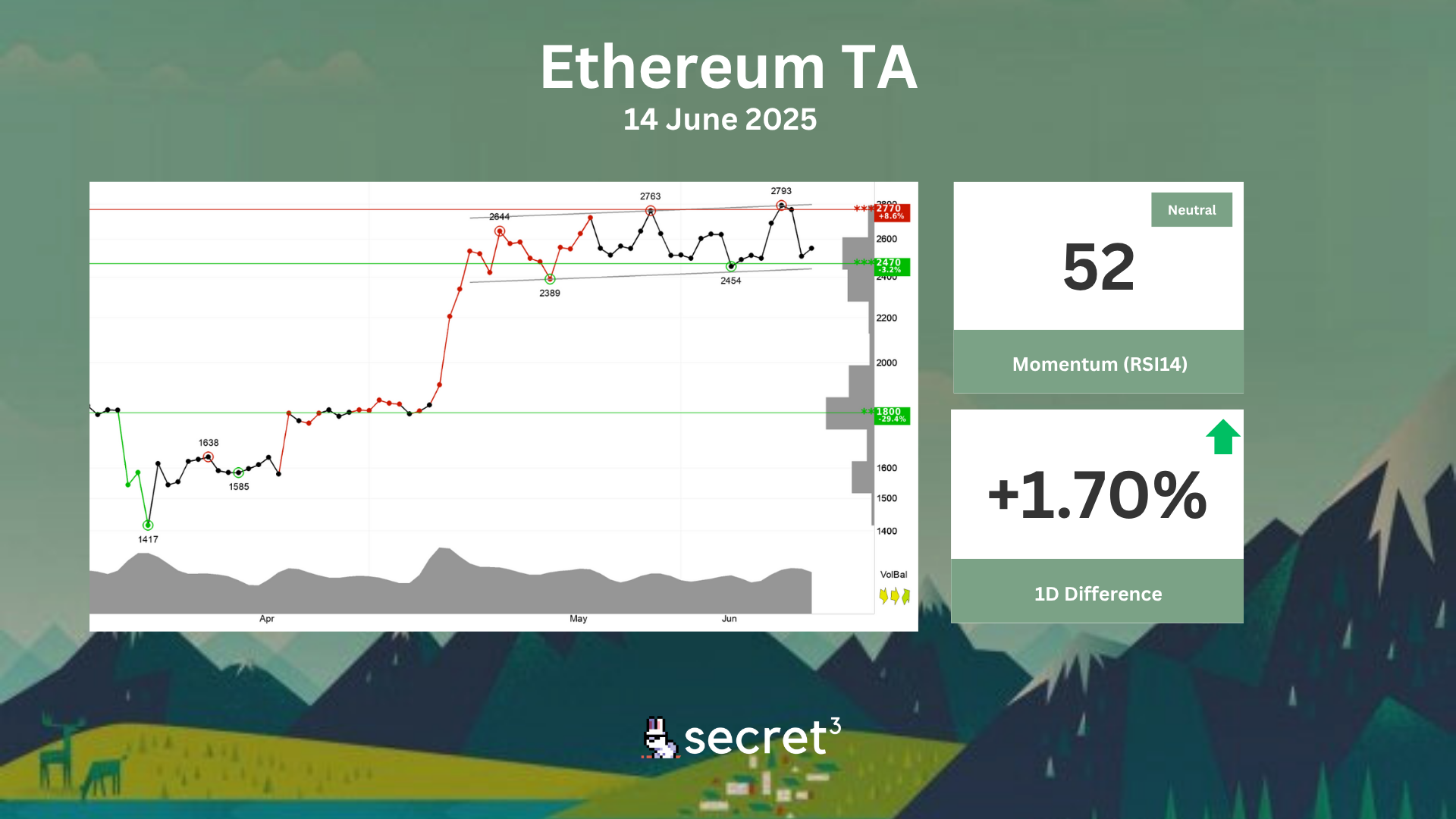

Ethereum - Ethereum is within an approximate horizontal trend channel in the short term. This indicates that investors are uncertain and waiting for signals of further direction. A break upwards will be a positive signal, while a break downwards will be a negative signal. The currency is approaching support at 2470 points, which may give a positive reaction. However, a break downwards through 2470 points will be a negative signal. Volume has previously been high at price tops and low at price bottoms. This strengthens the currency and indicates increased chance of a break up. The RSI curve shows a rising trend, which is an early signal of a possible trend reversal upwards for the price as well. The currency is overall assessed as technically slightly positive for the short term.