gm 14/05

Summary

gm, Bitcoin experienced a brief correction to $102,388 after reaching a three-month high of $105,819. This dip occurred despite positive developments in US-China trade talks, reflecting ongoing market volatility. Notably, Coinbase is set to join the S&P 500 index, marking a milestone for crypto integration into traditional finance. VanEck announced the launch of its first tokenized fund backed by US Treasuries, while Dubai revealed plans to accept cryptocurrencies for government payments through a partnership with Crypto.com. These developments underscore the growing mainstream adoption and institutional interest in cryptocurrencies, even as the market navigates short-term price fluctuations.

News Headlines

💼 Nasdaq-Listed Company Acquires $105M in Solana

- DeFi Development Corp purchased 172,670 SOL (~$24M), bringing total holdings to nearly 600,000 SOL ($105M).

- The company's shares rose 19% on the news, marking a 1,700% increase year-to-date.

📊 Crypto Liquid Funds Struggle to Beat Bitcoin This Cycle

- Many crypto liquid funds are underperforming compared to Bitcoin, which rose 110% in 2024.

- Bitcoin's dominance has increased to 63%, making it difficult for altcoin-focused funds to outperform.

🏦 Anchorage Digital Acquires Stablecoin Issuer Mountain Protocol

- Anchorage is acquiring Mountain Protocol to expand its stablecoin offerings.

- The deal will integrate Mountain Protocol's team and technology into Anchorage's operations.

🔄 ICON Rebrands to SODAX, Abandons Layer 1 Blockchain

- ICON has rebranded as SODAX and shifted away from operating its own Layer 1 blockchain.

- The move aims to enhance adaptability and competitiveness in the evolving blockchain landscape.

📈 Bitcoin ETFs Hit New Peak with Over $41 Billion in Assets

- U.S. Bitcoin ETFs have accumulated over $41 billion in net inflows, reaching a new all-time high.

- This milestone comes after facing significant withdrawals in previous months.

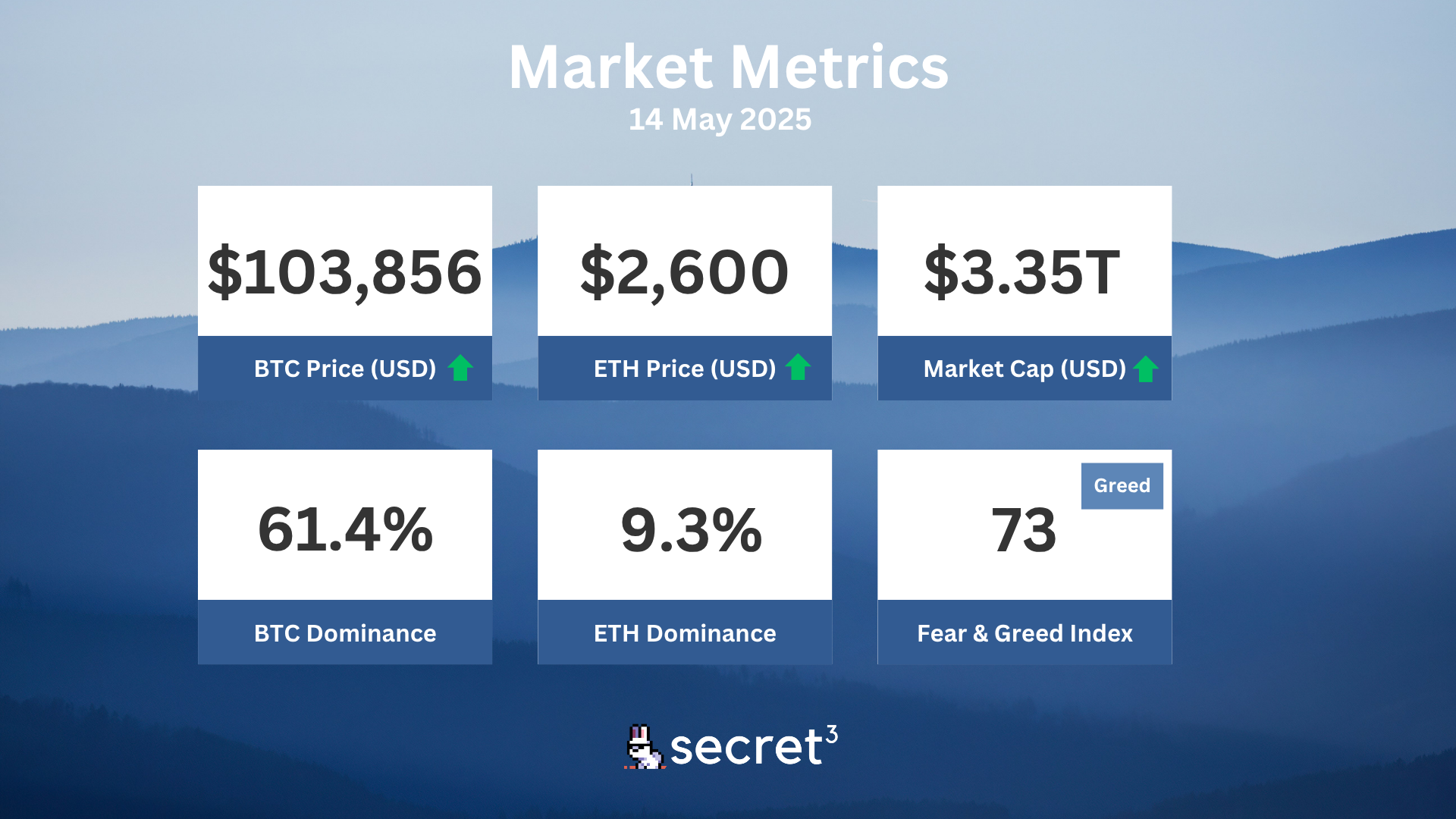

Market Metrics

Fundraising & VC

1. Perpl (Undisclosed, $9.25M) - DEX on Monad blockchain

2. Nirvana Labs (Seed, $6M) - Web3 infrastructure provider

3. SpaceComputer (Pre-seed, Undisclosed) - Cypherpunk crypto systems for the space frontier

Regulatory

🏛️ SEC Chair: Blockchain Holds Promise for New Market Activities

- SEC Chair Paul Atkins announced a shift towards clear rulemaking for crypto, moving away from enforcement-first policies.

- Atkins highlighted blockchain's potential to enable new market activities not currently addressed by existing regulations.

⚖️ UK Launches First FCA-Regulated Crypto Derivatives Trading Venue

- GFO-X, the first regulated crypto derivatives trading venue, has launched in the UK with FCA authorization.

- The platform aims to provide institutional investors with a compliant environment for trading cryptocurrency derivatives.

💰 Wyoming to Launch First State-Issued Stable Token in July

- Wyoming is set to launch its first state-issued stable token in July, partnering with Inca Digital for security measures.

- This move aims to solidify Wyoming's position as a leader in blockchain and cryptocurrency innovation.

🏦 Gibraltar to Establish Crypto Derivatives Clearing and Settlement Rules

- Gibraltar is set to introduce regulatory frameworks for clearing and settling crypto derivatives.

- The aim is to enhance market integrity within the evolving cryptocurrency sector and attract institutional investors.

🚨 India Tightens Crypto Oversight in Border Regions

- India has increased surveillance on cryptocurrency transactions in border regions like Jammu and Kashmir.

- The move aims to combat terror financing and address concerns about the use of cryptocurrencies for money laundering.

Technical Analysis

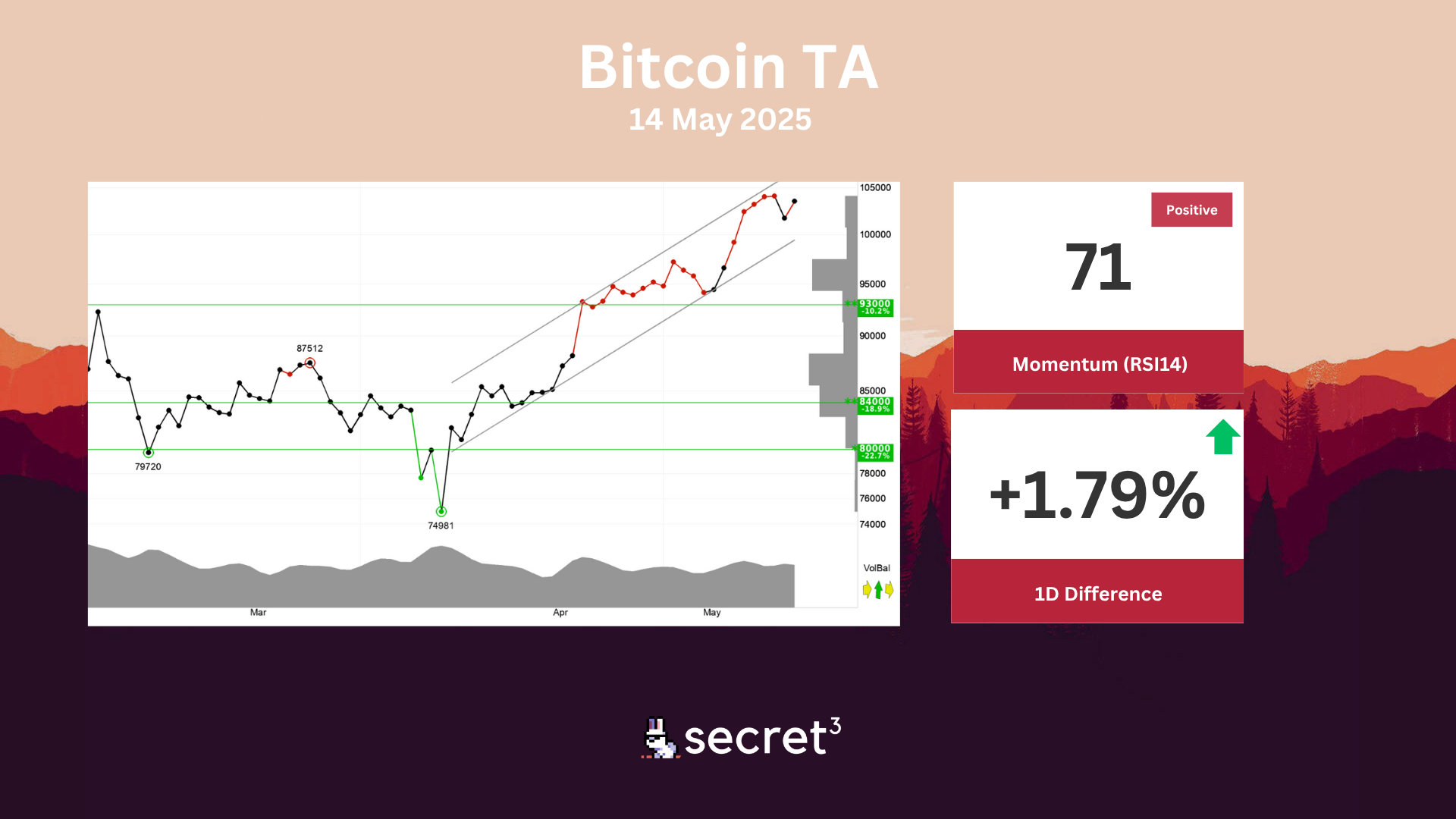

Bitcoin - Investors have paid higher prices over time to buy Bitcoin and the currency is in a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 93000 points. Positive volume balance shows that volume is higher on days with rising prices than days with falling prices. This indicates increasing optimism among investors. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Bitcoin. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.

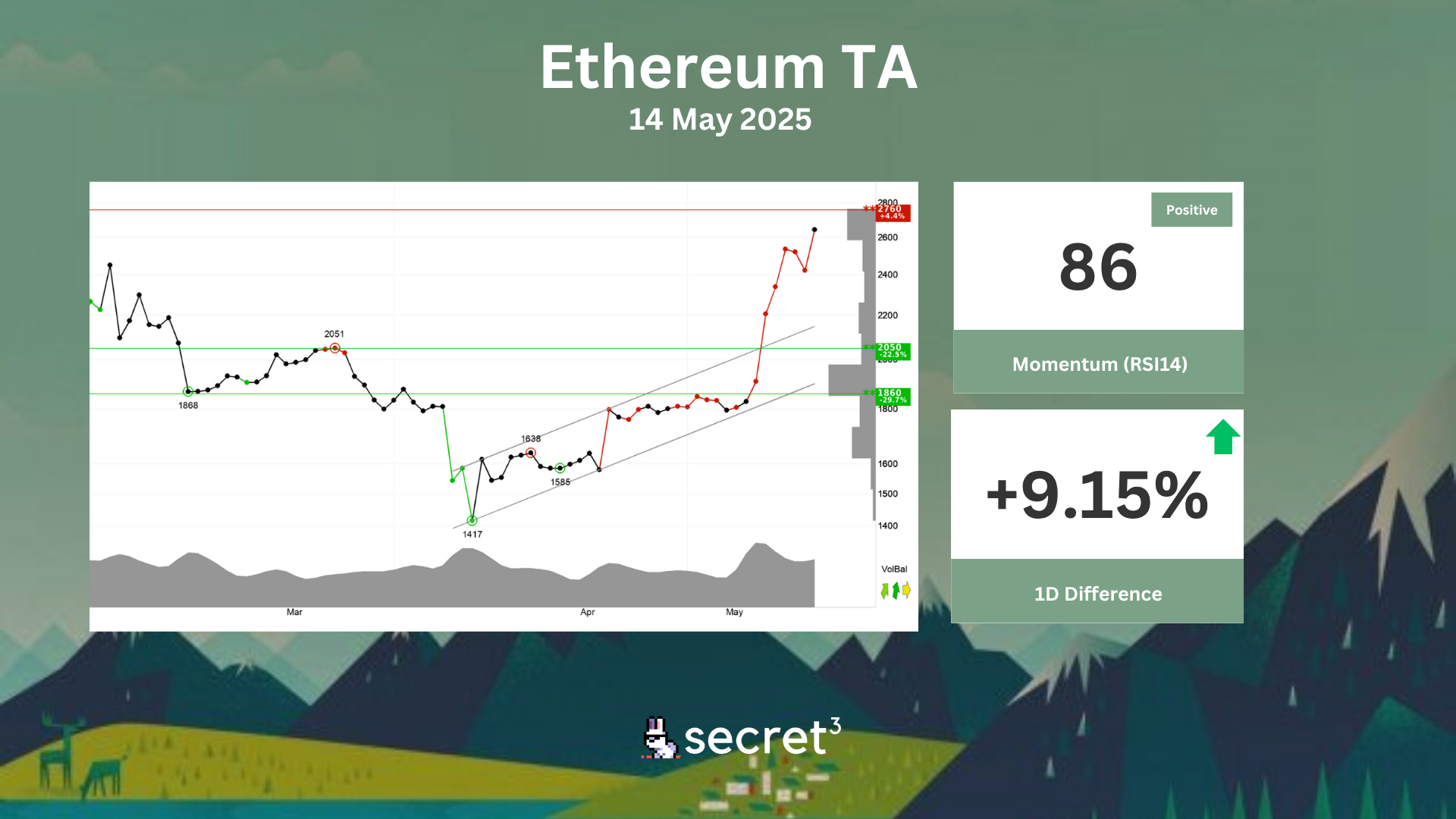

Ethereum - Ethereum has broken the rising trend up in the short term. This signals an even stronger growth rate. The currency is approacing resistance at 2760 points, which may give a negative reaction. However, a break upwards through 2760 points will be a positive signal. Positive volume balance indicates that buyers are aggressive while sellers are passive, and strengthens the currency. RSI is above 70 after a good price increase the past weeks. The currency has strong positive momentum and further increase is indicated. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically slightly positive for the short term.