gm 14/03

Summary

gm, The U.S. Senate Banking Committee advanced the GENIUS Act, a stablecoin bill, with bipartisan support, signaling progress in cryptocurrency regulation. Meanwhile, Bitcoin struggled to maintain momentum, dropping to around $82,000 amid concerns over U.S. trade tensions. Notably, Binance secured a $2 billion investment from Abu Dhabi's MGX, highlighting continued institutional interest in the crypto space. Additionally, Ripple obtained regulatory approval in Dubai to provide cross-border crypto payment services, further expanding its global presence.

News Headlines

📊 Ethereum Gas Fees Drop 95% One Year After Dencun Upgrade

- The average gas fee for Ethereum has seen a remarkable decline of 95% since the implementation of the Dencun upgrade a year ago.

- An average swap now costs approximately $0.39 in fees, compared to around $86 a year earlier, significantly improving the network's usability and cost-effectiveness.

🌊 Hyperliquid Raises Margin Requirements After $4M Loss

- Hyperliquid, a trading-focused blockchain network, is increasing margin requirements following a $4 million loss from its liquidity pool due to a large Ether liquidation.

- Starting March 15, a minimum collateral margin of 20% will be enforced for certain open positions to mitigate systemic risks associated with large positions.

🔍 Solana CME Futures Launch Signals Potential ETF Approvals

- The upcoming launch of Solana futures on the Chicago Mercantile Exchange (CME) indicates that the first US Solana exchange-traded funds (ETFs) may be imminent.

- These futures, set to debut on March 17, could pave the way for approval of spot Solana ETFs, which are anticipated to be cleared by May for asset managers like VanEck and Canary Capital.

💼 Binance Receives $2 Billion Investment from Abu Dhabi's MGX

- Binance has secured a historic $2 billion investment from Abu Dhabi-based investment firm MGX, marking the largest single investment ever made in a crypto company.

- This significant milestone is expected to shape the future of digital finance, with Binance focusing on building a more inclusive and secure ecosystem.

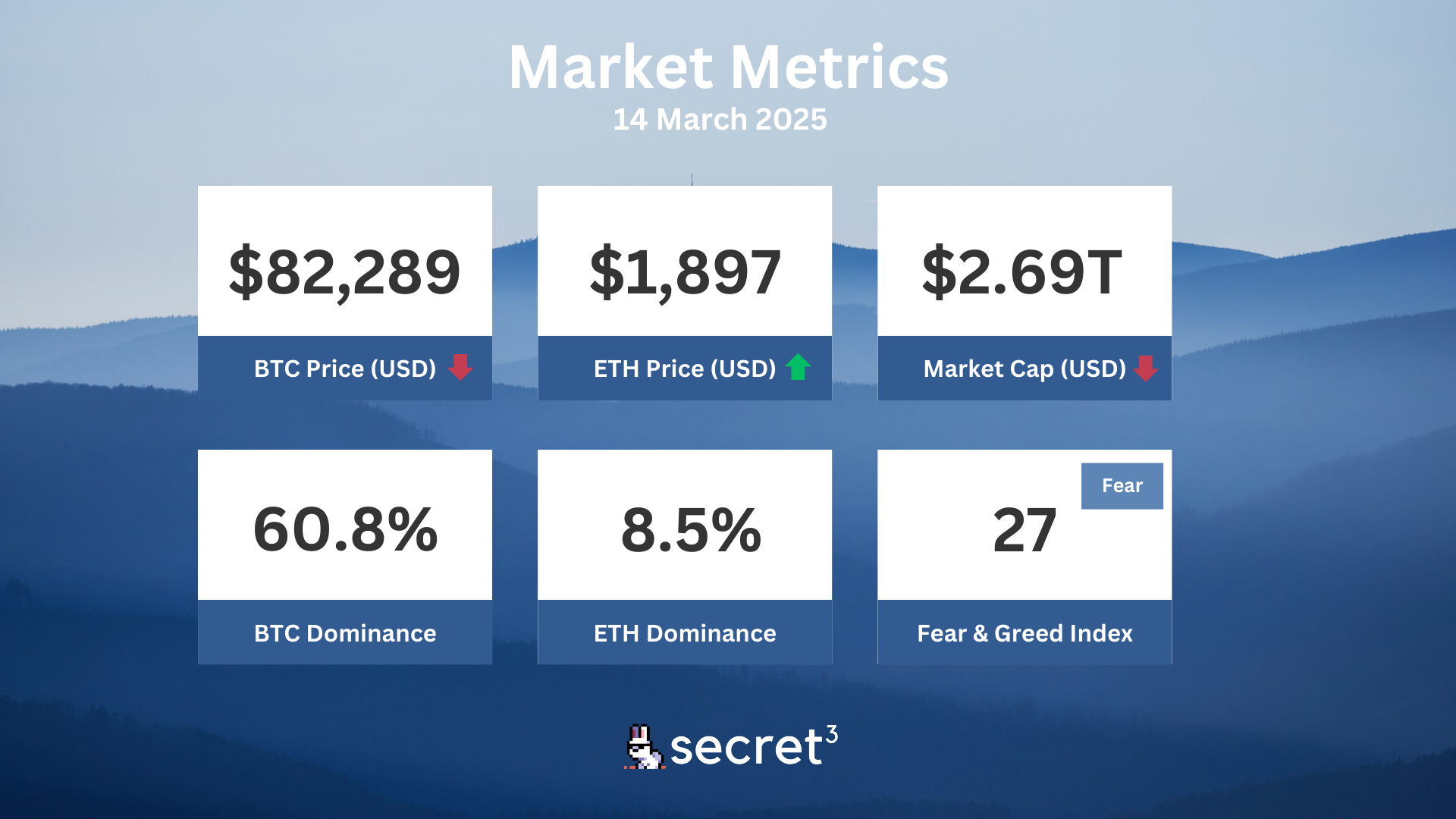

Market Metrics

Fundraising & VC

1. Solv Protocol (Undisclosed, $10M) - Bitcoin staking platform

2. PoP Planet (Undisclosed, $6M) - AI-powered decentralized identity platform

3. Aura (Seed, $5.5M) - AI model validation & monetization layer

4. HOPR (Strategic, $4.8M) - Blockchain data protection and privacy

5. W3i Software (Strategic, $1.5M) - DeFi solutions company

On-chain Data

1. Sei Network (SEI) token unlock in 1 day ($42.88M, 4.72%)

2. Arbitrum (ARB) token unlock in 2 days ($32.14M, 2.1%)

3. ApeCoin (APE) token unlock in 3 days ($7.95M, 1.95%)

4. Neon (neon) token unlock in 3 days ($6.66M, 22.51%)

5. Melania Meme (MELANIA) token unlock in 4 days ($18.40M, 4.89%)

Regulatory

🌐 Turkey Tightens Crypto Regulations

- Turkey's Capital Markets Board released new rules for crypto asset service providers, including exchanges and custodians.

- Regulations establish minimum capital requirements, executive background checks, and enhanced compliance standards.

💼 Vermont Drops Staking Case Against Coinbase

- Vermont withdrew its legal action against Coinbase regarding alleged unregistered securities offerings through staking.

- The decision aligns with recent SEC shifts in regulatory guidance on crypto products and services.

🏦 Ripple Secures Dubai License for Crypto Payments

- Ripple obtained regulatory approval from Dubai's financial regulator to offer blockchain-powered payment solutions.

- This makes Ripple the first licensed payment provider in Dubai's financial center, expanding its Middle East presence.

🏛️ Senate Advances Stablecoin Bill with Bipartisan Support

- The GENIUS Act for stablecoin regulation passed the Senate Banking Committee with an 18-6 vote, gaining bipartisan backing.

- The bill aims to create a framework for nonbank stablecoin issuers under state or national charters.

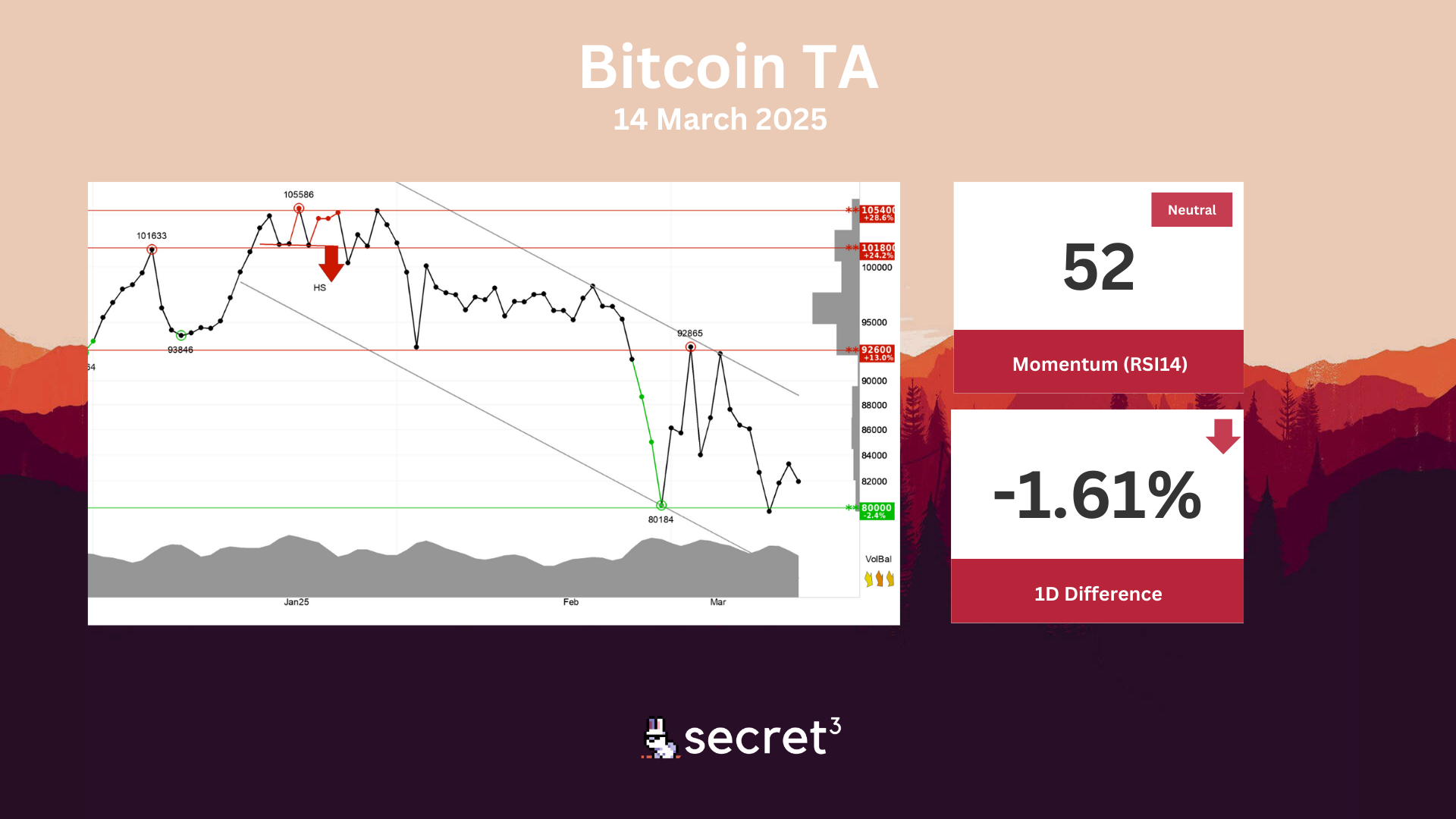

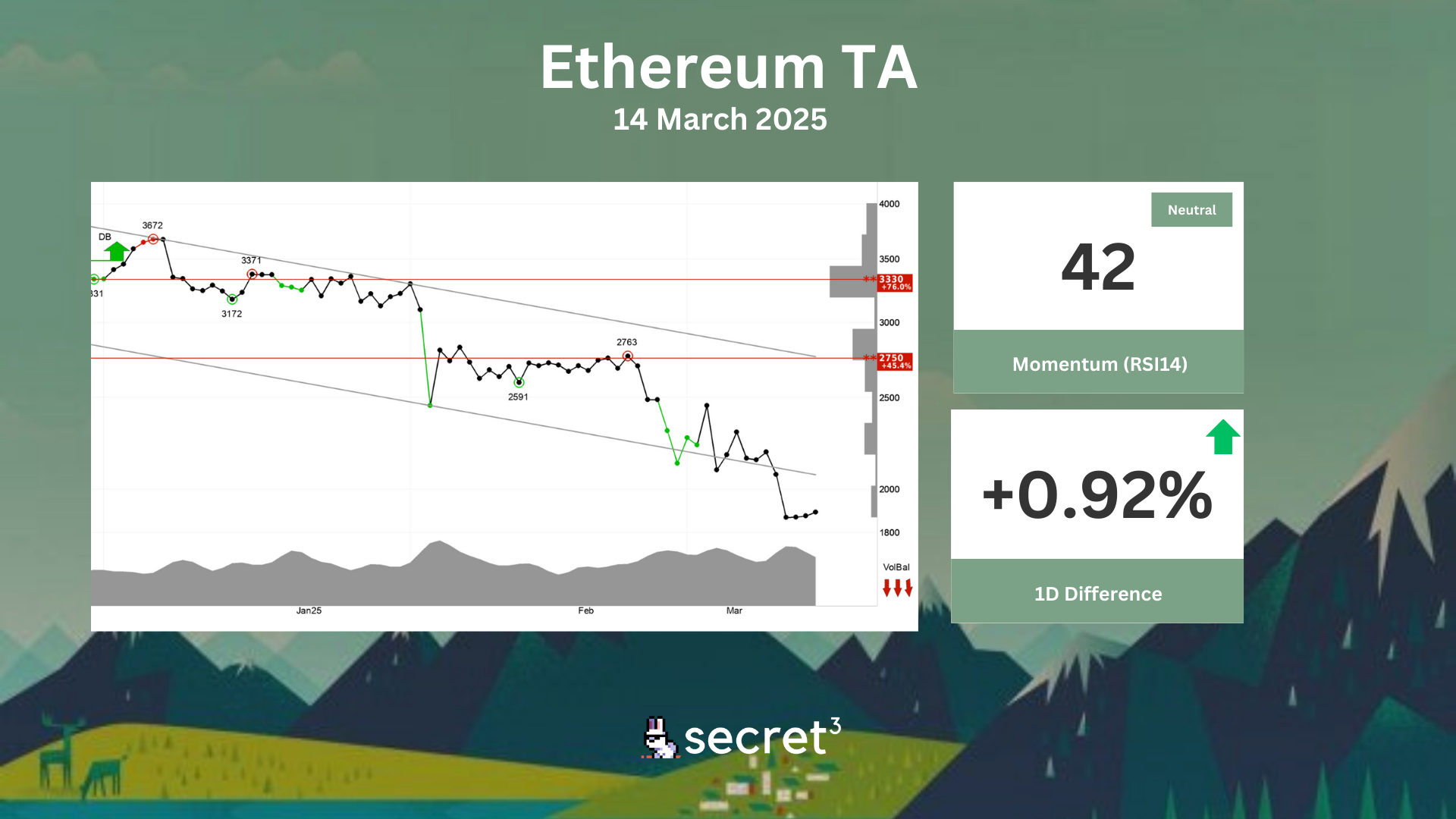

Technical Analysis

Bitcoin - Bitcoin is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. The currency has support at points 80000 and resistance at points 92600. The currency is assessed as technically negative for the short term.

Ethereum - Ethereum has broken down through the floor of the falling trend channel in the short term, which signals an even stronger falling rate. The negative development, however, may give rise to short term corrections up from today's level. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2750 points. The volume balance is negative and weakens the currency in the short term. RSI diverges positively against the price, which indicates a possibility for a reaction up. The currency is overall assessed as technically negative for the short term.

Governance & Code

🐺 Shapeshift DAO | Additions of KPIs (Preliminary Discussion)

- This proposal seeks to implement a standard for KPIs and success metrics for DAO products and initiatives.

👻 Aave DAO | GHO Gas Token Framework (Preliminary Discussion)

- This proposal from Aave Labs outlines a general approach for utilizing GHO as the gas token of a network; the framework is designed to be adaptable for any L2 network interested in using GHO in this capacity.

⚖️ Balancer DAO | Fund OpCo Product Team Q2/25 (Preliminary Discussion)

- This proposal requests $113,602 to fund Balancer OpCo’s product team for three months, from Apr. 1 to Jun. 30, 2025.