gm 13/06

Summary

gm, PayPal announced plans to expand its PYUSD stablecoin to the Stellar blockchain and Circle's USDC launches on Ripple's XRPL network. Traditional finance continued its crypto push as Stripe acquired crypto wallet infrastructure firm Privy to enhance onboarding experiences, while payment giant Shopify partnered with Coinbase to enable USDC payments on Base. The U.S. Senate advanced the GENIUS Act for stablecoin regulation with a 68-30 vote, though crypto industry insiders now believe the broader market structure bill is unlikely to pass this year. Meanwhile, Ethereum experienced internal turmoil as former lead Geth developer Péter Szilágyi accused the Ethereum Foundation of undermining his team by secretly funding a parallel development group.

News Headlines

📱 Hong Kong to develop crypto tracking tool for money laundering

- Hong Kong's Customs and Excise Department is collaborating with the University of Hong Kong to develop a tool to track cryptocurrency transactions linked to money laundering activities.

- Since 2021, Hong Kong has recorded 39 significant money laundering cases, with seven involving cryptocurrencies, including one case with over 1,000 suspicious transactions totaling approximately $229 million.

🏭 Centralized Bitcoin treasuries hold 31% of BTC supply

- According to Gemini research, centralized treasuries including governments, ETFs, and public companies now control approximately 30.9% (6.1 million BTC) of Bitcoin's circulating supply, marking a dramatic 924% increase over the last decade.

- The concentration of holdings is significant among the top three entities, controlling between 65% to 90% of total institutional holdings, with sovereign treasury wallets remaining mostly inactive but posing potential market influence.

🌐 Circle Stock Jumps as USDC Stablecoin Expands to Sam Altman's World Chain

- Circle's shares rose over 10% following the expansion of its USDC stablecoin to World Chain, a blockchain developed by OpenAI CEO Sam Altman, enhancing transaction efficiency and security.

- This integration automatically upgraded bridged USDC tokens to native USDC on World Chain and places the stablecoin on 21 different blockchains, strengthening Circle's position in the market.

⚠️ FSB Warns Crypto Nearing Tipping Point as Stablecoins Deepen TradFi Ties

- The Financial Stability Board's outgoing Chair Klaas Knot warned that while crypto doesn't currently pose a systemic risk, this could change rapidly as entry barriers for retail investors are dropping significantly through vehicles like crypto ETFs.

- The growing stablecoin market, now exceeding $251 billion in market cap, is strengthening ties with traditional finance through substantial holdings in US Treasurys, leading to increased regulatory scrutiny.

📊 Unique Bitcoin holder trend backs BTC's next price discovery phase

- A "unique duality" is emerging in Bitcoin's market structure where long-term holders (LTHs) are realizing profits while simultaneously increasing their overall supply, with daily profits peaking at $930 million.

- This phenomenon is largely driven by institutional investors and US spot Bitcoin ETFs favoring long-term custody, creating a stable but tightly wound market with potential for sharp price movements if sentiment changes.

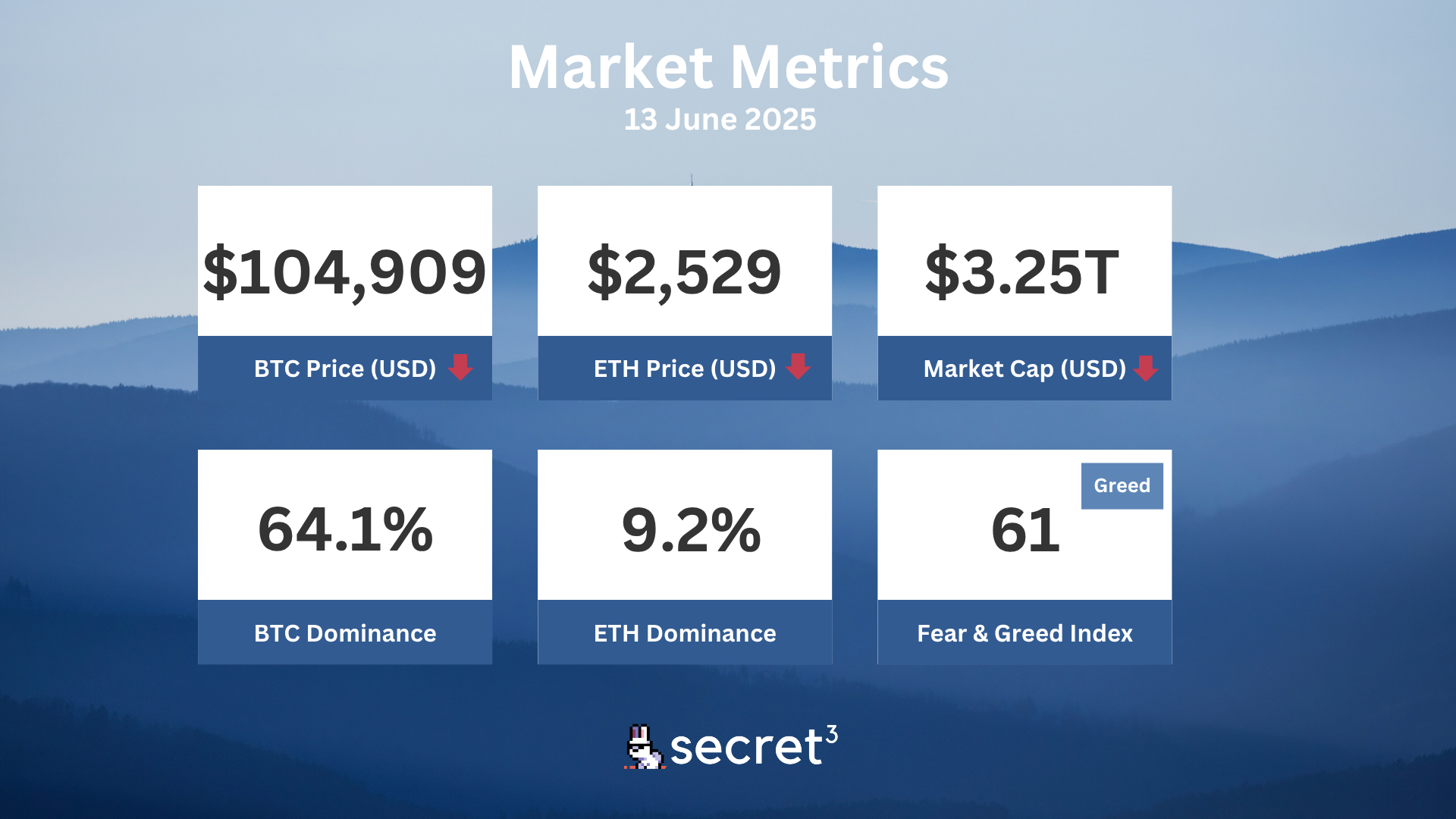

Market Metrics

Fundraising & VC

1. IREN (Debt Financing, $450M) - Next-generation data center business

2. SOON (Undisclosed, $5M) - High-performance Rollup Stack powered by decoupled SVM

2. Hey Anon (Undisclosed, $144K) - On‑chain AI-powered DeFi assistant

Regulatory

🚫 SEC Withdraws Proposed Crypto Custody and DeFi Rules

- The SEC has rescinded several Biden-era proposed regulations, including rules that would have expanded the definition of 'exchange' to cover DeFi protocols and imposed stricter custody requirements for digital assets.

- This regulatory rollback allows investment firms to maintain current digital asset custodians without pressure to comply with stricter standards that many crypto service providers couldn't meet.

⚖️ Ripple and SEC File Motion to End Legal Battle, Release $125M in Escrow

- Ripple Labs and the SEC jointly filed a motion in Manhattan federal court to dissolve an injunction and release $125 million held in escrow, with Ripple proposing to pay a $50 million civil penalty.

- This marks a significant step toward resolving the lawsuit that began in 2020, reflecting the SEC's shifting enforcement approach under the new administration.

🌐 Philippines Enacts Comprehensive Crypto Regulations

- The Philippines has introduced strict regulations requiring crypto-asset service providers to register as local corporations with a minimum paid-up capital of approximately $1.8 million.

- The new framework mandates physical offices, segregation of customer assets from corporate funds, and regular reporting to authorities, addressing the country's estimated $107 billion unregulated crypto market.

🛑 Australian Advisor Banned for 10 Years Over Crypto Scheme

- Australia's financial regulator has imposed a 10-year ban on financial adviser Glenda Maree Rogan for allegedly deceiving clients in a $9.6 million crypto investment scam.

- Rogan allegedly told clients they were investing in high-yield fixed-interest accounts but directed their funds to cryptocurrency platforms flagged as potential scams.

🔄 Jack Ma's Ant International Seeks Stablecoin Licenses

- Ant International, a unit of Jack Ma's Ant Group, is preparing to apply for stablecoin licenses in Hong Kong and Singapore, reflecting increased institutional interest in regulated crypto payment systems.

- The company aims to utilize stablecoins for cross-border transactions and treasury management services, building on its current blockchain-based platform which processed $1 trillion in global transactions in 2024.

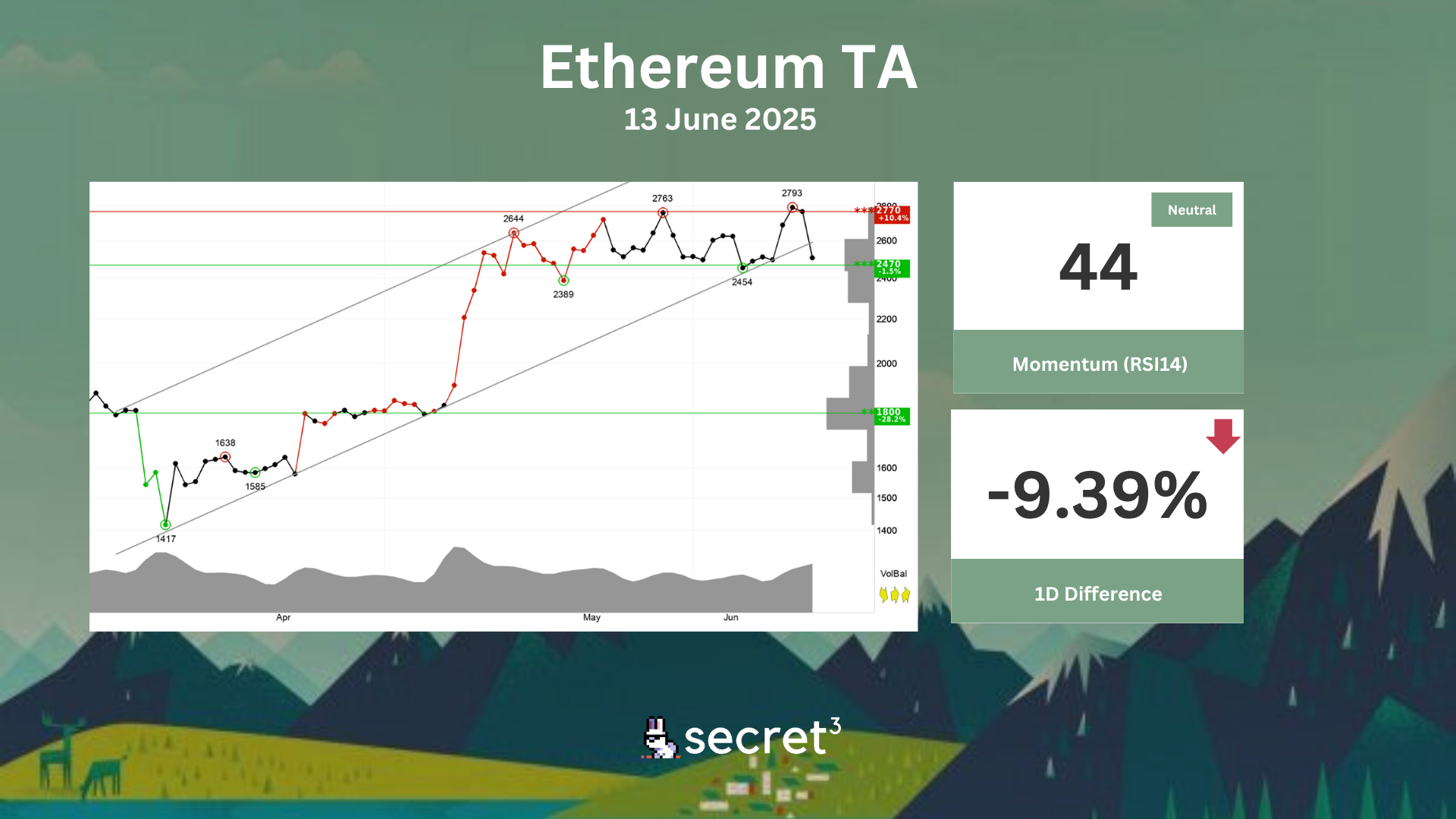

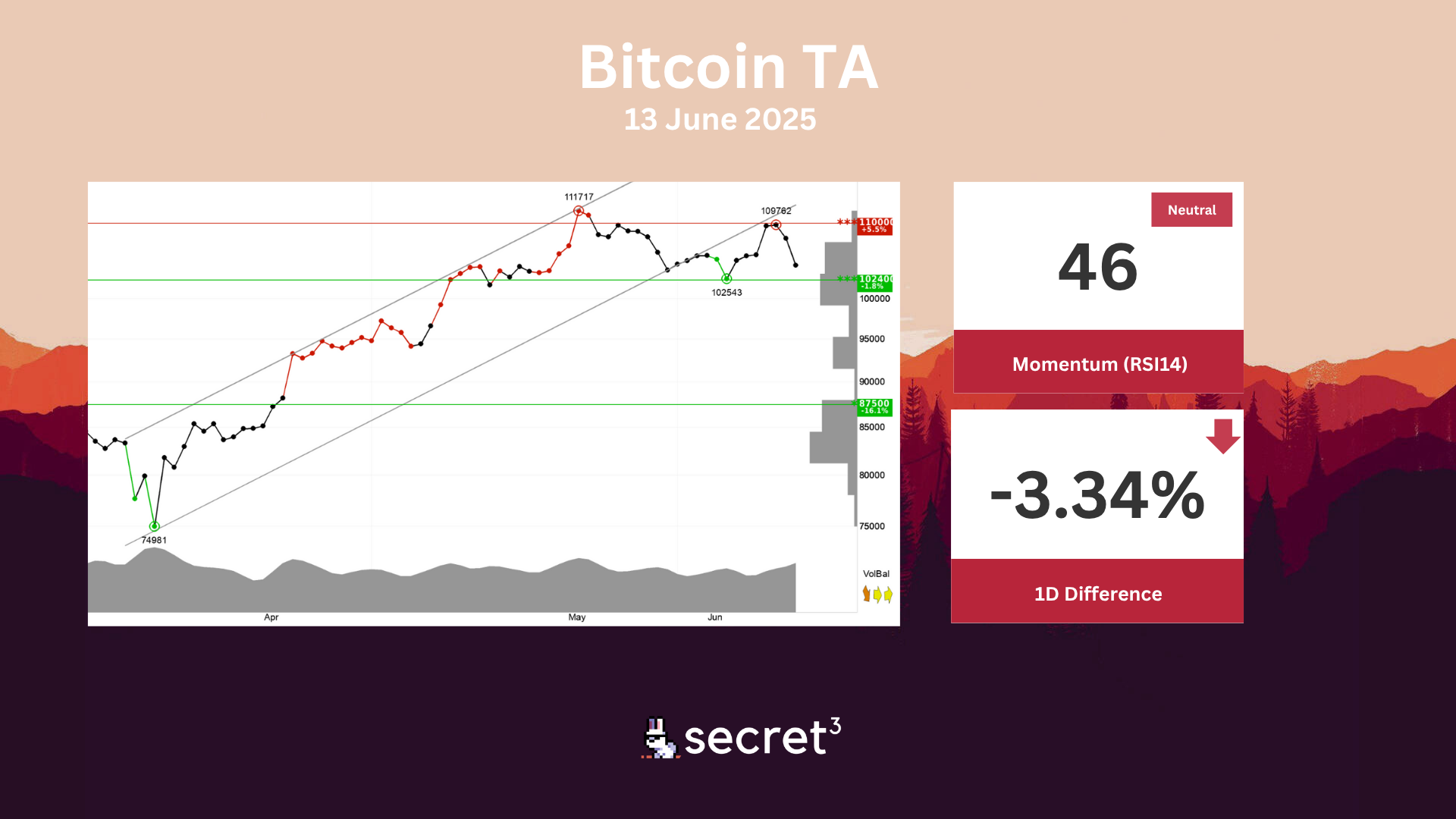

Technical Analysis

Bitcoin - Bitcoin has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. The currency is approaching support at 102400 points, which may give a positive reaction. However, a break downwards through 102400 points will be a negative signal. The currency is assessed as technically slightly positive for the short term.

Ethereum - Ethereum has broken the floor of the rising trend channel in the short term, which indicates a weaker initial rising rate. The currency is testing support at points 2470. This could give a positive reaction, but a downward breakthrough of points 2470 means a negative signal. Volume tops and volume bottoms correspond well with tops and bottoms in the price. This weakens the trend break. The currency is overall assessed as technically positive for the short term.