gm 13/03

Summary

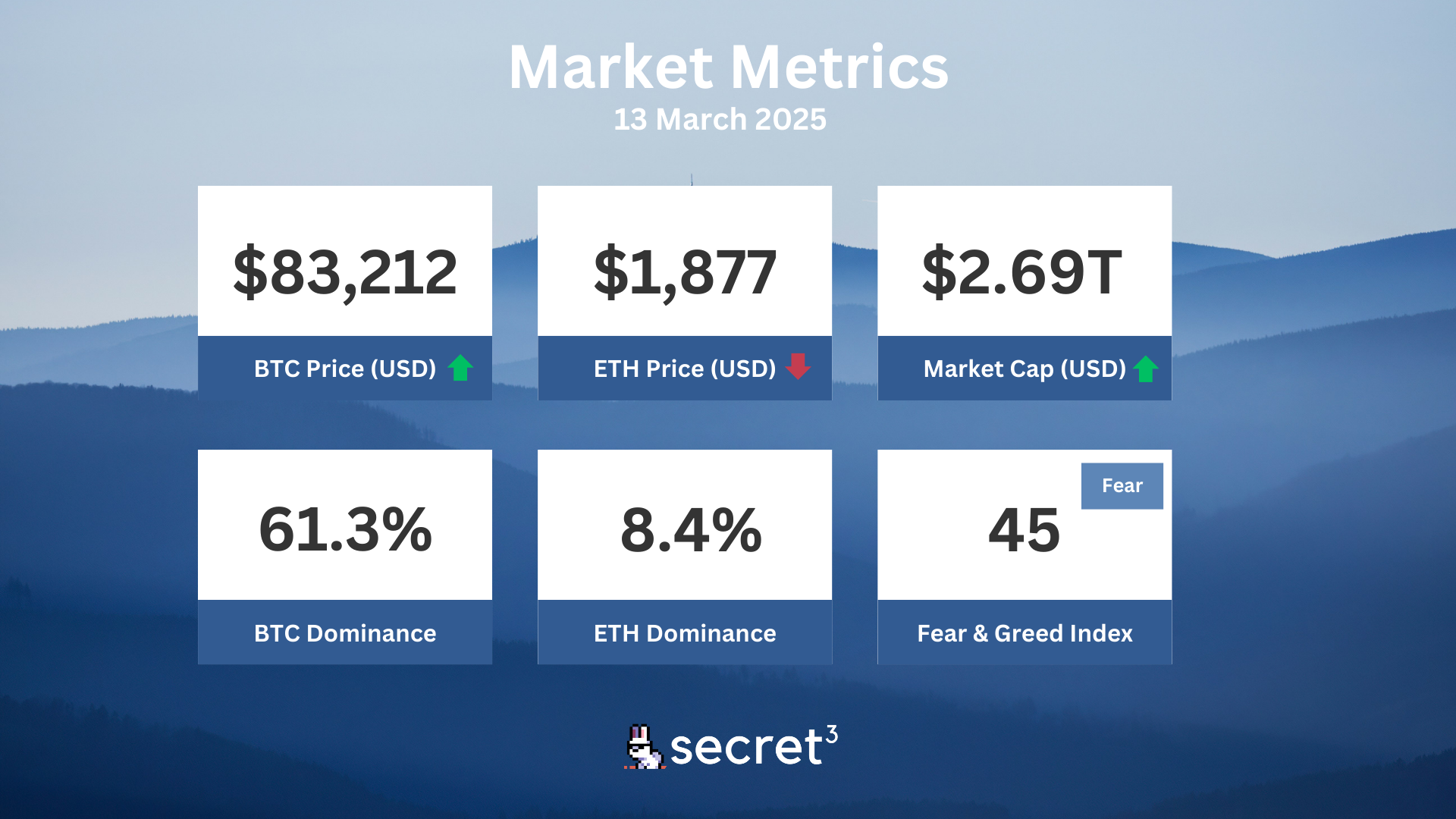

gm, Bitcoin rebounded to around $83,000 after a recent dip, while altcoins struggled to keep pace. Notably, Coinbase secured approval to re-enter the Indian market, signaling potential growth in a key region. Meanwhile, the US House of Representatives passed a resolution to overturn the IRS's DeFi broker rule, potentially easing regulatory pressure on the sector. On the institutional front, Binance received a substantial $2 billion investment from Abu Dhabi-based MGX, paid entirely in stablecoins, highlighting growing interest from traditional finance players in the crypto ecosystem.

News Headlines

🏦 Ripple Obtains Dubai License for Crypto Payments in UAE

- Ripple has received regulatory approval from the Dubai Financial Services Authority to provide cross-border crypto payment services in the UAE.

- This makes Ripple the first licensed blockchain payment provider in the Dubai International Financial Center, a free-economic zone with distinct tax and regulatory frameworks.

💹 Franklin Templeton Files for XRP ETF, Joining Growing List of Applicants

- Franklin Templeton has filed for a spot XRP ETF, becoming the latest firm to enter the growing XRP ETF race.

- The ETF aims to track XRP's performance, with assets to be held at Coinbase Custody Trust.

🔒 Trezor Resolves Security Vulnerability with Help from Competitor Ledger

- Ledger helped Trezor address a security vulnerability in its Safe 3 and 5 models that could have left them susceptible to advanced attacks.

- Trezor has patched the vulnerabilities and confirmed that user funds are safe, though they have not detailed how the patch was applied.

📊 Ethereum/Bitcoin Ratio Hits 5-Year Low, Suggesting Potential Shift to Altcoins

- The ETH/BTC ratio has dropped to its lowest level since mid-2020, currently standing at 0.02281.

- Trader Alex Kruger suggests considering a shift towards higher-performing altcoins, as potential gains could be greater with altcoins if the market recovers.

📉 Crypto Trading Volume Slumps Over 50% Since February, Signaling Market Exhaustion

- Daily crypto trading volume has fallen from a peak of $440 billion to $163 billion by March 12.

- Analysts report that declining trading volumes amid slight price recoveries indicate waning enthusiasm among traders.

Market Metrics

Fundraising & VC

1. Mesh (Series B, $82M) - Global crypto payments network

2. Axelar (Private Token Sale, $30M) - Cross-chain communication network

3. Vest Exchange (Undisclosed, $5M) - Decentralized perpetual futures exchange

4. Obol Technologies (Public Token Sale, $3M) - Decentralized operator ecosystem

Regulatory

🌐 Russia Proposes Allowing Wealthy Investors to Trade Crypto

- Russia's central bank proposed allowing high net-worth individuals to buy and sell crypto during a 3-year trial.

- Participants must have over 100 million rubles ($11.5M) in investments or 50 million rubles ($5.7M) annual income.

🏧 Nebraska Enacts Crypto ATM Consumer Protection Law

- Nebraska passed the Controllable Electronic Record Fraud Prevention Act to regulate crypto ATMs and protect consumers.

- The law requires clear fraud risk disclosures and mandates operators provide refunds for scams within 90 days.

💼 OKX Secures MiFID II License for EU Derivatives Trading

- Crypto exchange OKX obtained a MiFID II license to offer derivatives products across the EU.

- This follows OKX's recent registration under the MiCA framework for crypto services in 28 EU markets.

⚡ Bolivian State Energy Firm to Use Crypto for Imports

- Bolivia's state energy company announced plans to utilize cryptocurrency for paying imports.

- The initiative aims to streamline international transactions and reduce costs.

Technical Analysis

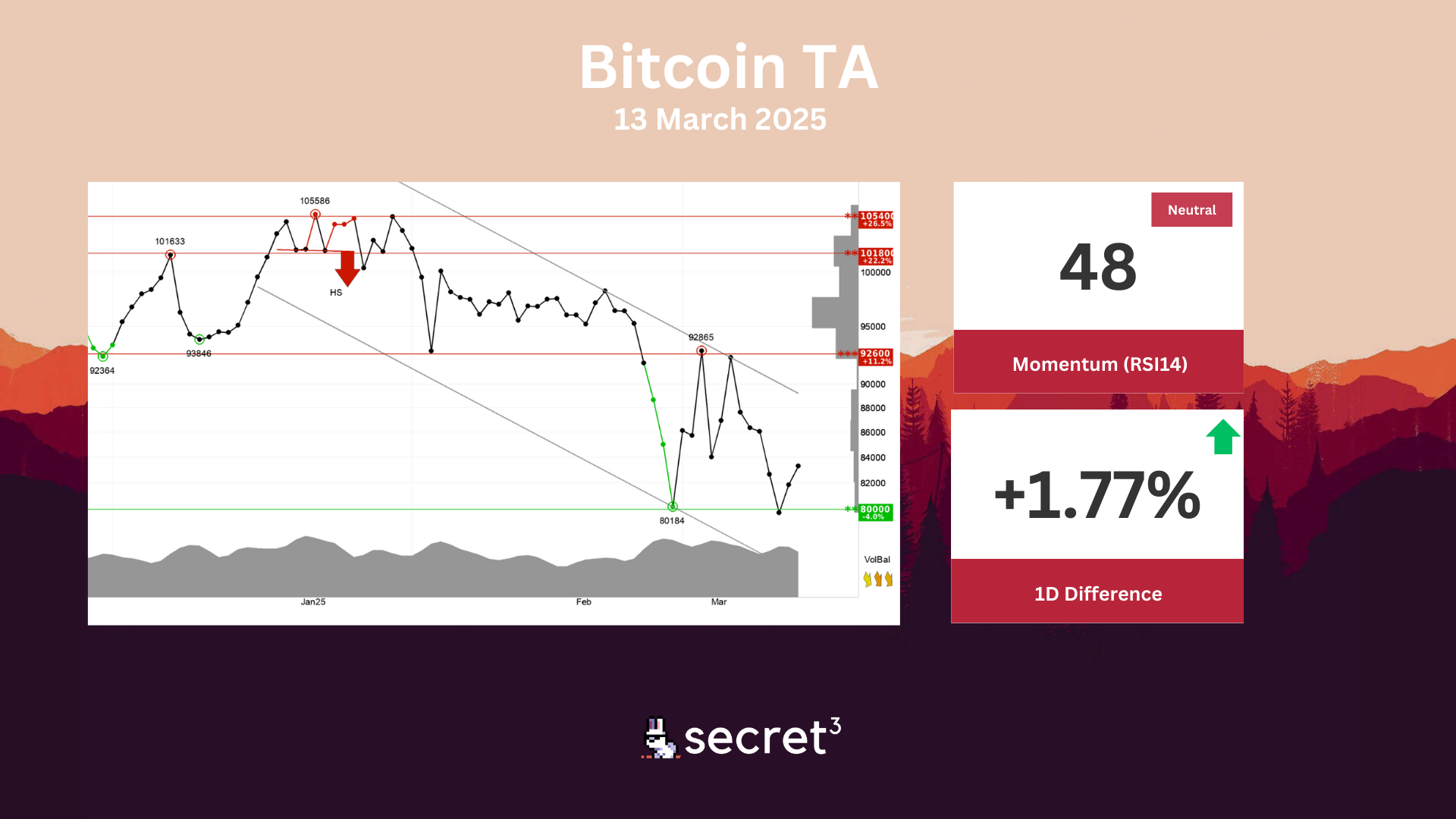

Bitcoin - Bitcoin is in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Bitcoin. The currency has support at points 80000 and resistance at points 92600. The currency is assessed as technically negative for the short term.

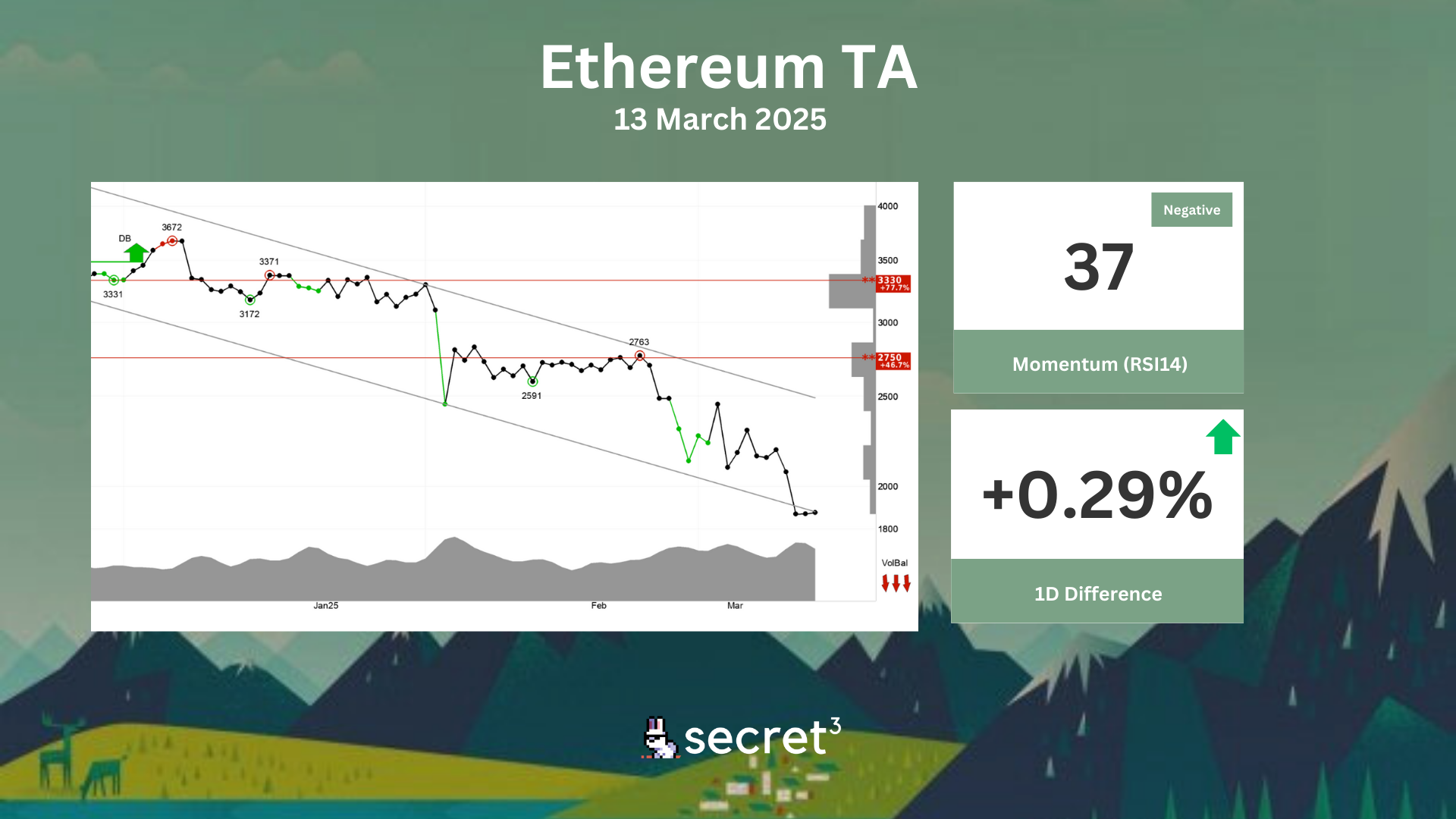

Ethereum - Ethereum has broken the falling trend channel down in the short term, which indicates an even stronger falling rate. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2750 points. Negative volume balance indicates that volume is high on days with falling prices and low on days with rising prices, which weakens the currency. RSI diverges positively against the price, which indicates a possibility for a reaction up. The currency is overall assessed as technically negative for the short term.