gm 14/02

Summary

gm, Ethereum Foundation allocates $120 million in Ether to various DeFi protocols to bolster community confidence. Meanwhile, US Bitcoin mining companies reported supply chain issues due to delays from Chinese manufacturer Bitmain, raising concerns about mining profitability. Additionally, Coinbase reported impressive Q4 earnings with revenue soaring to $2.3 billion, largely driven by increased crypto trading following President Trump's election victory. These events highlight the ongoing evolution of the crypto ecosystem, from institutional moves to regulatory impacts and market dynamics.

News Headlines

📊 VanEck: State Bitcoin Reserve Bills Could Add Up to $23B in Buys

- 20 US states are considering establishing Bitcoin reserves.

- If enacted, this could result in $23 billion demand for Bitcoin (247,000 BTC)

🛒 GameStop Stock Price Pumps After Report of Bitcoin Buying Plans

- GameStop stock rises 18% after hours on reports of potential Bitcoin investment.

- This aligns with the broader trend of corporations considering Bitcoin investments.

🌊 OpenSea Unveils SEA Token and New Version of its Exchange

- OpenSea confirms launch of SEA token for active users and early adopters.

- This move aims to enhance user experience and community engagement.

🚀 Story Protocol Debuts Mainnet to Bypass IP's Rent-Seeking Intermediaries

- Story Protocol launches IP-focused blockchain backed by a16z.

- This move aims to make $61 trillion IP asset class programmable.

🏦 Circle's USDC Hits Record Market Cap Over $56B as Stablecoin Demand Soars

- USDC reaches record market cap exceeding $56 billion.

- USDC outpaces Tether USDT's growth in recent months.

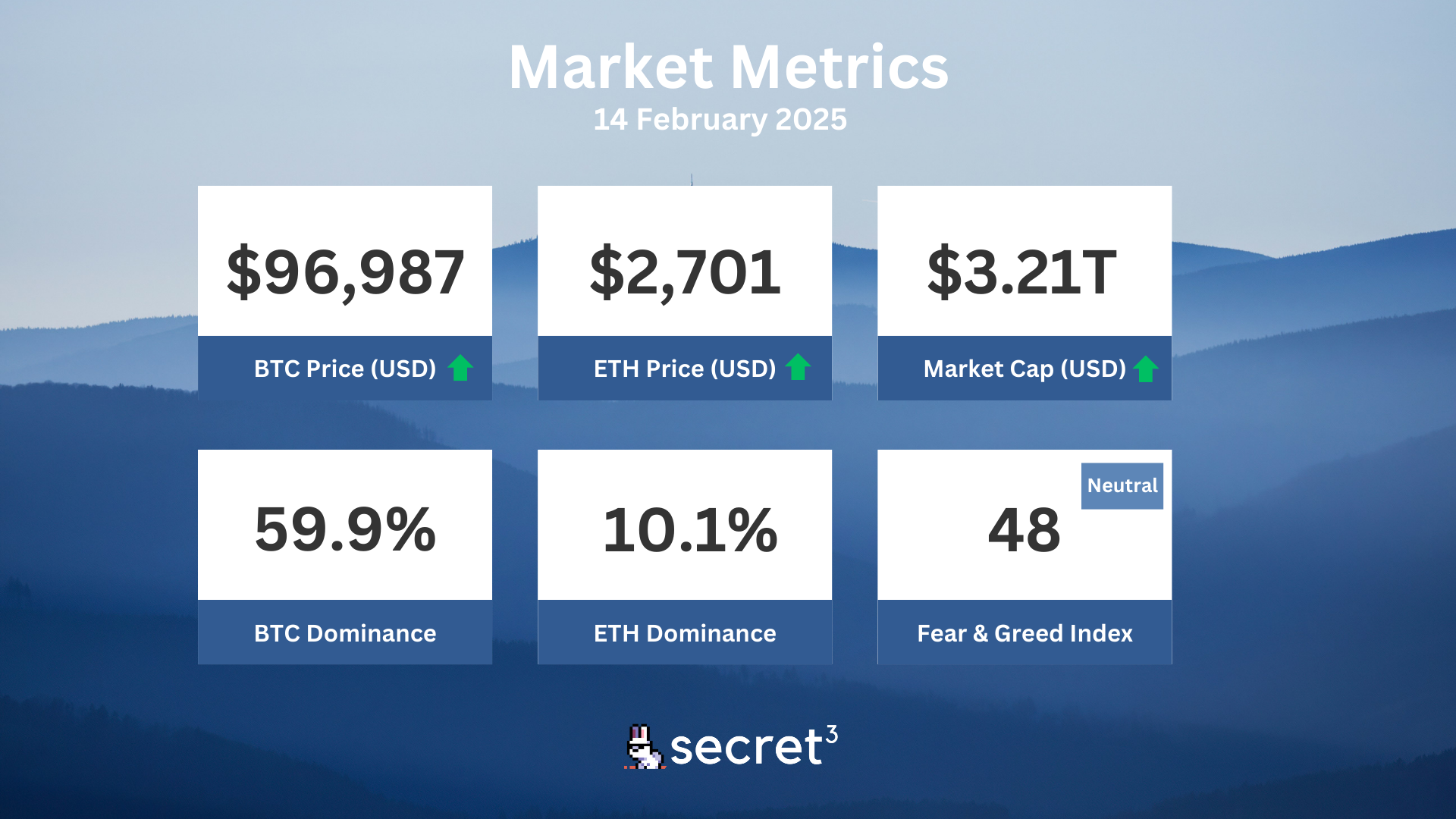

Market Metrics

Fundraising & VC

1. Plasma (Series A, $20.5M) - Purpose-built blockchain for stablecoin payments

2. StakeStone (Undisclosed, $10M) - Omni-chain liquid staking token protocol

3. Teneo Protocol (Seed, $3M) - Data utilization and tokenization for DePIN and AI

4. Fireverse (Series A, $2.5M) - Web3-based music platform

On-chain Data

1. Sei Network (SEI) token unlock in 1 day ($52.02M, 4.96%)

2. Avalanche (AVAX) token unlock in 2 days ($42.70M, 0.4%)

3. Arbitrum (ARB) token unlock in 2 days ($45.42M, 2.13%)

4. ApeCoin (APE) token unlock in 3 days ($11.39M, 2.16%)

Regulatory

🏛️ Trump Completes Key Appointments for U.S. Crypto Regulation Team

- President Trump nominates Jonathan Gould, a former crypto executive, to lead the Office of the Comptroller of the Currency (OCC).

- The appointments signal a shift towards a more crypto-friendly regulatory approach, potentially reviving the concept of limited-purpose national bank charters for crypto-focused banks.

🤝 What the SEC's Truce With Binance Means for Coinbase and Other Crypto Lawsuits

- The SEC agrees to pause its lawsuit against Binance, signaling a potential shift in regulatory policy towards cryptocurrency industries.

- This development could open doors for resolutions in other crypto-related cases, though uncertainty persists regarding future enforcement actions.

🌐 Coinbase Eyes India Comeback, Seeks Regulatory Green Light

- Coinbase is in talks with Indian regulators to potentially re-enter the market after halting operations in 2023.

- The exchange is engaging with India's Financial Intelligence Unit (FIU) to explore compliance with regulatory requirements.

💼 Michigan becomes latest state to propose crypto reserve bill

- Michigan's House introduces a bill to allow the state to invest in cryptocurrency, becoming the 20th US state to consider such legislation.

- The bill would enable the state treasurer to invest up to 10% of both the general and economic stabilization funds in cryptocurrencies.

📊 SEC acknowledges Grayscale's XRP and DOGE ETF filings

- The SEC acknowledges Grayscale's filings for spot XRP and Dogecoin exchange-traded funds (ETFs).

- This marks a significant shift in the SEC's approach under new leadership, potentially leading to greater acceptance of cryptocurrency ETFs.

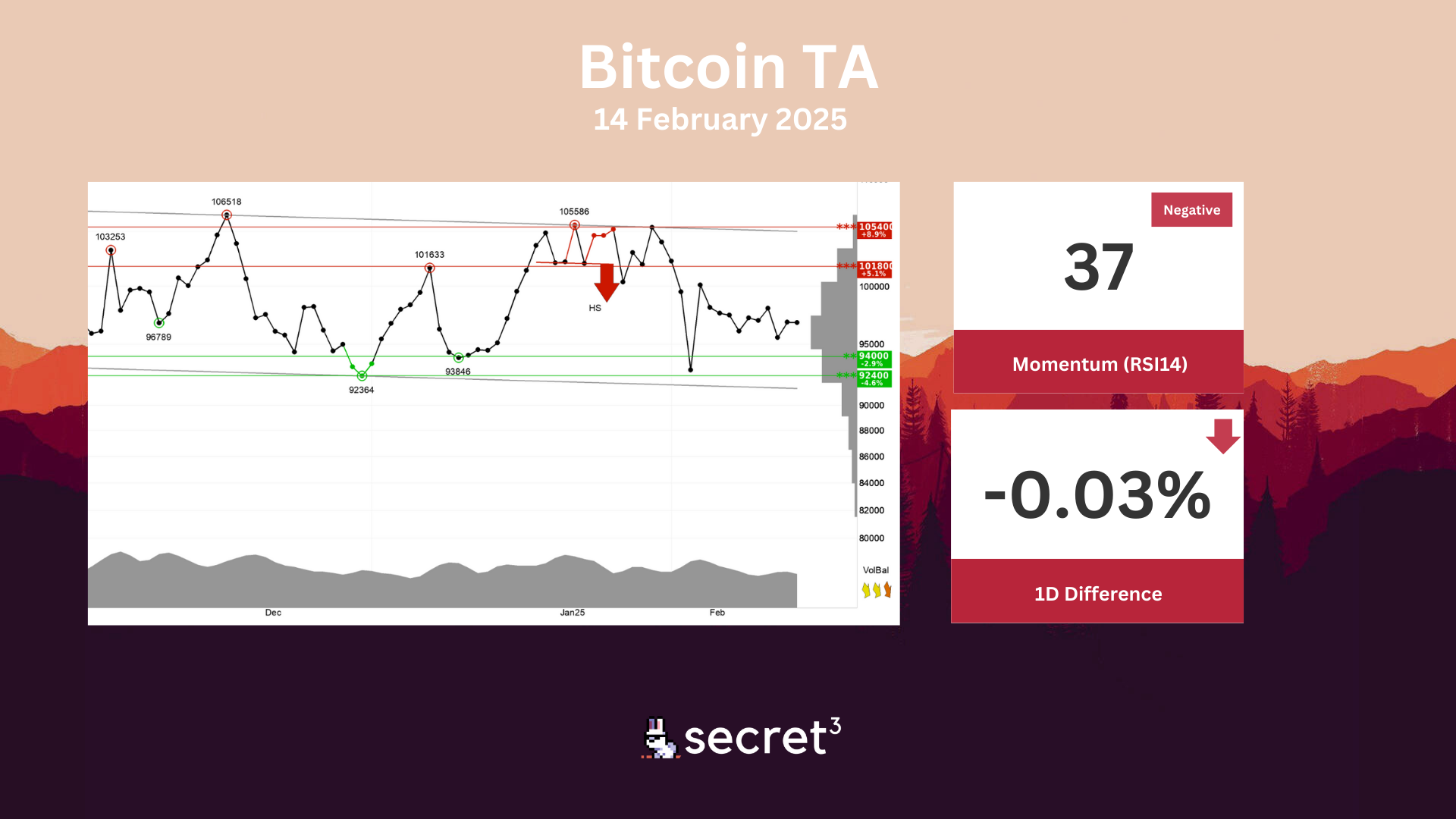

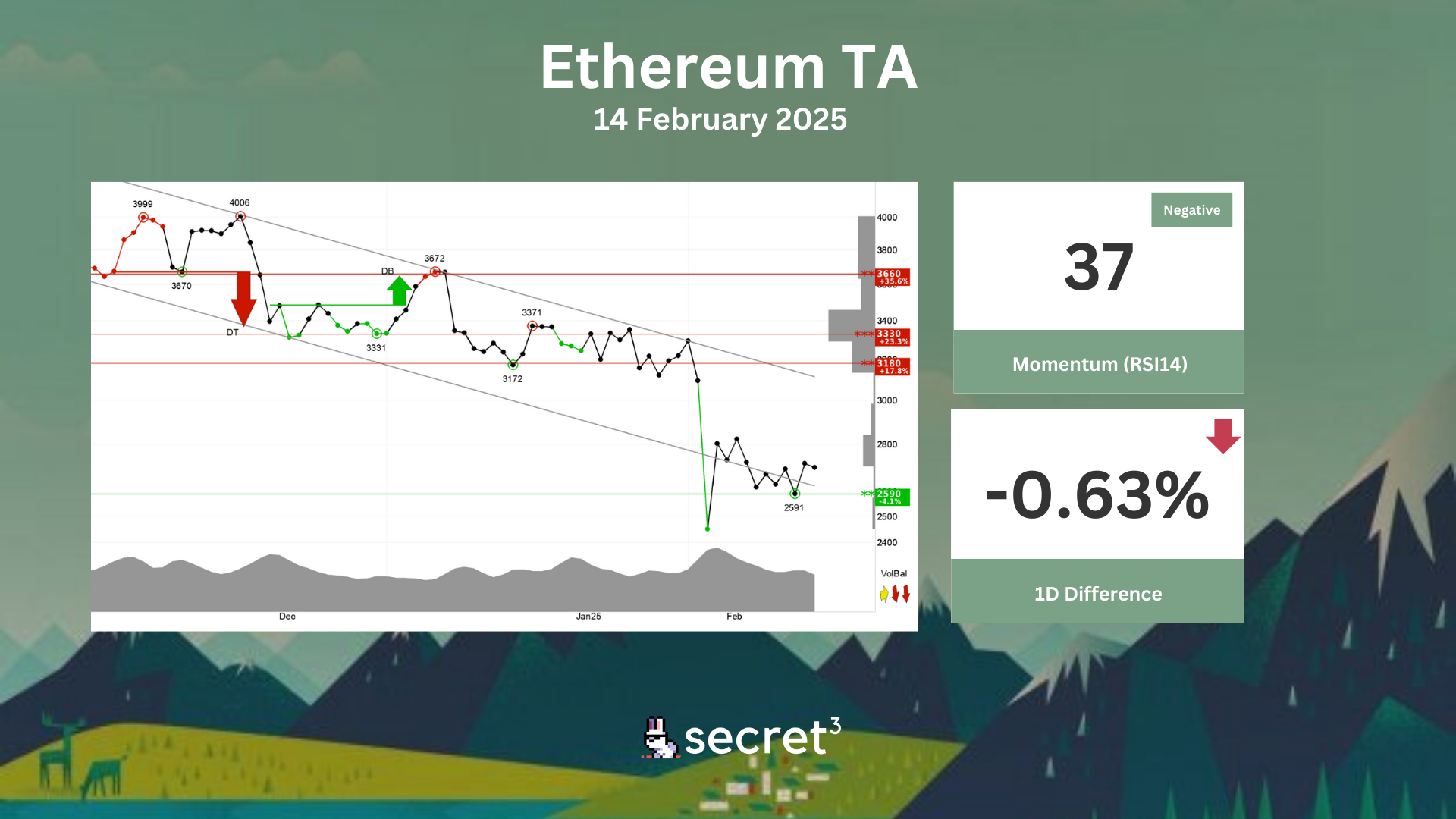

Technical Analysis

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term. This indicates that investors are uncertain and waiting for signals of further direction. A break upwards will be a positive signal, while a break downwards will be a negative signal. The currency has support at points 94000 and resistance at points 101800. The currency is assessed as technically slightly negative for the short term.

Ethereum - Ethereum is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. The currency has support at points 2590 and resistance at points 3180. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

⚖️ Karrat DAO | Burn-Bolster Mechanism (Preliminary Discussion)

- This proposal aims to implement a Burn-Bolster Mechanism, which would modify the use of the KARRAT token by allocating a portion of each transaction to both token burning and treasury funding.

💧 Lido DAO | wstETH Deployment on Swellchain (Preliminary Discussion)

- This proposal seeks to deploy wstETH (Wrapped liquid staked Ether 2.0) to Swellchain, with the ultimate goal of the recognition of the wstETH bridging components by the Network Expansion Committee.