gm 13/02

Summary

gm, The SEC agrees to pause its lawsuit against Binance, signaling a potential shift in regulatory approach. This move has sparked speculation about similar actions for other crypto companies like Coinbase and Ripple. Meanwhile, Bitcoin experienced a slight decline following higher-than-expected U.S. inflation data, dipping below $95,000. Despite this, institutional interest remains strong, with Goldman Sachs significantly increasing its Bitcoin and Ethereum ETF holdings. Additionally, Franklin Templeton expanded its OnChain U.S. Government Money Fund to include Solana, reflecting growing institutional engagement with blockchain technology beyond Bitcoin and Ethereum.

News Headlines

📊 Robinhood's Crypto Revenue Soars 700% in Q4, Driving Record Profit

- Robinhood reported a remarkable 700% increase in crypto trading revenue in Q4, contributing to record profitability as digital asset interest surged.

- Crypto revenue hit $358 million, up from $45 million the previous year, making up over one-third of total transaction-based revenue, which rose more than 200% to $672 million.

🔍 CME Group Reports Record Crypto Volumes for Q4

- CME Group announced record cryptocurrency trading volumes in Q4 2024, achieving an average daily trading volume of approximately $10 billion for crypto derivatives, marking a 300% increase from the previous year.

- Crypto derivatives emerged as one of the fastest-growing product lines in 2024, significantly driven by retail investor interest, especially in Bitcoin futures.

🏦 Franklin Templeton Expands $594M Market Money Fund to Solana

- Franklin Templeton has expanded its OnChain U.S. Government Money Market Fund (FOBXX), currently valued at $594 million, to include Solana among the blockchains supporting it.

- This addition signals growing interest in Solana for tokenization, particularly after Securitize's initiatives involving tokenized real-world assets on the network.

🌟 Ethereum Is in One of Its 'Deepest Undervaluation Zones in Years'

- Ethereum has entered one of its most significant undervaluation periods in recent years, according to analysts at Bitwise.

- The ETH/BTC ratio is down 47% over the past year, with one ETH currently yielding only 0.027 BTC.

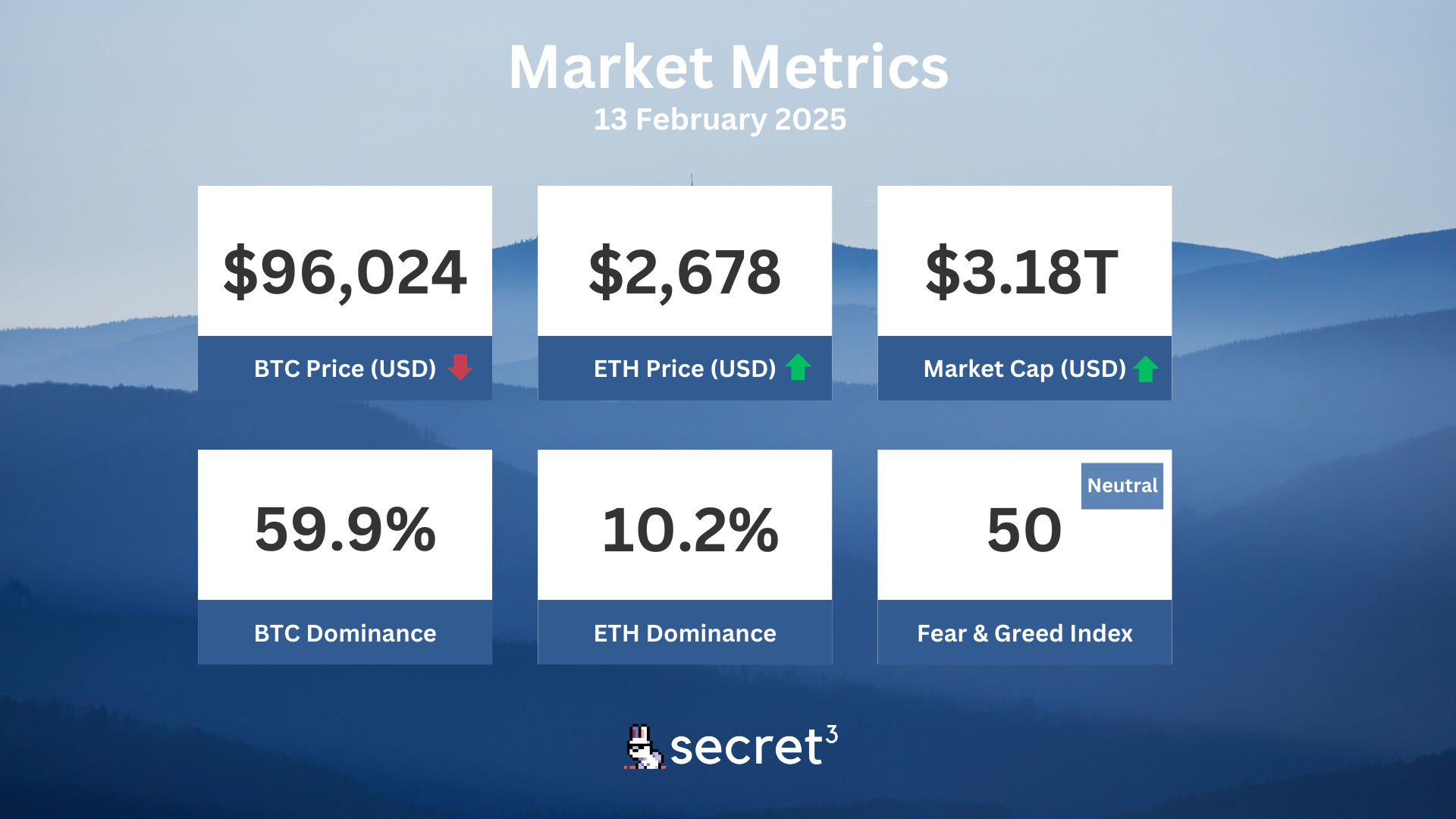

Market Metrics

Fundraising & VC

1. InfiniFi (Pre Seed, $3M) - On-chain fractional reserve system

2. Cabal (Seed, $3M) - governance-focused platform on Initia's Layer 1

3. EstateX (Strategic, Undisclosed) - RWA protocol & L1 blockchain

On-chain Data

1. NAVI (NAVX) token unlocked today ($359.94K, 1.03%)

2. Sei Network (SEI) token unlock in 2 days ($51.54M, 4.96%)

3. Avalanche (AVAX) token unlock in 3 days ($42.99M, 0.4%)

4. Arbitrum (ARB) token unlock in 3 days ($45.82M, 2.13%)

Regulatory

🏦 Trump Nominates Crypto-Savvy Jonathan Gould to Lead OCC

- President Trump has nominated Jonathan Gould, former chief legal officer at Bitfury, to lead the Office of the Comptroller of the Currency (OCC).

- Gould's background in the crypto sector signals a potential shift towards a more crypto-friendly approach within financial oversight organizations.

🌐 US States Push for Strategic Bitcoin Reserves

- Nearly a third of US states are exploring the creation of strategic Bitcoin reserves, potentially resulting in $23 billion in demand for Bitcoin.

- This movement aligns with Trump's vision for a national digital asset stockpile, indicating a shift in how governments view cryptocurrencies.

🔒 Brazil Upholds Ban on Worldcoin's Biometric Data Collection

- Brazil's National Data Protection Authority (ANPD) rejected Worldcoin's appeal, upholding a ban on the project's practice of rewarding users for biometric data collection.

- The decision reflects ongoing global scrutiny of biometric data practices in the crypto space.

📊 Inflation Concerns Impact Crypto Markets

- US inflation surpassed expectations, with the annual CPI reporting at 3% for January 2025, causing Bitcoin to dip below $95,000.

- The unexpected inflation data triggered concerns about macroeconomic pressures impacting digital assets, influencing crypto market sentiment.

🏛️ New York Senator Proposes Crypto Task Force

- New York state Senator James Sanders Jr. has introduced a bill to form a 17-member crypto task force to study the impact of cryptocurrencies on state revenue and regulations.

- The task force's findings are expected to guide future crypto policy in New York, which currently has some of the strictest regulations in the U.S.

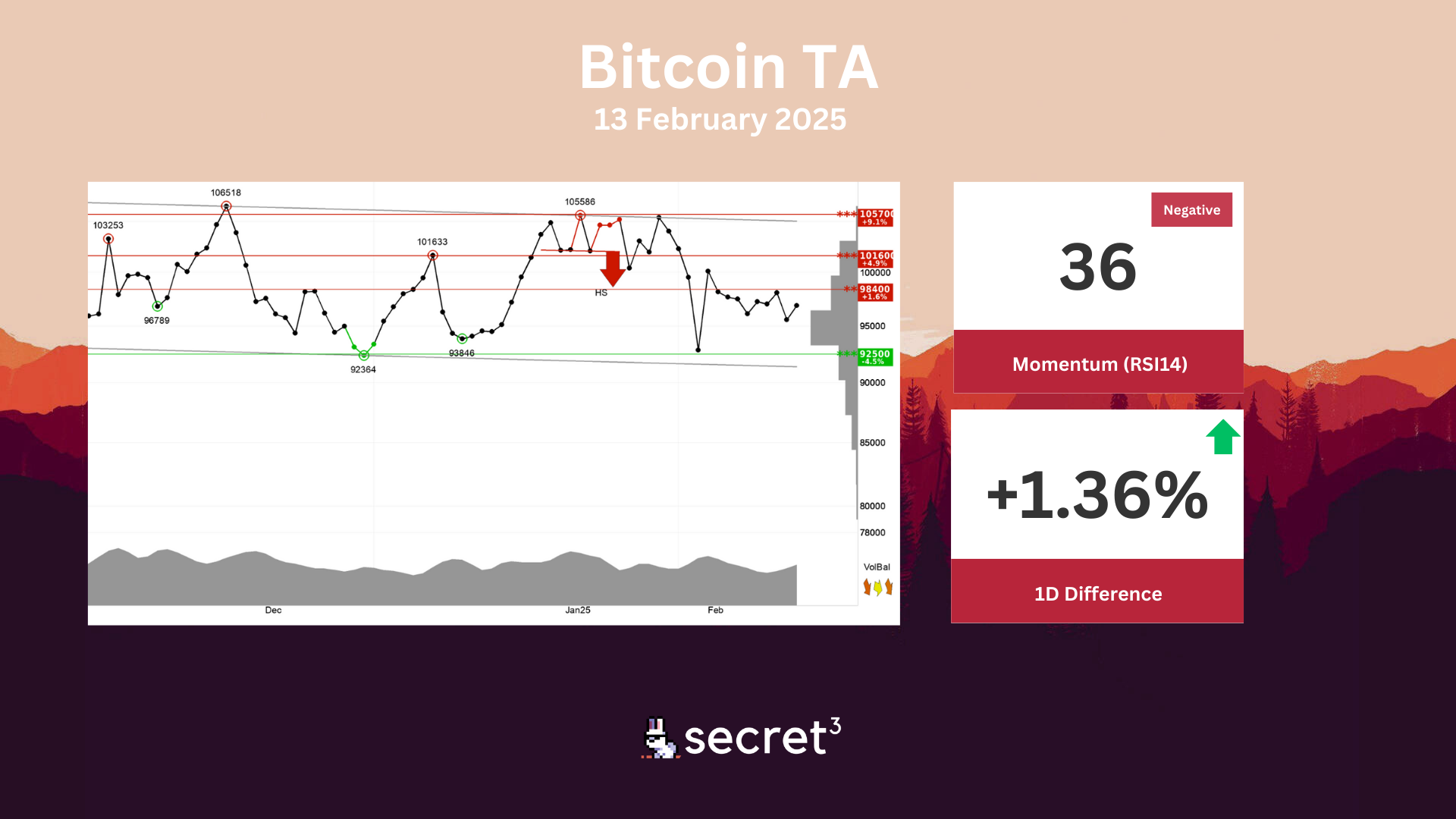

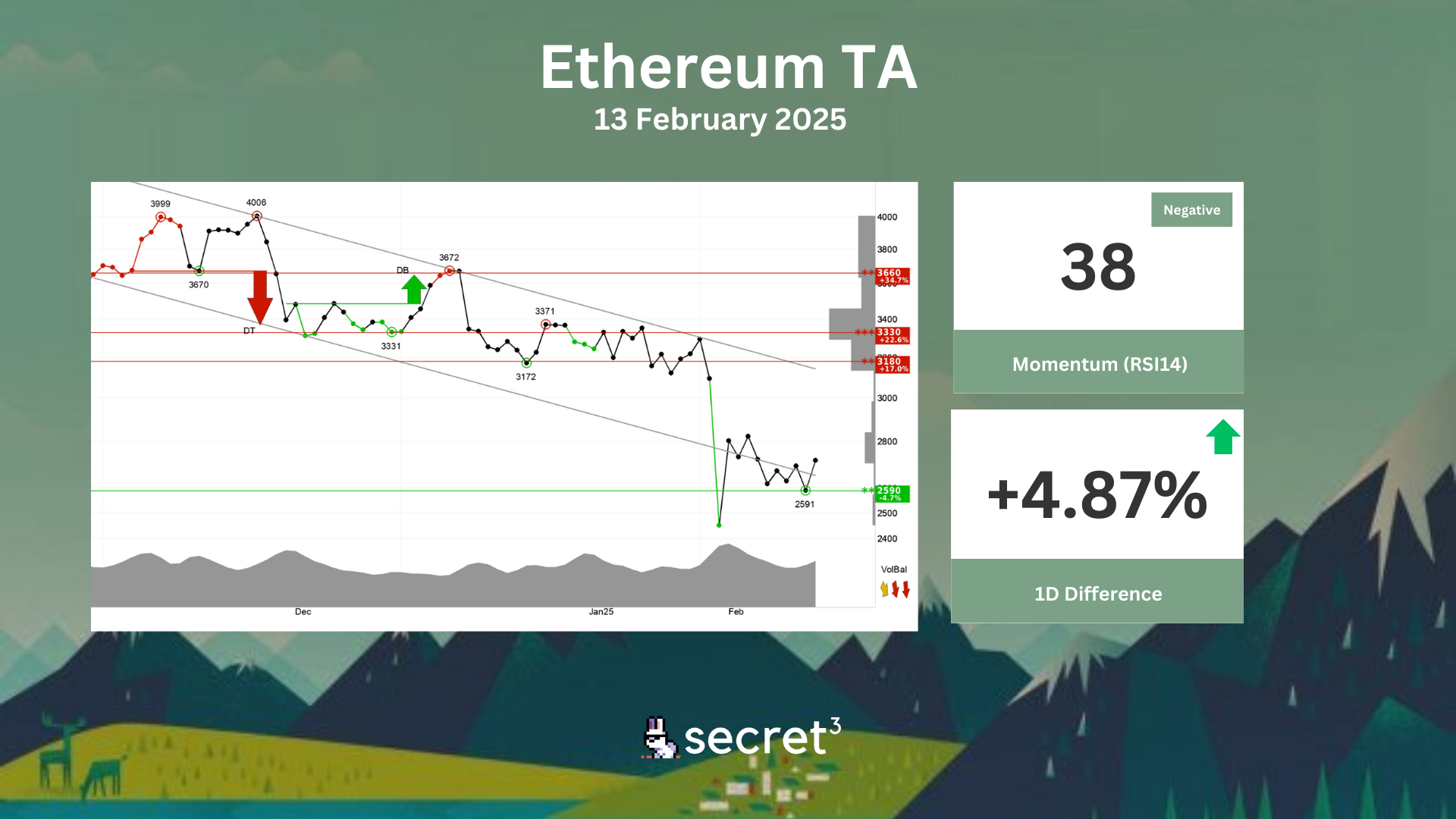

Technical Analysis

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. The currency is approaching resistance at 98400 points, which may give a negative reaction. However, a break upwards through 98400 points will be a positive signal. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. This weakens the currency and indicates increased chance of a break down. The currency is overall assessed as technically negative for the short term.

Ethereum - Investors have accepted lower prices over time to get out of Ethereum and the currency is in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency has support at points 2590 and resistance at points 3180. Volume has previously been low at price tops and high at price bottoms. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

🦋 Morpho DAO | Grants Pilot Program Selection (Active Vote)

- This proposal seeks to select which grants will be funded under the Morpho Grants Pilot Program.

👻 Aave DAO | GHO Gas Token Framework (Preliminary Discussion)

- This proposal outlines a framework for utilizing GHO as a gas token across blockchain networks.

⚖️ Balancer DAO | Enable Gauges for tETH V3 Pools (BIP 784)

- This proposal seeks to enable a gauge for the tETH/Aave-weETH pool on Arbitrum without an emission cap.