gm 12/06

Summary

gm, the CLARITY Act advances through two House committees and the GENIUS stablecoin bill cleared a key Senate vote with 68-30 support. Ethereum's ecosystem showed remarkable strength, with governance tokens like Uniswap and Aave surging following SEC Chair Paul Atkins' announcement of an "innovation exemption" for DeFi projects, while ETH ETFs recorded their best day in four months with $125 million in inflows. On the technology front, TOOL introduced a promising middleware solution to enable 1-second transaction execution on Ethereum without rollups, and Franklin Templeton launched an innovative "Intraday Yield" feature for tokenized assets, allowing yield to be accrued down to the second.

News Headlines

💰 Fortune 500's Interest in Stablecoins Triples from Last Year

- Nearly 29% of Fortune 500 executives now indicate plans or interest in stablecoins, a dramatic rise from just 8% last year, with 7% of respondents reporting their companies currently use or hold stablecoins. This surge is attributed to inefficiencies in current payment methods.

- Small and medium-sized businesses show even stronger interest, with 81% considering stablecoins (up from 61% last year) and 46% anticipating crypto use within three years, as the stablecoin market reaches $719 billion in monthly transfer volumes and exceeds 161 million holders globally.

📱 Stripe Acquires Crypto Wallet Provider Privy

- Stripe has acquired Privy, a crypto wallet infrastructure firm known for its embedded wallet technology that simplifies onboarding by allowing users to create wallets without traditional seed phrases. Privy's technology supports over 75 million accounts and 1,000 developer teams.

- This acquisition represents Stripe's second major move in the cryptocurrency space in the past year, following plans for stablecoin financial accounts, with Privy set to continue operating independently while benefiting from Stripe's resources.

💳 PayPal Expands PYUSD Stablecoin to Stellar

- PayPal is expanding its stablecoin, PayPal USD (PYUSD), to the Stellar blockchain, adding to its existing presence on Ethereum and Solana networks, pending regulatory approval. This will enhance PYUSD's utility on a platform focused on faster, cheaper cross-border payments.

- The expansion aligns with PayPal's commitment to integrating stablecoins into its services, with plans to enable Venmo users to purchase PYUSD, further increasing accessibility as the stablecoin market continues to grow significantly.

🏦 Bank of Korea Governor to Meet Bank Chiefs as Stablecoin Debate Heats Up

- Bank of Korea Governor Rhee Chang-yong is meeting with heads of major commercial banks on June 23 to discuss the issuance of won-backed stablecoins, aligning with increasing political momentum toward regulating digital assets in South Korea.

- Recent data indicates substantial capital outflows of $40.6 billion in digital assets, primarily in stablecoins, raising concerns about monetary sovereignty that the government hopes to address through local stablecoin issuance.

📊 SOL Price Could Target $300 as Solana ETF Approval Chances Jump to 91%

- SOL futures open interest has increased by 12%, indicating strong institutional interest, while Solana's price rose 4.3% to $165, supported by total value locked in Solana DApps reaching its highest level since June 2022 at approximately $9.1 billion.

- The probability of SEC approval for a Solana ETF has surged to 91%, which could unlock significant institutional capital and potentially drive SOL's price toward a target of $335, representing a potential 103% increase from current levels.

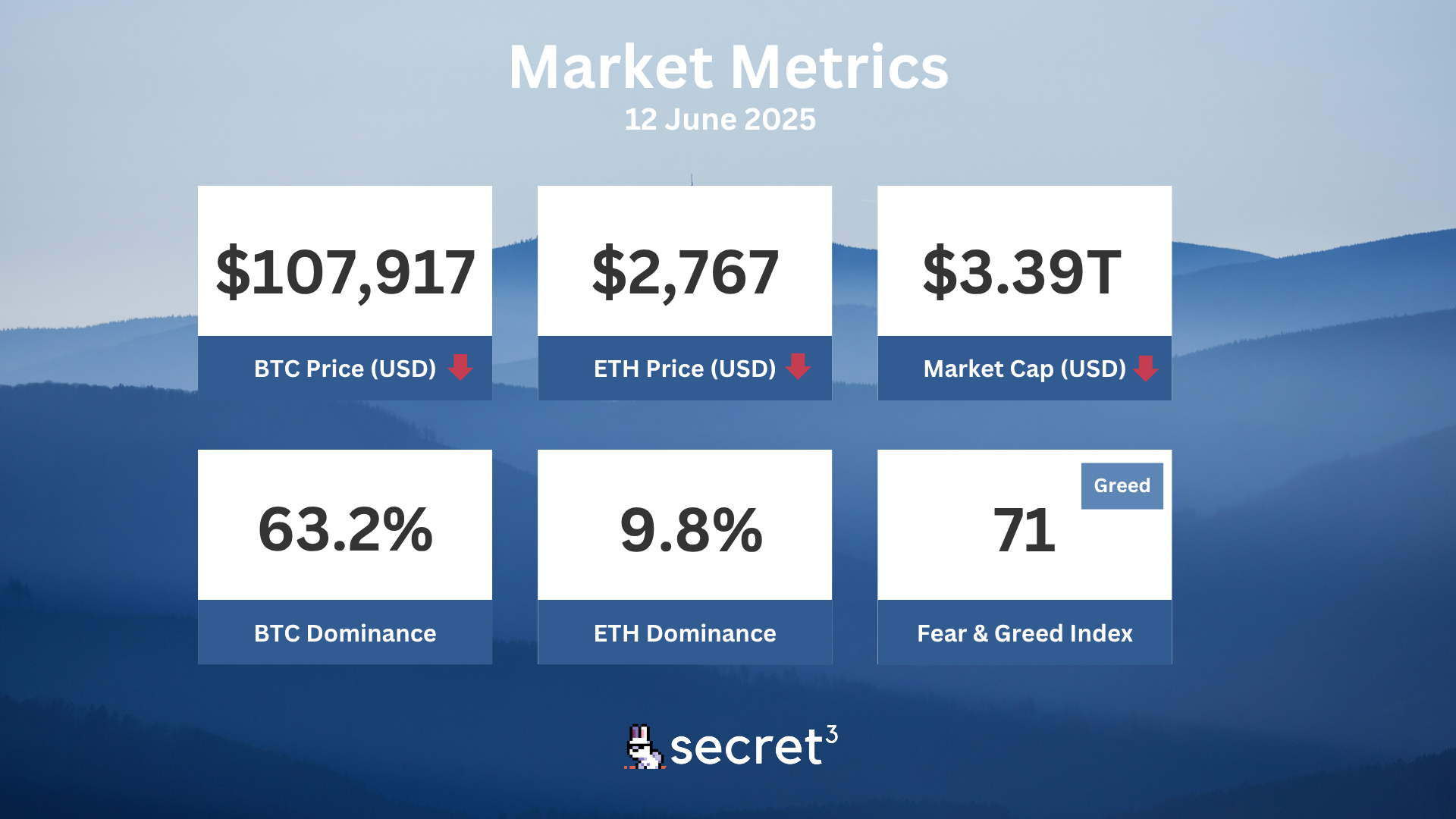

Market Metrics

Fundraising & VC

1. OneBalance (Series A, $20M) - Infrastructure for chain abstraction

2. TYB (Series A, $11M) - Web3 community rewards platform

3. OpenTrade (Undisclosed, $7M) - Stablecoin infrastructure and yield platform

Regulatory

🛑 Connecticut Bans Government Crypto Investments

- Connecticut has unanimously passed legislation prohibiting state and local governments from purchasing, holding, or investing in cryptocurrencies, making it one of the few states with an explicit ban.

- The law requires crypto businesses to disclose all material risks associated with virtual currencies and includes verification requirements for users under 18.

👨💼 CFPB's Top Enforcer Resigns with Trump Criticism

- Cara Petersen, acting enforcement director of the Consumer Financial Protection Bureau, has resigned while criticizing the Trump administration for undermining the agency's functions.

- The CFPB's operational cutbacks raise concerns for crypto consumers who may now have limited recourse for complaints against exchanges and other service providers.

🔍 Representative Demands SEC Documents on Ethereum

- Representative William Timmons has requested that SEC Chair Paul Atkins provide documents on the agency's historical approach to Ethereum under former leadership.

- Timmons criticized previous SEC inconsistencies regarding Ether's status as a security, citing the approval of Ether ETFs as evidence that it cannot be considered a security.

⚖️ Ukraine Introduces Bill for Crypto Asset Reserve

- Ukrainian lawmakers have registered a bill that would allow the National Bank of Ukraine to include cryptocurrencies like Bitcoin in state reserves.

- While the bill permits the central bank to allocate crypto assets, it doesn't mandate them to do so, leaving amount and timing decisions to the National Bank's discretion.

Technical Analysis

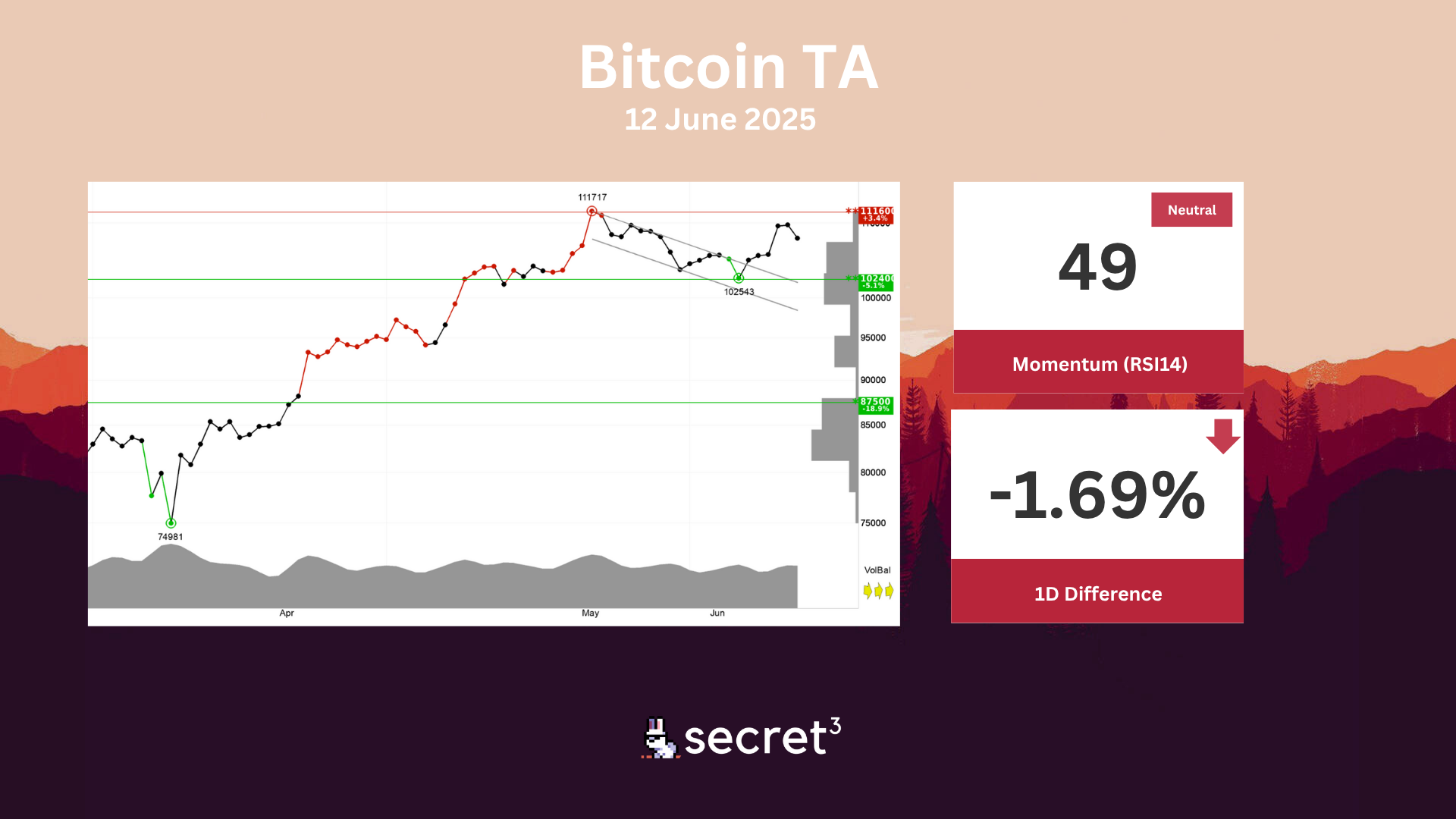

Bitcoin - Bitcoin has broken through the ceiling of a falling trend channel in the short term. This indicates a slower falling rate initially, or the start of a more horizontal development. The currency has support at points 102400 and resistance at points 111600. The currency is assessed as technically slightly negative for the short term.

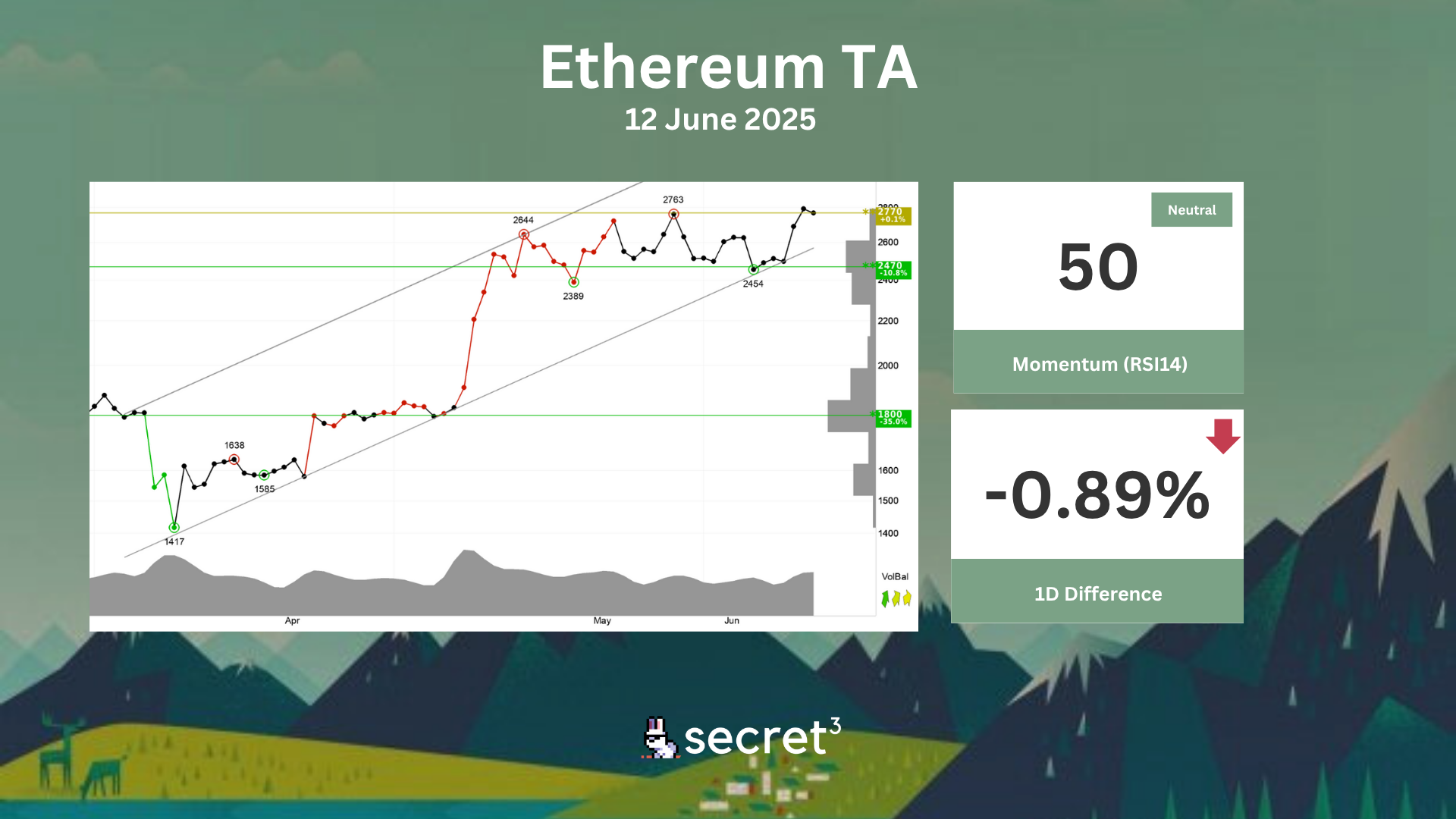

Ethereum - Investors have paid higher prices over time to buy Ethereum and the currency is in a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. The currency is testing resistance at points 2770. This could give a negative reaction, but an upward breakthrough of points 2770 means a positive signal. Volume has previously been high at price tops and low at price bottoms. This strengthens the trend. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically positive for the short term.