gm 12/04

Summary

gm, Bitcoin maintained strength above $82,000 amid a weakening US dollar. President Trump signed a resolution repealing the IRS's DeFi broker rule, marking a win for the crypto industry. The SEC dismissed its lawsuit against Nova Labs (Helium), signaling a potential shift in regulatory approach. Meanwhile, Ethereum co-founder Vitalik Buterin unveiled a roadmap for enhancing privacy on the network. These events, coupled with Bitcoin's resilience in the face of economic uncertainty, suggest a dynamic period for the crypto market as it navigates regulatory changes and technological advancements.

News Headlines

📉 S&P 500 Briefly Sees 'Bitcoin-Level' Volatility Amid Trump Tariff War

- The S&P 500 Index briefly mirrored Bitcoin's volatility following Trump's April 2 tariff announcement, with volatility spiking to 74 vs Bitcoin's 71.

- This unusual spike in stock market volatility stems from proposed tariffs on imports from trade partners and escalating duties on Chinese imports.

🏗️ StarkWare Researchers Propose Smart Contracts for Bitcoin with ColliderVM

- Researchers from StarkWare and Weizmann Institute of Science have developed ColliderVM, a protocol enabling complex smart contracts on Bitcoin.

- The system uses Scalable Transparent Arguments of Knowledge (STARKs) to verify complex offchain computations with minimal onchain data.

🚀 Solana (SOL) Price Surges Amid ETF Approval Speculation

- Solana's price increased by 7.45% over 24 hours, driven by market rebound and optimism about potential SOL ETF approval.

- Speculation is fueled by the appointment of crypto-friendly Paul Atkins as SEC chair, with Polymarket projecting a 76% chance of SOL ETF approval in 2025.

💰 BlackRock Reports $3B in Digital Asset Inflows During Q1, But Holdings Down $5B

- BlackRock saw $3 billion in inflows to digital asset-focused funds in Q1, marking the fifth consecutive quarter of inflows.

- However, the total value of crypto asset holdings decreased by $5 billion to $50.3 billion due to falling Bitcoin and Ethereum prices.

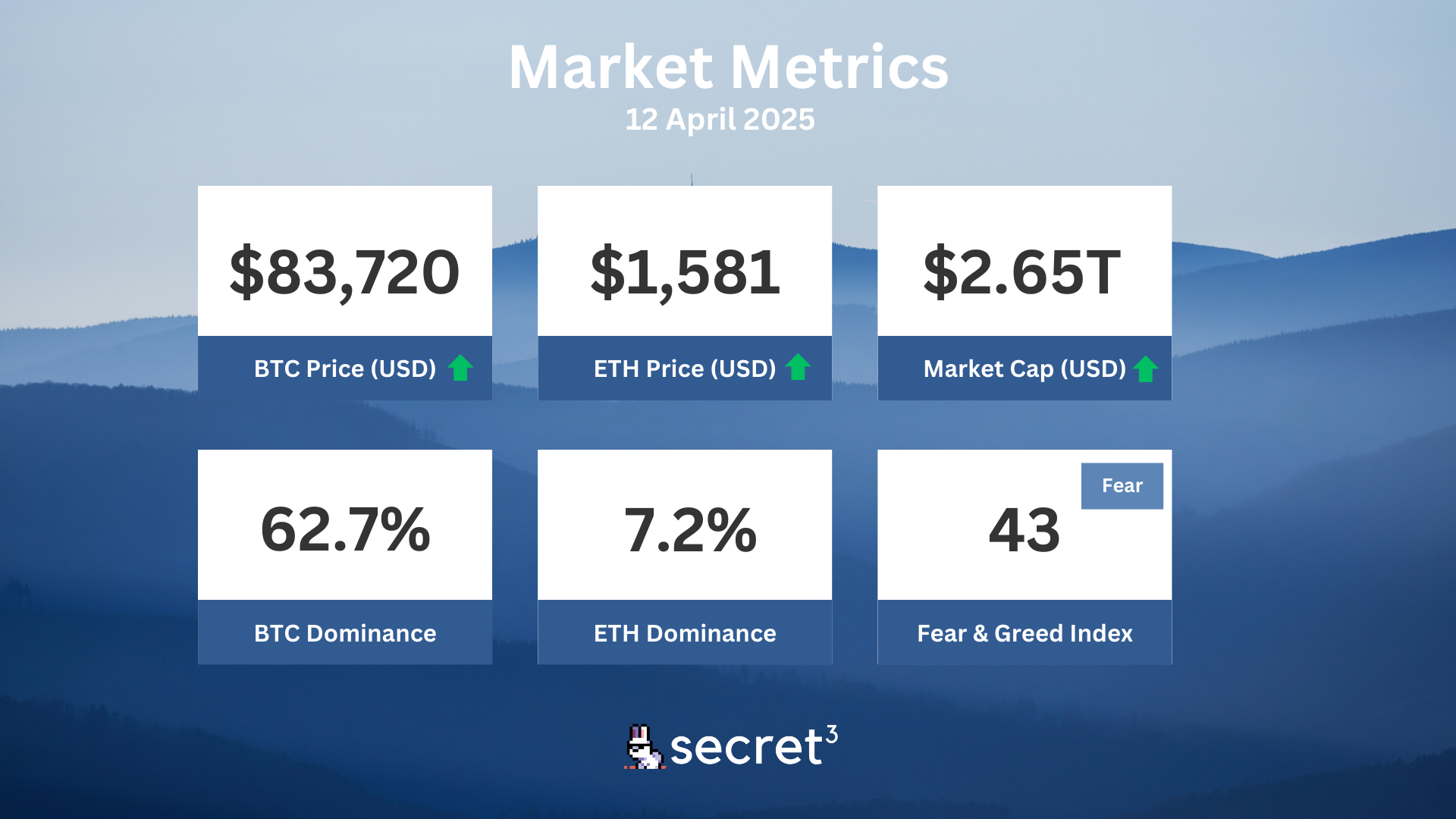

Market Metrics

Fundraising & VC

1. APX Lending (Undisclosed, $20M) - Crypto lending platform

2. Towns (Series B, $10M) - Blockchain messenger

3. OpenZK (Strategic, $6M) - Layer 2 blockchain platform

Regulatory

📊 SEC Staff Issues Guidance on Crypto Token Disclosures

- The SEC released a statement emphasizing the need for comprehensive disclosures regarding cryptocurrency tokens.

- Companies are urged to provide detailed information about token sales, attributes, and associated risks to investors.

🏦 HashKey Receives Hong Kong Approval for Crypto Staking Services

- HashKey obtained approval from Hong Kong's SFC to offer staking services for cryptocurrencies like Ethereum.

- This makes HashKey one of the first regulated exchanges in Hong Kong to provide such services.

🌐 Pakistan Proposes Compliance-Based Crypto Regulatory Framework

- Pakistan is shifting towards a compliance-focused crypto regulatory framework aligned with FATF guidelines.

- The framework emphasizes KYC protocols and aims to combat terrorism financing and money laundering.

🏛️ Illinois Senate Passes Crypto Consumer Protection Act

- The Illinois Senate passed a bill regulating cryptocurrency firms and protecting investors from fraud.

- Entities engaging in crypto business with Illinois residents must now register with the state's financial regulator.

💼 US Senate Bill Threatens Crypto and AI Data Centers with Fees

- A draft bill in the US Senate proposes fees for data centers serving blockchain networks and AI models that exceed federal emissions targets.

- The bill aims to address environmental impacts of rising energy demands in the crypto and AI sectors.

Technical Analysis

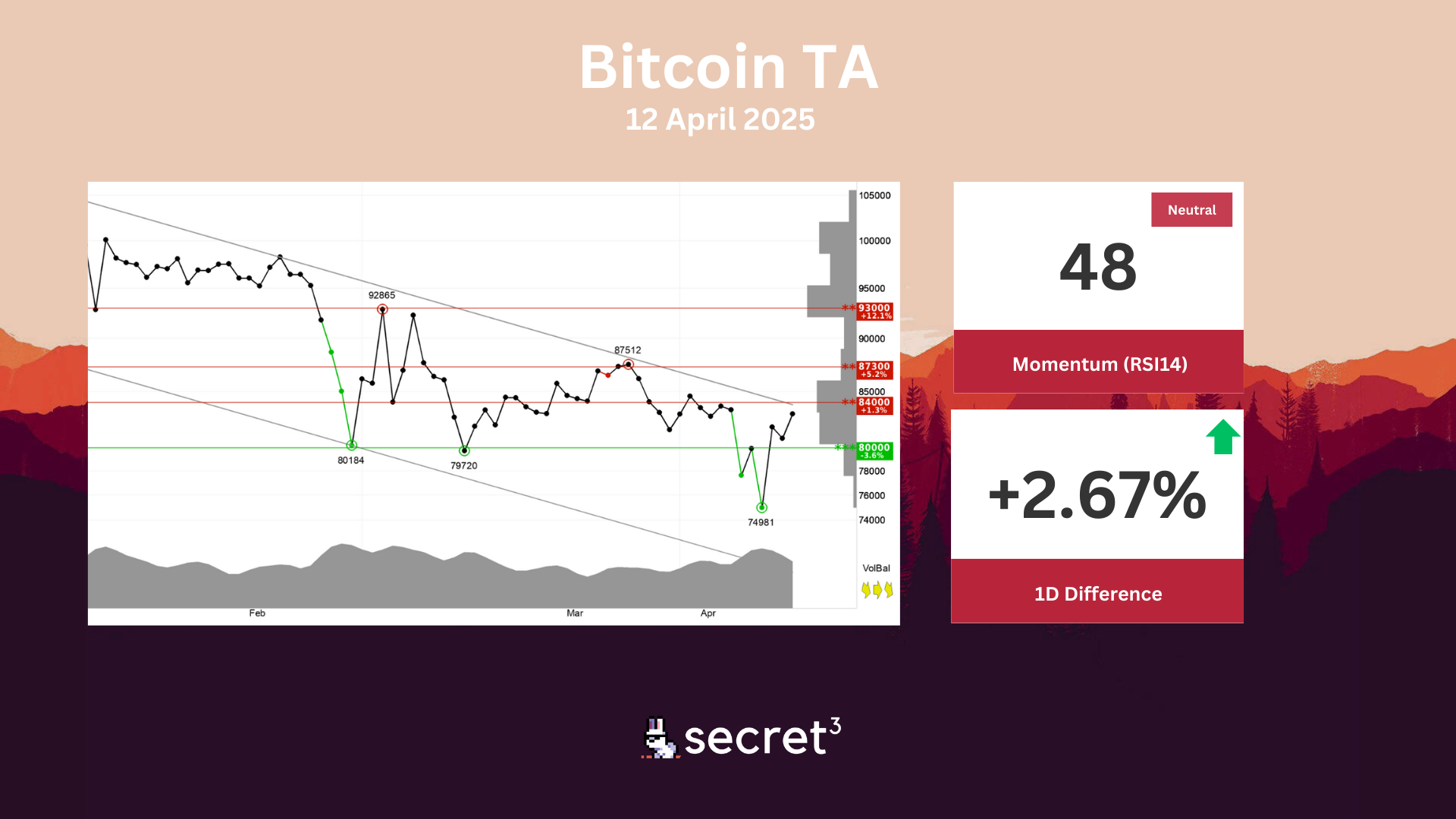

Bitcoin - Bitcoin shows weak development in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency is between support at points 80000 and resistance at points 84000. A definitive break through of one of these levels predicts the new direction. The currency is assessed as technically negative for the short term.

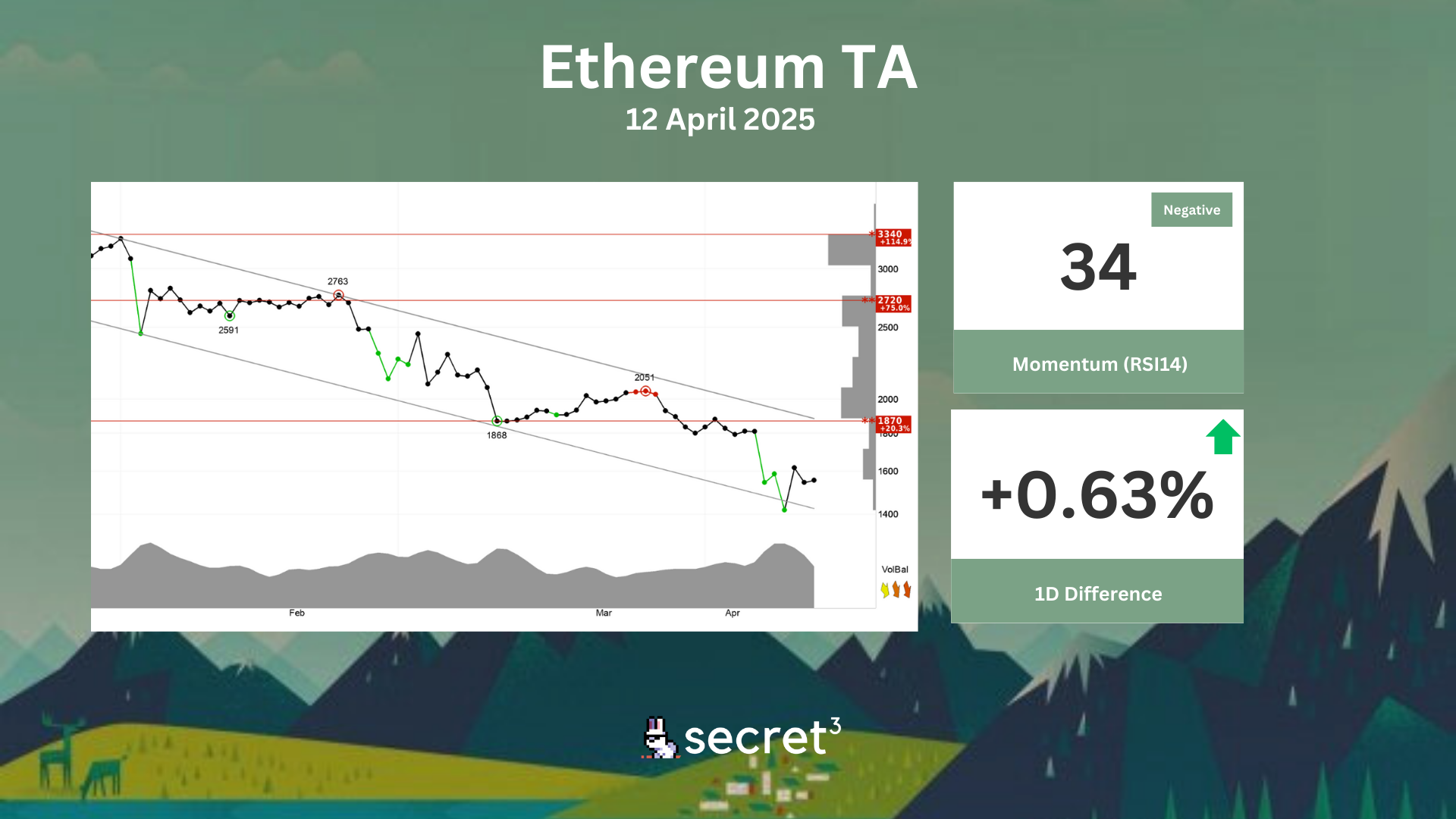

Ethereum - Investors have accepted lower prices over time to get out of Ethereum and the currency is in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 1870 points. The currency is assessed as technically negative for the short term.