gm 11/05

Summary

gm, Bitcoin surpassed $103,000 and Ethereum experienced a notable surge of over 8%. Coinbase announced its acquisition of crypto derivatives platform Deribit for $2.9 billion, signaling a major expansion into the derivatives market. Meanwhile, the UK government unveiled comprehensive draft regulations aimed at positioning the country as a global leader in digital assets. In the altcoin space, Dogecoin and other meme coins saw substantial gains, with DOGE jumping 27% as the broader market sentiment improved. These developments reflect growing institutional interest and regulatory clarity in the cryptocurrency sector.

News Headlines

📊 BlackRock's Bitcoin ETF Posts Record Inflow Streak

- BlackRock's Bitcoin ETF (IBIT) reported $356.2 million in inflows on May 9, marking its longest inflow streak of 19 consecutive days in 2025.

- The ETF has attracted $1.03 billion in inflows over the past week alone, reflecting growing institutional interest.

🤝 Coinbase Launches 24/7 Bitcoin and Ethereum Futures Trading

- Coinbase has officially launched 24/7 Bitcoin and Ethereum futures trading, enhancing trading flexibility for users.

- The service enables U.S. traders to engage in crypto futures trading at any hour, responding to price movements in real-time.

💰 Strategy's Bitcoin Purchases Creating Deflationary Pressure

- Strategy is purchasing Bitcoin faster than it is being mined, resulting in an estimated annual deflation rate of -2.33%.

- The company currently holds 555,000 BTC, considered illiquid with no intention to sell.

🌐 El Salvador Continues Bitcoin Purchases Despite IMF Deal

- El Salvador has acquired an additional seven BTC, increasing its total holdings to 6,173 BTC, worth over $637 million.

- This purchase comes despite an agreement with the IMF to stop using public funds for Bitcoin acquisitions.

💹 Ethereum Outpaces Bitcoin with 30% Surge in 48 Hours

- Ethereum's price has surged by 30% over the past 48 hours, outperforming Bitcoin's 8% increase.

- The rally is attributed to the successful Pectra upgrade, which aims to enhance network scalability and usability.

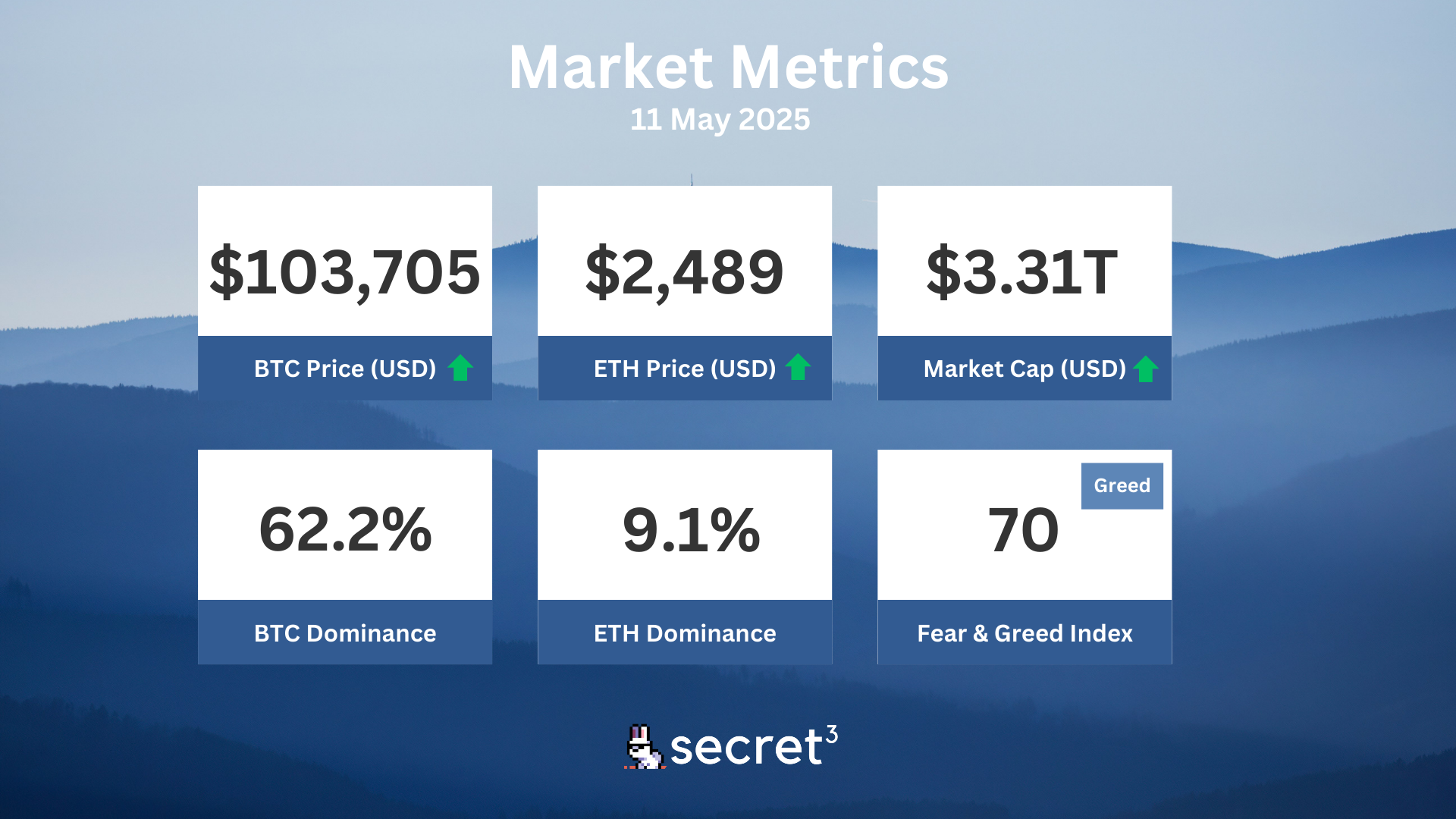

Market Metrics

Fundraising & VC

No fundraising data today.

Regulatory

⚖️ Senate to Deliberate on Stablecoin Bills

- U.S. Senate prepares to discuss new bills aimed at regulating stablecoins.

- Focus on financial stability, consumer protections, and economic impacts.

👮 UK Police Arrest Three in $20M Crypto Scam

- Metropolitan Police arrest three individuals in connection with a $20 million crypto scam.

- Operation Galafarm targeted fraudulent investment opportunities.

🏦 BlackRock Discusses Staking and Tokenization with SEC

- BlackRock meets with SEC Crypto Task Force to explore staking in crypto ETPs and securities tokenization.

- The discussion highlights growing institutional interest in expanding crypto offerings.

🚫 Senator Warren Opposes Big Tech Stablecoins

- Senator Elizabeth Warren strongly opposes major tech companies launching stablecoins.

- Cited concerns about impact on financial system and consumer protection.

🏥 Healthcare Firm Embraces XRP in Treasury

- Wellgistics Health announces plans to accept XRP payments and incorporate it into corporate treasury.

- The move aims to build blockchain-based payment infrastructure for healthcare network.

Technical Analysis

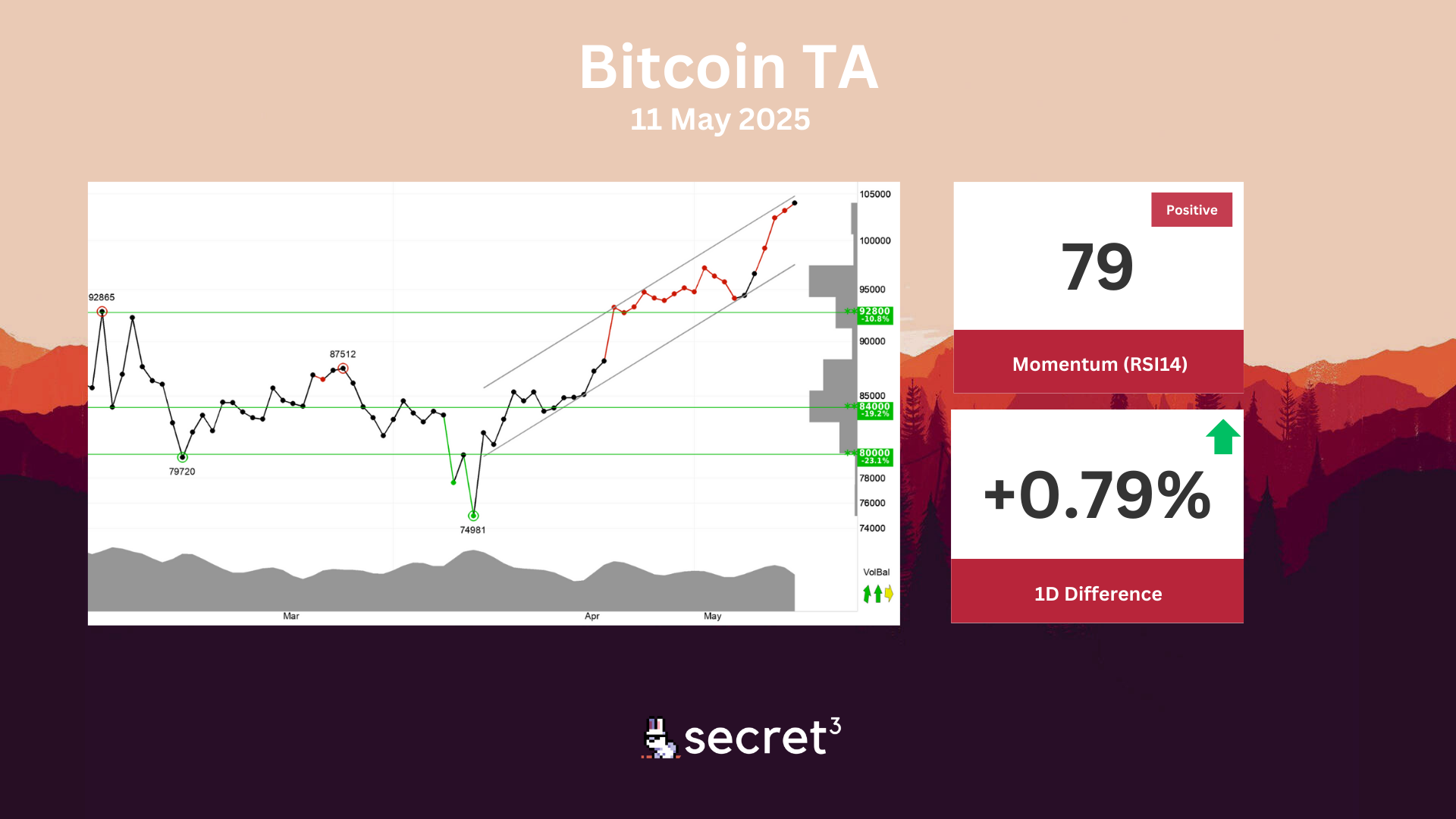

Bitcoin - Bitcoin is in a rising trend channel in the short term. This shows that investors over time have bought the currency at higher prices and indicates good development for the currency. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 92800 points. Positive volume balance indicates that buyers are aggressive while sellers are passive, and strengthens the currency. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Bitcoin. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.

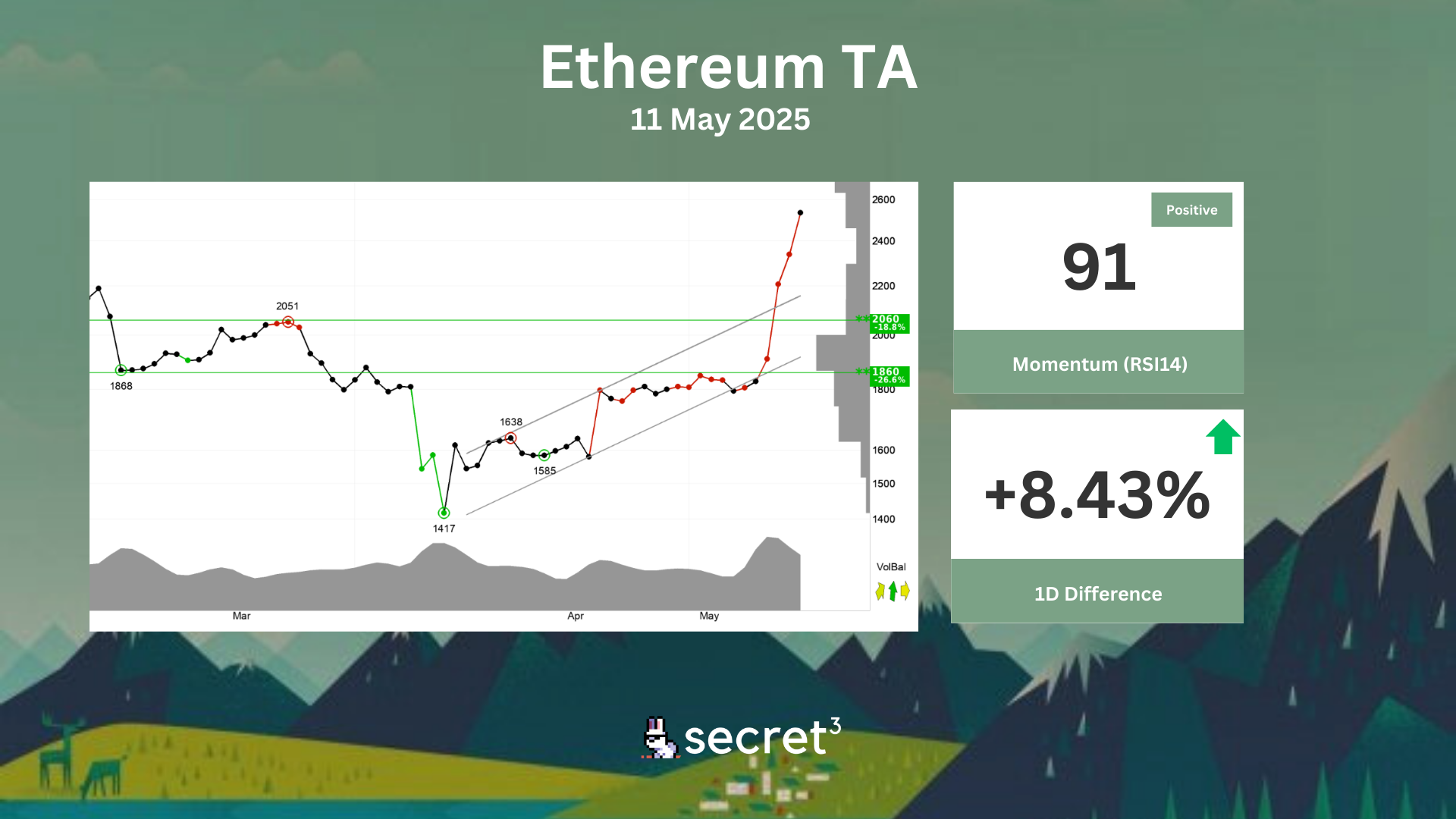

Ethereum - Ethereum has broken up through the ceiling of the rising trend channel in the short term, which signals an even stronger rising rate. The positive development, however, may give rise to short term corrections down from today's level. The currency has support at points 2060 and resistance at points 2770. Positive volume balance, with high volume on days of rising prices and low volume on days of falling prices, strengthens the currency in the short term. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Ethereum. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.