gm 11/04

Summary

gm, The SEC dropped its lawsuit against the Helium network, marking a shift in regulatory approach under new SEC Chair Paul Atkins. This change signals a more favorable environment for digital assets. Meanwhile, top Bitcoin mining companies generated around $800 million worth of Bitcoin in Q1 2025, led by Marathon Digital. President Trump signed a landmark crypto bill into law, repealing a controversial IRS rule on DeFi platforms, which is seen as a positive step for the industry. Additionally, the market saw volatility following Trump's tariff announcements, with Bitcoin briefly surging to $82,000 before settling around $80,750, up 7.5% in 24 hours.

News Headlines

🔒 Crypto Startup Axal Launches AI-Powered Trading Automation

- US-based startup Axal is using AI agents to automate crypto trading for non-technical users.

- The platform allows users to set risk tolerance and trading restrictions for various tokens.

💰 Meanwhile Raises $40M for Bitcoin Life Insurance

- Bitcoin life insurance firm Meanwhile has raised $40 million to expand its services globally.

- The company offers life insurance policies that maintain their value through Bitcoin.

📊 Spot Bitcoin ETFs See $772M Outflows Amid Inflation Concerns

- Bitcoin ETFs experienced $772 million in outflows as investors worry about tariff-driven inflation.

- Rising credit risk and declining liquidity in corporate bonds are pushing investors to safer assets.

🏦 Block Fined $40M Over Compliance Issues

- Jack Dorsey's Block agreed to pay a $40 million settlement to NY regulators over compliance failures.

- Issues included inadequate customer due diligence and monitoring of high-risk Bitcoin transactions.

🚀 Cathie Wood's Ark Invest Places Well-Timed Coinbase Bet Before Stock Surge

- Ark Invest purchased nearly 200,000 shares of Coinbase (COIN), valued at approximately $31 million, during a market downturn.

- Following Trump's announcement of a 90-day pause on tariffs, Coinbase's stock surged to around $180 per share.

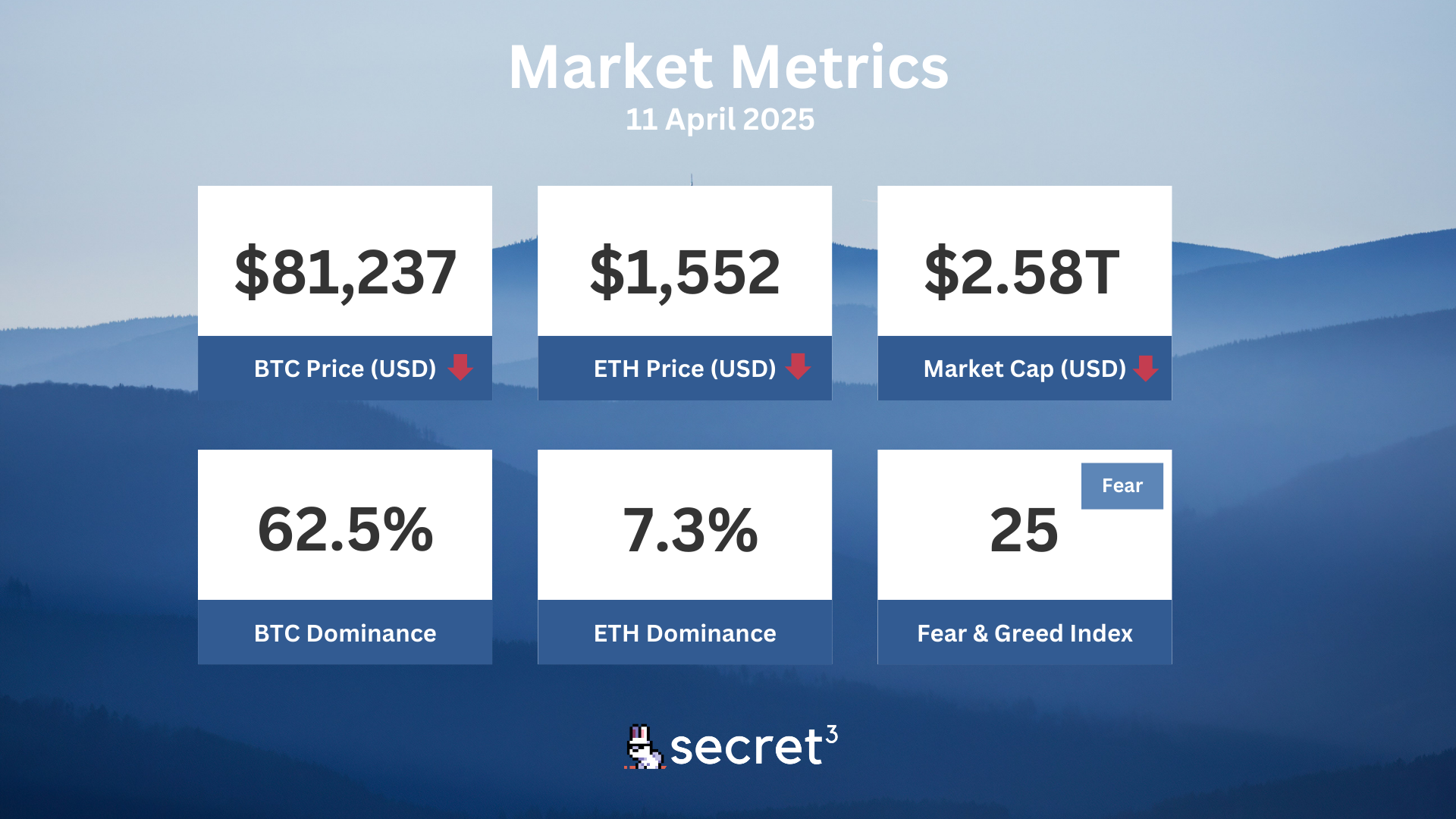

Market Metrics

Fundraising & VC

1. Wunder (Undisclosed, $50M) - Bot-free social media platform

2. Meanwhile (Series A, $40M) - BTC-denominated life insurance & annuities

3. Flashy Finance (Strategic, Undisclosed) - DeFi infrastructure as a service to games and social networks

Regulatory

🏛️ Senate Democrats Criticize DOJ's Decision to Disband Crypto Crime Unit

- Six Senate Democrats, led by Elizabeth Warren, criticized the DOJ's decision to eliminate its cryptocurrency investigations unit.

- They argue this move could enable increased sanctions evasion and other crypto-related crimes.

🏦 New Hampshire Passes Bitcoin Reserve Bill

- The New Hampshire House of Representatives passed a bill allowing the state treasury to invest in digital assets, including Bitcoin.

- The legislation permits investments of up to 5% of public funds in eligible assets with a market cap over $500 billion.

🌐 OpenSea Urges SEC to Exclude NFT Marketplaces from Regulation

- OpenSea has called on the SEC to exempt NFT marketplaces from regulation under federal securities laws.

- They argue that NFT marketplaces do not meet the definition of an exchange or broker as defined by current regulations.

💼 Thailand Targets Foreign P2P Crypto Platforms in New Regulations

- Thailand has implemented new regulations to shut down unregulated foreign peer-to-peer crypto platforms.

- Violators face up to three years in prison and fines of 300,000 baht ($8,700).

🚨 NY Attorney General Urges Congress to Keep Pensions Crypto-Free

- New York Attorney General Letitia James called on Congress to enforce federal regulations against cryptocurrency investments in U.S. pensions.

- She argues that digital assets have "no intrinsic value" and pose significant risks to investors.

Technical Analysis

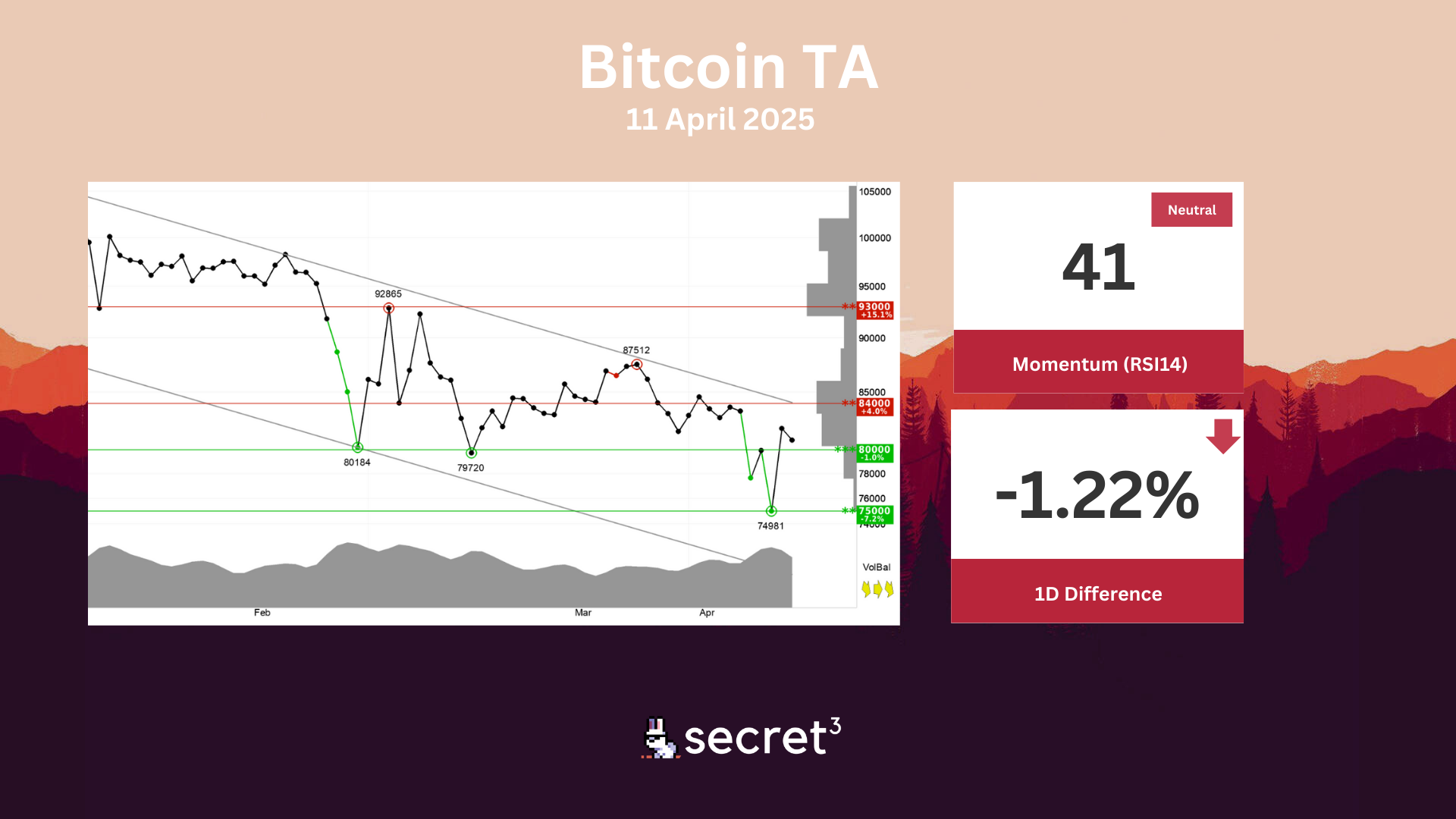

Bitcoin - Bitcoin is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. The currency has broken up through resistance at points 80000. This predicts a further rise. In case of negative reactions, there will now be support at points 80000. The RSI curve shows a falling trend, which supports the negative trend. The currency is overall assessed as technically neutral for the short term.

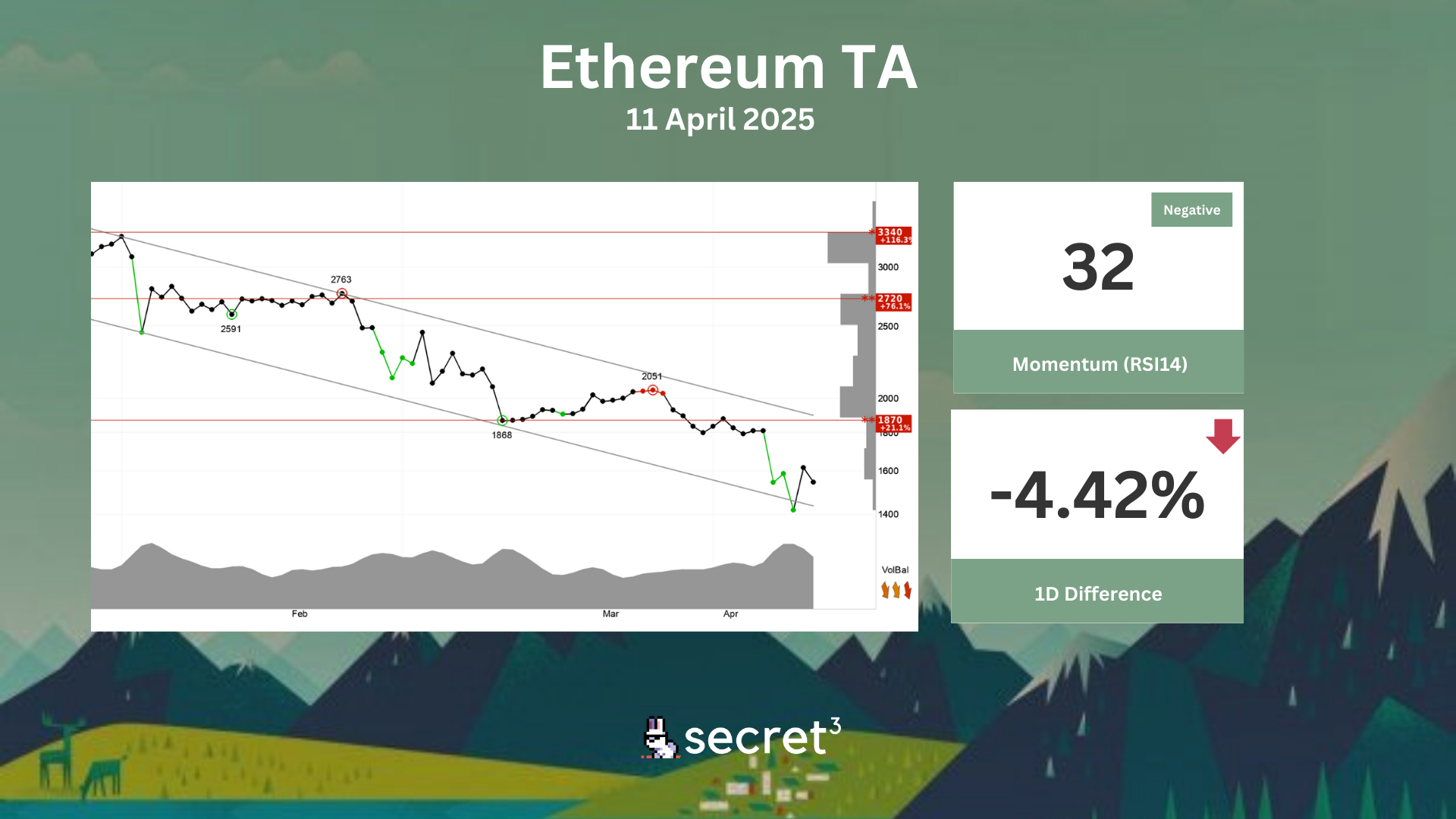

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 1870 points. The currency is assessed as technically negative for the short term.