gm 11/02

Summary

gm, Ethereum-based products outperforms Bitcoin for the first time in 2025. Ether-based exchange-traded products (ETPs) saw inflows of $793 million, compared to Bitcoin's $407 million, signaling a shift in investor sentiment. The market also reacted to U.S. President Trump's announcement of new tariffs on steel and aluminum imports, causing temporary volatility in cryptocurrency values. Bitcoin briefly dipped to $94,000 before recovering to over $97,000. Additionally, Grayscale Investments filed for a Cardano (ADA) ETF, sparking a 12% increase in ADA's price. These events highlight the ongoing evolution of the crypto market, with regulatory developments and macroeconomic factors continuing to influence investor behavior and asset performance.

News Headlines

💼 Strategy's Michael Saylor posts BTC chart after one-week break

- Strategy (formerly MicroStrategy) holds about 471,107 BTC, valued at $45.3 billion, with nearly $15 billion in unrealized gains.

- Despite a drop in software segment revenue, Strategy remains focused on acquiring more Bitcoin.

💡 OpenAI CEO: Costs to run each level of AI falls 10x every year

- OpenAI CEO Sam Altman states that AI costs decrease by approximately ten-fold each year.

- This could lead to a significant drop in product prices and broader AI usage.

🌐 Saudi Arabia partners with tech giants in $14.9B AI expansion

- Saudi Arabia announced a $14.9 billion investment in AI through partnerships with Google, Lenovo, and Alibaba.

- The investment spans emerging technologies and cloud computing.

🔄 CZ admits Binance token listing process is flawed, needs reform

- Changpeng Zhao criticized Binance's token listing process as flawed, urging for better practices.

- He emphasized the need for a longer notice period between announcement and listing.

🏦 Japanese Bitcoin Investor Metaplanet Announces Full Year 2024 Results, $35M in Unrealized Gains

- Metaplanet reported an unrealized gain of approximately $36 million for 2024.

- The company aims to acquire up to 21,000 BTC by the end of 2026.

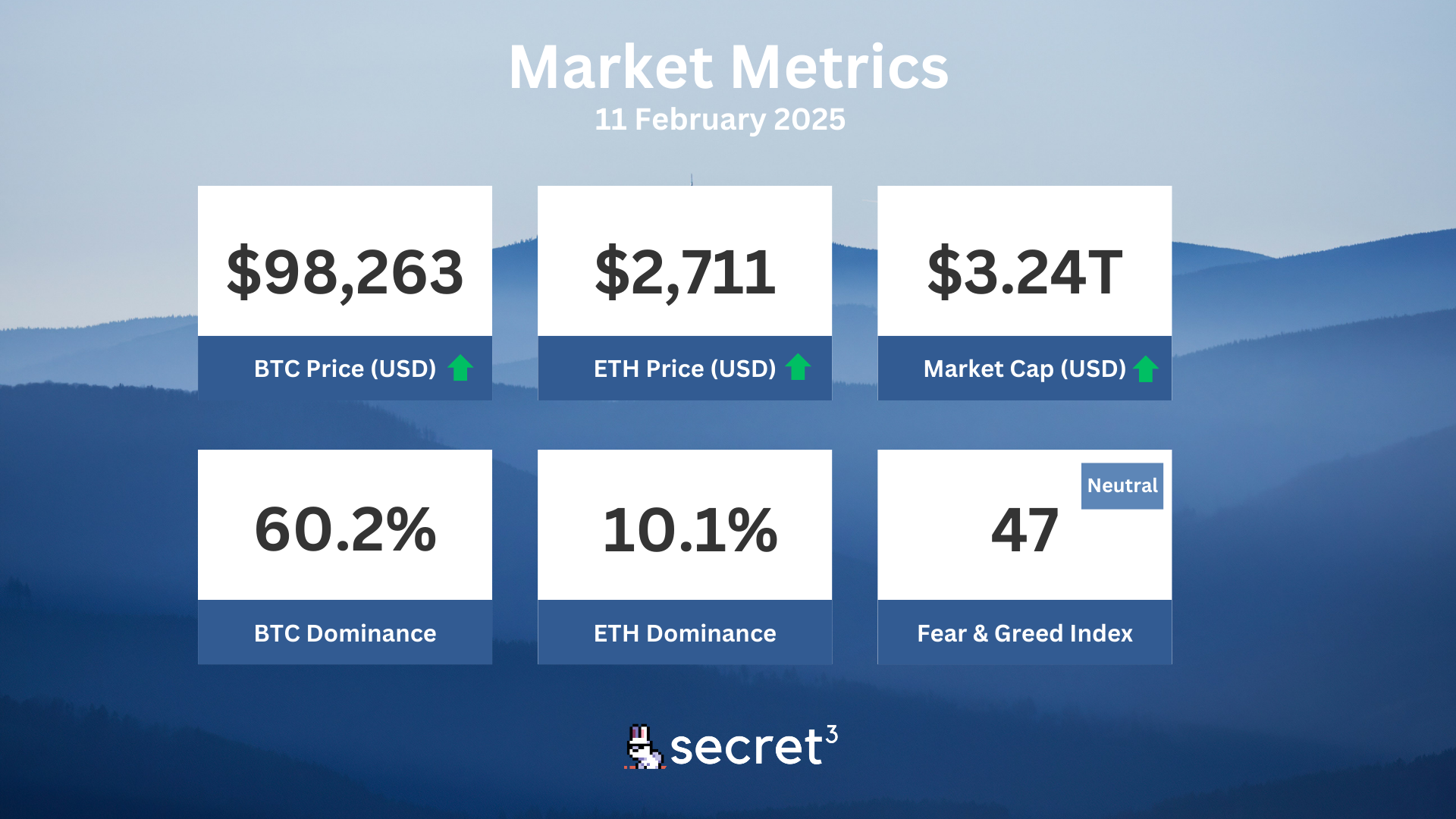

Market Metrics

Fundraising & VC

1. NodeGo (Undisclosed, $8.6M) - Decentralized computing for everyone

2. Hivello (Public Token Sale, $100K) - Token mining app

3. Banana for Scale (Strategic, Undisclosed) - Full-stack quasi-autonomous agent protocol

On-chain Data

1. Aptos (APT) token unlock in 1 day ($71.29M, 1.97%)

2. NAVI (NAVX) token unlock in 2 days ($342.95K, 1.03%)

3. Sei Network (SEI) token unlock in 4 days ($53.63M, 4.96%)

4. Avalanche (AVAX) token unlock in 5 days ($44.23M, 0.4%)

Regulatory

🚨 CFPB Chief Suspends Oversight and Cuts Funding

- The new head of the Consumer Financial Protection Bureau (CFPB) has cut off funding and suspended various regulatory activities.

- This move could significantly impact consumer protection in the crypto space and financial services sector.

📊 SEC Hacker to Plead Guilty in Bitcoin ETF Incident

- Eric Council Jr. will plead guilty to hacking the SEC's X account, which led to false claims about Bitcoin ETF approvals.

- The incident highlights vulnerabilities in handling sensitive financial information and the impact of misinformation on markets.

🌐 Hong Kong Adopts Cautious Approach to Crypto Regulation

- Hong Kong legislator Duncan Chiu advocates for a careful approach to crypto regulation, emphasizing clear asset classification.

- The strategy aims to develop frameworks ensuring safety and transparency in the digital asset landscape.

📜 Rep. Waters Calls for Support on Bipartisan Stablecoin Bill

- Representative Maxine Waters urges support for a bipartisan stablecoin bill drafted in the previous Congress.

- The legislation aims to close loopholes for issuers operating abroad and bar certain convicted fraudsters from senior roles at stablecoin firms.

🏦 OCC and CFPB Leadership Changes Signal Potential Crypto Policy Shift

- New leadership at the OCC and CFPB could lead to changes in crypto-related policies and bank engagement with digital assets.

- These developments may alter the regulatory landscape for banks, crypto firms, and consumers.

Technical Analysis

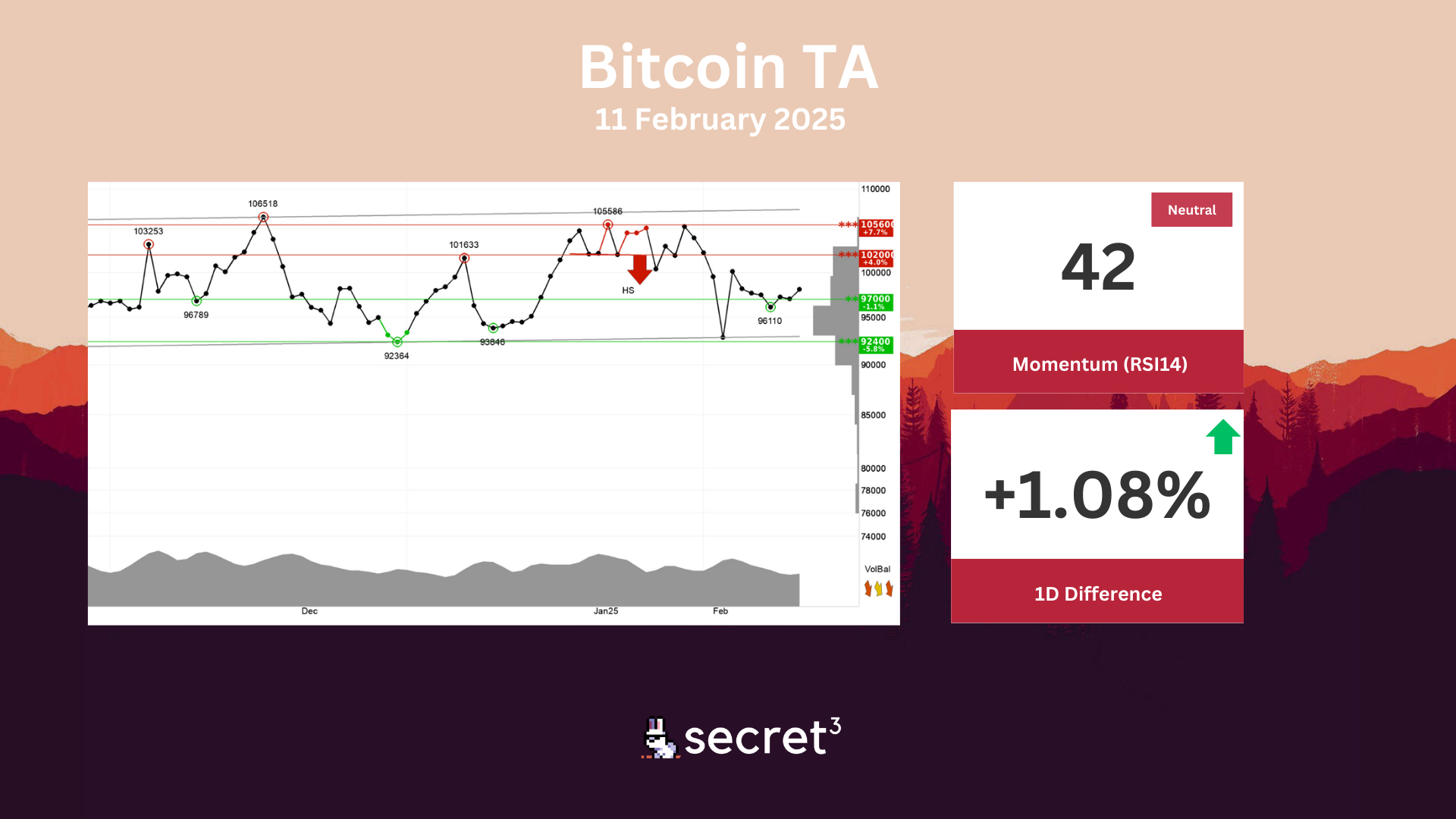

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term. This indicates that investors are uncertain and waiting for signals of further direction. A break upwards will be a positive signal, while a break downwards will be a negative signal. The currency has broken up through resistance at points 97000. This predicts a further rise. In case of negative reactions, there will now be support at points 97000. Volume has previously been low at price tops and high at price bottoms. This weakens the currency and indicates increased chance of a break down. The currency is overall assessed as technically slightly positive for the short term.

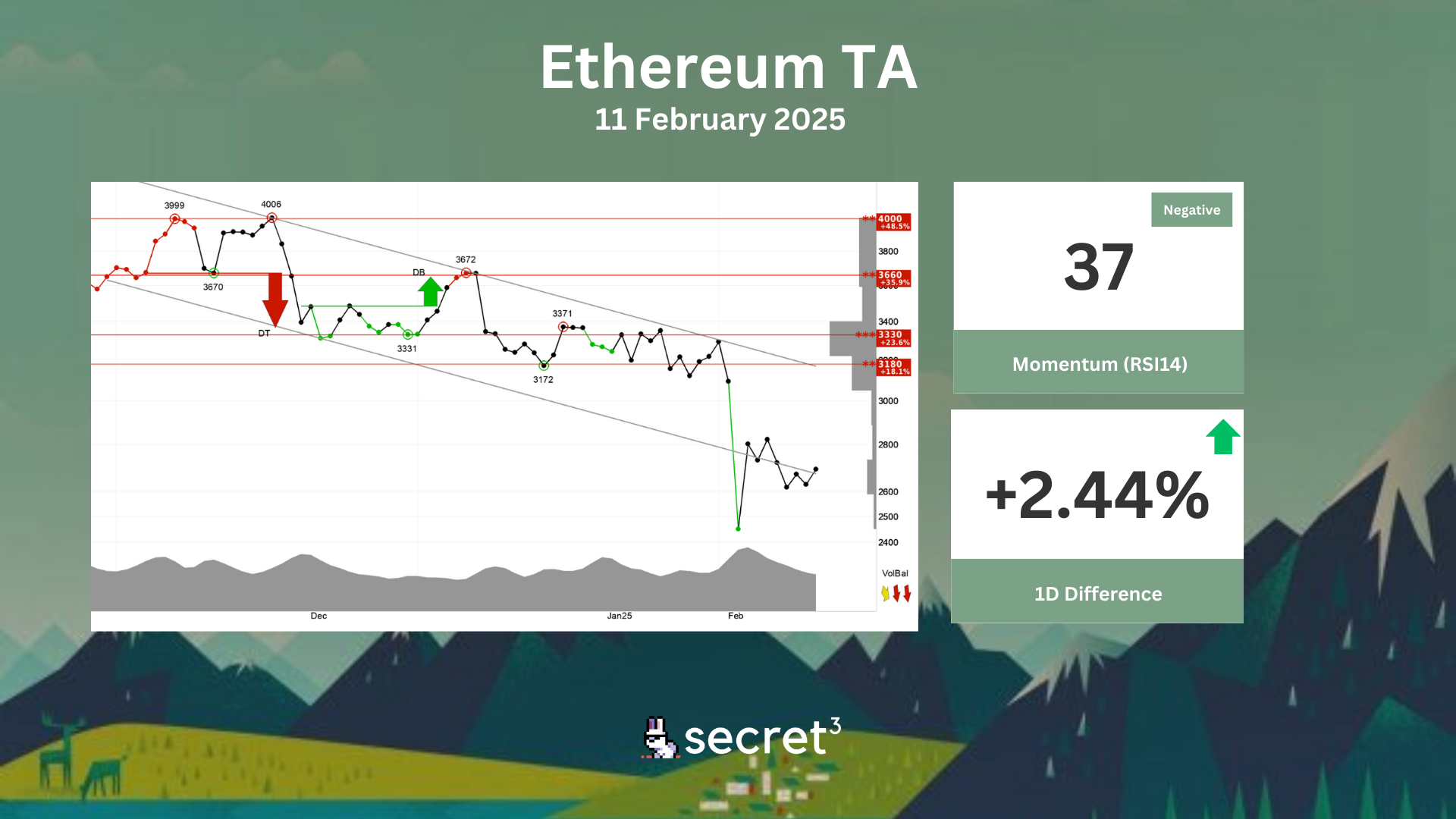

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 3180 points. Volume has previously been low at price tops and high at price bottoms. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

💰 Gitcoin DAO | 2025 Delegate Nominations (Active Vote)

- This proposal asks for the community to vote on 5 delegate nominees.

👻 Aave DAO | Deploy Aave v3 on Soneium (Preliminary Discussion)

- This proposal aims to deploy Aave v3 on Soneium.

☁️ Sky DAO | Whitelist sUSDS Deposit/Withdraw (Preliminary Discussion)

- This proposal aims to whitelist sUSDS deposit and withdraw in the Spark Liquidity Layer.