gm 10/06

Summary

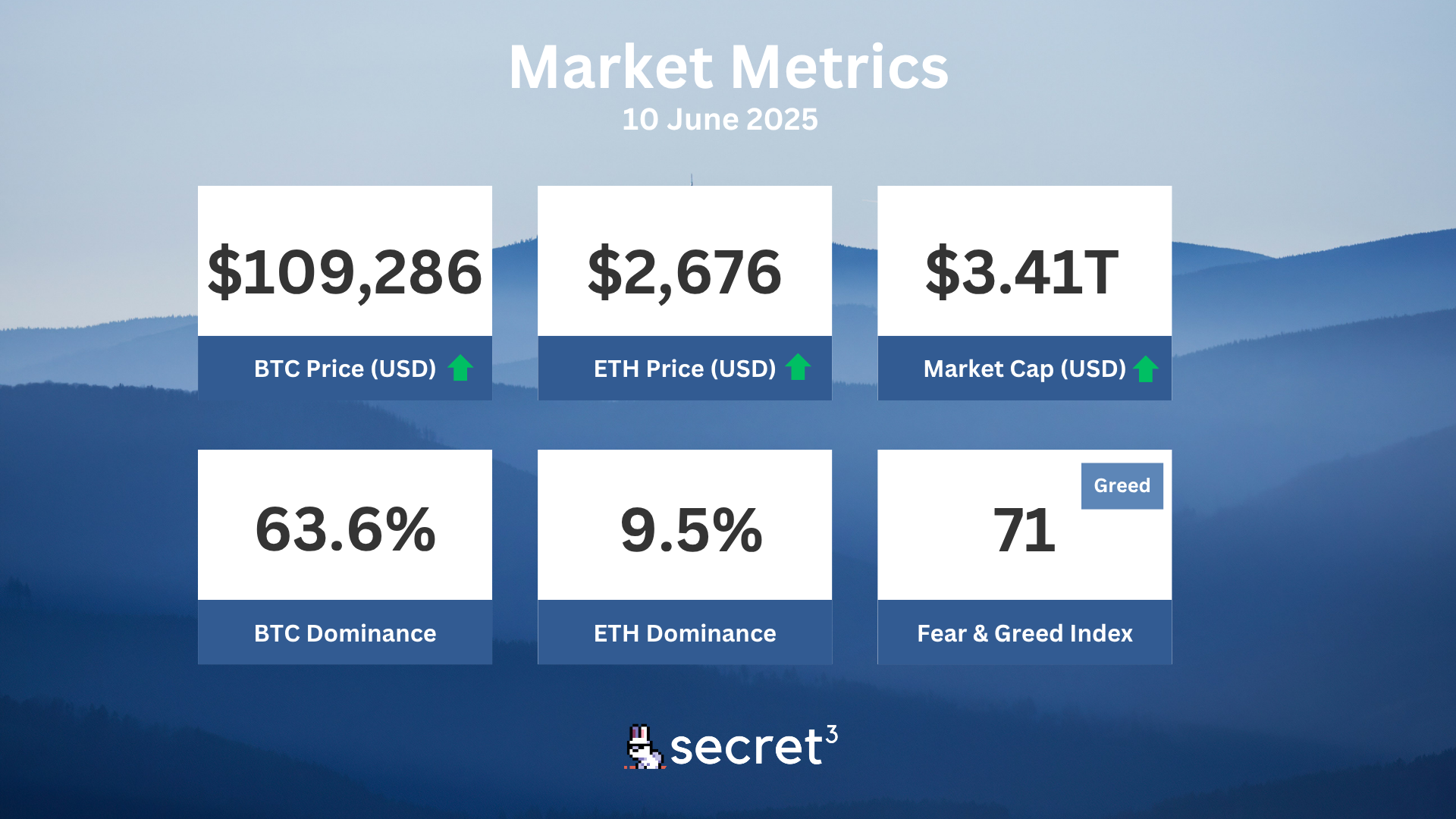

gm, Bitcoin surged past $110,000, approaching its all-time high with a 3.6% gain, while major institutions continued to accumulate the asset. Strategy (formerly MicroStrategy) purchased an additional $110.2 million worth of Bitcoin, marking its ninth consecutive week of accumulation, while several other companies including The Blockchain Group and KULR Technology announced plans to raise hundreds of millions for Bitcoin treasury purchases. Meanwhile, Coinbase CEO Brian Armstrong reported an 82% reduction in unnecessary account freezes, addressing a long-standing user concern. In the DeFi space, Cetus Protocol relaunched after a $220 million hack in May, implementing enhanced security measures and a compensation plan for affected users, while Hong Kong announced a significant CBDC pilot project utilizing Chainlink's Cross-Chain Interoperability Protocol to explore cross-border transactions.

News Headlines

👾 MapleStory Universe Revives Avalanche Network with 1M Daily Transactions

- Avalanche's blockchain has experienced a significant activity surge following MapleStory Universe's Web3 launch, exceeding 1 million daily transactions twice in one week—the highest levels since February 2024.

- Despite the renewed network activity, MapleStory's Nexpace Coin (NXPC) has declined 64% from its all-time high shortly after launch, while Avalanche continues to gain traction in the Web3 gaming space.

🚀 Cetus Protocol Relaunches After $220 Million Hack

- Cetus Protocol, a decentralized exchange on Sui, has resumed operations following a $220 million hack caused by a flaw in its pricing mechanism, with the team replenishing liquidity using $7 million in cash reserves and a $30 million USDC loan.

- To enhance security and transparency, Cetus plans to shift toward open-source development, initiate a white hat bounty program, and implement a compensation plan that sets aside 15% of CETUS token supply for affected users.

💡 SEC Chair Paul Atkins Calls Self-Custody a Fundamental American Value

- SEC Chair Paul Atkins criticized the previous administration's heavy-handed regulatory approach under Gary Gensler, arguing it hindered innovation in self-custodial digital wallets.

- Atkins emphasized the need for greater flexibility for market participants to engage in self-custody of crypto assets, which could reduce transaction costs and facilitate on-chain activities like staking.

🏦 Japanese Metaplanet Shares Jump 12% After $5.4B Bitcoin Acquisition Plan

- Metaplanet's stock surged over 12% after announcing plans to acquire 210,000 BTC by 2027, which would position the company as the second-largest public holder of Bitcoin globally.

- The stock traded at 1,505 yen ($10.42) with a peak of 1,641 yen ($11.36), marking a 22% increase at its highest point, demonstrating strong investor confidence in the company's Bitcoin strategy.

🔮 Analysts Predict XRP Could Reach $25 if ETF Approved, Then Crash 90%

- Crypto analysts forecast XRP could surge to $20-$27 in 2025, driven by a predicted 98% likelihood of SEC approval for a spot XRP ETF, following recent institutional interest including $471 million in XRP treasury investments.

- The analysts also warn of a potential 90% correction after the peak, with XRP possibly dropping to around $3.00 in a subsequent bear market, similar to previous crypto market cycles.

Market Metrics

Fundraising & VC

1. Turnkey (Series B, $30M) - Crypto wallet infrastructure

2. RISE (Strategic, $4M) - Ethereum Layer 2 blockchain

3. Towns (Private Token Sale, $3.3M) - decentralized communication protocol

Regulatory

🏛️ SEC Considers "Innovation Exemption" for Crypto Development

- SEC Chair Paul Atkins announced plans for a framework offering temporary exemptions from certain regulatory requirements to promote DeFi innovation and enable quicker market entry.

- The SEC is shifting from litigation-focused enforcement to notice-and-comment rulemaking, reviewing existing regulations to accommodate new technologies like self-executing smart contracts.

👮 $123M Crypto Laundering Ring Busted in Australia

- Australian authorities charged four individuals after an 18-month investigation into a $123 million money laundering operation that used a security company as a front to convert illicit cash into cryptocurrency.

- Police seized $170,000 in cryptocurrency, physical cash, luxury properties, and secured devices during 14 raids in Brisbane and the Gold Coast.

🌍 Kenya's Proposed 1.5% Crypto Tax Threatens Digital Growth

- Kenya's consideration of a 1.5% tax on every cryptocurrency transaction could undermine its fintech leadership and hinder financial inclusion across Africa.

- The tax could drive young African freelancers away from formal crypto channels, with local startups already incorporating in more crypto-friendly countries like Rwanda and South Africa.

💰 South Korea Pursues Won-Pegged Stablecoin

- Kaia blockchain announced plans to launch a South Korean won-based stablecoin following President Lee Jae-myung's inauguration, though constitutional challenges exist as the Bank of Korea holds exclusive currency issuance rights.

- The announcement triggered a strong market response, with shares of major payment providers like Kakao Pay and Danal surging nearly 30%.

🕵️ UK Appoints Crypto Specialist to Recover Assets from Bankruptcies

- The UK Insolvency Service has appointed Andrew Small, a former police investigator, as its first crypto intelligence specialist to recover digital assets from bankruptcy and criminal cases.

- The appointment follows a 420% increase in crypto-related insolvency cases in the UK over the past five years, with the value of involved assets surging 364 times to approximately £523,580 ($709,500).

Technical Analysis

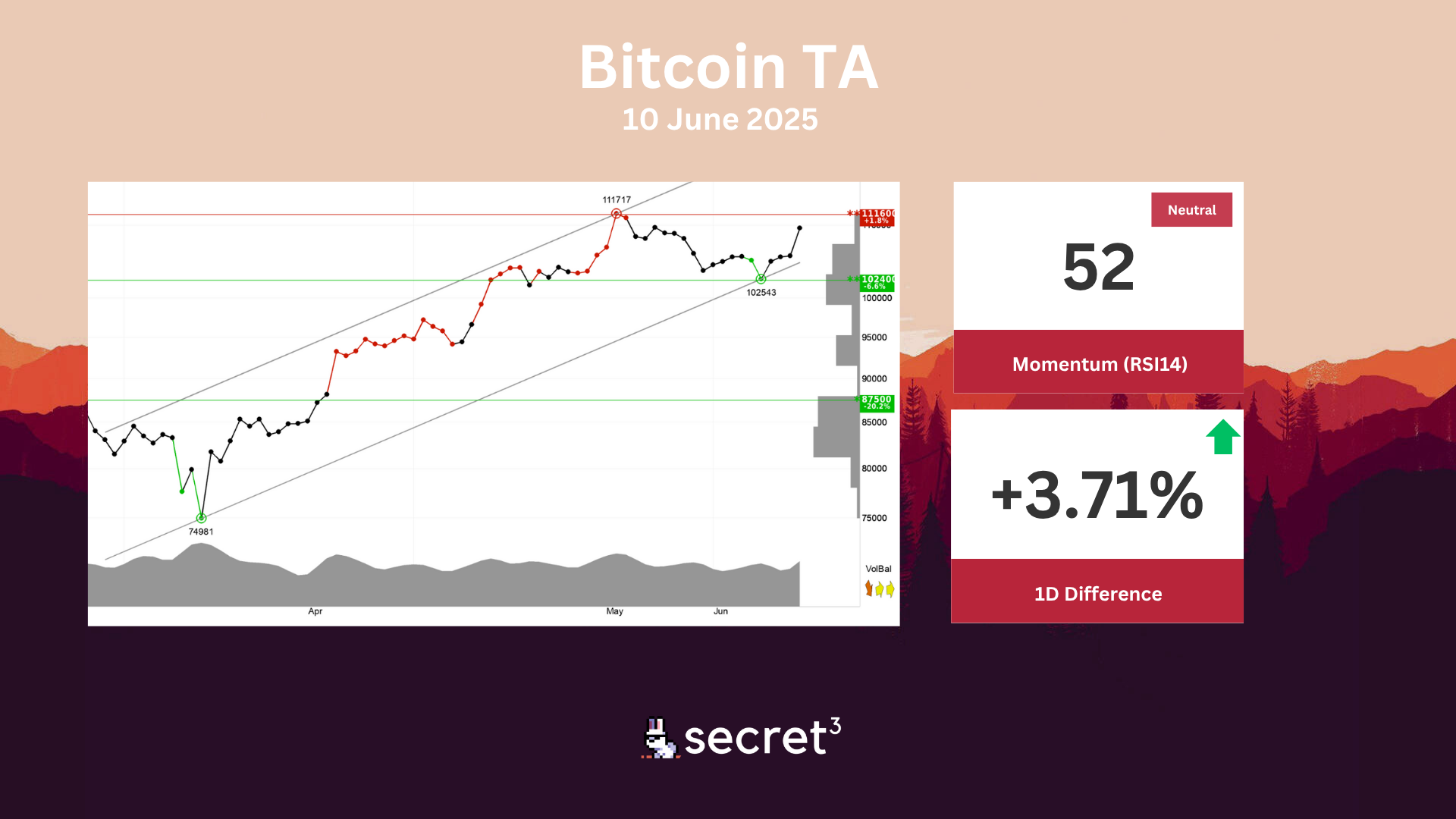

Bitcoin - Bitcoin shows strong development within a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. The currency is approaching resistance at 111600 points, which may give a negative reaction. However, a break upwards through 111600 points will be a positive signal. The currency is assessed as technically neutral for the short term.

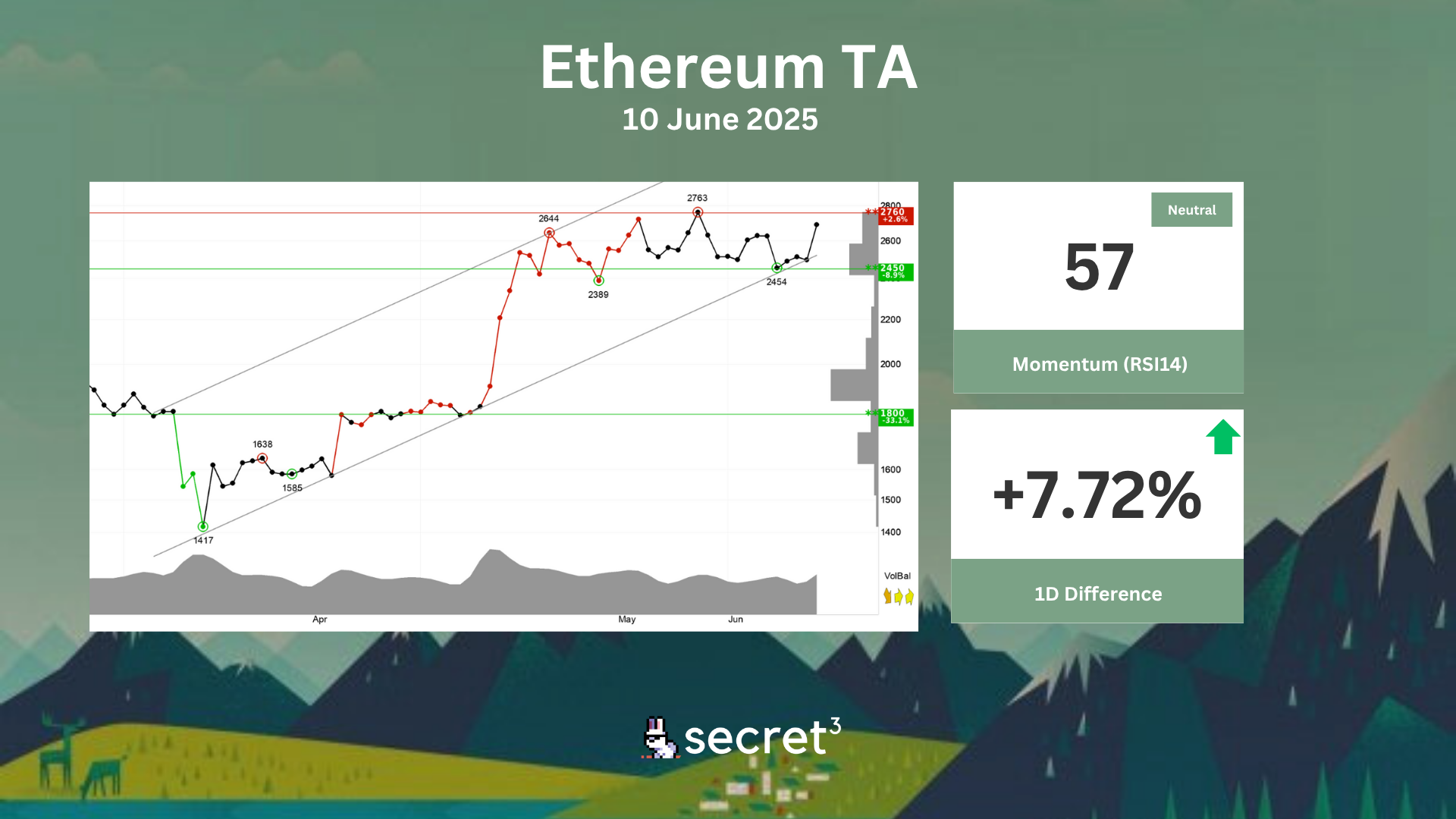

Ethereum - Investors have paid higher prices over time to buy Ethereum and the currency is in a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. The currency is approaching resistance at 2760 points, which may give a negative reaction. However, a break upwards through 2760 points will be a positive signal. Volume has previously been high at price tops and low at price bottoms. This strengthens the trend. The currency is overall assessed as technically slightly positive for the short term.